Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH!

Stock-Markets / Stock Market 2021 Sep 09, 2021 - 10:54 AM GMTBy: Nadeem_Walayat

Dear Reader

This is third and final part of my recent extensive analysis (Part 1) (Part 2) in advance of Financial Crisis 2.0 as a handful of stocks are driving the indices higher, Apple worth $2.3 trillion, Microsoft $2 trillion, Amazon $1.8 trillion, Google 1.8 trillion, Facebook $1 trillion even that over priced pile of poop Tesla came close to being valued at $1 trillion, we are definitely in a bubble, you only need to go onto youtube and watch the to the moon videos of Cathy Wood, literally everything's going to go to the moon because her barely out of puberty Quants decree it to be so. This is clearly a major warning sign of a unsustainable trend when indices are ruled by such a small clique of tech stocks where the greatest similarity is with the dot come bubble in terms of the valuation of stocks that actually produce revenues unlike the largely worthless dot com's of that time.

Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH!

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

The whole of which first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for currently just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent analysis - Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

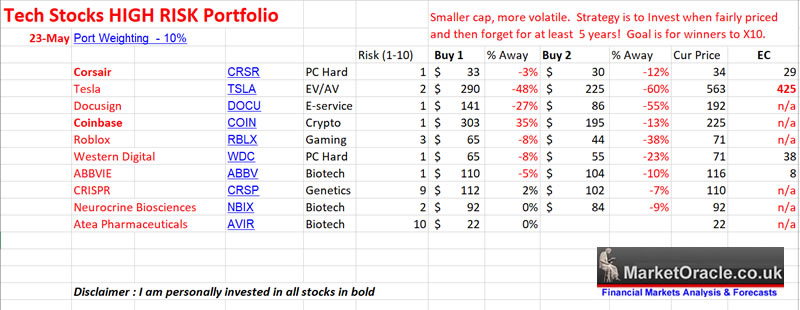

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

And my analysis schedule includes:

- Stock Market Trend Forecast September to December 2021 - Target this weekend

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 30% Done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

So do consider becoming becoming a Patron by supporting my work.

Investing During Uncertainty

We are in a stock market bubble, but how close are we to the bubble popping? What happened to the high risk tech stocks that Cathy Wood so loves was a warning that the bubble is starting to pop. But bubble mania peaks tend to have a lot of uncertainty associated with them is the peak now or is it 10%, even 20% from here?

And then what? Do we get a crash or a bear market of sorts? 20%, 30% even a 50% drop? So how should one invest when the outlook is so uncertain?

The first step is to ask oneself how would I react to a 30% drop in the value of my portfolio?

Will I great such a drop as a buying opportunity or lament at failing to have sold x,y,z when the prices were trading much high.

So my decision of 17th June 2021 was to position myself to great a potential drop in the market of say 30% enthusiastically as a great buying opportunity. I am now comfortable with whatever happens going forward even a blow off top that takes valuations to a whole new level in a final mania driven spike.

In terms of investing, during times of certainty one is fully invested. During times of uncertainty then one dollar cost averages, so if one wants exposure to a particular stock in an uncertain climate then buy once every couple of months or so. So set a date and then buy on that date.

In which respect I will eventually be buying back positions in Google and Facebook probably starting late October. In addition to having market orders under the market in case the stock market decides to take a tumble to my buying levels.

For where we stand look for warnings signs, look for deviations such as Tech stocks falling but the general indices such as the S&P and Dow trading to new all time highs. That's a deviation to take note of for what the Nasdaq does today the Dow will do tomorrow. Deviations are not a sign of health, they are a sign of market confusion, the market is in mania mode, and so panic selling from one sector sees the money flood into other sectors thus resulting general indices that still rise whilst the market is weakening, anyway that is how I see the market right now.

So I expect the market to correct hard, maybe experience a mini bear market, which should bring the value of all stocks down with it towards at least my buying levels.

However, it is entirely possible the the drops in the market will see even the good stocks trade down to become undervalued, which for the likes of Google, Amazon and Apple could translate into a 30% drop in their stock prices. But it is not certain, hence why better to de-risk now and wait and see what happens with mechanisms to invest.

