ESG ETF Investing Flows Drive Clean Energy to Fresh Highs

Companies / Investing 2021 Jan 07, 2021 - 03:54 PM GMTBy: Chris_Vermeulen

The ESG theme has taken the capital markets by storm in 2020. Fund flows into this space have been relentless, helping to drive the clean energy sector to fresh highs. In the first half of 2020, 23-new exchange-traded funds were launched under the ESG umbrella. By the end of the Q3, ESG index funds hit $250 billion in value. The ESG umbrella focuses on many different areas and has flourished during the pandemic. With a vaccine on the horizon, the question for investors is whether this sector will remain sustainable.

What is ESG and ESG Investing

The term ESG stands for:

- Environmental

- Social

- Governance

The term brings to mind concepts like climate change, diversity and inclusion, and resource scarcity. While these are forms of ESG, it also covers social practices, including labor and talent management and data security and product safety. It includes employee experience, executive pay, and ethics. There is a wide divide amongst stakeholders on what the term means and how to communicate and manage the concept.

ESG investing appears to be a derivative of socially responsible investing (SRI), which has been in existence for decades. While profits have always been considered the “mothers milk” of stocks, modern investors have realized that shortchanging stakeholders is a high price for society to pay. A company’s stakeholders include its employees, customers, suppliers, as well as the environment, which play a crucial role in the functioning of the corporation.

There is a fine line between ESG investing and SRI. ESG investors actively look for companies that show robust environmental, social, or governance attributes. SRI focuses on excluding industries that have failed to demonstrate compliance in socially responsible areas. ESG provides broader flexibility into specific companies’ practices and the different management attributes that make up a corporate initiative.

Inflows Into ESG Have Been Impressive

Inflows to ESG have been robust. ESG ETFs surged to $22 billion in the first half of 2020, which was more than 3X the 2019 total, according to Bloomberg. One of the issues that regulators face is that there is no clear definition of what constitutes ESG.

The Concept is Here to Stay

Some corporate actions show me that ESG is here to stay. Stakeholders at public companies are getting assurances from management that their contributions will remain an essential aspect of management’s focus. In 2020, Starbucks Corp. announced that the company would mandate antibias training for executives and tie their compensation to increasing minority representation in its workforce. Their diversity and inclusion mandate’s target is to have 30% of corporate employees be minorities by 2025. While profits at any level are key, it’s hard to imagine that an executive will allow their bonus to be eroded by failing to meet a corporate ESG mandate.

The Best Asset Now Process

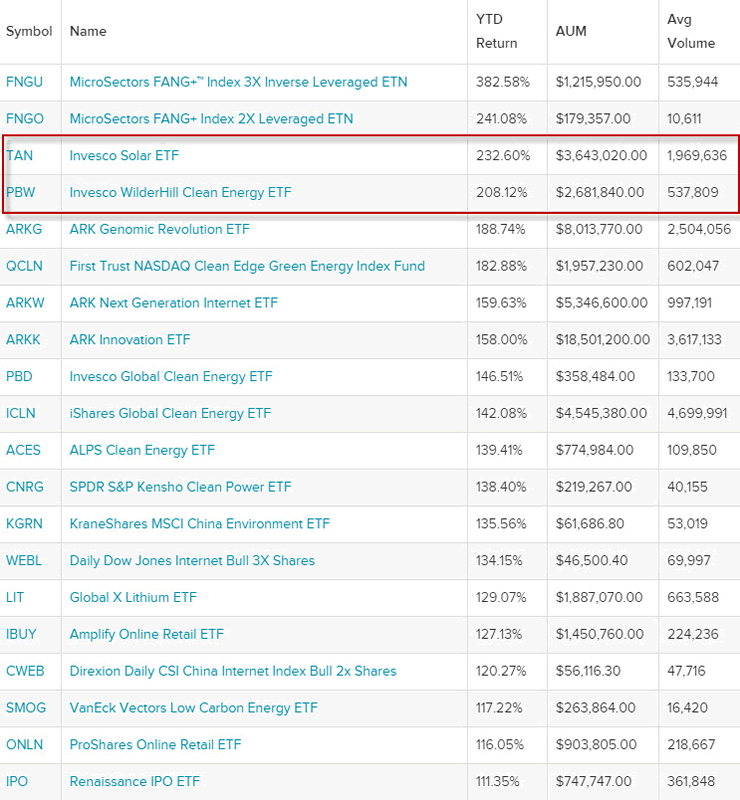

I have mentioned this before and I have not wavered. I like to use a BAN strategy (Best Asset Now) to find leading sectors. Two ETFs have largely outperformed the rest that conforms to the ESG concept. These ETFs represent sectors that have shown leadership and are currently two of the top-5 best performing ETFs in 2020. These ETFs have generated bullish chart patterns that point to much higher prices following their recent breakouts.

There is a reason to be bullish. President-elect Joe Biden named former Secretary of State John Kerry to lead his administration’s climate change efforts. Kerry will be the “climate czar” and will be in charge of coordinating programs that are expected to stretch across multiple agencies. This could include executive orders issued by the new President-Elect to provide avenues beyond Congress to advance climate priorities. This is positive news for clean energy ETFs. If you are a stock trader, these are the BAN ETFs to look at which will outperform.

TAN Hits Fresh Highs

The Invesco Exchange-Traded Fund Solar ETF accelerated to multi-year highs in November and is poised to test resistance near the 2011 highs at $91.70. This would add another 11% to its already robust 162% return in 2020. While prices could temporarily consolidate near this $92, a close above this level would lead to a test of the 2010 highs at $115. A close above $115 could lead to a test of the all-time highs near $307. Momentum is positive as the MACD (moving average convergence divergence) histogram is printing in positive territory with an upward sloping trajectory which points to higher prices.

PBW Invesco Exchange-Traded Wilderhill Clean Energy ETF

Has broken out and is poised to test the 2008 highs near $119.50. Support is seen near the 10-week moving average of $71.70. Momentum is positive as the MACD (moving average convergence divergence) histogram is printing in positive territory with an upward sloping trajectory, which points to higher prices.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Do you want to stay ahead of these sector trends and learn which sectors are the best opportunities for your trades? Our BAN Trader trades the Best Asset Now using to consistently earn better-than-market returns. Learn how our BAN Trader solution can help you keep focused on the best trading opportunities in 2021 and beyond while helping you protect and grow your wealth. Go to www.TheTechnicalTraders.com to learn more about BAN Trader, or let me teach you how to trade this strategy yourself by watching my FREE webinar! Scroll below to register for your seat now and make 2021 your year to PROFIT!!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.