US Dollar Has Crossed the “Event Horizon”

Currencies / US Dollar Feb 05, 2021 - 12:40 PM GMTBy: Raymond_Matison

The “event horizon” is a term used in astronomy which describes an imaginary point some distance from a black hole in the center of a galaxy where the gravitational force becomes so strong that any heavenly body which crosses that point (visualized as a circle around the black hole) cannot escape the hole’s gravitational pull, and matter is inexorably pulled into the black hole destroying it completely. This is an apt analogue to the continuous and increasing printing of fiat currency where once an astronomic amount of debt is issued creating the currency, it then starts to lose purchasing value such that it is no longer possible for it not to lose all or most of its value, and it collapses on itself. Similar to stellar mass being destroyed in the case of black holes, the currency and its purchasing value is completely or mostly destroyed.

This article proposes that unrelenting growth of national debt, which is the basis for currency creation has reached a global inflection level such that the value of fiat currencies across the globe, with several notable country exceptions, are drawn into a whirlpool of decline that will ultimately result in its near complete loss of value.

The problem of deficit spending

It seems unnecessary to cite the number of decades over which government budget deficits have persisted - nor their size, since fundamentals have been insistently ignored by politicians, economists, and investors. Our government increases national debt simply by selling more Treasury bonds to foreign and domestic investors (or the Federal Reserve), incurring this increasing liability for which citizens are responsible to service and ultimately pay off.

When a government issues additional debt which is not benefiting its citizens or oppresses them, it is known as odious debt – which is deemed as illegitimate. Since the persistent growth of debt is debauching the value of currency and decreasing its purchase value, it is not benefiting its citizens. Our government, for the purpose of more easily servicing its mountain of debt has also caused the Federal Reserve to suppress interest rates which is also financially oppressing citizens. Savings of citizens essentially earn no interest, and pension funds become increasingly underfunded undermining their future welfare. Simply odious.

Consider, for example, the evaluation that a mortgage lender makes in approving a loan for a home purchaser. The maximum loan approval amount will relate to the income of the borrower. Historically, such loan amounts – excluding special considerations - have topped out at approximately 2.5 times the income of the borrower. It is true that the government and its borrowing power are quite different from that of an individual citizen, so direct comparisons can be fraught with distortions. However, it is well to keep in mind that government’s only income comes from taxes. In addition, the national debt that needs to be serviced by taxes on individual citizens must largely come from citizens who already have borrowed nearly to their limit when receiving a mortgage loan.

In 2019, U.S. government collected $3.5 trillion in taxes, whereas federal debt clock currently stands at $27.8 trillion – an income to debt ratio of 7.9. In addition, the nation’s new political administration has already proposed additional spending of $1.9 trillion, partially to cope with the economic hardship related to the corona virus epidemic. Additional spending, in trillions, will occur as the nation tries to cope with a still, almost national lockdown of business and manufacturing enterprises, and soon to be acknowledged economic depression. See: Gold’s Role in the Greater Depression of 2020 http://www.marketoracle.co.uk/Article67212.html

Credit defaults across the industry including hospitality, airlines, commercial real estate such as offices, malls, retail stores, and corporate defaults of highly leveraged balance sheets – the so called zombie companies, guarantees that our national debt cannot and will not ever be repaid. Credit and bond defaults, domestically and internationally, will cause a worldwide banking crisis. It will be a crisis of such scale, that it cannot be papered over by FED or other central bank liquidity, quantitative easing, or massive printing programs. The notion that the Federal Reserve can print dollars to pay off our national debt is theoretically, if unethically, possible. Remember that all government debt has been serviced by hard-earned income from millions of Americans laboring billions of hours. So if the Federal Reserve were to simply print the currency to pay off federal debt, such an action will come at the price of destroying faith or confidence in the dollar currency globally, and would render the dollar immediately valueless.

Expansion of debt and currency

Continuing decline in the purchasing value of the world’s global reserve currency stems from the relentless increase of its emission. As a global reserve currency, enough dollars must be available for its global usage, underlying its insistent expansion. This dilemma was first postulated by economist Robert Triffin, who in 1960 testified in Congress that the U.S. as a global reserve currency possessor would have to become the world’s greatest debtor, as debt is the basis of currency creation – and an incredible amount of currency would be needed to satisfy global trade.

