Monetary and Economic Financial Reset

Stock-Markets / Financial Markets 2020 Oct 03, 2020 - 03:50 PM GMTBy: Raymond_Matison

Difficult to contemplate or understand concepts in monetary theory, economics, or the stock market are often described by comparing or referring to natural events observable in our universe. In this article we use three physical phenomena to describe imminent economic transitions: in the creation and issuance of fiat money, the future implosion of our present debt based money, electronic currency applications circumventing banks, new distributed ledger means of conducting business, and the possibility of true global human emancipation.

Ray Kurzweil in his masterpiece book “The Singularity is Near” published in 2005 answers the question as to what is a Singularity. “It is a future period during which the pace of the technological change will be so rapid, its impact so deep that human life will be irreversibly transformed. Although neither utopian nor dystopian, this epoch will transform the concepts that we rely on to give meaning to our lives, from our business models to the cycle of human life, including death itself.” Mr. Kurzweil was describing a period in the near future when computer computational and learning power exceeds that of the human brain. A singularity can also be seen as a discontinuity in a system where after reaching an inflection point the prior laws or characteristics of that system no longer apply. Today, there are several global converging singularities which will irreversibly transform our society and human life, several of which we will address here.

In astronomy, a black hole is a region in space where there is an aggregation of mass, such as in a galaxy, where gravity is so strong at its center as to warp space itself around it, creating a spatial discontinuity pulling matter toward and into it, whereby matter is torn apart and collapses from this gravitational force. With this singularity matter falls into a “black hole”, collapses, and disappears.

Entropy is concept which postulates that in closed physical systems order naturally tends to disorder. Applying this concept to social or government constructs implies that centralized systems become increasingly decentralized. These three natural phenomena will be useful explaining several approaching financial and societal singularities.

National debt singularity and black hole

Our nation’s monetary system has been managed by the Federal Reserve Bank since its Congressional approval and establishment in 1913. Despite the official sounding name, the Federal Reserve Bank is neither federal not governmental, as it is owned by private banks. The government has given it certain mandates such as optimizing inflation and unemployment for our economy, or keeping prices stable, which largely have been managed by modifying the rate at which new fiat money is created, and the setting of interest rate levels. Money is created simply by the FED crediting the Treasury in an amount equal to its debt issued as Bills, Notes, or Bonds; interest rates are controlled by its Open Market Committee.

Debt and fiat money have expanded massively over recent years, as government and politicians confirmed their persistent inability to produce a surplus in the setting of a federal budget. It is budget deficits that require increasing national debt – the repayment of which is the responsibility of government, but dependent on taking more wealth from taxpaying citizens. For example, using the size of our national debt as a rough measure for the increase in growth of money (which understates that growth), we observe that between the years 2000-2020 national debt has grown from $5.7 to $26.7 trillion – an annual growth rate of 8.0%. During this same time period the debt to Gross Domestic Product ratio rose from 56.6% to 136.6% (according to the National Debt Clock), highlighting the deteriorating urgency to our national financial solidity.

Authors Carmen Reinhart and Kenneth Rogoff, in their book analyzing eight centuries of financial folly titled “This Time is Different” note that in the creation of the European Union its Maastricht treaty set the limit of debt to GDP at 60% as a means to protect the Union from individual country default. America’s present debt cannot be repaid from taxes, and should forewarn of coming exceptional government or FED action. That is to say that we are approaching a point of discontinuity which will manifest as a monetary and financial singularity.

Chairman of the FED, Mr. Powell, has reconfirmed that the FED is seeking inflation that averages 2% over time. This is a crafty and deceitful word game. Over decades economists have tried subtly to change the definition of inflation itself – from the increase in the growth of money – to a rise in prices. The rise in prices is the consequence of the growth or inflation of money. The FED has persistently overachieved a 2% growth in the money supply (money inflation), as indicated by the growth of national debt at 8% over the last 20 years. The failure to distinguish money inflation from cost inflation allows economists to muddle the discussion over inflation, such that it diverts responsibility for economic damage from the FED.

