Precious Metals: The Foundation of A Sound Financial Portfolio

Commodities / Gold & Silver 2020 Dec 14, 2020 - 05:04 PM GMTBy: Nick_Barisheff

Precious metals are the bedrock of the financial world. They have permanent value and are the oldest form of money in the world. If you don’t own physical gold and silver, your investment portfolio lacks a sound foundation. Precious metals are often sought after as a store of permanent value, and as a method of diversifying portfolios.

While cash, bonds, stocks and real estate offer investors financial diversification, precious metals underpin all other assets, particularly during times of economic turbulence and market turmoil.

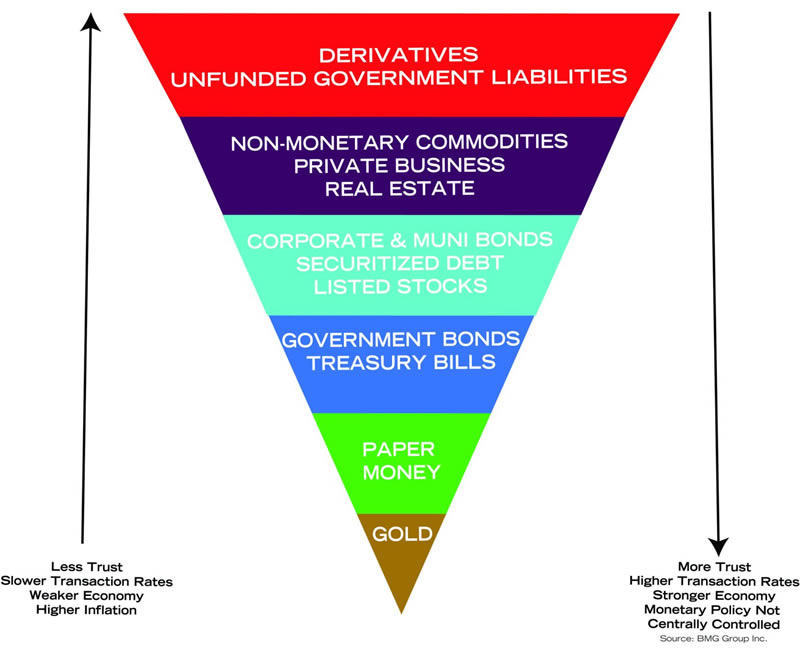

Imagine an upside-down pyramid containing successive layers of asset classes.

That’s what the late John Exter envisioned when he devised a model ranking assets based on their risk level and financial soundness. The American economist and central banker placed risk-free gold at the apex of the inverted pyramid, below Federal Reserve cash, U.S. treasury bills, notes and bonds, AAA-rated corporate bonds, paper currencies, certificates of deposit (CDs), bank deposits, commercial paper, state and municipal bonds, junk bonds, segments of the Eurodollar market, Third World debt, insolvent borrowers and thrifts.

A monetary researcher and visionary, Exter understood how gold’s scarcity and trustworthiness made it foundational in an unstable financial world. He knew gold would endure amid expanding debt and an unlimited supply of paper currencies, which he referred to as “IOU Nothings.”

Exter’s original gold-based pyramid is a simple yet timeless way of viewing a top-heavy financial infrastructure, which today is burdened by $1 quadrillion in unregulated derivatives, $270 trillion in snowballing global debt and trillions more in unfunded liabilities. In an overleveraged and indebted world, gold is the keystone, supporting all other assets that bear greater risk and loss potential.

Consider these examples:

- Cash deposits and government bonds lose value to inflation in a low-interest or negative-interest rate environment.

- Corporate and municipal bonds can become worthless when companies fail and cities default due to excessive debt.

- Stocks can decline during stock market crashes and may become worthless.

- Even real estate investments can decline in value when financial bubbles pop and property markets collapse.

All investments ebb and flow with the economic tides. Less stable ones drift like shifting sand. Some wither and perish in the barren financial desert. Physical precious metals endure through the ages. They withstand market chaos and weather financial storms. They retain value. Physical bullion will never become worthless. That’s why gold, silver and platinum are essential in a balanced and diversified portfolio.

Not all precious metal investments are alike; however, some are riskier than others, especially paper-based products.

Trading precious metals contracts—such as futures and options—on the commodity exchanges is the most speculative, along with owning stocks of startup mining companies that explore for gold and silver deposits. Closed-end funds and exchange-traded funds (ETFs) that track bullion prices offer growth and income potential, as do established gold and silver producers, but they also carry risk based on management decisions, counterparty risks and overall market conditions. These investments compromise the most important characteristic of bullion – liquidity. They are only as liquid as the number of shares traded daily. In comparison, the physical bullion markets have a turnover of about $60 billion/day.

Unallocated or pooled bullion accounts offer more security and less risk, though not the same degree as outright precious metals ownership, and also have counterparty risks. Bullion in these accounts can be leased out by the custodian.

With the lowest risk and greatest liquidity, physical gold, silver and platinum is your best and safest option. Tangible precious metals provide permanence in an ever-changing world, protect and preserve wealth, and act as a financial backstop during troubled and tumultuous times. For small amounts, a home safe will do for storage but for larger holdings, it is safest to have a reputable custodian that will hold your bullion on an allocated basis.

Open-end mutual fund trusts that hold physical bullion on an allocated basis are a good choice for registered accounts like RRSPs, IRAs and Keough plans, because they buy and sell bullion into and from the bullion markets – the liquidity is the same as bullion with no counterparty risk.

Every storm-worthy structure has a strong foundation. Every stable bridge has a sturdy buttress. Every balanced and robust financial portfolio is bolstered by rare, rock-solid precious metals.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2020 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.