Next Time You See "4 Times as Many Stock Market Bulls as There Are Bears," Remember This

Stock-Markets / Stock Market 2021 Jul 29, 2021 - 04:55 PM GMTBy: EWI

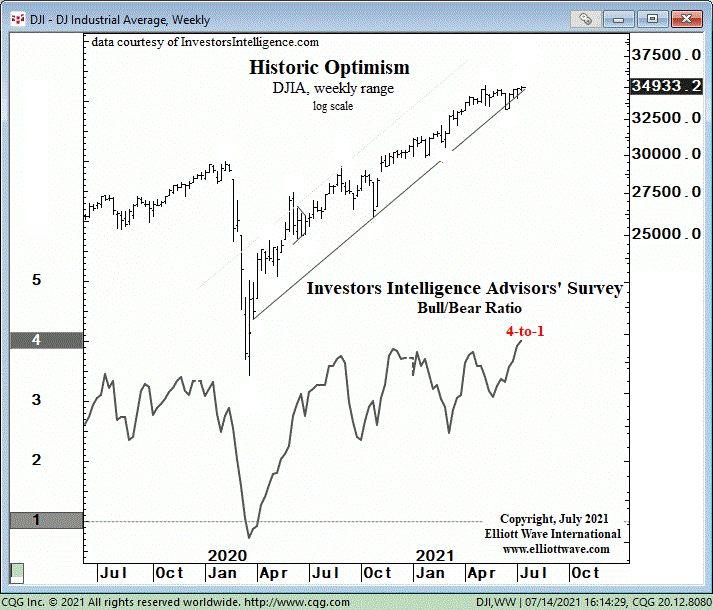

See how stock investors' "historic optimism" served as a warning

After a 12-year uptrend, just when caution might be in order, investor psychology has remained highly and stubbornly optimistic.

As the July Elliott Wave Financial Forecast, a monthly publication which provides Elliott wave analysis of major U.S. financial markets, said:

Large traders are more exuberant than ever. On June 11, large trader buy-to-open call purchases jumped to 45%, a new record.

A highly bullish outlook was also expressed in this July 10 Marketwatch headline:

The bull market in stocks may last up to five years -- here are six reasons why

Notice that the headline's suggestion is that the bull market has just started.

That five-year forecast might turn out to be correct -- but then again, keep this in mind from an earlier 2021 Financial Forecast:

A top never feels like a top. The bigger they are, the more permanent they seem.

And here's yet another recent look at sentiment via a chart and commentary from the July 14 U.S. Short Term Update, a thrice weekly Elliott Wave International publication which provides near-term analysis of key U.S. financial markets:

The most recent result of the weekly Investors Intelligence Advisors' Survey (InvestorsIntelligence.com) shows that the percentage of bulls rose to 61.2%. ... With the percentage of bears dropping to just 15.3%, there are now four times as many bulls as there are bears. Since the stock market crash of 1987, a span of a Fibonacci 34 years, only 1.5% of the total weekly readings in the II bull/bear ratio have been higher than the 4-to-1 ratio of this past week.

Interestingly, just two days after this analysis published, the Dow Industrials dropped nearly 300 points on Friday (July 16) and on the following Monday, as of this writing, the Dow has tumbled more than 900 points.

To stay independent from the sentiment of the crowd, it's a good idea to employ Elliott wave analysis and other technical indicators. They will help you stay on track -- objectively, independently from the "bullish" news that inevitably fools the crowd.

If you'd like to learn about Elliott wave analysis, or need to brush up on the subject, there's great news: You can access the online version of Frost & Prechter's Elliott Wave Principle: Key to Market Behavior -- 100% free.

All that's required for free access to the book is a Club EWI membership. You can join this Elliott wave educational community for free, and membership allows you free access to a wealth of Elliott wave resources on financial markets, investing and trading.

Getting back to the book, here's a paragraph from the first page of Chapter 1:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Get more insights by following this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Next Time You See "4 Times as Many Bulls as There Are Bears," Remember This. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.