When Will the Fed Taper?

Interest-Rates / US Interest Rates Oct 09, 2021 - 11:27 PM GMTBy: The_Gold_Report

In this review of the quarter, Adrian Day, founder of Adrian Day Asset Management, discusses the Federal Reserve's asset purchases, its talk of tapering them, and what that could mean for the broader markets.

To taper or not to taper, that is the question. So far, the Federal Reserve’s constant talk and threats of an impending taper have performed the job better than actually doing anything. Stocks are flat, gold is down, as are bonds. But markets are beginning to grow weary of the constant threats with no action. When the Fed actually starts to taper, we may see markets turn. It was a poor quarter in most major markets and assets.

Key question: When will the Fed taper?

So, it was not a happy quarter. There are many negative influences weighing on the markets, from stubborn COVID virus to China’s credit problems. But the most important fact, we believe, is the constant threat of Federal Reserve to taper (reduce asset purchases). This is, per se, negative for bonds, while the stock market has thrown a tantrum at previous tapers, and the mere thought of tightening is deemed negative for gold. But it is not quite as simple as that, as we explain below.

"It is going be a while—I think at least 2023—before the Fed increases rates, and even then, it will lag inflation."

The Fed has been talking about tapering for months now, but has been constantly pushing back on actually doing anything. The story changes day by day, but two things are clear. First, it will have to cut back new purchases at some point; and second, it is extremely hesitant to actually do anything meaningful. Even after Fed Jerome Powell said a couple of weeks ago, after the Fed’s last meeting, that they would commence tapering in December—itself not fulfilling expectations that it would begin in September—he has started walking it back, talking of “supply-side constraints holding back the economy…not getting better…the outlook is highly uncertain.”

That does not sound like a Fed chairman determined to start the tapering process soon. The Fed also fired (allowed to retire) two regional Fed chairman caught conducting personal trades. By coincidence (?), these were the two most hawkish—or rather “least dovish”—of Fed officials and can now be replaced by accommodative Biden appointees.

It won’t be sufficient

Let’s be clear about a couple of things. First, tapering is only reducing the pace of new purchases; it is not selling anything. So the Fed’s balance sheet, which has continued to grow at an accelerating pace the last couple of months (24% in the last three months compared with 19% in the last 12 months) even as they discuss tapering, will still be larger a year from now than it is today. Second, as Powell himself made very clear in his Jackson Hole speech at the end of August, the Fed is separating tapering from raising interest rates. The Fed won’t be raising any time soon.

Of course, since there was no net Treasury issuance in June, July and August—the Fed bought it all—a reduction in buying from that source will of itself see market rates rise. Private investors demand more than the tiny yields on offer; the latest Treasury auctions in September all went fairly poorly. The 30-year now yields 1.91%, up over the past month, but still meaningfully below current inflation. So it carries a negative real yield. Even the most speculative-grade bonds, five out of every six, carry a negative real yield, with the average yield under 4%.

"Just four stocks—Microsoft, Apple, Google, and Tesla— accounted for about half the performance of the S&P over the past three months."

Any cut back in buying of Treasuries from the Fed, however, will have an impact. If there is a $2 trillion to $3 trillion fiscal deal, then, according to Larry Lindsay, bonds equivalent to 9% of the U.S. GDP will have to be issued next year. Who is going to buy them at today’s yields? Foreign flows turned negative last year, after years of foreign buyers cutting back new buying. Meanwhile, other traditional safe havens, like Germany and Japan, saw net foreign inflows.

Fed’s bark is worse than its bite

It is going be a while—I think at least 2023—before the Fed increases rates, and even then, it will lag inflation. This is why Fed jawboning has more effect than action. The Fed threatening tightening makes investors nervous. Any cut back is, per se, a negative for the bond market.

Powell talks about supply-side constraints, but if he is looking for a reason (or excuse) to postpone tapering again, there is no shortage of those: the looming “ESG recession” in Europe; the pending Evergrande default in China; another (unexpected?) jump in new unemployment claims, as well as an economy losing some steam rapidly.

Economic recovery rapidly slowing

The strong economic rebound is tapering off, because of the new COVID variant and supply chain issues, as well as a natural decline from earlier quarters “base” effect. The massive government stimulus programs are also having a negative effect. The private sector in aggregate lost just 7% of income last year, yet government handouts amounted to 15%. This may help some individuals (and it has enabled many less-than-well-travelled people to take trips to Mexico, Miami Beach and Puerto Rico), but it does not generate a sustained economic recovery.

