Zinc Two Year Bear Market Coming to an End?

Commodities / Metals & Mining Oct 20, 2008 - 04:21 PM GMTBy: John_Lee

Centuries before zinc was discovered in the metallic form, its ores were used for making brass and zinc compounds, its ores were used for healing wounds and sore eyes. It is believed that the Romans first made brass in the time of Augustus (20 B.C. - 14 A.D.). In the 13th century Marco Polo described the manufacture of zinc oxide in Persia. At Zawar, India, both zinc metal and zinc oxide were produced from the 12th to the 16th century. From India, zinc manufacturing moved to China in the 17th century where it developed as an industry to supply the needs of the brass industry.

Centuries before zinc was discovered in the metallic form, its ores were used for making brass and zinc compounds, its ores were used for healing wounds and sore eyes. It is believed that the Romans first made brass in the time of Augustus (20 B.C. - 14 A.D.). In the 13th century Marco Polo described the manufacture of zinc oxide in Persia. At Zawar, India, both zinc metal and zinc oxide were produced from the 12th to the 16th century. From India, zinc manufacturing moved to China in the 17th century where it developed as an industry to supply the needs of the brass industry.

In 1743, the first European zinc smelter was established in Bristol in the United Kingdom. A major technological improvement was achieved in Germany which led to the erection of smelting works in Belgium and Germany. In 1836 hot-dip galvanizing, the oldest anti-corrosion process, was introduced in France. Zinc production in the United States started in 1850.

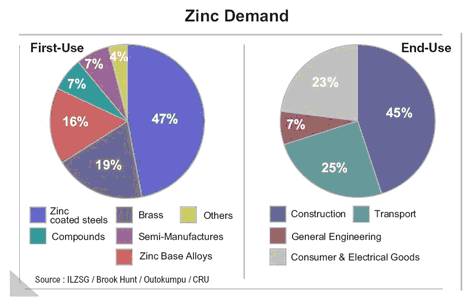

Zinc Applications: First & End Uses ( from International Zinc Association, http://www.iza.com )

Over 7 million tons of zinc are produced annually worldwide. Nearly 50% of the amount is used for galvanizing to protect steel from corrosion. Approximately 19% are used to produce brass and 16% go into the production of zinc base alloys to supply e.g. the die casting industry. Significant amounts are also utilized for compounds such as zinc oxide and zinc sulfate and semi-manufactures including roofing, gutters and down-pipes.

These first use suppliers then convert zinc into in a broad range of products. Main application areas are: construction (45%) followed by transport (25%), consumer goods & electrical appliances (23%) and general engineering (7%).

Growing Application: Zinc Batteries

Zinc based energy systems have tremendous advantages including high specific energy, recyclability, safety and zero emissions. Zinc is used in the manufacture of a variety of battery chemistries, both primary and rechargeable, consumer and industrial.

Battery usage worldwide has been growing dramatically in recent years with the demand for batteries in cellphones, cars (including hybrid cars), laptop computers and other devices. Zinc has played an increasingly large role in battery manufacturing as Zinc-Nickel, Silver-Zinc and Zinc-Air batteries are displacing competing battery types such as Lithium-Ion. In particular, Zinc-based batteries are less volatile, non-toxic, recyclable and can hold more energy than similarly-sized Lithium-Ion batteries. As battery usage continues to grow, concerns over disposal of toxic used battery acids will make Zinc an attractive choice.

Zinc Supply and Demand

The supply of Zinc comes from two sources: mining and recycling. The supply from mining, like many other metals, is largely inelastic to short term price changes. To start a mine, it takes years of planning, permitting and construction. It is complex social, economic, and political exercise to idle or shut a mine.

The supply of recycled zinc is also not very responsive to price changes because recycled zinc is a largely a by-product of recycled steel.

Zinc demand comes from construction and consumer demand for many metal products, from automobiles to brass and electronics. In recent years, rapid consumption growth in Asia has driven demand to outstrip mining supply (supply/consumption ratio <1). In 2007 and 2008, production has continued to grow while consumption growth has slowed.

