Where is Crude Oil Price Headed?

Commodities / Crude Oil Nov 05, 2021 - 02:59 PM GMTBy: Submissions

With the OPEC+ meeting on Thursday, oil looks to be in a corrective phase, as pressure is on for more crude. Are we looking at bearish winds ahead?

Crude oil prices have started their corrective wave, as we are approaching the monthly OPEC+ group meeting on Thursday, with some market participants now considering the eventuality of a larger-than-expected rise in production.

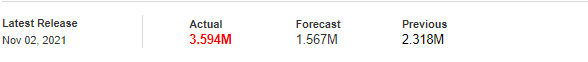

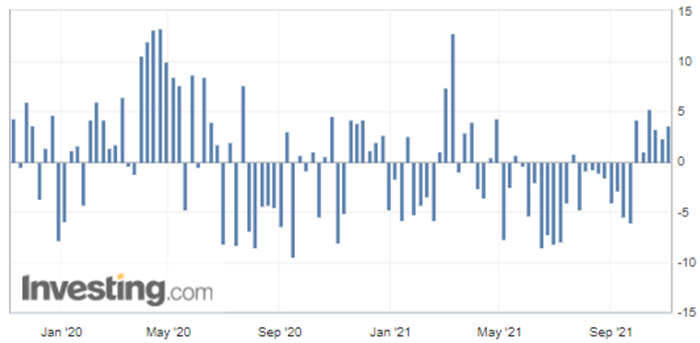

U.S. API Weekly Crude Oil Stock:

Inventory levels of US crude oil, gasoline and distillates stocks, American Petroleum Institute (API) via Investing.com

Regarding the API figures published Tuesday, the increase in crude inventories (with 3.594 million barrels versus 1.567 million barrels expected) implies weaker demand and is normally bearish for crude prices.

Meanwhile, in the United States, the average price of fuel stabilized on Tuesday after several weeks of increase, according to data from the American Automobile Association (AAA), however, that’s 60% higher than a year ago.

Chart – WTI Crude Oil (CLZ21) Futures (December contract, 4H chart)

In summary, we are now getting some context on how the oil market might develop in the forthcoming days, with some crucial events to monitor as they could have a strong impact on the energy markets, and particularly on the supply side.

My entry levels for Natural Gas were triggered on Monday (Nov.1), and I’m updating my WTI Crude Oil projections.

Have a nice weekend!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.