Stock Market Shaking Off the Taper Blues

Stock-Markets / Stock Market 2021 Sep 18, 2021 - 05:10 PM GMTBy: Monica_Kingsley

S&P 500 recovered from the selling at open, but the picture is hardly one of universal strength. Tech rose while value erased half of the intraday decline, and high yield corporate bonds closed little changed. Risk-on seems as slowly returning unless you look at the retail sales surprise boosting the odds of Sep taper. Is it though really going to happen?

I continue to think the Fed won‘t move too far, too fast, and that no real action would follow later this month. The job creation isn‘t at its strongest, and yesterday brought us a daily overreaction to positive data, which coupled with the preceding manufacturing ones reveals that the moderation in economic growth would be indeed shallow and temporary. This daily panic was nowhere better seen than in gold and silver – neither USD nor yields moved much.

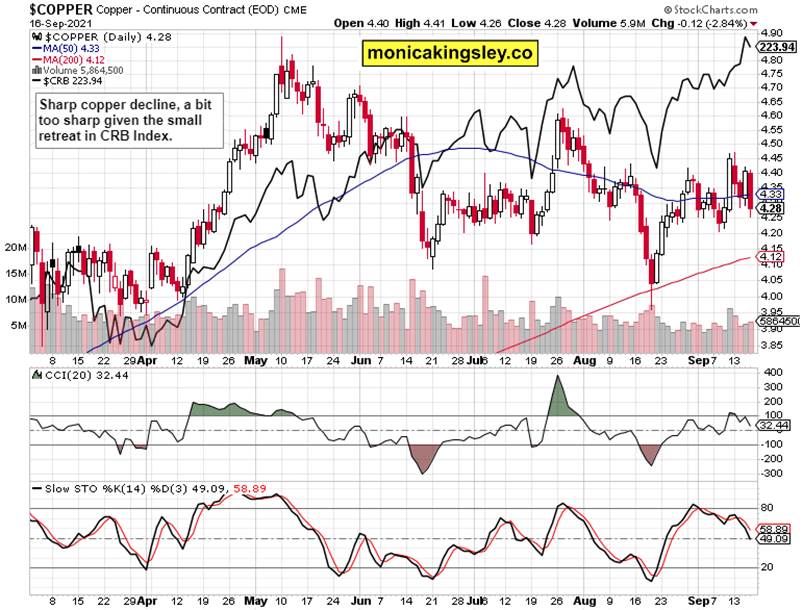

Unless the 4,440 level in S&P 500 is broken to the downside, stocks appear on the verge of yet another accumulation while commodities are best positioned to rise strongly (the Fed isn‘t mopping up excess liquidity, no). Crude oil hasn‘t spoken the last word, and looks ready to continue upwards following a little consolidation around $72. Copper‘s wild ride continues, and I‘m not looking for the red metal‘s 50-day moving average to start declining.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

The overall shape is one of cautious accumulation, with the final questions apparently being whether the bears mount some more strength and attempt breaking below the 50-day moving average, which had held since mid Mar.

Credit Markets

Credit markets though look like hanging in the danger zone still – return to daily strength in both HYG and quality debt could invalidate it. The overall message is unclear still.

Gold, Silver and Miners

Instead of the yesterday mentioned slow grind a little lower in a fake show of weakness, the yellow metal declined more profoundly. Miners and silver got spooked too, but the HUI:GOLD ratio hasn‘t broken below late Aug lows. The bears have a short-term technical advantage, and the $64K question is when the bulls step in.

Crude Oil

Oil stocks are supporting a little breather in oil now – the coming correction is likely going to be a buying opportunity.

Copper

Copper once again outperformed other commodities on the downside, but its corrections are likely to be bought.

Bitcoin and Ethereum

Brief consolidation after the Bitcoin golden cross is here, and it could still be a bull flag even if a dip below the 200-day moving average is likelier.

Summary

Stealth accumulation or one more bear raid in stocks? Commodities seem unfazed, with only the precious metals (and copper) under pressure from the taper nearby fears. Even cryptos are retreating a little, but dollar‘s inability to stage a strong rebound tells us not to overestimate the Fed‘s willingness to act and throw the markets off kilter.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.