Any slowdown in construction industries and consumer demand (as has been seen in 2007 and 2008) will cause zinc demand to fall.

| World Refined Zinc Supply and Consumption 2003 - 2008 | ||||||

| 000 tonnes | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 Jan-Jul |

| Mine Production | 9545 | 9709 | 10149 | 10461 | 11092 | 6974 |

| Zinc Consumption | 9842 | 10652 | 10617 | 11023 | 11343 | 6775 |

| Supply/Consumption Ratio | 0.970 | 0.911 | 0.956 | 0.949 | 0.978 | 1.029 |

Source: International Lead and Zinc Study Group

| Largest Zinc Producing Nations (tonnes) | |

| China | 2,600,000 |

| Australia | 1,380,000 |

| Peru | 1,201,794 |

| United States | 727,000 |

| Canada | 710,000 |

| Mexico | 480,000 |

| Ireland | 425,700 |

| India | 420,800 |

| Kazakhstan | 400,000 |

| Sweden | 192,400 |

Source: International Lead and Zinc Study Group, 2005

Largest Zinc Consuming Nations (tonnes) |

|

| China | 3,047,000 |

| United States | 1,069,000 |

| Japan | 602,000 |

| South Korea | 503,000 |

| Germany | 501,000 |

| India | 394,000 |

| Italy | 373,000 |

| Belgium | 345,000 |

| Taiwan | 306,000 |

| France | 271,000 |

Source: International Lead and Zinc Study Group, 2005

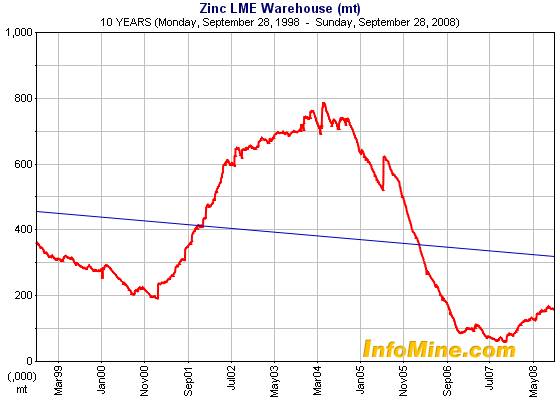

Zinc Inventories & Price Levels

2004-2007 saw a rapid decrease in Zinc warehouse inventories due to growing demand in Asia. Since bottoming out in 2007, Zinc inventories have only recovered slightly as demand has remained very strong.

With falling inventories, Zinc prices rose past $2.00/pound at the end of 2006. Prices have steadily retreated in 2008 despite low inventories and strong demand.

Conclusion:

Zinc has proven to be a valuable, irreplaceable commodity over the centuries. While the global economy has slowed, the usage of zinc remains high. This has forced inventory levels to be persistently near ten-year lows. Fundamentally, as Asian and other emerging markets upgrade their infrastructure and improve their lives, massive amounts of zinc will be used for medical, battery, and construction applications.

In our view, at current price levels the global economy is not prepared for any sudden disruption in supply or investment demand of the metal. Either factor could elevate the price of Zinc substantially higher than today's 70 cents/lb.

Early investors realized this opportunity and cashed in on the speculative frenzy in 2006, driving zinc to well over $2.20/lb. Now with prices back to the 3-year low of 70 cents/lb, (a historic low level when adjusted for inflation), the market has presented another chance to ride the secular bull in Zinc.

Part II - Zinc Mining Investing

How Zinc is Mined ( from International Zinc Association,(http://www.iza.com)

80% of zinc mines are underground, 8% are of the open pit type and the remainder is a combination of both. However, in terms of production volume open pit mines account for as much as 15%, underground mines produce 64% and 21% of mine production comes from the combined underground and open pit mining.