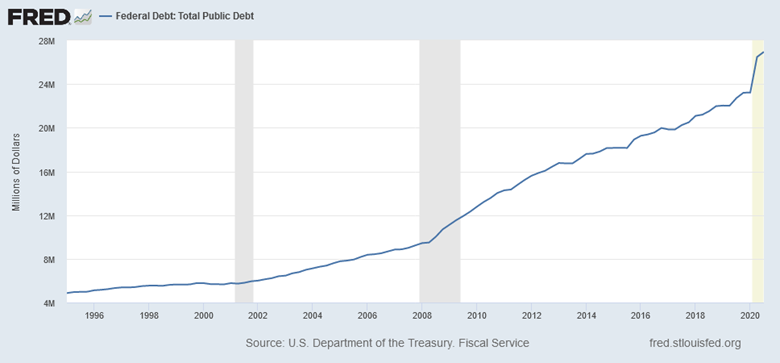

The following chart shows the unremitting growth of national debt, which is the basis for the dollar’s currency creation.

Several observations are worthwhile here: note that there appear visually four distinctive periods of varied growth rate in the debt over this twenty-five year period. Debt started to increase more rapidly after financial problems after the 2000 market crash. That rate of expansion in the money supply accelerated noticeably after the 2008 financial/market crisis. And most recently, the growth in debt has started to grow exponentially.

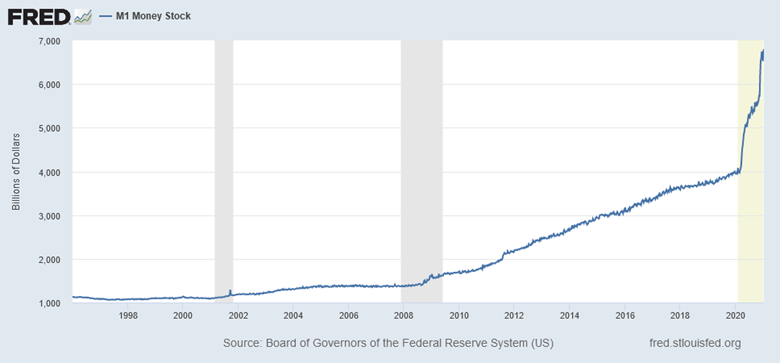

The following chart depicts the expansion of our nation’s money supply, which observably is increasing at a rate similar to that of national debt.

These two charts corroborate that federal debt and the growth of our money supply are now growing at rates which have become exponential. Yet our current virus/economic crisis supports the thesis that debt/money supply growth will in fact have to accelerate further over the next several years.

Dollar’s purchasing value

The preceding charts suggest that there should be a demonstrable relationship between the growth of debt/currency and the decline in the purchasing value of the dollar. Such relationships can be shown between currencies, and value to hard assets such as gold. The following chart shows the dollar index over the last seven years – with a pattern which for chartists is quite ominous, suggesting that a dramatic decline in the value of the dollar is again likely.

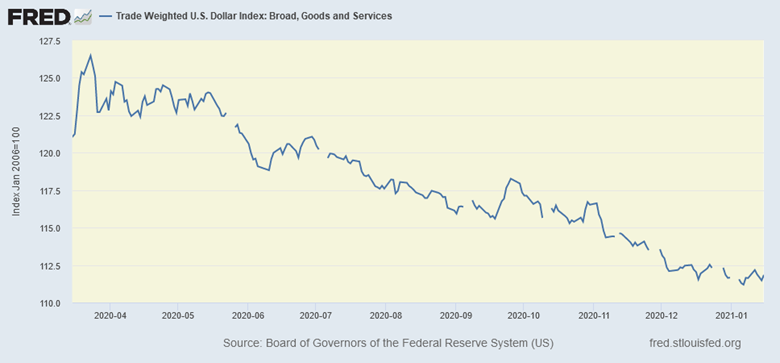

As added confirmation, the following chart shows the trade weighted U.S. Dollar Index for goods and services since the advent of the virus pandemic last year. This trade weighted U.S. Dollar Index confirms the decline in the purchasing value of the USD from the perceived arrival time of the corona pandemic.

This chart makes it clear that since economic lockdowns of America’s industry and thousands of small businesses, the value of the currency has been declining. Of course, most other advanced country currencies have declined also, so all currencies are, or should be losing value relative to gold.

