Silver $100 Price Ahead

Commodities / Gold and Silver 2021 Apr 04, 2021 - 06:26 PM GMTBy: The_Gold_Report

Peter Krauth, editor of Silver Stock Investor, discusses the macroeconomic environment for silver and why he is embracing the metal's volatility. Being a silver investor over the last few weeks has become more psychologically challenging.

That's true even for us die-hard silver enthusiasts.

After all silver had a standout 2020, having gained about 47% in its best year since 2010. That easily outpaced gold's own impressive 25% return.

But the reality is that so far in 2021, silver is down 9%. And meanwhile, nearly all the fundamental market drivers have remained intact. It seems the pressures on silver prices are likely from two angles. The first is after such an impressive 2020, it was due to correct. That's what bull markets do.

The second pressure point is a rising U.S. dollar index, likely thanks to rising long-term bond yields. However, it's important to consider that this trend will also run its course and exhaust itself. That could happen naturally, or the Fed could intervene by imposing Yield Curve Control.

But higher yields are a sign of soaring inflation expectations and burgeoning economic activity. And a stronger U.S. dollar, which favors imports over exports, is probably not a favored outcome for central planners.

So patience is the best approach at this point. In my view, the end of this silver correction is nigh.

Embrace Silver Volatility

In a recent report, Bank of America's commodity analysts indicated they expect to see silver prices averaging $29.28 this year. That's based on their expectation for a modest supply deficit of 281 Moz. They also point out, "While we expect a rebound in supply this year, output should remain below the peak levels seen a short while back, also because the project pipeline is relatively empty."

The push for green energy combined with massive infrastructure spending, and stalwart investment demand, should keep a bid under the silver price and help it rise again this year.

Although silver is down 9% in 2021, and has retreated 19% since its August peak near $30, that's certainly well within historical bull market corrections.

The point is silver corrections come with the territory. Investors need to embrace them, and use them to their advantage.

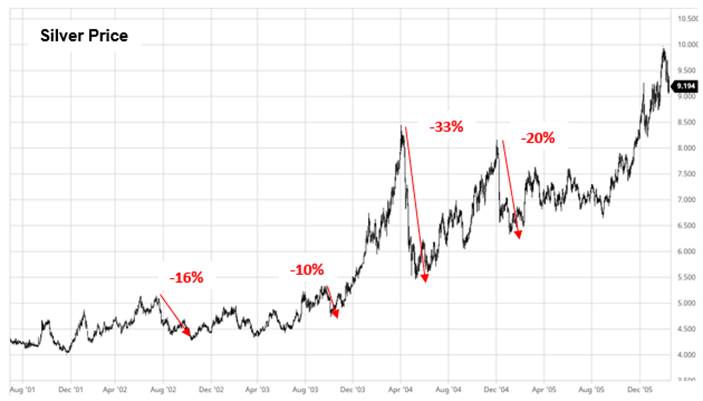

Between 2002 and 2006, silver dropped 10% or more four separate times.

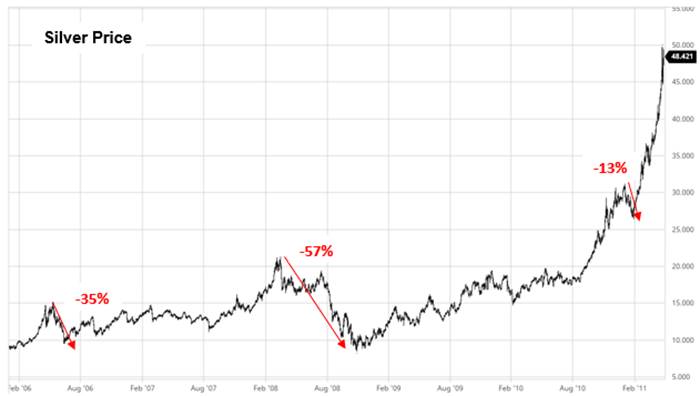

Then, between 2006 and 2011, more short but sometimes deep corrections came, with silver dropping 13% or more three separate times.

The point is to look at what silver did after those corrections. In nearly every case, it went on to establish new bull market highs.

