Gold Price Trend Forecast into 2021, Is Intel Dying?, Can Trump Win 2020?

Commodities / Gold & Silver 2020 Oct 20, 2020 - 07:17 PM GMTBy: Nadeem_Walayat

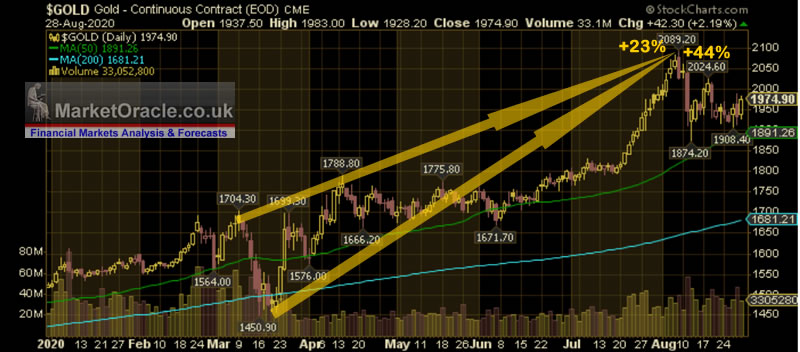

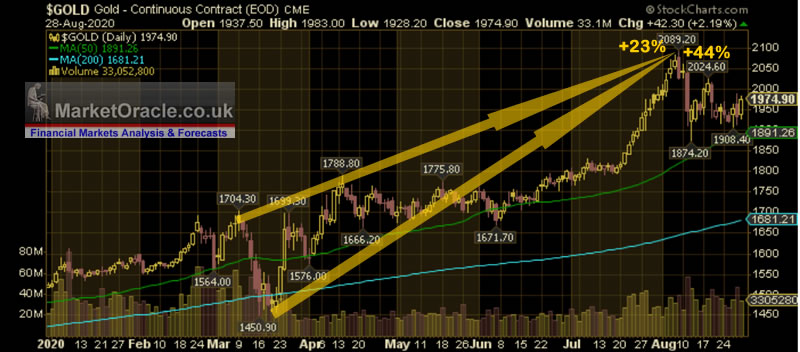

The Gold price traded to a new all time high to well beyond the $2000 milestone after having held in a trading range at just below $1800 for most of the post corona crash bounce.

June saw the gold price further lift it's trading range to $1840 before the fuse was lit and Gold preceded to bust through $1900, and soon above it's previous $1911 all time high, then $2000, finally coming within a whisker of hitting $2100 before turning lower to enter into a trading range of between $2025 and $1875.

The whole of this extensive analysis was first been made available to Patrons who support my work - Gold Price Trend Forecast into 2021, Is Intel Dying?, Can Trump Win 2020?

- Gold Trend Recap

- QE4EVER

- Inflation Mega-trend going Hyper!

- The End of Capitalism?

- Gold Price Analysis and Trend Forecast

- Silver New All time High Coming?

- Is Intel a dying mega corp?

- Nvidia Ampere Blast off!

- TSMC

- AI stocks current state

- Can Trump win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

GOLD PRICE TREND ANALYSIS

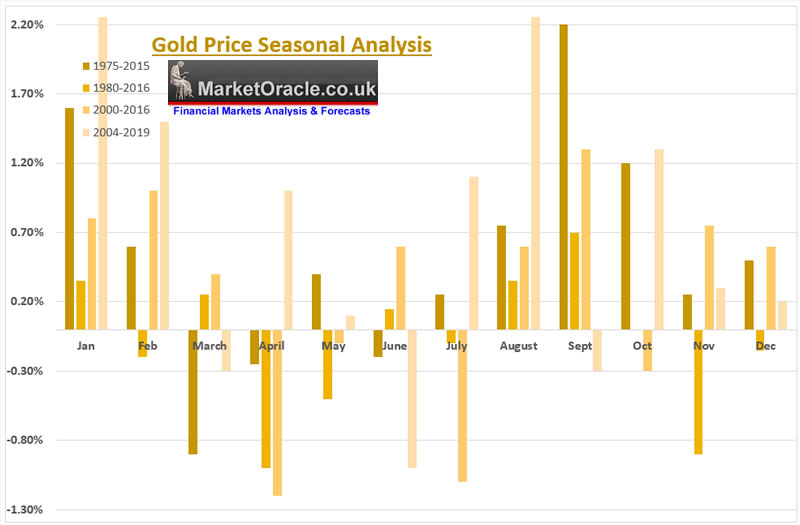

SEASONAL ANALYSIS

The most reliable seasonal patterns are for a strong January and February, followed by a weak period spanning March to July. Strong August and September, followed by a volatile uptrend into the end of the year.

As far as seasonal patterns go, they have proven quite reliable for Gold this year, i.e. we had a strong Jan / Feb then basically flat into July before the surge higher to new highs during August.

(Charts courtesy of stockcharts.com)

The seasonal pattern suggests that Gold is not done to the upside i.e. September 'should' see a further burst of upside activity to new all time highs with some follow through into October before a correction of sorts late October and during November and likely an up tick of sorts during December. So strong September, bullish October, weak November, weakly bullish December.

What about 2021?