This vast and growing amount of debt and money can be likened to a mass in space that increases its gravitational force, which then propels this mass of debt to collapse into a financial black hole which destroys its purchasing value. Gigantic amounts of increasing debt, particularly over these recent quarters, with credible expectations that during these covid-19 pandemic years it will expand further almost uncontrollably is now “warping the money space”. It also heightens the lack of confidence or trust in the future value of our dollar currency both domestically and internationally, whose value will decline or can collapse – just as with a galactic black hole. This diminishing of dollar value is an unavoidable singularity that will affect the citizens of the whole nation.

Understanding money and price inflation

A 2% rate of inflation seems benign, one that appears to cause no reason for alarm, and no harm. However, a 2% rate applied over a 36 year period reduces purchasing power of a dollar by half! More insidiously, it reduces the purchasing value of your savings and investment assets also by half. That is incredible harm.

Consider a married man starting a family and saving for his children’s college or university education. When the children are ready to start school, the parent and children discover that the rise in the cost of education has risen to nearly triple the original cost estimates, as the depreciated value of their savings is not enough to pay for current education costs. The children must borrow funds - becoming debt slaves even before their maturity, or ability to seek a gainful employment.

As an example, the Bureau of Labor Statistics shows the average annual increase in college tuition from 1980-2014 grew by nearly 260% compared to the nearly 120% increase in all consumer items. In 1980, according to the Department of Education, the average cost of tuition, room and board, and fees at a four-year post-secondary institution was $9,438. The average tuition for a private nonprofit four-year institution for the 2017-2018 school year is $34,740. No wonder student debt now exceeds $1.5 trillion.

Since central banks employ hundreds, if not thousands of America’s smartest economist PhD’s, the FED surely understands, the consequences of their present continuing rapidly expanding monetary policies. It results in the ultimate destruction in the value of our currency, and therefore people’s total savings. The original 1913 fiat dollar has already lost 99% of its value, as confirmed by the fact that a one ounce dollar gold coin, then valued at $20 now costs approximately $2000 of paper currency.

As the rate of interest is being intentionally repressed to facilitate government servicing its overbearing debt, and money inflation spurred through continuing issue of debt and currency, bond investors are forced to accept negative real interest rates. This financial repression helps the government by reducing, through inflation, the real value of national debt. If investors foreign and domestic will not accept this level of financial repression, and demand a higher return, then the cost of money (interest rates) and product prices will accelerate. When China is observed to be buying less U.S. debt, is it because for political reasons that it is spiting the United States, or is it because the U.S. is not providing an interest rate to investors commensurate with the risk? Rising interest rates and prices are inevitable. For government debt to be serviceable, and the FED fiat money creation system to survive, the FED needs to have prices rise. Persistent deflation would destroy the FED and our current form of financing government deficits.

The most recent narrative from FED Chairman Mr. Powell is that he would like to have price inflation temporarily rise above 2%. Price inflation means that consumer prices will rise, yet money inflation means the purchasing value of the currency declines. The FED claims that it is persistently trying to stimulate our economy, in order to accelerate economic growth. However, such goals are clearly incompatible, deceitful and contain a huge lie! After all, less purchasing power of a currency, and higher prices cannot possibly stimulate an economy! Technology-driven lower prices and increasing purchasing power of one’s money naturally allows a consumer to stimulate an economy. So the question is, what have been the real goals of the FED over the last century?

Our new financial markets

The FED’s accelerated printing of money, practical elimination of interest rates, creation of bubble markets, now requires the adoption of substantially different rules for prudent investing and capital preservation than those which existed previously. For example, an increasing number of money managers and hedge funds are adding gold to their portfolios. Indeed, investor luminary Warren Buffett has recently purchased gold stocks with proceeds of bank stock sales, and Ohio States $1.8 billion pension fund is now allocating 5% of its fund to gold. In addition, some investment hedge fund managers are now also allocating funds to cryptocurrencies such as Bitcoin.