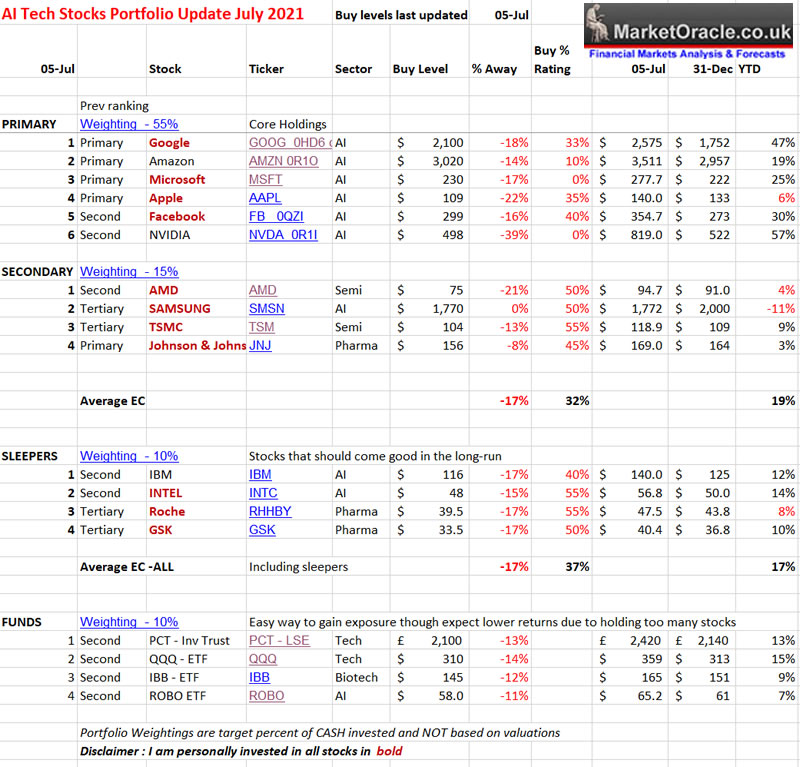

AI Stocks Portfolio Buying July Levels Update

The buying levels for my stocks portfolio largely remain unchanged from my last update of 25th of May 2021. A reminder that the Buy % rating is how good of a buy I rate the stocks right now i.e. when a stock is at 100% then I rate it as a great buy in terms of trend and valuation. Whilst 0% rates as a bad buy right now.

As you can see I am not seeing much value in buying anything right now. Typically the AI stocks would need to fall by between 15% and 20% to perk my interest into buying, and a lot more for the likes of Nvidia (-40%). Also I am completely disinvest ed form Nvidia, Amazon, PCT and IBM, and I have reduced holdings in Google, Microsoft and Facebook. Whilst the rest remain untouched. So I am cash rich at the moment and we will see what happens..

HEDGING AI Stocks Portfolio

I am regularly asked how I am hedging my stocks portfolio, so here is a brief overview. Bit firstly understand this HEDGING is betting AGAINST the primary trend, so it is far, far higher risk than just investing, and so has to be time limited which requires a hands on approach and so is nowhere near as easy as just buying good stocks on the dips and to invest and forget as you cannot lose more than what one invests but hedging done badly can, for that we only need to look at the so called Hedge funds going bust, in fact it was a couple of hedge funds that started the ball rolling on the financial crisis in July 2007 when 2 Bear Stearns Hedge funds went POP! as I wrote at the time (Jul 31, 2007 - 12:50 AM GMT Hedge Fund Subprime Credit Crunch to Impact Interest Rates)

LOCKED AND LOADED

Understand that my primary objective is to focus on what I am going to buy when the stock market falls, so I need to ensure I have my shopping list of stocks with the rough prices I will be willing to buy the stocks at with funds ready on account, locked loaded to enable me to buy. Being locked and loaded primed to buy IS PRIMARY!

So understand hedging is not something most investors should even consider or engage in because it is HIGH RISK, hedging is NOT investing, Hedging is TRADING that demands experience to a greater extent why I instead encourage buying the dips rather then trying to short the dips as buying the dips has a very high probability of success whereas shorting the dips is at best going to be a 50/50 proposition!

OPTIONS

Are very seductive, i.e. buy a put option at a particular strike price and imagine all of the money one will make when they expire deep in the money. Unfortunately most options expire worthless. I consider options as the HIGHEST of high risk activities to engage in as they are designed to extract money from Option buyers which is why I DO NOT TRADE OPTIONS.

FUTURES

To hedge against a drop in my portfolio then I trade the downside in a stock index future, usually the Dow with tight stops and limits. The thing about futures is that one needs to monitor the index so as to amend stops, and the risk is that a. the decline is temporary so one is betting against the trend, and that even if one is right on direction one can still get stopped out with a loss.

STOCK FUTURES

The next tool is shorting stock futures. What one does here is to pick the weakest stocks and then short them so that if the portfolio takes a tumble in value then at least some of that reduction in value will be offset by the gains on the stock that has fallen to a greater degree.

The problem is that one one is picking the weakest stock to short, then it cannot be a stock that one is invested in for the fundamental fact that I consider all the stocks I am invested in as being good stocks with good upside potential. For instance if I was pretty sure that Apple was seriously over valued to the extent it's stock price could crash by 20% or more then I would not be wasting my time trying to short Apple stock but instead I would SELL my Apple stock (which I have).