A bullish January / early February before Gold once more corrects / consolidates it's gains into the summer months, so it looks like we are set for 2 impulse runs higher to new all time highs, one into October, and a 2nd into Late Jan / early Feb 2021.

Is such a seasonal pattern probable?

Yes, Gold is in a BULL market so should trend higher, and given the bullish nature the weakness from Feb to June may prove less so than seasonally suggested.

US DOLLAR

Normally there tends to be an inverse relationship between the US Dollar and Gold. When the Dollar rises, the gold price tends to fall and visa versa.

It has definitely been the case for the past 6 months following the March spike to Dollar safety since when it's been all down hill for the Dollar, which goes a long way to explain Gold's bull run translating into Gold bugs should not get carried away as the rise in the Gold price is VERY DOLLAR DEPENDANT! Though of course ALL currencies are in a state of perpetual free fall. it's just that the dollar is falling faster then the rest at this point in time. Nevertheless this does take some shine off Gold's bull run as it is what one would expect to happen given the fall in the US dollar.

So what's next for the Dollar ?

We'll it is in downtrend. However, I doubt we are going to see a similar trend lower as that we have already witnessed, that would be too easy. More likely is that the dollar does not have much downside left and could rally towards resistance along $95. So implies continuing weakness towards voting day followed by a post election bounce, which closely matches my seasonal Gold pattern expectations i.e. strong Gold price into October then a weak November, mild December before Gold awakens once more during the new year for another spurt higher.

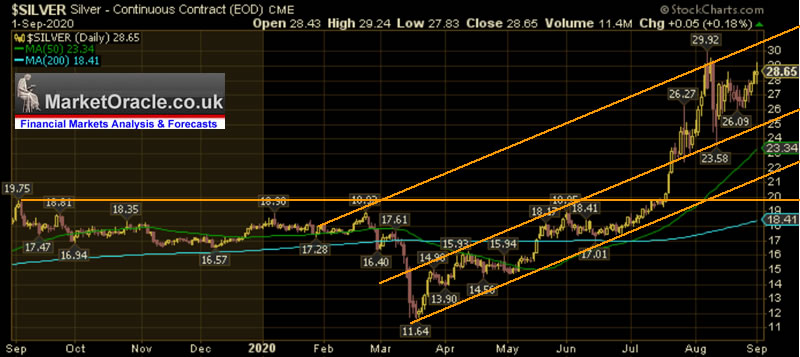

Gold / SIlver Ratio

Gold price of $1975 divided by the Silver price of $28.5 results in a ratio of 69.3, this is down from a peak of 131! So you can very well understand why I have been stating for some time that Silver was a extremely cheap compared to Gold, In fact in my last Gold analysis way back in January the ratio was 89.

(Charts courtesy of stockcharts.com)

The ratio has now corrected itself towards historic norms, though Silver is more volatile so tends to overshoot in both directions. Anyway Gold is now NOT expensive relative to Silver, or Silver is no longer dirt cheap relative to Gold depending on ones vantage point.

GOLD LONG-TERM TREND ANALYSIS

The long-term chart shows an accelerating bullish trend following the Mid 2019 $1400 breakout of it's trading range. That was the first major signal that the Gold price should target a trend towards it's all time high of $1923, following which would remain pending a breakout to new highs. Well that breakout has now happened!

Looking at the accelerating curve of the chart I am sure many Gold bugs will be salivating at the prospects of the trend continuing on the accelerating trajectory which implies the likes of $4000 by the end of 2021! Which IS possible! Though NOT probable!

So we have had a breakout to new all time highs, so we should so couple or more such trends to new all time highs over the next 6 months or so.

TREND ANALYSIS

Gold price reaction from $2100 looks corrective, resembling a converging triangle, so should eventually resolve to the upside.

MACD - The MACD continues to unwind its overbought state having fallen to a level that allows for an imminent resumption of the bull run.

RESISTANCE : Gold is trading near resistance of $2025, then $2090, so not much resistance overhead which should be the direction of travel.

SUPPORT : At recent lows of $1915, $1875 and then previous highs of $1825. So likely the lowest Gold could correct to is $1825

ELLIOT WAVES: Elliott wave is not clear, it's a case of pin the tail on the donkey here. So I'll pin the tail on $2090 being a Wave 3 and the current correction a Wave 4. as it best fits the chart patterns.

Formulating a Gold Price Trend Forecast

The key point is that Gold has broken out to a new all time high, hitting $2090 and then correcting. So once the correction resolves then Gold 'should' resume it's bull trend.

On many measures such as trend analysis and MACD and moving averages Gold has unwound it's overbought state so a resumption of the bull trend should be imminent.

Seasonal analysis suggests Gold continuing higher should be imminent, followed by a correction ahead of voting day and then rallying into the new year for a strong January 2021.

Fundamentals - Rampant money printing to INFLATE prices is bullish for assets that cannot be easily printed.

The key triggering point for the resumption of gold's bull run will be a break above $2025.

In terms of where to? That would need to be extrapolated from channels and other geometric tricks of the trade because there is no price action beyond $2090 to call upon.