Interest rates

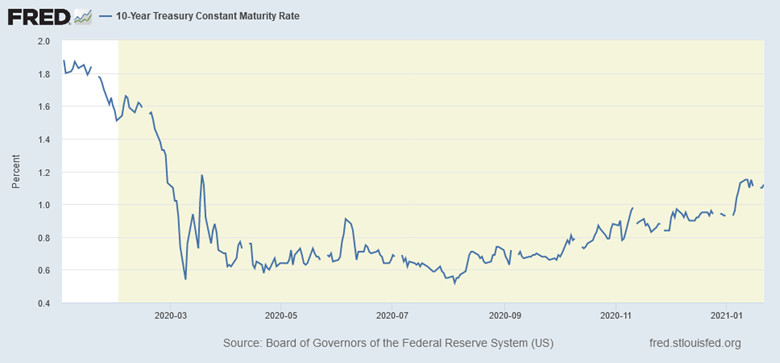

Appreciation and understanding of the implications of such data and charts means that investors should be less willing to invest in U.S. Treasury financial instruments without receiving yields for the implied reduction in credit quality. The following chart demonstrates that investors are beginning to demand higher yields.

The natural progression of economic events should keep interest rates rising despite the FED’s most intense efforts to keep interest rates low. Despite the deflationary pressure of a severely injured economy and its concomitant effect to reduce price inflation, foreign investors going forward will not purchase US treasuries without being adequately compensated with increased interest rates for the perceived risk of such investments. As more debt is issued and interest rates rise, the cost of servicing the debt rises also, and the ability to finance future debt diminishes, as the cost of such debt increases eventually to prohibitive levels. When federal debt can expand no more, everything implodes.

Consider also how the virus-affected unemployment rate and lost contributions from employers affects the continued funding of Social Security. The ratio of number of persons supporting those receiving benefits due to impactful unemployment is declining rapidly. Pronouncements by the FED that it will keep interest rates near zero for the next several years does not provide confidence that returns on pension fund assets will be adequate to fund the actual pensions. This is another quiet but tragic financial implosion taking place currently.

Gold price, and its manipulation

Arguably, the price of precious metals, gold and silver, have been manipulated since 1971, when president Nixon severed the ability for foreign nations to exchange dollars for gold. In 1998 GATA, the Gold Antitrust Action Committee was formed to expose and litigate this price manipulation. Banks have paid fines and some traders have been convicted of manipulative trading practices, but the manipulation goes on. Banks are pleased to profit from the price manipulation, and the government is happy to collect billions in fines from the banks. Fines are the cost of doing this nefarious business. If the government wanted to stop precious metal price manipulation, it would convict and jail the perpetrators, or bank management – but it won’t happen because it is just too profitable for everyone.

Rarely is gold price manipulation visible in a daily gold trading chart. However, as the following chart shows explicitly, gold prices on January 4, 2021 had movements that are not representative of free markets. This price anomaly could result from computer algorithms constructed for this purpose.

Considering the scale of price movement shown in this chart, the sudden reduction in the market price for gold (twice) is not reasonable, and corroborates the charge of price manipulation.

For decades gold has been the standard against which fiat currency has been compared. That is of course the reason for its price suppression – because a rising gold price belies a weak fiat currency and failed monetary management. However, over the last decade Bitcoin, an electronic currency which is absolutely constrained from increasing its volume due to computer programmed limitation has grown to increasingly become a respected store of value. Accordingly, those who rely on blockchain-based Bitcoin as an alternative to the dollar see its price movement as an indicator comparable to gold. Bitcoin’s price over the last year has risen dramatically, as its price has remained volatile. Over the next several years, as institutional investors and millions of individual investors enter this space, and Bitcoin’s price rises, its volatility will normalize and subside.

