This High-Confident Trade Set-up Makes for High-Confident Traders

InvestorEducation / Elliott Wave Theory Dec 07, 2020 - 12:16 PM GMTBy: EWI

"Confident trader." Ten-fifteen years ago, the idea used to be an oxymoron -- and now, it's a multi-billion self-help industry with everyone from Wall Street gurus to armchair experts offering their brand of motivational wisdom: trust falls, vision boards, brain retraining, positive visualization, mentorship, and so on.

The common goal being: Help traders tap into their inner Rocky when they step into the "ring" of financial markets.

The problem is, not everybody can channel Rocky. Some of our inner "champions" have the muscle mass of a mozzarella stick no matter how many can-do mantras you throw at them.

Which is why Elliott Wave International's Senior Instructor Jeffrey Kennedy -- an actual market expert with 25+ years of experience forecasting trends and offering traders practical lessons -- believes the single best way to build confidence as a trader is to know exactly what a high-confident trade set-up looks like on a price chart -- as in, any price chart, on any time frame.

So, what does that look like?

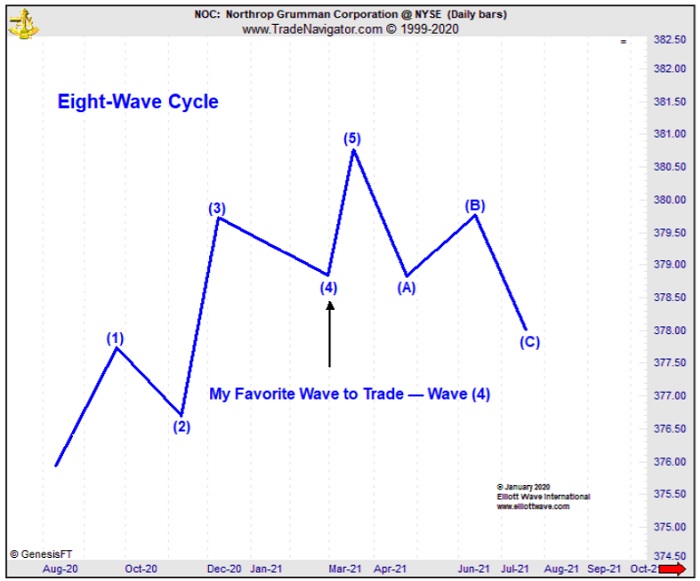

Well, the Elliott Wave Principle -- a.k.a., Elliott wave theory, or wave analysis -- asserts that markets progress in simple patterns, pictured here as five waves up (an impulsive pattern) and three waves down (a corrective pattern).

Within this pattern, there are four trade setups that help traders minimize risk. After all, for every trader, rule number one is not to "make money" -- it's to protect capital.

And for Jeffrey, one of those chart setups offers the highest probability of success: the fourth wave pullback. The reason being, once you have confirming price action of a fourth wave -- i.e., in bull market, a pullback that ends above the prior low -- you can prepare for a fifth wave move to a new high.