Gold Price Trend Forecast 2020 Conclusion

My forecast conclusion is for the Gold price to resume its bull trend sooner rather than later, with the key trigger being a break above $2025. Gold likes round number so the next stop is likely just north of $2200 before Gold corrects in the wake of US election uncertainty. Following which expect further Gold weakness due to LESS uncertainty once the election result is known until the forces of rampant money printing reassert themselves in investors / speculators minds as they attempt to discount future inflation by means of buying assets such as Gold, which would suggest the next stop before Gold corrects once more is likely to be just over $2,400 by late Jan / early Feb as illustrated by my following forecast graph.

Silver New All Time High?

Gold has traded to a new all time high so why has not Silver? That will be because Silver is MORE volatile and LESS predictable in terms of trend and timing which is why my approach to Silver is SIMPLE, invest when cheap and then wait for the SPIKE to materialise to cash in on.

As my earlier analysis on the Gold / Silver ratio shows, Silver has been playing catchup to Gold now trading to a ratio of 69. Where during a spike Silver could trade to 50 which on today's Gold price of $1976 would convert into a Silver price of about $40! Though I expect such a ratio to be temporary. Meanwhile the Gold price forecast target of $2,400 at a ratio of 69 converts to a Silver price of $35.

However, given the ratio's trend trajectory than Silver trading to a ratio of 64 to Gold is more likely than not which converts to a Silver price of $37.5.

I know $37.5 is nowhere some of the crazy talk of $100+ that Silver bugs around the internet are currently dreaming of, but so far I am not seeing anything that suggests Silver achieving anything other than $40 at best.

The bottom line is that Silver has been playing catchup to Gold, it was dirt cheap, now not so cheap when considering valuations of the past 10 years, so I doubt we will see a similar push higher as we saw from $11 to $30, instead into Feb 2021, $37.5 to $40 is probable.

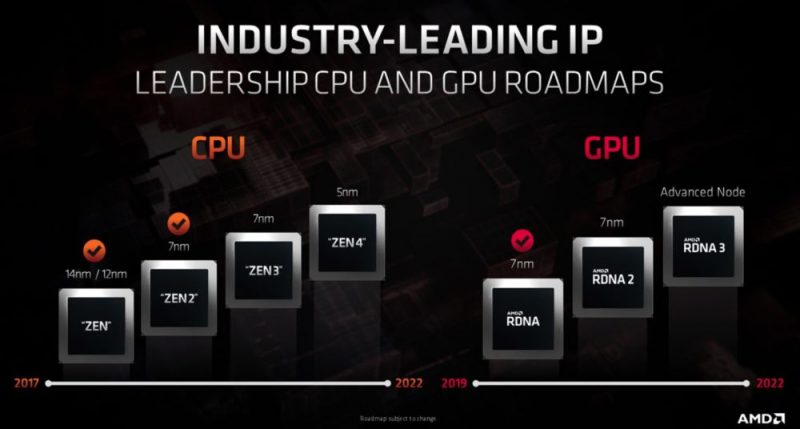

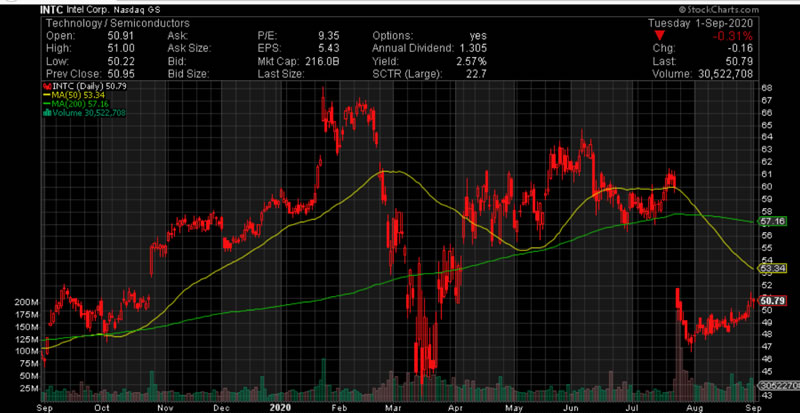

Is Intel a DYING Mega-corp?

My warnings of the past year of a brewing seismic shift taking place in the CPU market continues to become manifest both in the announcements coming out of each Chip producer and on the stock price charts as AMD is literally crushing Intel with a strong possibility that unless AI and Quantum computers come to Intel's rescue than we are witnessing the slow death of a tech giant that will eventually be replaced by a corporation that just a few years ago traded at about 1/100th Intel's market cap!

Two dynamics are at work

1. AMD is OUTPERFORMING expectations with it's CPU lead over Intel set to extend on release of the 4000 series proper. Whilst it's recently released 4000 APU's (3000 series processors with GPU cores) has resulted in huge demand for these processors especially from laptop manufacturers resulting in huge backlogs of orders that will likely be repeated with the release of Zen 3 4000 series desktop processors due to be announced later this month that are definitely going to hit Intel HARD because AMD IS DELIVERING WHAT IT PROMISES hence huge demands for it's processors. Thus AMD's 7nm architecture looks set to advance to 5nm next year.

