For Some Remote Workers, It Pays to Stay Home… If Home Stays Local

Personal_Finance / Employment Oct 12, 2020 - 04:15 PM GMTBy: John_Mauldin

By Dawn Pennington : None of us are medically invincible. We saw that last week when the president and first lady announced they had tested positive for COVID-19.

Remote work has helped to save many jobs and lives. And as coronavirus infection and death rates continue to tick higher, many people are settling into the idea of teleworking for the longer haul.

For some, that means social-distancing from expensive cities and seeking more space in the suburbs or across state lines.

Workers who flee to cheaper pastures, however, may soon find that the grass isn't always greener. Especially if they are thinking about leaving Silicon Valley—whose firms were among the first to champion open office spaces—and taking their jobs with them.

Palo Alto, Calif.-based VMware (VMW) said it will now allow its employees to work from home on a permanent basis.

That's great news for people who want to stretch their salaries. Silicon Valley is known for having some of the highest salaries in the nation.

It also has some of the highest housing costs. (Remember that 897-square-foot Palo Alto home that sold for $2.59 million two years ago?)

No wonder there's a talk about "Tech Exodus." But I'm not a buyer… of that theory, anyway. That's because, if a VMware worker decides to move out of Silicon Valley, he or she will have to take a pay adjustment.

These salary adjustments are based on the expected cost of labor in different areas. Moving to Denver would result in an 18% salary reduction, while moving to LA or San Diego would mean an 8% cut.

It's not just VMware…

Is the California Real Estate Gold Rush Already Back On?

Facebook (FB) has also told employees that the company will be making the transition to more permanent remote options. Employees are expected to work from home until July 2021, and the company expects half of the workforce to stay remote within the next 10 years.

Source: ZipRecruiter

No matter where you are, you can apply to become Facebook's first director of remote work. According to the job posting, this person will lead the push toward “remote-first ways of working.”

But like VMware, it might pay to think about securing your Silicon Valley residence sooner rather than later.

It will almost definitely pay to do that if you want to work, or continue working, for payments processor Stripe, which is among those who want to cut pay for those employees who move outside of Seattle, New York, or the San Francisco Bay area.

However, Stripe is also offering those employees $20,000 to relocate. And a Twitter (TWTR) spokesperson recently said that the company is also looking to localize compensation.

Tech firms are the ones that seem most logical to go fully remote. Being the first movers, they get to make up the rules.

You might see more industries take their cues from the Silicon Valley giants, and soon.

A Remote-Work Reckoning Is Coming

VMware has said that it expects employees to be honest about any relocations. But I think this will be a hard policy to police. Especially since it acknowledged that, if workers move temporarily to be with family or some other short-term reason, they will not have to take a pay adjustment.

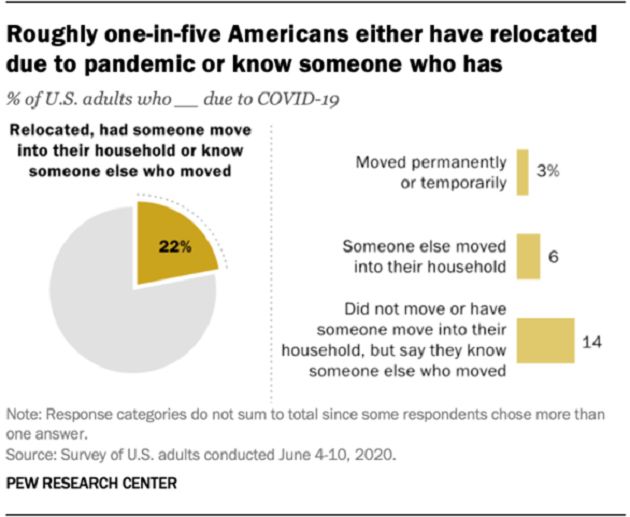

Source: Pew Research Center

Some 22% of people who moved in the early part of this year did so because of the coronavirus.

Moon Salahie, owner of Elite Moving & Storing in Yonkers, NY, said, “People are fleeing the city in droves.” He has been working nonstop since the city began reopening and said that 90% of the moves are to the suburbs.

That includes out-of-state suburbs like Connecticut, where some 16,000 New Yorkers fled between March and July.

We can assume people wanted more space for their new indoor lifestyles. But many also likely relocated for financial and/or social reasons.

The Tax Man Will Keep You Company Wherever You Go

I’m reminded of my "permanent nomad" friend who’s a full-time RVer. She’s been parked in the same spot for a year, near our favorite coffee shop in West Palm Beach. But with her company's office closed indefinitely, she is reconsidering her permanent address.

One option means no state income tax, while the other does. But the second comes with much lower insurance premiums for all her vehicles.

If you've recently crossed state lines—virtually or otherwise—there's also a chance that your income might be eligible to be taxed in multiple places.

- The state where your primary residence is located can tax your income no matter where in the world you make it.

- But any state where you earn income also has the right to tax income earned there.

Only 13 states have agreed not to tax workers who have moved there temporarily because of the pandemic. So, accountants are advising taxpayers to keep track of how many days they spend working in each state.

As for my friend, my bet is that she finds a way to have it all. There's certainly never been a better time to ask for it…

A Bigger Perk Than Pay

Right before the US lockdowns started in earnest, Global Workplace Analytics reported that nearly 90% of workers it surveyed wished they had telework options.

Many employers were resistant despite that same survey's findings that they could save $11,000 per year per employee just by requiring them to be in the office half-time.

Given that, a pay cut doesn't seem to make much sense. On the other hand, if you're going someplace where the cost of living is cheaper and your quality of life is higher, is that really losing out?

Dawn Pennington is the Editorial Director at Mauldin Economics.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.