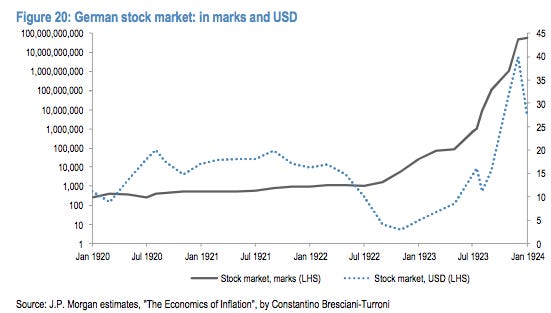

Accelerated creation of new additional dollars decreases its value relative to other currencies. However, stock markets can remain high or even rise for a time period, as more devalued dollars are necessary to purchase goods or stocks. This precedent was clearly illustrated in Germany after WWI. Germany had printed currency to help finance the war effort. More money printing was necessary when England and France imposed draconian war reparations payments designed to forever keep Weimar Germany from reemerging again as an industrial leader or viable competitor. More debt was necessary to restart their war-torn economy. This money printing had the effect of increasing the mark-dollar exchange rate from 4.2 marks per dollar in 1914 to 4.2 trillion marks to the dollar in 1923. It also had an amazing effect on stock market.

The following chart demonstrates how stock prices can rise in the face of economic apocalypse. Note that the Y-axis of this chart is logarithmic due to the incredible level of money and price inflation – were this not so, the chart would need to be hundreds of feet long! So the Weimar stock market rose exponentially – as their wealth was being destroyed.

History is said not to repeat, but rhyme. The U.S. has amassed the largest debt of any country in the world, principally related to military expenditures related to selected wars. What are the global consequences of our government not being able to repay its debt? In light of the covid-19 virus, additional fiscal policy spending and debt is issued to restart the economy. Our stock market has been defying economic reality for several years. However, be mindful that the stock market could still rise from a decline in the value of the currency. All of this rhymes with historic events. America is not a war-devastated country, so it will unlikely experience the hyperinflation of Weimar Germany, and any reduction in the value of the dollar may take longer to take place. But hold on, we are at a market discontinuity leading to a financial singularity, and it’s going to be quite a wild ride.

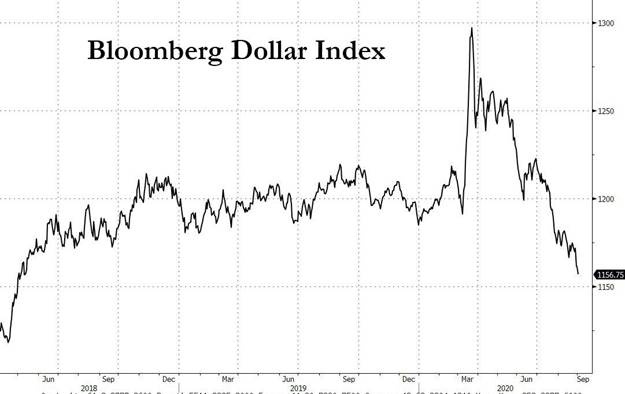

In recent months U.S. currency has been weakening relative to a basket of other significant currencies. This weakening is occurring even as those other currencies have also expanded their money in circulation. Whether the dollar temporarily recovers or not, the long term value of it will continue to decline. The following chart shows this recent dollar weakness quite graphically.

Given record budget deficits related to the corona virus, and the nation’s need for rapid economic recovery, and FED Chairman’s desire to accelerate price inflation, we can anticipate that the dollar has to weaken over time. Temporarily, manipulations may bring gold or Bitcoin prices down, but economic reality will correct these dislocations in due course.

So what is your real investment return if the markets double over the next few years, but the value of the currency declines by 80%? The result is destructive to adequate retirement funding, and to maintaining a protective margin of assets for unexpected costs such as long-term unemployment or meeting payments for medical emergencies.