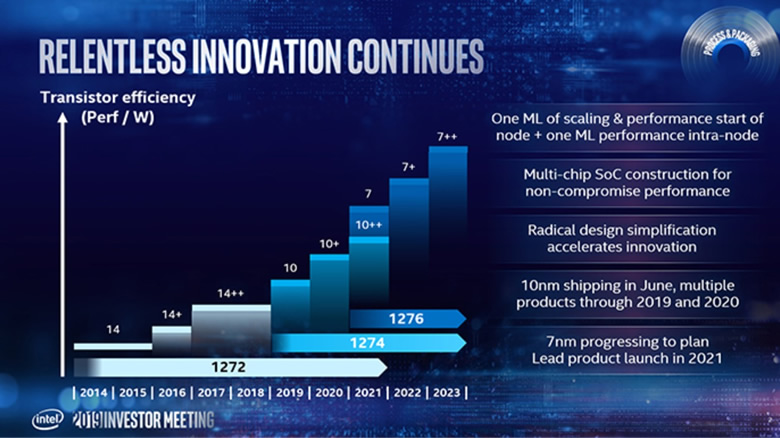

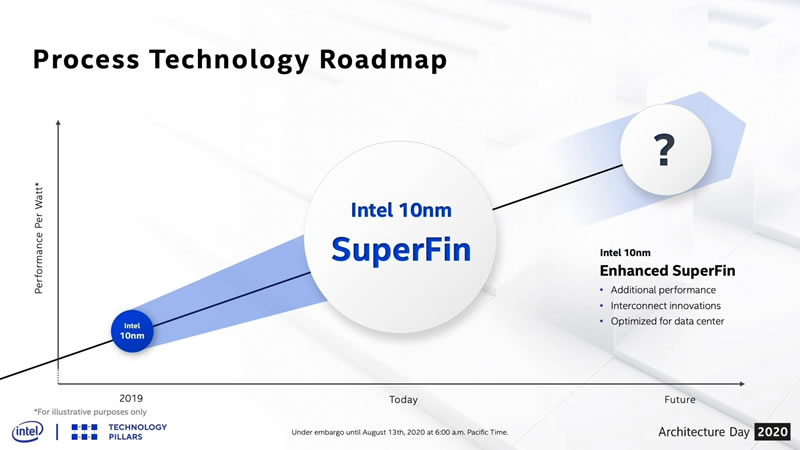

2. INTEL has lost it's way. Basically the patients are in charge of the Intel asylum, it's management sucks! It's as though Intel's management is working in AMD's best interests! This has been a trend that has been underway for a good 3 years. For instance Intel was supposed to have moved to 10nm node processors by Mid 2016 and 7nm by Mid 2018 as this graphic from 2010 illustrates.

Instead Intel is only now in Mid 2020 very slowly moving to 10nm with the release of laptop CPUs, but no desktop CPUs yet! Whilst the 7nm node is supposed to appear in 2021. With odds strongly favouring Intel FAILING to delivery once more. This level of incompetence that spans a good 4 years is literally KILLING INTEL! The morons in charge of Intel are KILLNG the granddaddy of CPU manufacturers.

Even Intel's latest roadmap released just a few weeks ago has already been busted, with news filtering out of the dying tech giant that it's 10nm process does not yield enough working CPU dies to be profitable, and it's 7nm process is also BROKEN! i.e. they are just not able to make it work. Therefore there is not going to be any 7nm processors in 2021, perhaps not even in 2022! As Intel has yet to fix its 10nm process so that it becomes profitable. Therefore it looks likely 10nm desktop processors won't appear until next year either.

And if that was not bad enough, Intel has decided to cripple it's 10th Gen motherboards by limiting memory speeds on all but the most expensive high end x570 boards, this stupid move has rightly drawn much criticism from the tech community which acts as another nail in Intel's coffin. That and support for PCIe 4.0 has been kicked down the road to 2021. This despite AMD delivering support for PCIe 4 for approaching a year now.

Basically whichever way one looks at it Intel is now approximately 18 months behind AMD! That is a huge tech time gap to make up and catch upto what had been a tiny flea on the back of the Intel elephant barely 3 years ago! Instead now is seriously threatening Intel's existence as one of the worlds dominant CPU designers and manufacturers.

So just as I have been warning for well over a year now that Intel is badly losing in the CPU wars to AMD and that unless Intel gets its act together soon the world could be at the beginnings of seismic shift in the CPU world which IS now manifesting itself in the stock charts as Intel dropped like a stone after it's recent revelations concerning a further delay to 7nm CPU's to 2023, when AMD has been selling 7nm processors since 2019! By the time Intel actually starts delivering 7nm CPUs AMD could be outselling them with 3nm CPU's!

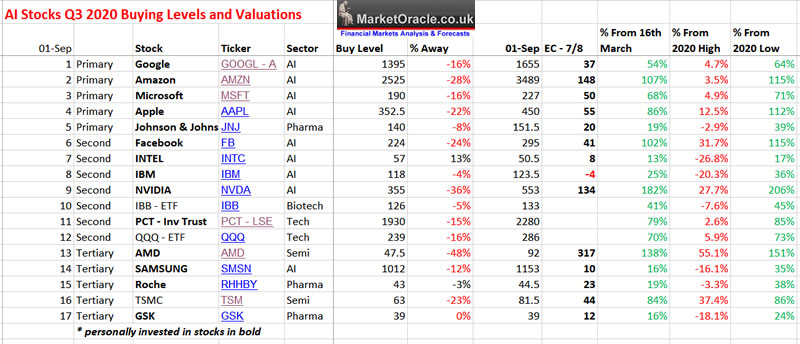

In terms of the AI portfolio then this means that Intel has had to be relegated from primary to secondary and AMD promoted to 13th of list though still remains as a higher risk tertiary stock due to being very expensively priced.

