Why "Trouble is Brewing" for the U.S. Housing Market

Housing-Market / US Housing Jun 07, 2021 - 06:01 PM GMTBy: EWI

"Home price declines follow home sales declines"

In many parts of the country, the price of homes has been skyrocketing.

Indeed, the index of home prices across 20 large cities increased at a yearly pace of 13.3% in March, according to a well-known home price index.

That statistic appears to represent a sign of health for the housing market. So, you may ask: "Why is trouble brewing?"

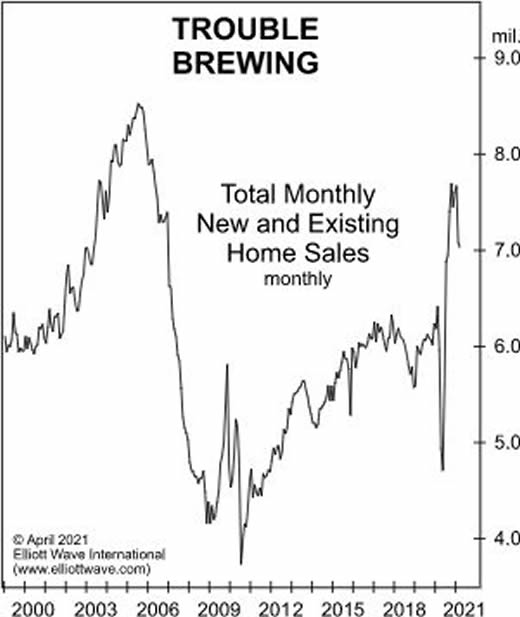

Well, this chart and commentary from our May Elliott Wave Financial Forecast provide insight:

We keep hearing about the "Housing Madness" that shows "No Signs of Slowing." A would-be renter offered $2 million for a summer rental in the Hamptons and was turned down! Still, there are subtle but important signs of trouble in paradise. As the chart shows, total new and existing home sales made a countertrend rally high in October, which was still 21% below the all-time high in July 2005. As we have noted, home price declines follow home sales declines.

In fact, after the May Elliott Wave Financial Forecast published, a May 29 Marketwatch headline said "Pending home sales sink as the housing market falls back to Earth." Here's a quote from the article:

Pending home sales dropped 4.4% in April compared with March, the National Association of Realtors reported this week... [which] offers reason for caution. Buyers who have been unable to get into a contract for a home may eventually opt to give up and wait... That could throw cold water on the hot housing market.

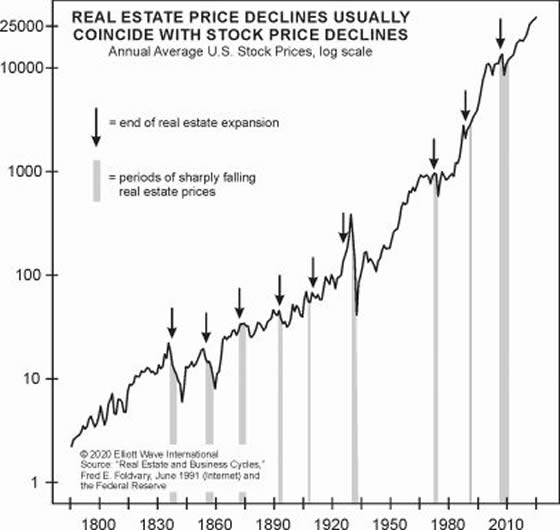

Also, keep an eye on the stock market. History shows that stock and real estate prices tend to be closely correlated.

Here's a chart and commentary from the 2020 edition of Robert Prechter's Conquer the Crash:

Real estate prices have always fallen hard when stock prices have fallen hard. The chart displays this reliable relationship.

You can get Elliott wave analysis of U.S. stocks – plus more insights into the U.S. housing market – by reviewing Elliott Wave International’s Financial Forecast Service.

If you’re unfamiliar with Elliott wave analysis, or need to re-acquaint yourself with the Wave Principle, know that you can access the online version of the book, Elliott Wave Principle: Key to Market Behavior, for free!

Here’s a quote from Frost & Prechter’s Wall Street classic:

The Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.

All that’s required for free access to the book is a Club EWI membership. Club EWI is the world’s largest Elliott wave educational community (about 350,000 members and growing rapidly) and is free to join.

Just follow this link and you can have the book on your computer screen in moments: Elliott Wave Principle: Key to Market Behavior – free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Why "Trouble is Brewing" for the U.S. Housing Market. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.