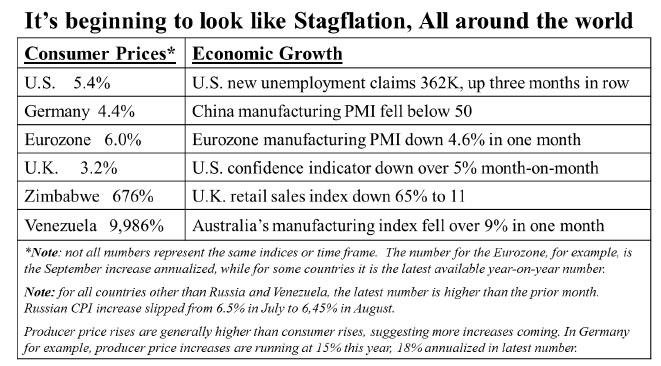

This may be one of the shortest economic recoveries ever. Economic indicators are pointing down even as inflation is moving up, not only U.S. but around world. Job growth, for example, has spluttered, with new unemployment claims rising for three weeks in a row. There are currently more than 10 million job openings posted, now higher than number of people unemployed. Over half of restaurants in the U.S. were unable to pay their rent in September as higher costs offset the impact of more patrons. This spells stagflation.

Prices continue to move up

The other part of stagflation may take a while to build, given the significant deflationary trends extant at the same time. But inflation (as measured by PPI [producer price index] and CPI [consumer price index]) has been steadily moving up since last August. The market—not only gold, but stocks and bonds as well—still seem to believe the Fed’s “transitory” narrative. But the Fed has a poor record of predicting the economy, and more and more people can see for themselves that prices are going up. The Fed will lose much credibility over this.

Costco's comments in a conference call last week are worth quoting. "Inflationary factors abound: higher labor costs, higher freight costs, higher transportation demand, along with container shortages and port delays, increased demand in certain product categories, various shortages of everything from computer chips to oils and chemicals, higher commodities prices. It's a lot of fun right now.”

Apartment rents are shooting up. Notwithstanding new supply from now-allowed evictions on non-paying tenants (allowed in some states, anyway), landlords have to make up for lost income and repairs, as well as making up for the inflation over the past 18 months.

Even the Fed’s favorite gauge—which underestimates inflation—is up 3.6% ex food and energy, its highest in 30 years. The Fed under Powell emphasizes data, so by its nature is backward looking. They will inevitably be behind inflation.

Overvalued U.S. equities heading for fall?

U.S. stocks are losing their momentum, both relatively and in absolute terms, with the market down in September on a mini-temper tantrum. Valuations are at extreme levels, higher than at the height of the dotcom mania in 2000 by some metrics. Then, a few stocks were far more expensive, but today the median valuations are higher. The median p/e on the S&P now stands at 34 times, while in 2000 it was “only” 22 times. Only by comparison with bonds do equities look good value, but bonds are in a bubble because of central bank buying.

Yet the market remains complacent and indications of speculative excess abound. Short interest, for example, stands at 1.5%, the lowest in 30 years (the same as in 2000 on the eve of the dotcom bust) and down from over 3.5% a decade ago. Margin levels remain elevated.

There are signs of a looming tumble, however. The market is seeing lower volume on up days (whereas strong bull markets have had high volume on up days). Market breadth is deteriorating, as the number of stocks above their 200-day moving averages is dropping even as indices were moving up; half of the S&P 500 are already down 10% or more, and just four stocks—Microsoft, Apple, Google, and Tesla— accounted for about half the performance of the S&P over the past three months.

U.S. assets have been a very crowded investment for many years, and they are overvalued relative to other markets. Smart money has been shifting to both value and cyclicals, and especially in foreign markets. Unfortunately, with the slowdown in Europe, stocks there now appear expensive as well.

Overall, we are increasingly concerned about the possibility of a near-term pullback in global equities markets, particularly given the overvaluation, as the Federal Reserve and other major central banks move, hesitatingly, towards some form of tightening. The global economy and debt situation are not secure enough to withstand too much tightening. This is temporary, and we are confident that they, and particularly the Fed, will start easing again within a year or so, favoring combatting economic weakness over fighting inflation.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Disclosure: 1) Adrian Day: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Evrim Resources, Midland Exploration, Altius Minerals and Lara Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: Midland Exploration, Vista Gold, Almaden Minerals, Altius Minerals, Fortuna Silver Mines, Lara Exploration, Evrim Resources, Kingsmen Creatives. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Evrim Resources, Midland Exploration, Vista Gold, Almaden Minerals, Altius Minerals and Lara Exploration, companies mentioned in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.