Digital currency and blockchain

The continuing evolution of the internet has germinated and matured opportunities that could not even be envisioned while it was developing over decades. For example, programming which causes computers to communicate in a neural net has spawned the distributed ledger technology, or blockchain, which confirms the validity of transactions without the necessity of a central trusted institution. A practical example of this incredible concept is the issue of Bitcoin, a computer code which assigns value to an individual internet address. Bitcoin is a digital currency, which by its programmed limitation for the number of coins that can ever be issued, could become a better store of value when compared to an accelerating near infinite supply of fiat paper dollars.

It seems that central banks have been caught completely unprepared for private enterprise to conceptualize and actualize this world-changing development. Today, thousands of platforms already on the internet provide the methodology supported by computer code and distributed networks for emergent technologies to alter the very foundations by which business will be conducted globally. This advance has provided computer networks the ability for executing “smart contracts” without third-party trusted intermediaries and making instantaneous peer to peer digital payments around the globe.

A comprehensive report was issued in August, 2020 by Block Research entitled “A Global Look at Central Bank Digital Currencies”, which was commissioned by KPMG and Blockset. The lead authors Ryan Todd and Mike Rogers state: “The purpose of this white paper, written for practitioners and enthusiasts alike, is to present a global perspective on the state of central bank digital currency (CBDC) developments to date.” “Enclosed is an examination of the growing body of CBDC literature across central banks and international organizations, such as the Bank for International Settlements (BIS) and the International Monetary Fund (IMF).” See: This white paper,

All central banks in the world are highly interested in this digital currency concept, as central banks must believe that they are the only organizations which should have the right to issue digital currency. Indeed, they are working on the design and function of such a currency, which would provide banks with the opportunity to issue their own version of digital currency, reduce financial transaction costs, increase profits, and at the same time more effectively track and control all citizen payments and assets.

However, the premise that only central banks should issue “money” is wrong. Over millennia, people involved in trade decided themselves what means of payment they would accept. It was only with the global acceptance of gold and silver as means of payment, and growth and centralization of commercial banks (which brought them immense economic power), that central banks were able to wrest and capture the vital issue of currency from governments.

With today’s distributed ledger and blockchain technology, central banks are superfluous – they are not needed at all. Formerly, government could not be trusted to issue fiat currencies, because of the temptation to issue funds for additional spending, and the FED’s complicity always enabling additional government spending. Now blockchain can be used to create a digital currency that by its very design and programming is limited in both size and growth, the constraints of which cannot be violated. This would mean that money for wars would not be available, without the specific approval of citizens, dramatically reducing the amount of continuing conflict in the world. It also means that government could now issue its digital currency itself, bypassing the central bank overlords, without citizen fear that this currency would be debauched.

The coming inability or discontinuity for the FED and our government to issue additional national debt, and to service it (never mind paying it down) is a coming notable singularity event. The present fiat paper money issue by central banks is also approaching a discontinuity, due to the singularity of technologically empowered new private, bank, or government crypto and digital currencies issues. Both events are compounded by the singularity of distributed network systems, and blockchain. The collision of these three singularities will have a combined effect on our global community that will be momentous and truly life changing.

Capitalism nearing a social discontinuity

Over recent years high profile elites have made the assertion that capitalism is broken. In reality it is not broken but abused by those in power and those who make all the rules by not understanding as to what is required to keep capitalism healthy and functioning properly. It relates to ravenous greed, and the lack of practical benevolence required to keep capitalism healthy. The formally uneducated, but naturally wise arch-capitalist Mr. Henry Ford understood this a century ago as he raised his factory worker’s salaries such that they could afford the company’s products and have a higher standard of living. This wisdom is escaping the economic PhD’s and capitalists of the current century, and capitalism suffers.

Another factor slowly killing capitalism is the persistent debauching of the fiat currency by the FED, and unremitting growth of debt which has enlarged wealth disparity. Thus capitalism is enfeebled and the growth of socialism once more fervent. After two centuries of learning and historic experience on socialism, no one should be surprised that Marxism, the implementation side of socialism, is now bringing riots and wreaking havoc through our cities, and society.

