This eye-opening, in-depth introduction to precious metals ownership will help you avoid many of the pitfalls that befall first-time investors. Find out who invests in gold, what role gold plays in serious investors’ portfolios, and the when, where, why, and how of adding precious metals to your holdings. To end right, it is critical that you start right, and the six keys to successful gold ownership will point you in the right direction.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––————–

“To be clear, the road ahead for America will be rough,” writes Neil Howe, author of the modern classic, The Fourth Turning (1997), in a recent analysis posted at Hedgeye. “But I take comfort in the idea that history cycles back and that the past offers us a guide to what we can expect in the future. Like Nature’s four seasons, the cycles of history follow a natural rhythm or pattern. Make no mistake. Winter is coming. How mild or harsh it will be is anyone’s guess, but the basic progression is as natural as counting down the days, weeks, and months until Spring.”

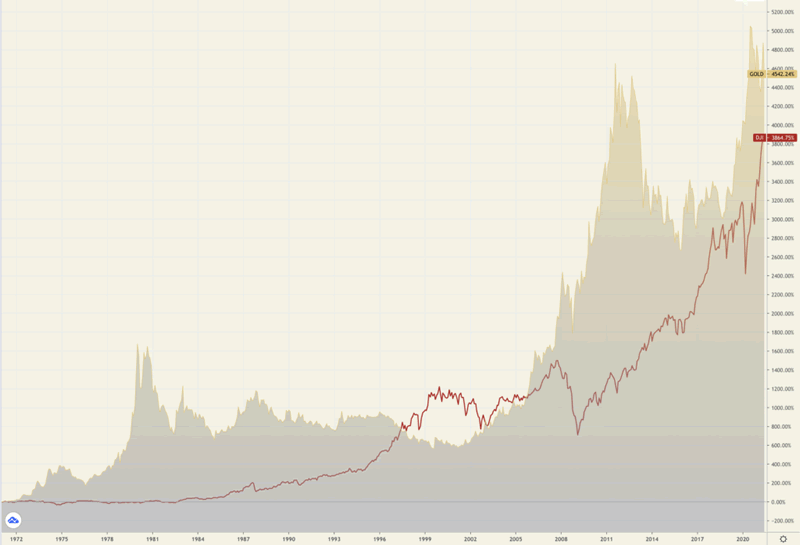

For those who, like me, buy into Howe’s notion of a Fourth Turning, the problem is to get to the other side of the woods with our assets reasonably intact. “Currently, this period began in 2008,” he points out, “with the Global Financial Crisis and the deepening of the War on Terror, and will extend to around 2030. If the past is any prelude to what is to come, as we contend, consider the prior Fourth Turning which was kicked off by the stock market crash of 1929 and climaxed with World War II.” Eventually, he says, we will find our way to a first turning – a time of renewal – but we will be sorely tested before we get there. The precious metals have offered solid protection through the first half of the Fourth Turning. Gold is up 145% since the collapse of Lehman Brothers in September 2008 – the event most analysts associate with the start of the crisis. Silver is up 165%. In both instances, the greatest price acceleration occurred in the early years of the crisis.

The adverse reaction to the Fed’s alleged hawkish turn in the gold market toward the end of June was far more profound than it was in other markets leading to some to ask the question, “Why?” In our view, a good many of the heavyweight professional money managers who endorse gold publicly are physical buyers and quite content to stay out of the way when computer-based trading takes the price down. As buyers of the metal itself and long-term holders for asset preservation purposes, they can enter the market when they think it has bottomed and add to their stockpiles accordingly.

Too, we are in the middle of the annual summer slowdown in gold trading, so the market is very thin. Though investors, generally speaking, tend to take to the sidelines in the summer months, they are keeping a wary eye this year on unemployment and inflation readings while attempting to gauge, as well, how the Fed might respond. If the market happens to offer a discount, physical buyers globally will not be averse to taking advantage of it.

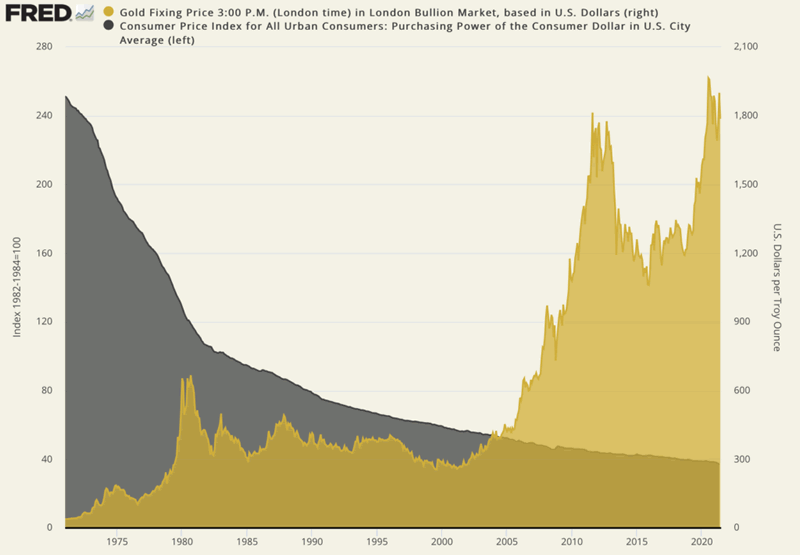

In a column posted a little over a week ago, Financial Times’ Robert Armstrong reported inquiries from his readership about safe assets in a time of “regime change” in Washington and the “unleashing” of loose fiscal and monetary policies. “Gold is an obvious candidate,” he writes. “It is often touted as an inflation hedge. But that is too general. … Gold has followed real rates, slavishly but in reverse, for 15 years, rising when real rates fall and falling when they rise. There is a simple reason: the real return on money is the opportunity cost for holding gold, an asset that yields nothing.”