So why is Intel still a secondary and AMD tertiary, well it should br noted that Intel fabricates its own CPU's whilst everyone else including AMD and Apple outsource theirs to the likes of Samsung and TSMC. And Intel will eventually be launching their 11th generation CPU 10nm+ Super fin architecture 'Tiger lake' that include integrated Xe graphics that 'could' beat AMD's 4000 APUs and thus be in demand for laptops and budget desktops without dedicated GPUs.

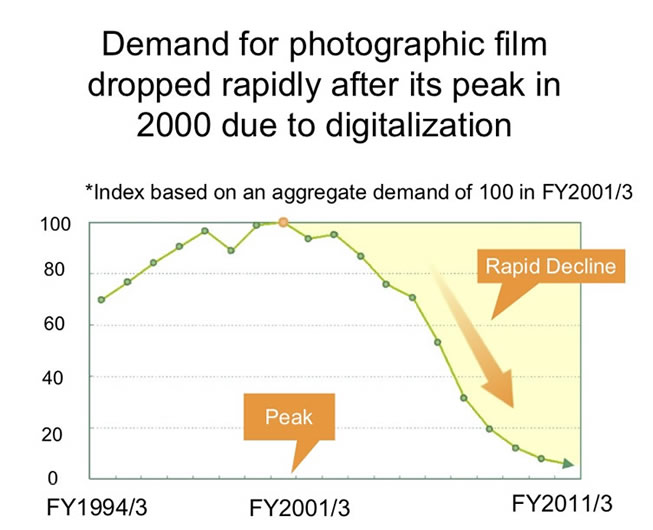

And it should not be forgotten that whilst AMD is winning the total compute power war, Intel CPU's are still just managing to keep ahead on single core workloads which is important in gaming due to higher clock speeds that 11th Gen Tiger lake CPU's will aim to continue. So IF Intel gets its act together it can at least compete against AMD in some segments of the market, but then again AMD Zen 3 processors about to be announced in September could also take the gaming crown away from Intel, if the the likes of the 4600x, 4700x, 4800x, 4900x and 4950x can beat Intel's best on single cores which given leaks of IPC increases of upto 20% AMD could just manage to do and thus achieve CPU supremacy over Intel by delivering more cores, high frequencies and greater gains in IPC, ALL for LESS price! Which is the price Intel pays for having basically under delivered for a good 5 years thus allowing a competitor to come from nowhere and take it's CPU market share which is what happens when companies start to die, as has happened countless times before i.e. Kodak the once king of photography comes to mind that failed to keep up with the competition just as is the case with Intel today.

So what would I do as a Intel stock holder?

Firstly as you know I am invested for the LONG-RUN for the duration of a mega-trend so I have NOT sold any Intel stock, nor am I looking to buy any more Intel stock unless I see some positive developments.

Yes, Intel management sucks, but even if the corporation is dying it's not going die overnight i.e. there is enough scope for the AI mega-trend to LIFT Intel stock price along with it, all Intel has to do is be competent. It does not need to outperform just deliver that which it promises.

A little bit of competence could go a long way to repairing Intel's image and stock price.

INTEL BREAKING NEWS

It seems like that virtually everything Intel is involved in these days it somehow manages to screw up! And so is the case with a new super computer named Aurora that Intel is building for the Department of Energy's Argonne Laboratory which was supposed to be installed during 2021. However, Intel has announced a 12 month delay in supplying CPUs for the super computer and that many of the chips won't be manufactured by Intel but instead sourced from a third party. Hmm who could that be? We'll the corporation at the cutting edge of mass production of high end CPU's is Taiwanese TSMC which is thus very probably the likely the new source of Intel's super computer CPU's, given it's own production failures. And the deeper one goes down the CPU rabbit hole then the more one becomes aware of the growing importance of TSMC.

NVIDIA BREAKING NEWS - Ampere Blast Off!

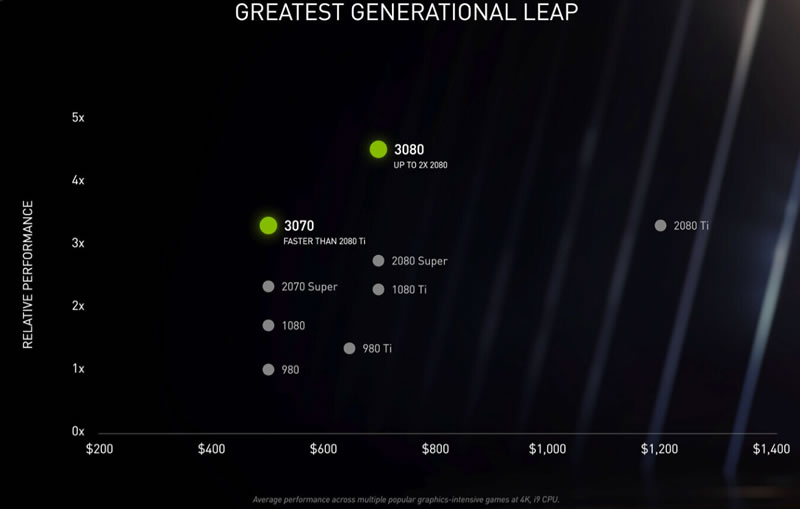

Nvidia has just released information on their next gen RTX 3000 GPU's , and if what NVIDIA announced is true then they have just blown away the rest of the competition for a good 2 years! Just on the basis of today's release! This is what a good AI stock looks like!