Our financial reset, and post-singularities futures

Following the invention of the internet, a technical singularity, another singularity in the form of distributed networks and blockchain as manifested by the introduction of digital cash has been realized. We continue to experience exponential technological innovation, with smart computerized contracts which do not require the former gatekeepers and toll-takers of banks and attorneys for many transactions. Such technology threatens the present financial elite of their deeply entrenched power system as it challenges their status.

The world has a real opportunity to free itself of the dark forces which have robbed citizens of the value of their money, and brought forth global and regional wars and military conflicts. Those in power will not voluntarily relinquish their privileges, therefore it is up people to shape by whatever means necessary their preferred future.

Both political parties have demonstrated too much corruption, as high level political captives dependent on election expense funding are serving our financial elites in government. However, if liberty-loving uncompromised politicians in government were to retake control of their constitutional responsibility to issue money and take it away from central banks, but this time constrained by the technology of blockchain, we could experience a financial emancipation of humans worldwide. On the other hand, if Central Banks implement their version of digital currency, and somehow choke-off private cryptocurrencies, the financial elite will control people absolutely in the future by creating a centralized all-managing financial dystopia. In this sense the ultimate battle between good and evil, Armageddon, will be fought over the next decade.

A decentralized global system of money issued without Central Bank participation would stop financial oppression, eliminate erosion of the currency’s purchasing value, stop increasing national indebtedness, eliminate costly and unnecessary wars, increase worker savings, provide for adequate pension assets, and liberate people worldwide. For this financial emancipation of mankind to take place, it is sufficient that banks as the present central controllers of credit and currency issue have competition. The marketplace and Gresham’s Law would become the arbiter of real value. Bitcoin and other similar currencies already in existence confirms the challenge to fiat currency issued by central banks, and points to the technological singularity that has the power to free people from the bondage of centralized banks and provide decentralized financial services to those who have never been banked in the past. This is one preferable future for mankind that is worth striving for.

Our financial markets are precarious as they have plunged three times in two years. Extrapolating current trends are now dangerous as market volatility has increased. Indeed one cannot extrapolate current trends when approaching a financial singularity, because at the point of discontinuity the rules and laws change in unpredictable ways. The markets could now crash. But the markets could also rise substantially as they did in Weimar Germany. Stock prices went up by multiples, but it was not a bull market; this market was defined by the decline in the value of a currency. Ultimately, investors lost everything. It seems prudent investors must now seek those sectors that preserved their wealth in the past – real assets such as real estate, farms, art, silver and gold.

This article started by pointing out that we are facing the collision of three separate but related financial singularities. While entrenched financial elites will do anything to keep centralized control, distributed computer networks, privately issued digital currencies provide hope for a decentralized system of digital money. In presenting these two different futures, we have conveniently slid by the fact that we must first survive what during next year’s spring or summer will retroactively be affirmed by the CBOE as the Greater Depression of 2020. This five or more year period will be challenging for all, but traumatizing for many.

Thus the collision of these three singularity events – the rapid decline in purchasing value of our currency due to the continued enormous growth of national debt, the coming end of the issue of fiat paper currency issued by our central bank and their attempt to introduce centralized digital currency, and the creation of private, nongovernmental decentralized digital currencies together with the concept of distributed computer networks allowing for a new way to confirm contracts and changing the means by which business will be conducted in the future will be transformative. Ideally, people must use care, good intent, and foresight to shape this complex multi-singularity event into a decentralized preferable future - which will arrive whether we have planned wisely for it or not. In addition, the visible lack of decency attendant public riots and wanton destruction of property nationwide by Marxist agitators points to the very real possibility of a historic constitutional discontinuity which will evolve into a social singularity event related to the upcoming U.S. national elections. These changes taken together represent a global paradigm shift, which consequently will bring forth a New World Order. We have the privilege to live in a unique, “singularity” time period.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2020 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.