Stock Market Rescued by the Fed Again?

Stock-Markets / Stock Market 2021 Sep 24, 2021 - 10:12 PM GMTBy: Monica_Kingsley

S&P 500 recovered only to dive again – carving out a base? The bulls are attempting to, but neither value, nor tech, nor the credit markets are convincing. The dust is settling though, and the bears are equally in need of a fresh reason to sell – the intraday tug of war is entirely reasonable as Evergrande failed to spook the markets more. Just wait for what happens when the markets come face to face with another unacknowledged event of this magnitude. In our era, it‘s about the contagion effect, manic-depressive market psychology, and uncertainty of the impact.

It‘s not only about China real estate cooling down, spilling over to Hong Kong. Wtll the House approval on the bill to suspend fresh borrowing obstacles and avoid a partial shutdown do? What would the Senate say – and then everyone as the tax tsunami keeps approaching? Global liquidity isn‘t rising after all either.

Fed taper is a side show, but still one that too many are glued to. The dollar would suffer if it doesn‘t materialize later today – and it won‘t be announced, which would make precious metals rejoice.

Back to stocks, these are also likely to welcome no taper. The Fed has been already tightening (which means these days it was decreasing the pace of expansion) through the back door, bringing down inflation expectations in spite of the real world input costs, shipping rates and frail supply chains challenges on top of the job market issues. Transitory inflation is still the mainstream thesis – the shift to real assets will become more accentuated once the realization of a higher and entrenched inflation arrives. And it‘s not about real estate and owners‘ equivalent rent either.

Commodities did welcome yesterday‘s reprieve, and Treasury yields are unlikely to clobber them the way perceived systemic risks could (did). In a decelerating real economy faced with numerous deflationary pressures, the slow and steady rising yields phase, is deferred for now. And when these do rise again, it may or may not be about returning economic growth, but forced by the systemic realities. Remember that rates are very low by historic comparisons, and the resilence to absorb a modest rise (think 10-year more than a bit above 2%) won‘t be there without consequences.

Cashing in on the S&P 500 short profits yesterday, was reasonable from the total portfolio risk point of view (did I say a fresh high was reached?).

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

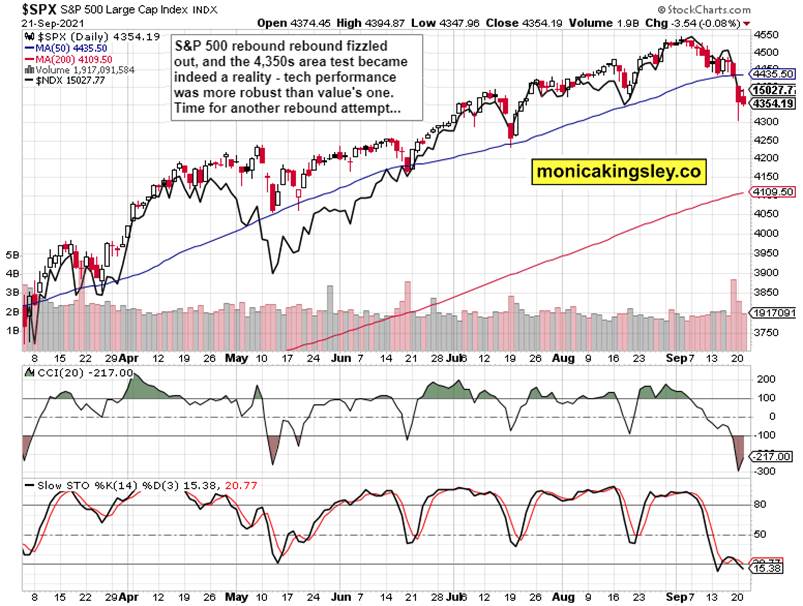

S&P 500 and Nasdaq Outlook

Daily hesitation followed by more downside, but volume is decreasing – stocks look readying an upswing attempt.

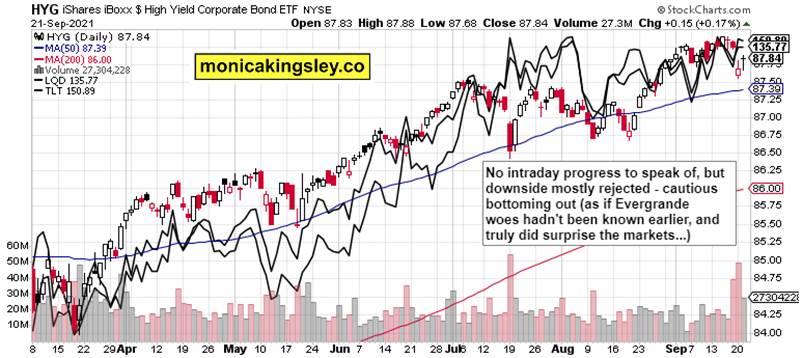

Credit Markets

High yield corporate bonds merely kept opening gains – there is still hesitation, and the window of opportunity for the bulls is narrow.

Gold, Silver and Miners

Positive price action of gold, joined by silver – the waiting miners reveal that a little consolidation is likely before the Fed speaks.

Crude Oil

Oil stocks show that the appetite for oil might be returning, and that‘s confirmed by the volume examination. Commodities such as oil and copper stand to benefit from calming the Evergrande and central bank jitters.

Copper

Copper gave up opening losses only to rebound before the closing bell. Volume could have been larger, but the beaten down red metal can keep rebounding at its own pace – the smaller volume is an indication it won‘t be a one-way path.

Bitcoin and Ethereum

Bitcoin and Ethereum haven‘t really recovered from the selloff, and the bears are holding the upper hand now.

Summary

My yesterday‘s question „Is the selling over, is it not?“ has the same answer „Still inconclusive, but time for the bears is running short.“ It looks like the markets are positioning for a return to risk-on based on today‘s FOMC, which is what quite a few would like to take as an opportunity to sell into strength. The point is the Fed won‘t surprise today, and the price gyrations are likely to continue, albeit at a lesser magnitude.

Thank you for having read today‘s free analysis, which is available in full here at my homesite. There, you can subscribe to the free Monica‘s Insider Club , which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.