For instance I was expecting a 30% increase in performance over the RTX 2000 series GPU's for the same $ price, instead NVIDIA is announced a 100% Increase in performance! Which means AMD and the rest of the market are NOT going to be able to get anywhere near NVIIDIA's GPU's in terms of price per performance, not even close for at least the next 2 YEARS by which time NVIDIA will be announcing it's RTX 4000 series GPU's!

The 3000 series is based on Nvidia Ampere architecture, where the following image illustrates the magnitude of their achievement as Nvidia have delivered far MORE than the market was expecting it to deliver, especially given that their previous Turing architecture was not that much of a leap from that which preceded it (Pascal).

If NVIDIA's slides turn out to be anywhere near true then I am sure many including myself will soon be buying an NVIDIA 3000 GPU given the huge jump in performance even if real world bench marks come in at say at 80% improvement instead of the 100% stated. For instance implies will now be able to train the same neural network in near half the time for the same $ price GPU. Though given the amount of demand it's likely the actual prices from third parties will be a lot higher than NVIDIA's MSRP's i.e. I think it will be quite some time before we can actually buy an RTX 3080 for anywhere near $699 / £649 from Nvidia direct or from the likes of Amazon.

And the stock price says it all! $552!!! Up from $175 just 6 months ago!

The rise in Nvidia's stock price may seem insane but its NOT because NVIDIA has effectively cornered the GPU market for the next 2 years! It literally has NO competition! Nvidia can literally sell as many GPU's as it can produce, simple as that!

And let's hope AMD also gives the markets a pleasant surprise when it announces it's Zen 3 Ryzen processors later this month, for which I am expecting a more modest IPC increase of between 18% to 22%.

That's a boost for 3 stocks on our list, NVIDIA, AMD and SAMSUNG because the RTX dies are manufactured by Samsung for Nvidia.

Taiwan Semiconductor Manufacturing Co. (TSMC)

So real question that should be asked is why is TSMC not on my list. We'll I have not included in the past for 2 reasons -

1. It's a a Taiwanese company thus higher risk. Though an announcement to build infrastructure to start manufacturing CPUs in the US is going to reduce that risk.

2. It used to be a relatively small cap stock but that has now changed given it's stellar stock performance over recent years.

So if AMD is now well and truly embedded on my AI list then yes TSMC should also now be included on my AI stocks as a tertiary stock. In terms of valuation it ranks similar to Google and Facebook right now.

Looking at TSMC stock price chart then well, OUCH!

The current price of $81.5 values the company on my EC indicator at 44 which is on par with Google, Facebook and Microsoft. Therefore it may be wishful thinking but the price I would likely consider buying TSMC at is $63 or lower which is 23% distance from today's price, so unlikely to be realised anytime soon. Still as March 2020 illustrates anything is possible, after all those second spikes are fast materialising.

In terms of technology, TSMC is working the CPU magic that Intel should be i.e. Intel is finding it difficult to move to 10nm whilst TSMC is preparing to move from 7nm today to 5nm in 2021 with work on 3nm in the pipeline for 2022. So it's no wonder that Intel is itself starting to source CPU's from TSMC, the way this works is that Intel gives TSMC the chip design and TSMC then manufacturers the chips for Intel, just as TSMC manufactures AMD's chip designs.

The bottom line is Moores Law is only dead for Intel. TSMC is galloping along on an exponential compute power curve that will by the Mid 20's move from silicon to other semi conductors such as nano tubes.

Anyway TSMC has now made an entrance onto my AI stocks list, that now numbers 14 stocks and 3 funds, and is at the top of my personal list of stocks to accumulate into whenever the opportunity presents itself.

Buying levels for Q4 will be updated following a stock market trend forecast.

The bottom line is AMD is prospering at Intel's expense. BUT Intel IS an AI Mega-trend stock which means whilst it is under performing nevertheless it is on an exponential trend trajectory as is the whole sector! Again remember the underlying principle here, AI stocks are on an exponential trend trajectory, even BADLY run AI stocks such as Intel. Yes, I know the economies are faltering, and yes unemployment is going to rocket higher so there is going to be a lot more real world pain for many millions of people, but all of that is immaterial where the AI mega-trend is concerned.

Apple Stock Price Crash by 75% on 31st August 2020!

Don't worry folks, it's a 4 for 1 stock split. In my experience stocks that split tend to get a small boost over the coming year or so as the split in price encourages more buyers. How much boost? Perhaps in the order of 5%-10% extra.

And talking about splits, Amazon is definitely ripe for a stock split! Perhaps by as much as a 10 for 1 split!