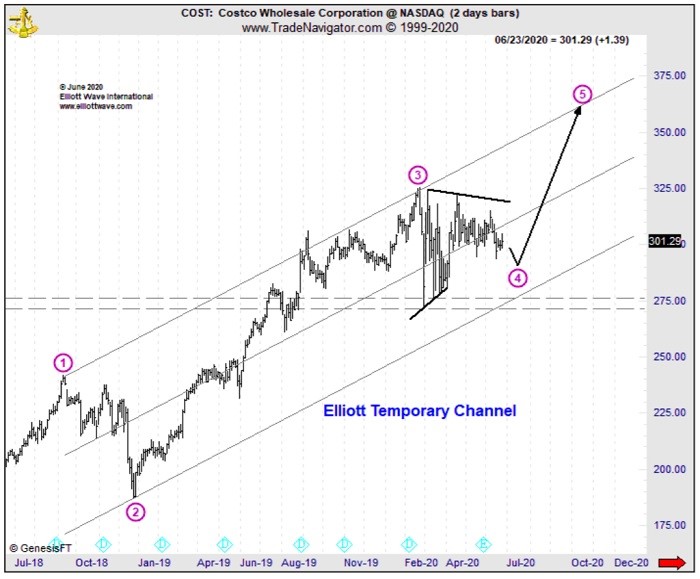

Let's apply to this knowledge to a real market. This past summer, Jeffrey found himself face to face with his favorite setup, the fourth-wave pullback, on the price chart of retail giant Costco (NASDAQ: COST).

In his June 24 Trader's Classroom video lesson, Jeffrey showed the following wave count on COST's chart, and outlined this bullish scenario moving forward:

The fourth wave pullback would terminate "no earlier than July" and set the stage for a fifth wave rally toward the $350 area, at minimum.

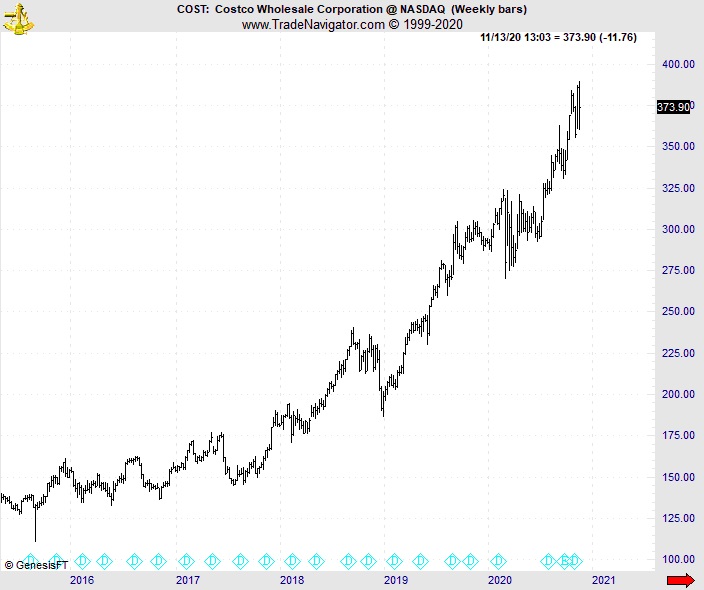

This next chart shows what followed: COST continued sideways until late July, after which prices broke out to the upside in a powerful rally to record highs.

In the end, becoming a more confident trader is about your attitude -- and the change in attitude comes from a solid understanding of what moves the markets.

For Jeffrey, the genesis of his 25-plus year-long progression from Elliott wave student to EWI's most popular instructor began with the discipline's "bible": "Elliott Wave Principle -- Key to Market Behavior."

This classic book showed Jeffrey the reliability of fourth-wave setups:

"Fourth waves are predictable in both depth and form, because by alternation they should differ from the previous second wave of the same degree. More often than not, they trend sideways, building the base for the final fifth wave move."

Elliott Wave Principle is a mainstay in every active Elliottician's library, dog-eared and underlined and frequently revisited for a refresher course on the core wave tenets, such as:

- Definitions and diagrams of the core Elliott wave patterns

- 3 cardinal rules of Elliott wave analysis

- Summary of all Elliott wave guidelines

- Common Fibonacci retracements

- Behavior of specific waves and corresponding investor psychology

And more!

The best part is, you can get a copy of Elliott Wave Principle -- Key to Market Behavior -- FREE -- with a Club EWI account. (It's a $29 value.) Club EWI is a free online community of investors, traders and thinkers. There is no fee to join, and it takes 15 seconds to get a Club password.

The moment you start reading page 1 of Elliott Wave Principle is the moment you begin your journey toward becoming a more confident trader, FREE.

This article was syndicated by Elliott Wave International and was originally published under the headline This High-Confident Trade Set-up Makes for High-Confident Traders. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.