Shorting the likes of Apple carries a huge amount of risk that there is a good chance that ones bearish view is WRONG, so much better to EXIT and buy back after any decline then to SHORT the stock.

So to find a stock to short, one looks for that stock that is heavily overvalued to ridiculous levels, and which has already shown clear sign that it has already started to weaken, deviate from other stocks such as TESLA.

So if the tech stocks do take tumble then whilst Google may fall 10%, Tesla would be expected to fall by 40% or more. However one is betting against the trend so one needs to use and move stops and set limits at achievable levels, which in Tesla's current case would be at $520 and at $430, with a view to moving stops behind the price as it falls so as to first move to break even and then to lock in a profit.

MECHANISM

My primary hedging mechanisms are DFT's and Futures, as using the likes of City Index and IG Index any profits are TAX FREE

Key Points

1. Short futures with tight stops and limits.

2. Short weak stocks with wide stops and limits.

3. Review positions and amend stops and limits, I usually review and update once per day, including deciding to exit early.

4. It is usually much better to reduce holdings of any stocks one is worried about than to go down the shorting the futures route.

5. I DO NOT TRADE OPTIONS

A reminder of what hedging is, one is hedging against a DROP in the value of ones portfolio. If the market does not drop or goes up then the HEDGE will result in a loss, which is the whole point of the hedge. Of course we can get lucky with a Wily Wonkas golden ticket where the portfolios value goes up and the HEDGE profits at the same time! I.e. AI stocks go up Tesla goes down. which is why one needs to keep moving those stops else one can quickly end up losing any paper profit on the hedge.

The bottom line is that hedging is not for most investors as it is BETTING against the TREND, so there is a high risk that the hedge will not pay off. In fact most of the time hedges generate very little extra profit for all the time and effort one puts in, because it is time consuming to trade futures and events such as March 2020 are unpredictable, no one could have seen that the Dow would spike to below 20k. Personally if memory serves me correctly early on in the decline I imagined that the Dow would bottom out at around 25k so there are times when one can get lucky on hedges's but they are rare.

Thus my primary strategy where stock market corrections are concerned is to be locked and loaded to BUY stocks, where any hedging is a side salad i.e. I am never going to hedge more than about 1% my portfolios value so it's not that big of an exercise due to the fact it is far higher risk than just buying the dip and I would probably be better served by not wasting my time hedging and instead reduce my exposure to the market.

Also I'm not going to mention my hedges on a regular basis because they are high risk, short-term and likely to confuse more than help i.e. the durations of my Dow short futures trades are usually measured in the days rather than weeks as they are that temporary. That and I don't have the time to be sat there watching the price movements in real time.

Neither will I start making a list of stocks to short because again IT IS TOO HIGH RISK where no matter how good the risk vs reward looks in terms of stops and limits, it's still a 50/50 bet because one does not know everything about the stock and what's going on and one is betting against the trend. For all we know loony toon Cathy Wood could hit the buy button on Tesla and send the stock soaring despite its current overvalued state, that is the risk of shorting stocks you don't know and at best you've got a 50/50 chance.

Hedging Conclusion

Head my warning - Shorting stocks is VERY HIGH RISK, it is NOT Investing, I do it sparingly and usually limited to just trading the Dow or FTSE short-term, beyond which from time to time if I see an opportunity I will short position trade a stock such as Tesla with stops and limits and amend accordingly. There is no free lunch / easy money to be made, shorting stocks IS VERY HIGH RISK which can financially wipe you out if you are not careful! For example there are dozens of Fund Managers such as James Clunie of Jupiter Absolute Return Fund who got burned shorting Tesla over a 3 year period in the run up to Tesla's end 2020 high which wiped out much of the the funds value and eventually being shown the door early December 2020.

And here's another example - Hedge Fund manager Mark Spiegel and his lunatic shorting of Tesla stock from $26, periodically spreading disinformation on Tesla in desperate attempts to drive the stock price lower so that he can cover his huge short losses.

I think the problem with those who get carried away shorting is that they forget going short is infinitely more risky then going long i.e. when long ones max loss is 100% (unless one makes the mistake of investing on margin), whilst when short ones max loss is when one goes broke!

Whilst this also acts as a lesson to all those who invest in managed funds, they are NOT lower risk than investing directly in stocks.