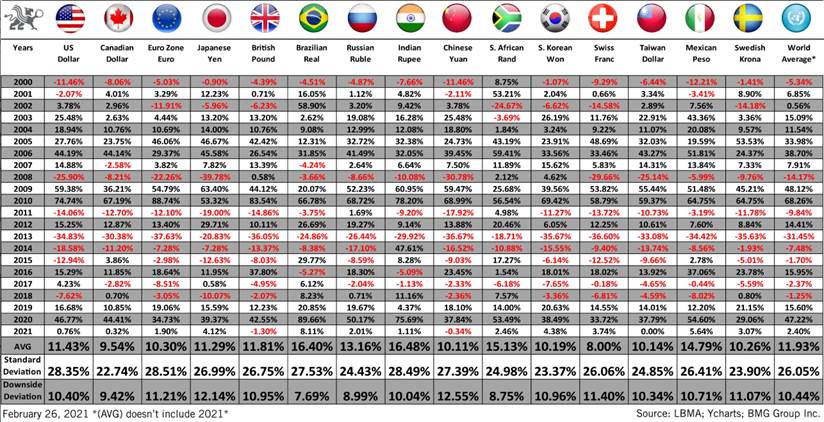

Now let's look at what silver has done in multiple currencies.

20 Years of Worldwide Silver Gains

As you can see from the following chart, over the past 21 years silver has produced an average annual return between 8% (Swiss franc) and 16.48% (Chinese yuan). In USD, silver averaged 11.43% per year.

Of course, that came with considerable volatility as well as a number of down years. But the world average is 11.93% gains annually over the last two decades. So the overall trend is undeniably up: we're in a silver bull market.

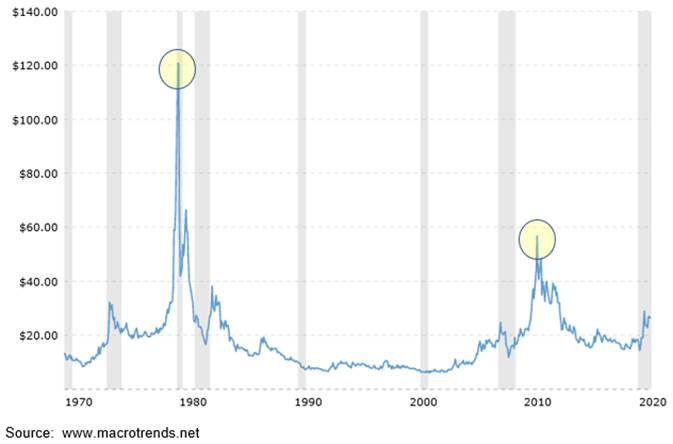

Now let's zoom out for a longer-term perspective.

If we account for inflation, and that's massively understated "official inflation," then silver prices peaked at $120 in 1980 and around $57 in 2011. Today's price near $24 is still well below those levels, suggesting a lot of upside remains ahead.

In fact at $24 today versus the inflation-adjusted $120 in 1980, silver is currently about 80% below that peak. And yet, current economic fundamentals like debt, deficits, spending, interest rates and supply/demand outlook are so much more bullish that the 1980 $120 level is likely to be easily surpassed.

Looking at silver from a technical perspective, in my view we are either at or near a final bottom for this correction.

The $23 and $24 levels acted as support multiple times between late September and mid-December. I think any further weakness is likely to be limited near $23.

If you hold or you've been buying silver and/or silver stocks over the past several months, two approaches make the most sense to me right now. Either sit tight if you feel you have sufficient exposure to this sector, or gradually add to some of your positions if you feel they've simply gotten too cheap.

Investors should emphasize how to be properly positioned in this market, with balanced exposure to physical silver, silver producers and royalty/streamers, as well as silver developers and even high-octane junior silver explorers.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks offer the best prospects as this bull market progresses. I recently added a junior explorer that's up 40% in just eight weeks despite current weakness, with scores of others ripe for buying now.

It's time to be a silver contrarian. History has rewarded us repeatedly.

$100 silver is well within reach.

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Disclosure: 1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.