In that same article, Armstrong makes a point similar to the one we have made consistently in our writings over the past few months. “Gold,” he says,” has one of the most stable relationships to economic fundamentals of any asset. It moves inversely to real interest rates with great regularity, especially in recent years.” If the inflation turns out to be entrenched rather than transitory, gold demand and the price could skyrocket based on its historically proven inverse correlation to real rates.

Armstrong goes a step further by saying gold could rise even if real rates were to go positive because investors would see it as a valuable hedge against general instability. As a long-time reporter at Financial Times and editor of the widely-followed Lex column on the pink pages, Armstrong’s views carry a great deal of credibility in the professional investor community. Armstrong says he is “no gold bug,” but he does offer a fair interpretation of gold’s utility under the current scenario at the link above.

Larry, Larry quite contrary

Wall Street is forever attempting to parse the mindset in Washington, D.C., and more precisely, and perhaps significantly, the mindset of the Biden administration. So when Larry Summers, the former Treasury Secretary and a stalwart in the Democratic Party, went off the reservation describing Biden’s fiscal and monetary policy as being too loose, it turned a lot of heads. Had Biden caved in to the MMT crowd and ultra-left progressives on economic policy?

“Now,” reports Politico under the headline Larry, Larry Quite Contrary, “the Biden administration is more likely to approvingly blast out an email with the latest Paul Krugman column than the latest Summers one (Krugman, notably, did not outright dismiss inflation fears in his column today). While senior Biden officials like Brian Deese and Gene Sperling are colleagues and friends with Summers, the administration is also chock-full of Summers critics – economists who believe that decades of Democratic economic policy that failed to address wage stagnation, outsourcing and rising inequality led to the rise of Donald Trump.”

The Biden administration’s willingness to concede economic policy to that wing of the party amounts to a powerful argument for owning gold and silver. A former staffer with Elizabeth Warren tweeted recently: “I can’t remember the last President who so clearly and unequivocally embraced full employment as their economic goal.” As far as we can gather, the Fed is steadfastly on the same page, despite all the hand-wringing on Wall Street about tapering.

Early this year, John Authers was among the first in journalistic circles to identify the new monetary regime change underway in Washington. “Let’s make a big assumption,” he wrote in an opinion piece posted at Bloomberg. “We really are in the process of not only a great shift toward reflation, but toward a new inflationary regime. What is this like, how can we tell, and what does the future hold?” Now a growing cadre of analysts agrees that the Fed and the federal government have launched a new era in monetary policy.

As the new regime is being deployed, it has become increasingly clear that the Biden policy mix is an attempt to overturn the framework that has been in place since the early 1980s – what the Reagan-Volcker team were to disinflation the Biden-Powell team might be to inflation. Among those early insights from Authers, he offers the following from Alex Lennard of Ruffer LLP. “Volcker said he was going to tame inflation, unemployment be damned. Now it’s the other way around. I don’t think people have quite realized that you’ve had this huge change in the mandate of policymakers.” There is no mystery in all of this with respect to what it means for gold. If we have indeed returned to the 1970s, then gold will play a vital role in the well-balanced portfolio and will be the subject of more than a few financial headlines.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––————–

“Inflation has no date of beginning. Inflation is the cancer of modern civilization, the leukemia of planning and hope; as with all cancers, no one can say when it begins or how fast it may spread. It is a disease of money, and when money goes, order goes with it. Inflation comes when a government has made too many promises it cannot keep and papers over the shortfall with currency which, ultimately, becomes confetti — and faith is lost.” – Theodore H. White, historian-political journalist, “America in Search of Itself” (1982) As quoted by Authers at the link above.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––————–

Final Thought

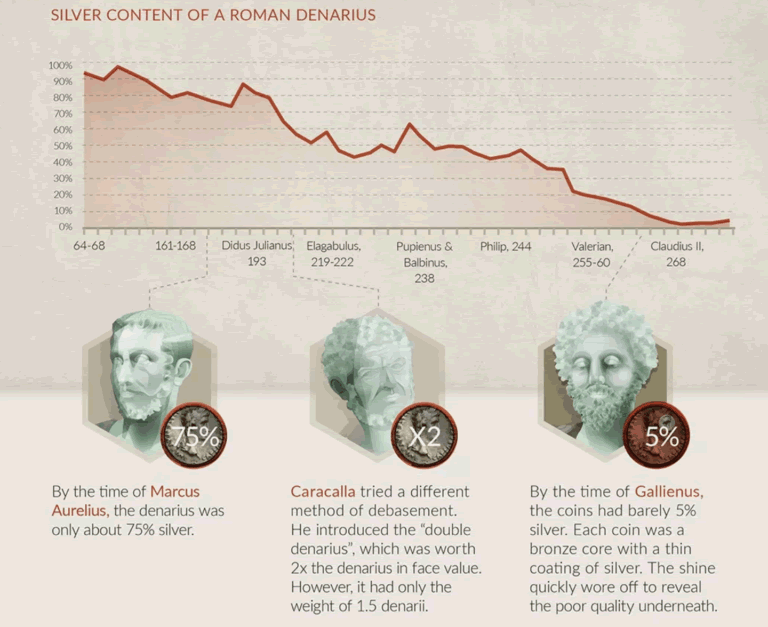

Image courtesy of Visual Capitalist • • • Click to enlarge

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. “A change of fortune,” Ben Franklin tells us, “hurts a wise Man no more than a change of the Moon.”

Up-to-the-minute gold market news, opinion, and analysis as it happens. If you appreciate NEWS & VIEWS, you might also take an interest in our Daily Top Gold News and Opinion page.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.