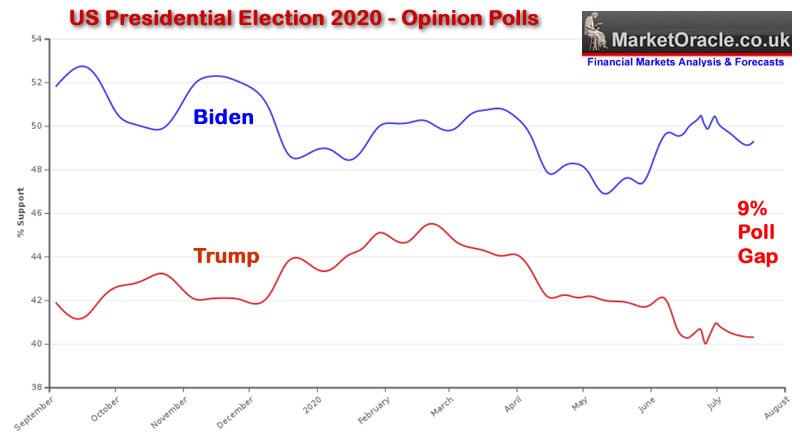

Can Trump Win 2020?

Now that the dust has finally settled and we all know it's going to be a face off between Trump / Pence vs Biden / Harris.

Current opinion polling suggests that Trump is going to lose badly on the back of the worst economic collapse in history, not to mention 188,000 dead Americans.

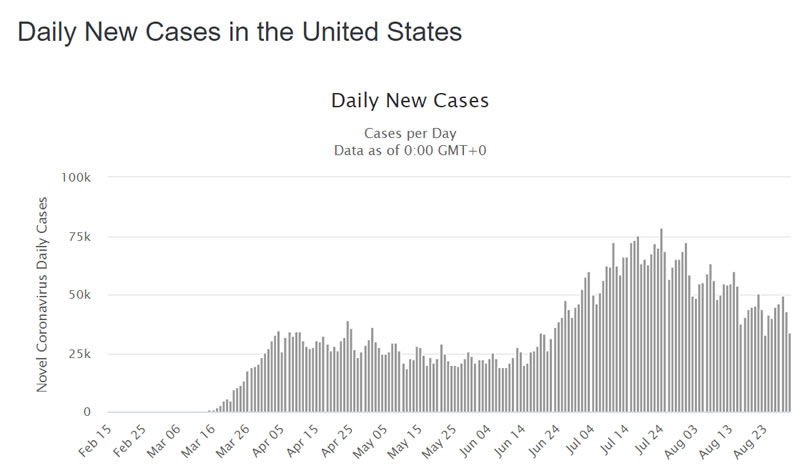

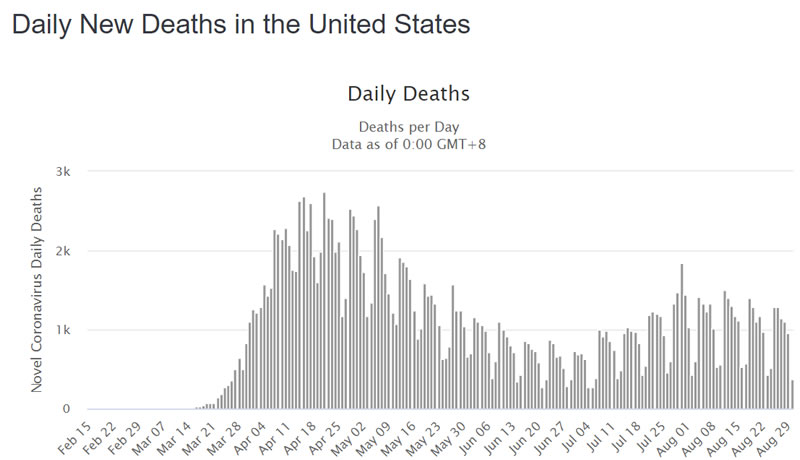

Any signs of hope on the pandemic front?

The 2nd peak that I warned off a near 3 months ago has more than materialised, with 2 months to go until voting day there is not much sign that the pandemic picture is going to improve in Trumps favour by voting day, especially given that the US is heading into colder weather. So it is highly probable that the US could be heading for a THIRD peak that would take the number of daily cases to a new high.

The only saving grace is that the second peak in the number of deaths did not exceed the first peak. Which means that at least the US medical establishment is better able to treat the disease without it killing the patients. Such improvement in covid-19 treatment will be critical in coping with the coming THIRD WAVE and gives some propaganda value for the Trump regime to focus on despite the horrific headline number of 188,000 dead americans that could exceed 250,000 by voting day.

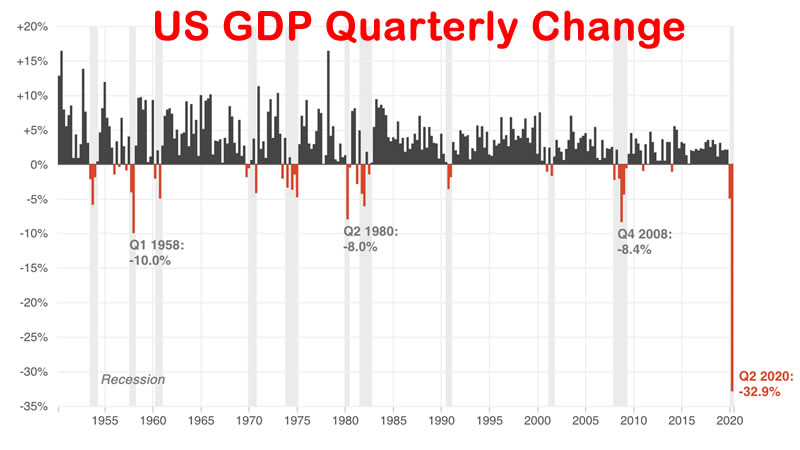

Economy? What economy?

