U.S. Worsening Economic Outlook

Economics / US Economy Oct 17, 2008 - 06:07 AM GMT

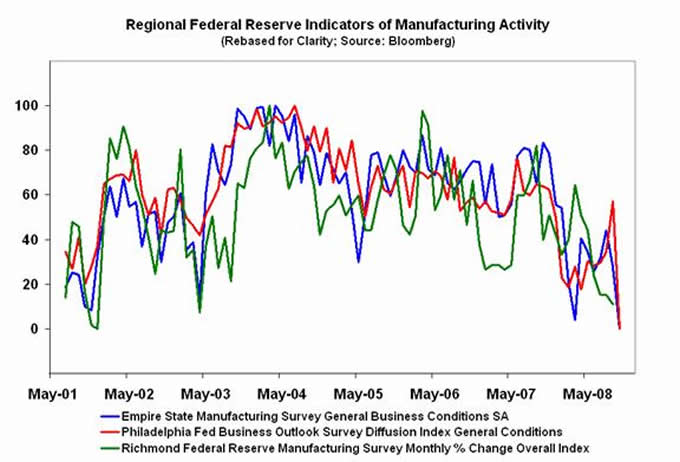

This morning, the Federal Reserve Bank of Philadelphia announced that its general economic index for October fell from 3.8 in September to a much worse-than-forecast minus 37.5, the lowest level in nearly two decades. That follows yesterday's news that the Federal Reserve Bank of New York's general economic index declined to a record low of minus 24.6, also below expectations. Together with another regularly updated index, the Richmond Federal Reserve Bank's manufacturing sector activity survey (October data has not yet been released), these indicators seem to make it clear that the economic outlook remains bleak.

This morning, the Federal Reserve Bank of Philadelphia announced that its general economic index for October fell from 3.8 in September to a much worse-than-forecast minus 37.5, the lowest level in nearly two decades. That follows yesterday's news that the Federal Reserve Bank of New York's general economic index declined to a record low of minus 24.6, also below expectations. Together with another regularly updated index, the Richmond Federal Reserve Bank's manufacturing sector activity survey (October data has not yet been released), these indicators seem to make it clear that the economic outlook remains bleak.

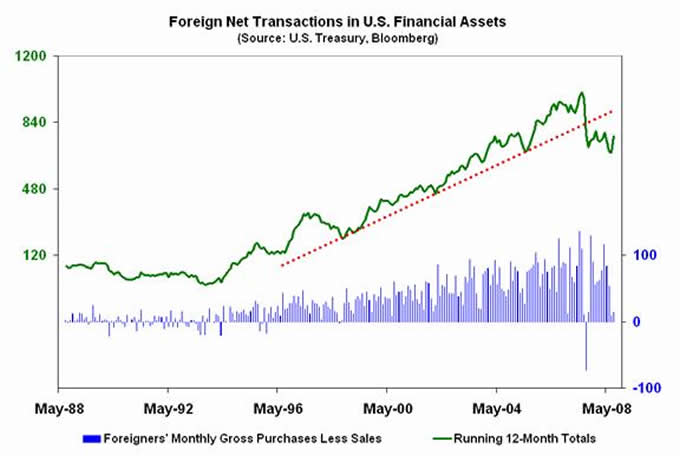

Also today, the Treasury Department announced that net foreign purchases of U.S. financial assets -- equities, notes and bonds -- rose from $8.57 billion in July to $13.98 billion in August. Although seemingly good news on its face, the increase was less than half of what economists were anticipating, according to Bloomberg. In addition, the pattern of running 12-month total inflows has remained fairly subdued following the break below a multi-year uptrend that occurred just over a year ago.

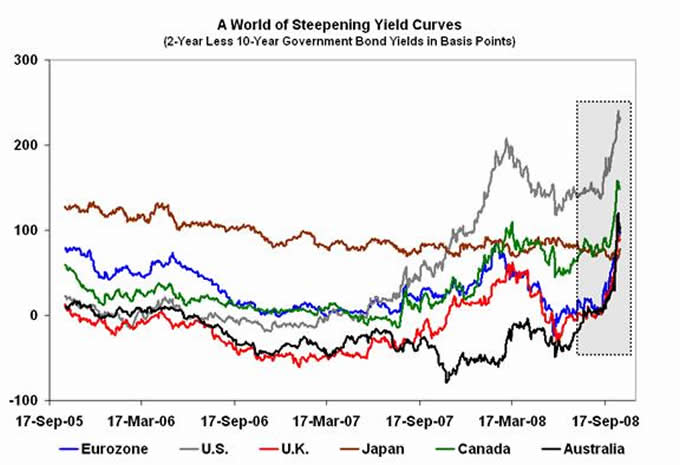

In recent weeks, there have been a great many efforts -- in the U.S. and elsewhere -- to “rescue” the financial system and make credit more freely available. However, it appears that policymakers' actions -- and the fear of government printing presses gone wild -- have brought about at least one unintended -- and unwelcome -- consequence: steepening yield curves around the globe. In essence, that means longer-term financing has become costlier for borrowers.

Moreover, while some might argue that wide spreads tend to benefit firms that borrow short and lend long (e.g., banks), history has shown that they are big losers in a curve-steepening environment. In part, that is because many of the assets they hold (e.g., bonds) lose value when longer-term interest rates are trending higher (because prices move inversely to rates). In other words, it's not just the absolute level of the spread that matters -- the direction and speed of the change in spreads is also important.

Finally, with authorities around the globe pulling out all stops to "rescue" the beleaguered financial sector -- including capital injections, extraordinary lending facilities and short-sale bans -- we could see bears refocus their attentions on a sector that seems poised for a lot more pain as economic conditions continue to worsen. Based on the accompanying chart of the S&P consumer discretionary sector relative to the financial sector, that shift appears to be already underway.

Stocks finished the day sharply higher following a successful intraday retest of last Friday's lows and a rebound in recently hard-hit energy and technology shares. Technicals appeared to rule as investors shook off a cross-section of weaker-than-expected economic data.

At the close, the Dow Jones Industrial Average surged 401.35 points, or 4.7%, to 8,979.26. The S&P 500 Index rallied 38.59, or 4.3%, to 946.43. The Nasdaq Composite Index jumped 89.38, or 5.5%, to 1,717.71.

December gold fell $31.20 to $807.80 in late-session electronic trading, a loss of 3.7%, while the U.S. Dollar index drifted 0.3% higher. Ten-year Treasury bond yields rose one basis point to 3.96%.

By Michael J. Panzner

http:/www.financialarmageddon.com

Copyright © 2008 Michael J. Panzner - All Rights Reserved.

Michael J. Panzner is the author of Financial Armageddon: Protecting Your Future from Four Impending Catastrophes and The New Laws of the Stock Market Jungle: An Insider's Guide to Successful Investing in a Changing World , and is a 25-year veteran of the global stock, bond, and currency markets. He has worked in New York and London for HSBC, Soros Funds, ABN Amro, Dresdner Bank, and J.P. Morgan Chase. He is also a New York Institute of Finance faculty member and a graduate of Columbia University.

Michael J. Panzner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.