Teck Cominco's open-pit Red Dog mine, the world's largest Zinc mine. Red Dog produces 554,000 tonnes of zinc annually, or about 5% of world consumption

Rarely is the ore, as mined, rich enough to be used directly by refineries; it needs to be concentrated at a mill. Zinc ores contain 5 -15% zinc. To concentrate the ore it is first crushed and then ground to enable optimal separation from the other minerals. Typically, a zinc concentrate contains about 55% of zinc with some copper, lead and iron. Zinc concentration is usually done at the mine site to keep transport costs to refineries as low as possible.

| World's Largest Zinc Mines | ||||||

| (millions of tonnes) | Location | Company | Proven & Probable Reserves | % Zn | Proven & Probable Zinc | Annual Zinc Output |

| Red Dog | Alaska | Teck Cominco (TCK.TO) | 85.0 | 18.20 | 15.47 | 0.554 |

| Rampura Agucha | India | Hindustan Zinc Limited (HZL) | 63.6 | 12.97 | 8.24 | 0.348 |

| Century | Australia | Oz Minerals (OZL-ASX) | 53.7 | 12.50 | 6.71 | 0.191 |

| Antamina | Peru | BHP/Noranda/TCK/Mitsubishi | 468.0 | 0.97 | 4.54 | 0.188 |

| Mt Isa - Black Star | Australia | Xstrata (XTA.L) | 32.5 | 5.10 | 1.66 | 0.300 |

| Lisheen | Ireland | Anglo American (AAUK) | 10.6 | 14.00 | 1.48 | 0.159 |

| Tara | Ireland | Boliden (BLS.TO) | 15.9 | 8.50 | 1.35 | 0.170 |

| Brunswick | New Brunswick | Xstrata (XTA.L) | 14.7 | 8.77 | 1.29 | 0.250 |

| Greens Creek | Alaska | Hecla (HL)/ Rio Tinto (RTP) | 10.1 | 10.10 | 1.02 | 0.018 |

| Perseverance (Matagami) | Quebec | Xstrata (XTA.L) / Donner Metals (DON.V) | 5.2* | 15.80 | 0.82* | 0.115** |

| *measured & indicated | **projected | |||||

Zinc Recycling ( from International Zinc Association, http://www.iza.com)

At present, approximately 70% of the zinc produced worldwide originates from mined ores and 30% from recycled or secondary zinc. The level of recycling is increasing each year, in step with progress in the technology of zinc production and zinc recycling. Today, over 80% of the zinc available for recycling is indeed recycled.

Zinc is recycled at all stages of production and use - for example, from scrap that arises during the production of galvanized steel sheet, from scrap generated during manufacturing and installation processes, and from end-of-life products.

Zinc-coated steel and other zinc containing products are slow to enter the recycling circuit due to the very nature of their durability. The life of zinc-containing products is variable and can range from 10-15 years for cars or household appliances, to over 100 years for zinc sheet used for roofing.

The presence of zinc coating on steel does not restrict steel's recyclability and all types of zinc-coated products are recyclable. Zinc coated steel is recycled along with other steel scrap during the steel production process - the zinc volatilises and is then recovered.

Zinc Mining Stocks

Lundin Mining (LUN.TO) :

Lundin has properties throughout Europe, Russia and the Democratic Republic of Congo producing base metals including copper, nickel, lead and zinc, as well as silver and gold in some properties. Their Neves Corvo Copper mine in Portugal is producing over 20,000 tons of zinc metal annually.

Teck Cominco (TCK/B.TO)

Teck owns the world's biggest zinc mine Red Dog. Today the company is a giant mining conglomerate with zinc, copper, gold, and coal production.

HudBay Minerals (HBM.TO) :

HudBay owns and operates the 777 and Trout Lake mines near Flin Flon, Manitoba, and owns other properties in North and Central America. The company recently acquired Skye Resources (Nickel) to expand and diversify its portfolio holdings.

For those who seek leverage and thrill of a zinc discovery, there are a few public zinc exploration companies trading in the Canadian markets. You can read the recent Financial Post mention of my favourite Zinc explorer, Donner Metals Inc (DON.V) here:

http://network.nationalpost.com/np/blogs/tradingdesk/archive/2008/09/23/gold-fields-brilliant-mining-lee-s-manager-picks.aspx (on Financialpost.com)

http://new.goldmau.com/media/mediapage/media_FP_Johnlee_2008_09_23.pdf (pdf format)

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.