Economic collapse on a scale not scene before in the United States is definitely not going to help Trump get re-elected. The following 2 charts say it all so no need for me to spout the obvious.

So can Trump still win?

My analysis ahead of the 2016 vote concluded that Trump as the anti establishment delirium inducing in the electorate Mr Brexit candidate had a 2% hidden from the pollsters swing in his favour of that 'should' just swing it in Trumps favour. Which it did delivering good betting profits for myself and those who had been convinced that Trump was likely to win.

This time round the hidden swing is probably nearer to 1.5%. Which unfortunately given the current state of play with Biden 9% ahead is just not going to be enough to tip it in Trumps favour on that metric alone i.e. Biden would still lead Trump by 6%.

However, where delirium is concerned Trump and his minions are starting to go full blast in what I expect to be ever expanding waves of delirium in attempts at confusing the electorate to the extent that they do not know the difference between that which is true and that which is false. We'll they have already had 4 years of Trump delirium and all through this pandemic. Inducing delirium amongst the electorate IS POTENT political weapon that most politicians use to some degree.

For a primer of how Delirium could once more help Trump win the election again watch my video from November 2016. of what to expect for 2020.

However, there is one variable that could help narrow the gap and bring the outcome into the realms of margins of error and that is the stock market. Basically the higher the Dow climbs the greater the probability that Trump will win, whilst the lower the Dow trades the less likely trump is to win.

The last close of 28,645 is not far off the Dows closing all time high of 29,600. SO as things stand where the stock market currently is and where it could trend to i.e. new all time highs means the effective 6% Biden lead is narrower still. How narrow warrants more in-depth analysis.

So the stock market will be the focus of my next analysis that will play a pivotal role in determining whether or not Trump can win a 2nd term in office, which if so given the betting markets could delivery us all more profits from potentially betting on an rank outsider.

However, if I had to pick today who I thought was going to win in November then given an actual poll lead of 9% and perhaps an effective poll lead of 5% then it would have to be Biden. BUT, it's not over yet! as I need to work out

a. What the Dow will do into election day.

b. To what degree will Trump benefit from a higher stock market, given that the Dow is now within 1000 points of it's all time high.

Again whole of this extensive analysis was first been made available to Patrons who support my work - Gold Price Trend Forecast into 2021, Is Intel Dying?, Can Trump Win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. including my most recent and next analysis that concludes in a detailed trend forecast for the stock market into December 2020.

Part 1- US and UK Coronavirus Pandemic 2nd and 3rd Waves Trend Implications for the Stock Market

- Stocks Correction

- The Inflation Mega-trend - The Great CPI Con trick.

- The Corona Depression Second Wave Current State

- UK Government Coronavirus Second Wave Panic

- US Pandemic Presidential Election Forecast Implications

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- ELLIOTT WAVES

- Dow Stock Market Trend Forecast Conclusion

- AMD is Killing Intel - Set to Achieve CPU Market Dominance

- AI Tech Stocks Q4 Buying Levels

And access exclusive to Patrons only content:

How to Get Rich Investing in Stocks by Riding the Electron Wave.

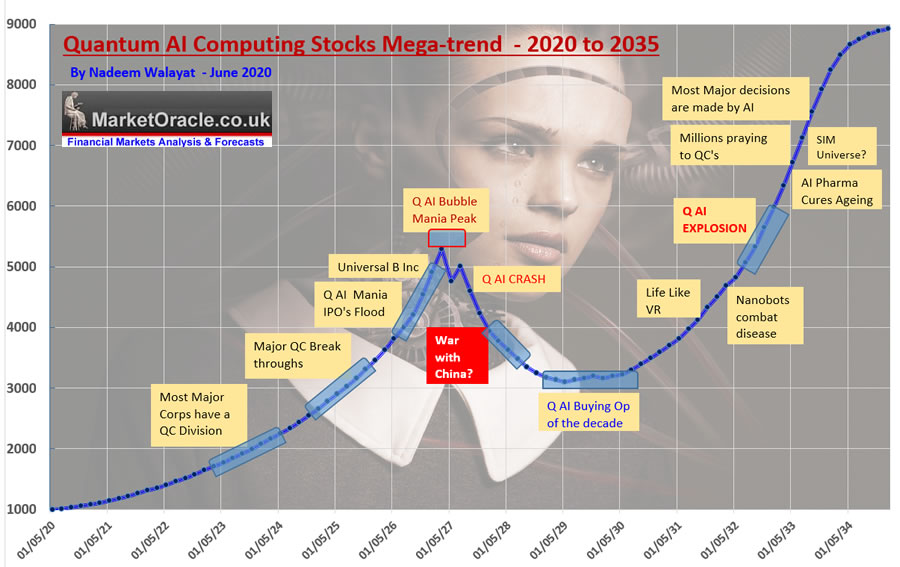

Not to mention trend forecasts such as - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.