Ethereum Surges to Record High, As for Fundamental Causes... it's "Game" Over

Currencies / Ethereum Feb 10, 2021 - 10:50 AM GMTBy: EWI

The GameStop fiasco did not spark Ether's rally; see the Elliott wave pattern that did.

Cryptocurrencies are well-known as hot-potato markets with volatile price swings. Most investors and traders see cryptos as "catch-and-release" - vs. - "buy-and-hold."

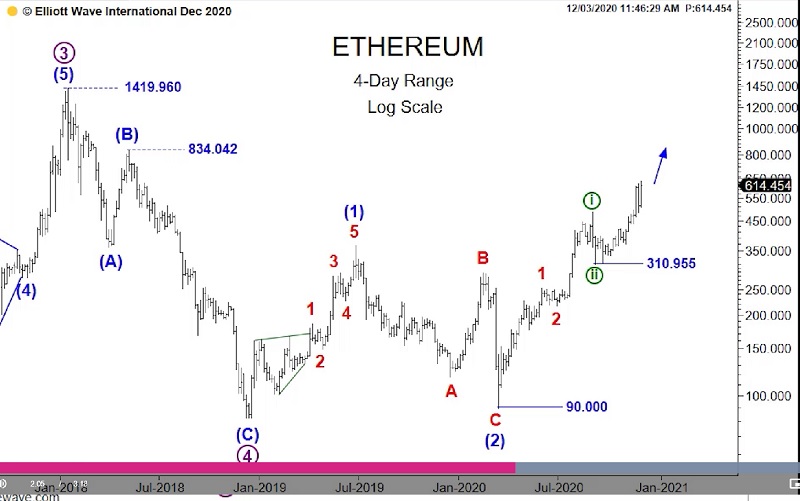

But this chart tells a somewhat different story. It not only shows that the #1 top performing cryptocurrency for 2020 and (so far) 2021 is #2 in line: Ethereum. But it also shows that, after trending sideways from August through October, ETH held and continued to hold the upside in a powerful rally to record highs on February 3.

The clamor to find "a reason" for Ethereum's surge was short-lived, thanks to the event cited in countless news stories regarding moves in nearly all financial markets so far in 2021: namely, the GameStop fiasco.

In case you've been on a stranded island and don't know what this is referring to, the short version of the fiasco goes like this: Members of the subreddit r/WallStreetBets bought up and talked up shares of the all-but-flatlined GameStop (GME) company (retail seller of video games) AFTER a major hedge fund manager called GME buyers "suckers."

This led to a short squeeze of Wall Street investment firms, two manic weeks of price swings, retaliatory trading restriction on the part of online brokerage apps -- AND a supposed spill-over in markets across the swath, including cryptos such as Ethereum, of which these headlines directly speak:

- "Ethereum Price Predictions: Will ETH Set a New Record After Reddit Rally?" (Feb. 2 Investorplace)

- "Cryptocurrency sees boost in popularity following GameStop Stock incident" (Feb. 1 BigCountry Homepage)

- "Ether Cryptocurrency Reaches Record High, Briefly Tops $1.5K Amid WSB Trading Buzz" (Feb. 2 Coindesk

Said the February 2 Coindesk article:

"Ethereum's ether (ETH) cryptocurrency logged a new record high on Tuesday, amid expectations the recent GameStop (GME) trading saga would accelerate the adoption of cryptocurrencies and decentralized finance (DeFi).

"With investment and trading platform Robinhood halting trading of certain assets like GameStop... the case for cryptocurrencies only grows stronger."

But here's what this explanation fails to consider: The GameStop "price war" began in mid-January. Yet, Ethereum's uptrend has been steadily underway since mid-November.

In turn, the case for cryptos, and Ethereum specifically, grew stronger long BEFORE a little-known Reddit forum launched a war against Wall Street. The November 13 Crypto Pro Service, in fact, showed the following chart of Ethereum which made that very, bullish case. It showed prices at the start of a third-of-a-third wave rally and said:

"We are looking for a break above 488.12 as the next key level to bolster the case that we are indeed subdividing further within this wave three of three pattern."

From there, Ethereum gathered strength and on December 3, the Crypto Pro Service said the crypto was on its way to setting new records.

"Pushing above the wave B high at 834.04 is the next objective for the bulls and from there then we would expect Ethereum to register all-time new highs [above 1419] as the third wave forecast calls for significant gains over the next several weeks."

Now that Ethereum has set those new records, the question becomes: Is Ether's winning streak over?

Elliott Wave International's Crypto Pro Service has the answer right now, with in-depth analysis of the crypto's intraday, daily, and weekly price trends. Don't absorb the shock of the market's next move -- arrive at those moves in advance with the premier, Crypto Pro Service.

Join In Elliott Wave International's Crypto Open House Through Feb. 11

Spot the NEXT big move in cryptos BEFORE it starts (FREE)

They've unlocked their entire Crypto Pro Service -- for 3 days only!

Now through 5 PM Thursday, February 11, you get clear, objective intraday + daily forecasts for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, XRP, EOS and Monero.

Hurry! Take advantage of this RARE opportunity to see where Bitcoin et al are likely headed next. It's a $298 value, yours FREE for a short window.

Join in the free crytpo event now.

This article was syndicated by Elliott Wave International and was originally published under the headline Ethereum Surges to Record Highs: As for Fundamental Causes... it's "Game" Over. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.