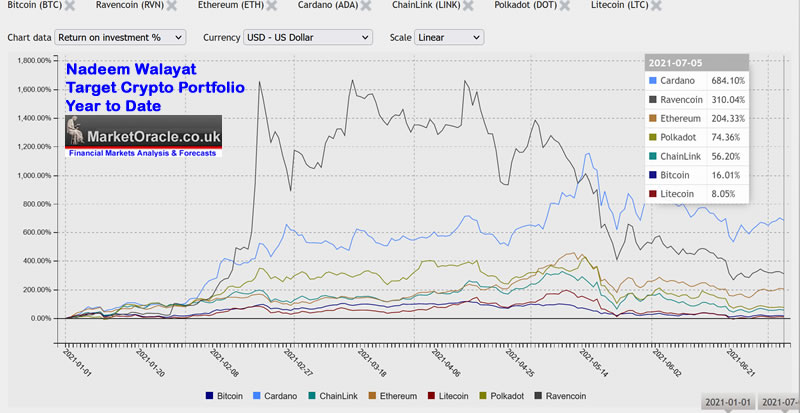

Crypto Bear Market Acclumation Current State

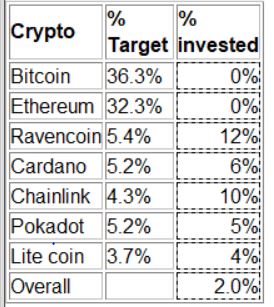

Current state of my accumulating during the great crypto bear market of 2021 (Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels) for buying levels check out the preceding in-depth analysis. Basically I am about 2% invested of the target portfolio as I await the crypto's to fall to anywhere near levels I would be willing to buy significant exposure. Still in case I turn out to be wrong, I have been buying at least some exposure to the Alt Coins such as Ravencoin, Cardano and Chainlink, whilst my position in Lite coin is courtesy of GPU mining with Nicehash.

And remember folks investing in crypto's is VERY HIGH RISK for the fundamental fact that despite the hype in reality they have NO REAL VALUE, PURE SPECULATION! I.e. there is always the risk that the party is over i.e. that we never see the likes of Bitcoin $65k ever again, so I am in no rush to buy unless I see the crypto's fall to my buying levels either that are I will hold NO Bitcoin or Ethereum!

Bitcoin Bull / Bear Indicator

This is a leading indicator that I am working on to flag if there is a high probability of BTC rolling over into a bear market or about to begin a bull market. This indicator has been wan ring of a BTC bear market since Mid March, with the 13th April all time high coinciding with a 96% SELL rating. The signal is designed to act like a switch i.e. to only trigger when bitcoin changes major trend. To further reinforce the switch each subsequent trading day after the initial TREND changing requires, 2nd and 3rd day reversal signals to confirm the original signal. Though it should be noted that I am skeptical of the indicator in that it may turn out to be only good for signaling the beginning of this bear market, and fail to signal the start of the next bull market, so I am using it with a skeptical eye, as long as it confirms the rest of my analysis which expects much lower prices for crypto's. We are nowhere near a bottom that could be a good 4 or 5 months away!

Current signal is a 96% SELL and Bitcoin has been on a SELL rating since Mid March so everything remains on track for MUCH lower crypto prices, typically at least another 50% drop from where they trade today!

Market Oracle AI Coin Thoughts

I still want to give this ago but am mindful of the regulatory environment. The objective of the coin would be one that it is leveraged to an AI stocks portfolio.

Current state of play -

1. Supply limited to 1 million coins where supply is backed by liquidity to put a floor under the price that initially would be $1 per coin.

2. Investment (from me) and coin sales (limited in the early years) to finance purchases of AI stocks. but these cannot be seen to be connected to the crypto token else fall into the securitization trap.

3. Annual upwards pressure on the coin market via 'dividend' investment buying (from me) at 10% of the value of the AI stocks portfolio i.e. BUYING of coins from the market each year thus reducing the supply and pushing the price higher.

4. Eventually the financing of the purchases will be via sales of the AI stocks portfolio, i.e. annually sell 10% of the AI portfolio, or equivalent from reserves to buy coins from the market and thus put upwards pressure on the price.

5. That there will be a web page that keeps track of the portfolio value, and 'dividend' buying of coins.

So basically the link between the coin and the AI portfolio would be via purchases of the coins from the market based on the value of the AI stocks portfolio thus reducing supply and pushing the price higher.

My next analysis will be the next 5 biotech stocks, likely soon followed by stock index (Dow) trend analysis, and then the UK housing market to also include a brief update on the current state of the US housing market.

In fact without further ado here are 2 of the 5 biotech stocks that I will be covering in terms prospects and risk profiles.

Aptorum Group

Cara Therapeutics

Bl********************

Ta********************

Bi********************

Here's a reminder of the High Risk small cap stocks portfolio where all 4 of the biotech stocks are up to date with CRISPR leading the way with a 40% rise.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast September to December 2021 - Target this weekend

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 30% Done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your partially switching from mega AI tech stocks to small cap biotech stocks analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.