AMC Is the Best-Performing Stock in America: Don’t Buy It

Companies / Investing 2021 Jun 23, 2021 - 02:49 PM GMTBy: Stephen_McBride

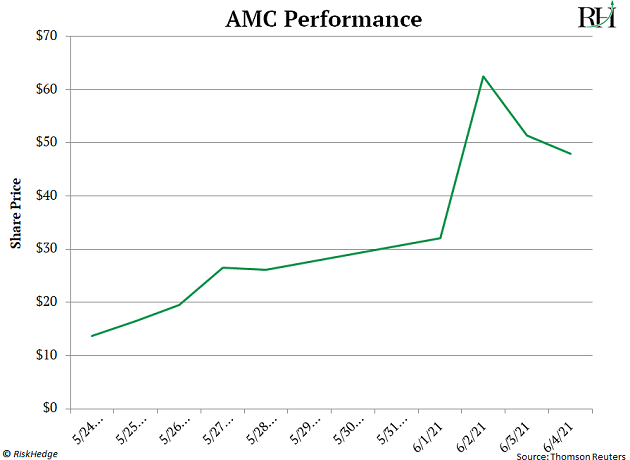

Here we go again. The stock of movie theater chain AMC Entertainment (AMC) just skyrocketed out of nowhere, jumping as much as 127% in one day earlier this month.

Here we go again. The stock of movie theater chain AMC Entertainment (AMC) just skyrocketed out of nowhere, jumping as much as 127% in one day earlier this month.

This would be an extraordinary move for any stock. For AMC, it seems downright crazy. According to CNBC, movie ticket sales in the US fell 80% in 2020. AMC lost $4.6 billion last year, thanks largely to COVID.

But AMC was bleeding cash long before the pandemic. In 2019, it lost $149 million. That’s because AMC’s core business of selling movie tickets is being permanently disrupted by a devastating one-two punch:

Streaming video lets anyone watch almost anything from their couch. And high-quality TVs have gotten so ridiculously cheap that almost anyone can afford a beautiful 65” flat screen that puts movie theaters to shame.

And yet, AMC is the top-performing stock in America this year... up an astonishing 2,230%. Now, if this sounds familiar, it should. AMC pulled a similar move five months ago.

Back in January, shares surged 300% in one day… and a mind-boggling 870% in 3 weeks. So, why is AMC suddenly soaring again?

It has nothing to do with America reopening. Or the newly released box office hit “A Quiet Place Part II” No: AMC went ballistic for the same reason as before.

An army of young traders are using social media to pump it up

In short: Thousands of traders flocked to Reddit forum “WallStreetBets” and touted AMC, convincing anyone they could to buy the stock. All in an effort to stick it to the big hedge funds that bet against AMC. Now, AMC is rewarding these traders with free popcorn:

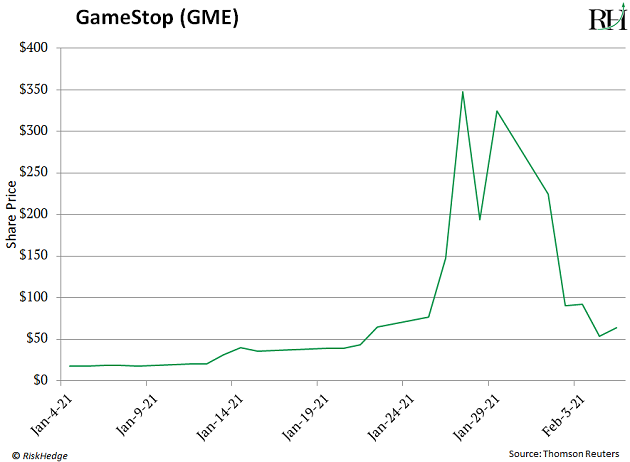

And it’s not just AMC exploding. GameStop (GME), the dying video game retailer, has erupted this year.

It’s the third best-performing stock in America, up 1,135%! BlackBerry (BB)—remember them?—has jumped 100%+. Build-a-Bear Workshop (BBW) is up 327%.

Up until this year, we’ve NEVER seen anything like this. Newbie retail investors banding together to pump stocks, and it actually working? Now it’s happened twice in five months. And I believe this is just the beginning. But now—investors are wondering—how can they profit from this?

Folks, that’s the wrong question

Don’t waste your time and money trying to front-run the next high-flying “meme stock.” AMC… GameStop… and BlackBerry are what we call “bottle rocket” stocks.

In other words, they may shoot up fast. But because their underlying businesses are poor, they’re practically guaranteed to come crashing back to Earth. Take GameStop: After soaring earlier this year, it went on to fall 85% in a month:

Unfortunately, many investors see these stocks soaring in the news and decide they want in on the “easy money.” So they pour in money blindly and get burned. Please: DON’T chase bottle rocket stocks.

Ask yourself: Would you be comfortable owning these stocks 6 months from now? The answer is no. Their businesses are likely on their way to zero.

Now, we know some investors don’t care about that. They just want to gamble. And get involved in this exciting story. If that’s you, please make sure you keep your position sizes in these stocks small. You should be prepared to lose your entire investment.

And keep in mind, there will be another AMC and GameStop

For one simple reason: “kids” are taking over the stock market. Young investors piled into stocks like never before in 2020. Online broker Charles Schwab gained a record 4 million new clients last year. More than half of these new investors are under 40.

In fact, Americans opened 10 million new brokerage accounts in 2020. And more than half of them came from Millennial favorite Robinhood. As you may know, Robinhood is a disruptor in the world of finance. It pioneered zero-fee trading. And its smartphone app allows you to buy and sell stocks at the swipe of a button.

The disruptor now has over 15 million clients, and their median age is 31. Guess what age the average Millennial will turn this year? 32.

What happened with AMC and GameStop is a big deal. It shows these young investors can move markets. And this force is 100% here to stay. Here’s the main takeaway: A whole new generation—the largest and most educated generation in American history—is coming into the stock market for the first time, together.

Again: This does not mean you should buy dangerous bottle rocket stocks. But it DOES mean you should prepare yourself, and start buying the right stocks as this massive shift kicks into high gear. I’m talking about stocks that can set you up for generational wealth, not just “flash in the pan” riches like AMC and GameStop.

At RiskHedge, we focus on “disruptor” stocks

Disruptors are companies that create and transform entire industries. In other words, disruptors invent the future. (That’s the opposite of what AMC and GameStop are doing.)

Amazon was a disruptor. It forever changed the way people shop. Its stock has soared an incredible 207,238% since its IPO in 1997. Netflix was a disruptor. It forever changed the way people watch TV and movies. Its stock has soared 49,000% since 2002.

Today, I’m focusing on disruptors with a long runway of growth ahead. And one of my favorite disruptors right now is Shopify (SHOP).

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.