DoorDash Has All the Makings of the “Next Amazon”

Companies / Tech Stocks Jan 22, 2021 - 02:08 AM GMTBy: Stephen_McBride

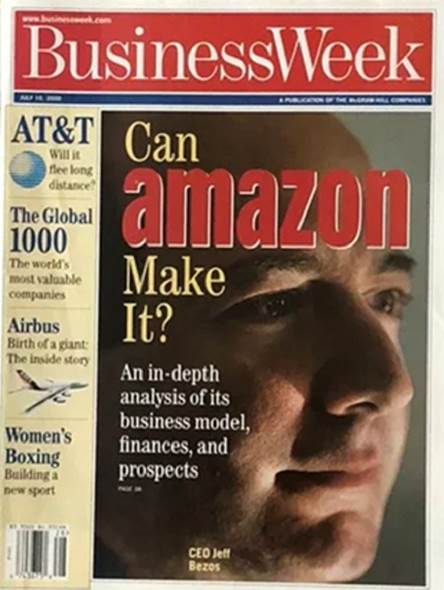

Can Amazon Make It? That was the headline plastered on the front page of BusinessWeek magazine in July 2000.

Amazon’s future looked bleak after the tech bubble burst earlier that year. The online shopping pioneer was hemorrhaging cash, forcing it to cut 15% of its workforce. Top fund managers cut Amazon from their portfolios. And over the following year, its stock price sank from $105 to $5.

Source: Twitter

In 2000, Amazon was a small online store selling books and CDs. It soon branched out to other categories like electronics. But folks remained skeptical. That same year, Wharton business school quipped, “The attempt to be more than a bookstore smacks of desperation.”

Do you know what all these analysts got wrong? They failed to see that Amazon’s goal was never to create an online bookstore. It was building an entire delivery system for internet shopping!

It figured out how to put books into boxes and ship them to your front door, fast. Then Amazon used the same system to deliver shoes, screwdrivers, and thousands of other items.

Ever wonder why internet shopping is so popular?

The “killer feature” is being able to click a button and have the items arrive on your doorstep a few days later. Imagine having to wait two weeks to get your online order? It just wouldn’t work. In fact, 7 out of 10 Americans think three-day shipping is too slow.

In short, Amazon’s empire is built on fast shipping. It’s slashed delivery times from two weeks to two days and changed shopping forever.

And, of course, investors who ignored that BusinessWeek article—and bought Amazon for under $10 a share—are living the high life and deserve a round of applause. It currently trades for more than $3,000 per share and is the front-runner for “stock of the century.” But I’m not writing you today to think about “what could have been.”

Today, we can buy a disruptor ready to beat Amazon at its own game…

You likely know food delivery apps have surged in popularity over the past few years. Click a few buttons and Postmates, Uber Eats, Grub Hub, or Caviar will pick up your burrito from Chipotle and bring it to your front door.

In fact, these firms raked in over $45 billion in sales last year. The thing is, food delivery is a cutthroat business. Restaurants already have notoriously razor thin margins. Throw a delivery “middleman” into the mix and there’s even less profit to divvy up. Even after 17 years in business, Grubhub (GRUB) still bleeds red ink each quarter.

Most folks lump DoorDash (DASH) in with this pile of money-losing food delivery upstarts. DoorDash launched almost a decade after Grubhub. But today, it’s America’s most popular food delivery app, twice as large as Uber Eats.

If you want a Big Mac delivered to your house, you don’t open a McDonald’s app. You open the DoorDash app, order it, and it’ll be delivered right to your front doorstep. Just like there are Uber drivers waiting to pick you up, DoorDash has food drivers waiting to pick up and drop off your Chipotle burrito. And DoorDash’s opportunity is far bigger than late-night takeout.

Food delivery is to DoorDash what books were to Amazon.

In 2000, top business school analysts thought Amazon was just an online bookstore. They didn’t see the big picture. Once Amazon could ship books across America, it could delivery almost anything. Today, most analysts see DoorDash as just another food delivery app. But pizzas and burgers are only the beginning.

Getting fresh food into consumers’ hands is a hard job to get right. If DoorDash can deliver ice cream before it melts, or pizza before it goes soggy, it can deliver anything. In other words, it’s “stress testing” the system in the toughest arena of all. But DoorDash’s goal is to build “the local, on-demand FedEx.”

In other words, a near-instant delivery system for mom-and-pop stores that will ship everything from flowers to coffee to gas.

DoorDash is pioneering the “delivery of everything.”

Last year, DoorDash announced it was teaming up with Sam’s Club. Folks who get medication from one of its stores can opt for same-day delivery. You order medicine from Sam’s Club, and DoorDash will bring it to you that very day.

The disruptor also partnered with retail giants Walgreens and CVS. Now you can get thousands of everyday items through its app, delivered right to your door. It’s even joined forces with grocery chains like Walmart. And get this: DoorDash promises to deliver “more than 10,000 grocery items in less than one hour.”

The disruptor is following Amazon’s playbook to a T. Become an expert in one area, and expand into new markets. And DoorDash’s multibillion-dollar opportunity is to become the on-demand FedEx for small businesses.

As I mentioned a few months back, mom-and-pop stores are moving online for the first time ever. COVID has forced your local florist or butcher to start delivering. DoorDash is helping entrepreneurs thrive in this new economy.

This is great for businesses that need delivery but don’t want all the hassle that comes with it. Now they can reach new customers through DoorDash’s app, and have them ship the item. Millions of Americans already order food through DoorDash’s app. Soon, we’ll be doing the same for all kinds of items.

Why wait a day or two for bleach to arrive from Amazon when you can order it from a local store and have DoorDash drop it off on your front porch in an hour?

This is how DoorDash disrupts Amazon

Remember, Amazon built its empire on fast two-day shipping. DoorDash is taking us to two-hour shipping. And not even Amazon can compete with its armies of local drivers, ready to deliver parcels at a customer’s beck and call.

In fact, during the holiday rush, Shopify found almost one-third of consumers received items through local delivery. In other words, DoorDash made the drop instead of UPS or FedEx.

Five million Americans have already signed up for DashPass, a $9.99 monthly subscription that gives you unlimited free deliveries. Today, most of these deliveries are from restaurants. As DoorDash pushes ahead with “the delivery of everything,” DashPass could become a better, faster Amazon Prime.

If Jeff Bezos founded Amazon in 2020, I bet it would look like DoorDash. Consider adding DoorDash to your portfolio today.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.