Stock Market Trend Forecasts Analysis Review

Stock-Markets / Stock Market 2021 Feb 17, 2021 - 06:27 PM GMTBy: Nadeem_Walayat

The stock market has continued to confound all of the doom merchants out there who blindly continue to point to the worst economic contraction since the great depression if not in history for most western economies. All whilst the Dow pushed its way to a new all time high into the end of 2020 and has continued to march ever higher during 2021 in response to which most investors have faced a barrage of that messages that the bubble is always about to burst, whilst my Patrons have received an unequivocal consistent message that this bull market has a long ways to go and that investors should not look a gift horse in the mouth when all of the stocks on my AI list were typically marked down by over 1/3rd against their Pre pandemic trading levels during March 2020.

In fact the Dow trading to new all time highs BEFORE the end of 2020 was always the MOST probable outcome as illustrated by analysis of December 2019-

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

I could continue in a similar manner but will just refer to my stocks specific analysis during 2021.

9th Feb 2020 - Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

27th Feb 2020 - The Coronavirus Stocks Bear Market Begins, When Will it End?

Dow Infected with the Coronavirus

Of course I am not going to just leave things at that and so here's my customary Dow price chart that condenses down my above analysis consequences of the Coronavirus into how things could play out over the next few weeks, baring in mind support levels are very buttery at the moment!

The chart illustrates that price action does not care much for technical levels as it's not being driven by technical's, or economic fundamentals but rather implied Coronavirus fundamentals that in my opinion the markets are still not fully discounting, hence at best we are at the half way point in what is likely to be a very a volatile downtrend, as I am sure the Fed will step in to buy stocks, so we are in for a very bumpy ride!.

BUT! It's going to be TEMPORARY! Think of it this way, the market is going to gift you a significant DISCOUNT in your favourite stocks.

9th March 2020 - Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

The bottom line is that the Stock market IS heading lower but that it will bottom WELL BEFORE we hear the worst of the Coronavirus Infections numbers in the news.

And now for the primary reason why we should look forward to this Coronavirus bear market because it gives us an opportunity to pick up AI mega-trend stocks at a deep discount to where they were trading a few weeks ago, with many of the stocks hitting their Q1 buying levels. So those who followed my analysis of keeping the AI Buying stocks list at hand will have been able to pick up Top AI stocks such as Apple at its Q1 buying level of 255, though you would have to have either used market orders or been very nimble footed as the stock spiked lower before rebounding sharply from $255.

Again remember that I consider this Coronavirus stocks bear market to be TEMPORARY, especially for top AI stocks such as Google!

17th March 2020 - US and UK Coronavirus Containment Incompetence Resulting Catastrophic Trend Trajectories

The Dow crashing to 20,000 is a consequence of gross negligence in the handling of the Coronavirus pandemic!

Google closed at $1073 yesterday! What was I doing ? The same as I have been doing for the past 6 trading sessions BUYING AI stocks, for I continue to view this PANIC sell off as being TEMPORARY.

The bottom line is that unless the virus is such that a working vaccine is impossible, then the Coronavirus market panic of 2020 is TEMPORARY!

So if I expect the AI stocks to eventually trade back TO NEW ALL TIME HIGHS, and it does it matter how low they trade during this panic or whether one buys Google at $1200 or $1100 or $1050, as in the long-run it's not going to make that much difference, the main thing is to be INVESTED, and the Coronavirus despite the palpable FEAR it is generating for genuine reasons, is still giving ALL a golden opportunity to pick up stocks selling typically 1/3rd cheaper than a a few weeks ago.

In the meantime, with each passing days increasingly grim death statistics continue to expect increasing pessimism.

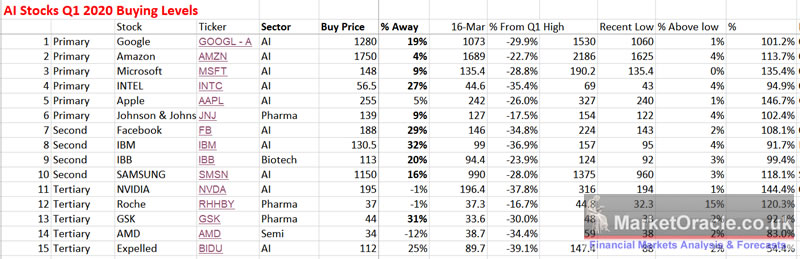

AI Q1 Stock Buying Levels

Firstly don't expect to be able to catch a falling knife, and secondly understand that there is NO SUCH THING as a MISSED market move! The only thing that matters is the price one enters at and the price one exits at, what the market does outside those two prices does not matter! I think this is one of the biggest factors that effect investors in their decision making process, i.e. because a stock was trading lower a few days ago they think they MISSED the bottom and should have bought! So wait for the bottom to repeat, which it may or more likely may not do! So fail to act and then kick themselves for the next several years! Well this bull market was 10 years old so all those who thought of buying during 2009 but thought to wait for a fall, after all the likes of Nouriel Roubini were repeatedly calling for stocks to crash lower.