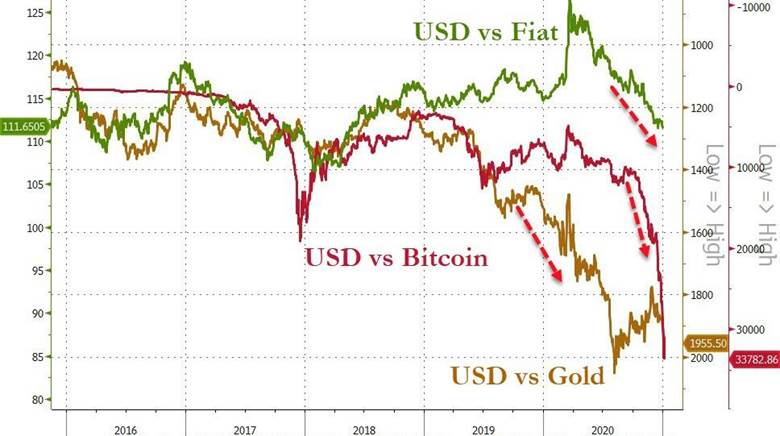

The following chart shows dollar’s decline relative to other currencies, gold, and Bitcoin.

The preceding charts above have shown quite dramatically, that the increase of national debt gave rise to increased currency growth. These charts also show how the acceleration of emitted dollars relates to the decline in the purchasing value of the dollar, and the increasing requirement for global investors to receive higher interest rates to compensate for the risk of the dollar losing its purchasing power. The immediate chart above shows that the dollar has lost value relative to other currencies, gold, and Bitcoin. As our national debt and currency issuance are maintained or accelerated over the next several years, gold and Bitcoin prices should rise dramatically.

Investment perspective

Ours is a consumer-driven economy, but now the FED and government is sending its currency directly to the people. What does the government’s sending its citizens currency checks really mean? It is an undisputable signal that the consumer is in trouble – and by extension - the FED and government is desperate and in trouble also. Consumers, even with the persistent stimulus from the FED can no longer reboot the economy. Likewise, small businesses have closed down, or more correctly have been forced by local or state governments to close down, eliminating them from being supportive to an economic restart.

In that environment, state and local governments are not getting needed taxes to fund their operations and state governments are going deeper into budget deficits and increasing debt. As businesses are closed, crucially important taxes that both employees and employers pay towards Social Security are not being collected, thus accelerating the date when it will run out of money and Social Security benefits will have to be cut.

Also in that environment, businesses are not serving customers and not receiving revenues – and therefore, are behind on rent or mortgage payments and servicing their bank credit responsibilities, while importantly not earning profits. These conditions underlie coming credit and bond defaults, which impinge on bank solidity and market stability. Financial markets could easily melt up reflecting the melt-down of our currency or could crash, reflecting the real state of our economy, or both. This is not the time to be in the markets at all. See: Monetary and Economic Financial Reset http://www.marketoracle.co.uk/Article67778 and The Last Minsky Financial Snowflake has Fallen – Now What? http://www.marketoracle.co.uk/Article66849.html

The virus pandemic will continue to depress economic activity, employment, incomes, and social stability for the next several years. The USD has crossed the event horizon, and the consequences to the dollar are understood and unavoidable. Internationally, a declining-value dollar cripples global bank reserves, and creates a worldwide banking crisis. Domestically, in addition to creating a banking crisis, it creates inflation and debilitates those living on pensions or fixed incomes. Given the increasing violence of public riots, it is debatable as to whether our Constitutional Republic will survive intact.

It is now clear that the period of “The American Century” is passing, and the torch of the U.S. dollar’s global currency is about to be handed to its next recipient. Over the last seven-hundred years, this global currency torch has been passed from Portugal to Spain, to Netherlands, to France, to Britain, and to the U.S. – so while the passing of this torch to the next recipient may traumatizing, it is historically quite common. We hope only that the nation’s leaders superior to our elected politicians can make this transition without resorting to kinetic, destructive war.

The next recipient of the global currency torch may not be a single country, but it could be a group of countries. In addition, because computer technology quite unintentionally is solving the Triffin dilemma, it is possible that no country takes on the role of a global fiat currency, but that a tokenized/computerized bridge currency is adopted for all nations. This technological development would free any single country or group of countries from the responsibility of issuing the global currency with its attendant historical burden of debt and currency emission to serve global needs. Acceptance of a blockchain-issued digital currency for settling cross-border payments that is inclusive to all the citizens of the world, and which is vastly more efficient than the present banking system would be a giant step towards a globally better future for all humanity. Thus potentially, a promising and prosperous future is awaiting everyone. However, we must first survive the Greater Depression of 2020.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2021 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.