Stock Market Gauntlet to the Fed

Stock-Markets / Financial Markets 2021 Sep 30, 2021 - 08:23 PM GMTBy: Monica_Kingsley

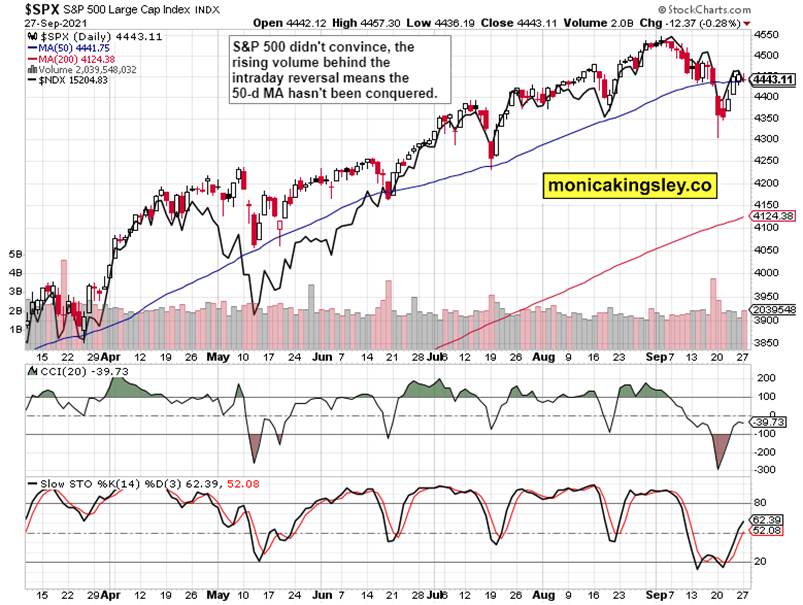

S&P 500 was unable to sustain intraday gains, and both VIX and volume show the bears want to move. Arguably, the key market to watch, are the Treasuries – the 10-year yield continues rising, knocking on the 1.50% door again. On the day of Powell‘s testimony, that‘s quite a message to the central bank.

As I wrote yesterday:

(…) Rising yields (the market believes in taper, it appears) across the board, with high yield corporate bonds holding up much better than quality debt instruments – I have seen stronger risk-on constellations really.

Importantly, the huge weekly jump in Treasury yields (the 10-year yield jumped over 20 basis points to 1.47%) failed to lift the dollar, which says a lot given the risk-off entry to the week. Meanwhile, the Fed jawboning continues, and the bigger picture leaves the ambitious Nov tapering suspect.

At the same time, the Fed‘s foot is to a large degree off the gas pedal, and even global liquidity is shrinking. New taxes are kicking in, job market woes are persisting, inflation isn‘t going away any time soon, challenged supply chains are forcing globalization into reverse, workforce is shrinking, GDP growth is decelerating, and no fresh fiscal initiatives are on the horizon – sounds like a recipe for stagflation.

The Fed can adjust (and even reverse) the tapering projections any time it pleases – it has played the job market card already. The dollar failing to gain traction though, is telling. Not even commodities as such are rolling over to the downside – actually, energies (oil, natural gas) have been the star performers (even within the S&P 500 sectors), and agrifoods are well positioned to do great as well. Copper and precious metals are feeling the short-term heat (still, the red metal offered a great entry point earlier today, making the open position profitable from the get-go), but the metals would stop reacting to the bad news while ignoring negative real rates (yes, transitory inflation is another myth the market place believes in) at some point. All roads lead to gold – inflationary and deflationary ones alike.

What can the Fed do? Underestimate inflation, be behind the curve, carefully play expectations while real world inflation coupled with shattered supply chains wreck the stock market bull over the quarters ahead? Or throughtfully slam on the brakes (which is what the markets think it‘s doing now), which would force a long overdue S&P 500 correction that could reach even 10-15% from the ATHs? Remember that the debt ceiling hasn‘t been resolved yet, so an interesting entry to the month of October awaits.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

The real question mark is where the bulls step in next, and whether they could carry prices over Monday‘s highs (4,470s) – this question is a bit too early to ask.

Credit Markets

Credit markets haven‘t moderated their pace of decline, but the yield spreads show we have higher to go once the current dust settles.

Gold, Silver and Miners

Gold managed to hold ground yesterday, but further yields pressure is likely to affect it, whether or not it translates to (marginally) higher USD Index.The bears have the short-term initiative till bonds turn.

Crude Oil

Crude oil didn‘t treat us to much of an intraday dip, and the oil sector shows the rush into energies is on – no matter how short-term extended and approaching the late Jun highs black gold is.

Copper

Copper hesitation goes on, with the red metal failing to gain traction the CRB Index way. Still, it‘s range bound, and FCX (which is important for gold too) is showing signs of life.

Bitcoin and Ethereum

Bitcoin and Ethereum bears have reasserted themselves, and would confirm the initiative with a break below $44K in BTC. For now, it‘s too early to declare the end of the trading range.

Summary

September storms aren‘t over yet, and declining bonds are a warning sign. Commodities are the most resilient, and will likely remain so, until precious metals sniff out the room for Fed‘s hawkishness as radically decreasing. The question marks over the timing and actual pace of taper, are persisting.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.