And that's the point of having a list of stocks and levels at which one would start accumulating when the opportunity presents itself..

Also remember that whilst the current spread of the Coronavirus may be exponential, so is the AI mega-trend. And who do you think is going to profit from the current crisis? Amazon, Google, Facebook, that's who! i.e. the coronavirus is reinforcing the importance of the virtual world.

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The recent panic sell off also acts as an important indicator of underlying relative strength of Apple and Amazon. One would have imagined that these two stocks having greater exposure to the real world than the virtual world would have faired worse then the likes of Google, i.e. being disruptive to Apples production of iphones and Amazon's supply chains. But no, so far they are showing that the market is already starting to discount recovery for these two stocks. And if one thinks about it then it makes sense that China will lead the V shaped economic bounce back by a couple of months ahead of the West, and thus improve the prospects for Apple and Amazons supply chain.

30th March 2020 - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

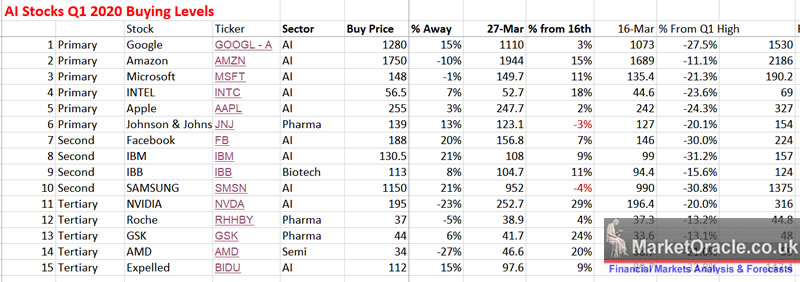

If you have taken one message away thing from my articles during the past month then it should have been that this Coronavirus stocks bear market is presenting investors with a BUYING OPPORUTNTY OF A LIFE TIME in AI stocks! For instance the last time I updated my AI stocks table on the 16th of March I wrote:

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The updated AI stocks table shows that many of the AI stocks have already significantly deviated strongly to the upside since the 16th of March, which in itself was not the low for AI stocks, i.e. if you were nimble footed then you could have picked up stocks at even cheaper levels.

Current state of the AI stocks as of 27th March relative to 16th March and Q1 Highs.

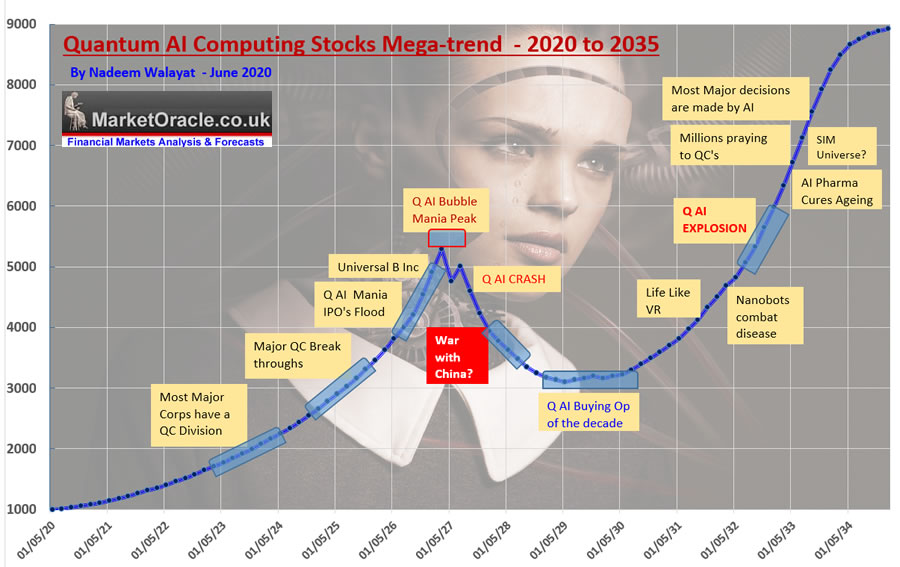

And so on culminating in my June analysis that sought to map out how I expected the AI stocks bull market to play out over the next 15 years.

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

With the remainder of the year having an eye on accumulating further exposure to AI stocks on any corrections that materialised in the wake of US election chaos and the ever higher pandemic waves.

Stock Market Analysis 2021

This will be my overall outlook for what to expect for 2021that I will follow up with a series of in-depth pieces of analysis that typically conclude in 2-3 month trend forecasts, similar to that for previous years.

This article is an excerpt form latest extensive analysis that concludes in detailed stock market trend forecast for 2021 that has first been made available to Patrons who support my work.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My forthcoming schedule for analysis includes:

- AI stocks buying levels update

- UK house prices trend forecast

- How to Get Rich

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.