Kondratieff Full-Season Stock Market Sector Rotation

Stock-Markets / Sector Analysis Nov 18, 2021 - 04:39 PM GMTBy: Chris_Vermeulen

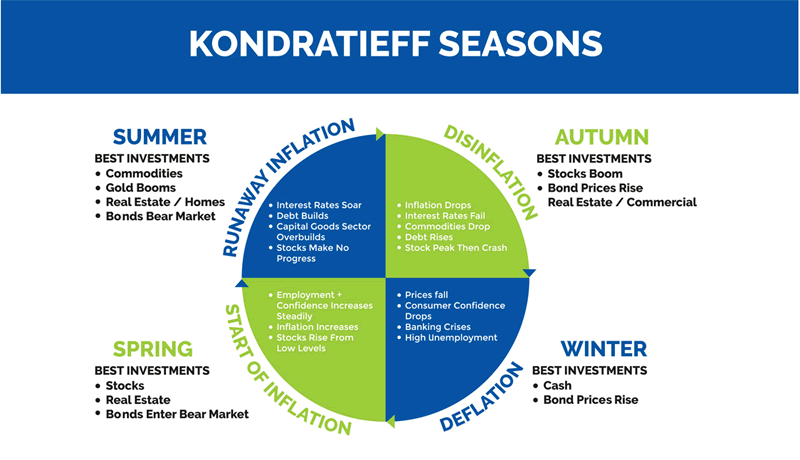

In part one of this article, I highlighted my opinion that the US and Global markets rolled through a hyper-active Kondratieff full-season rotation throughout the COVID-19 virus crisis. In 2017 and late 2018:

- Bonds were trading lower

- Gold and Silver were trading near multi-year lows

- Real Estate had peaked in the short term as rates started to rise a bit

- and the Stock market rallied to new all-time highs

All of these are components of a late Spring or early Summer type of Kondratieff Season.

If my assumption is correct, the COVID-19 crisis pushed the global markets into a 6+ month Summer, Autumn, and Winter seasonal cycle. This cycle transitioned back into an early Spring cycle in late 2020. Now, we are likely entering an Autumn Kondratieff season. Here, stocks boom, Bond Prices rise, and Real Estate and Commercial prices rise.

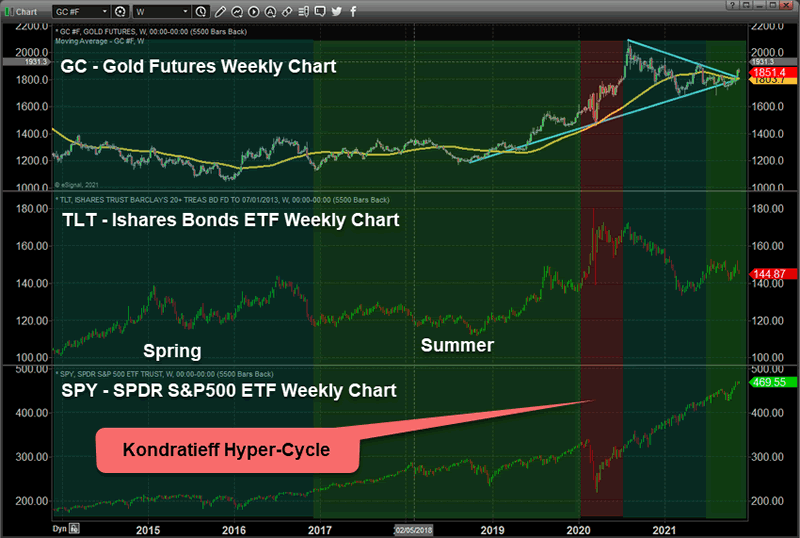

Gold, Bonds and SPY

The chart below shows Gold, Bonds, and SPY trends over the last 5+ years. It highlights the Kondratieff Seasons and the Kondratieff Hyper-Cycle that took place during the COVID-19 collapse. My belief is the COVID-19 crisis created a full Kondratieff Seasonal rotation in the global markets. Markets moved from a late Summer Season to an end of Winter/early Spring Season by January/February 2021. I believe that the Spring Season transitioned into an early Summer Season by June/July 2021. We are starting to shift toward a late summer season as we head into the end of 2021 and early 2022.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

If my research is correct, we’ll see large price trends last through January/February 2022. Following this, a shift in market sentiment after Q1:2022 – possibly into June or July 2022. Gold and Bonds will likely continue to trend higher over the next 5~6+ months as the Summer Season trends. The US Stock market will also continue to trend higher within the Summer Season. This means traders should prepare for increased potential volatility and more bullish trending into the first quarter of 2022.

Market Sectors Poised For Growth In The Current Kondratieff Season

I want to highlight several charts that I believe could see a continued bullish price trend over the next 6+ months. I also want to highlight why the Kondratieff cycles may play an essential role in trader/investor expectations over the next few years.

First, this continued Summer Season will transition into an Autumn season eventually. This is something for which we all need to be aware of and prepare. One could argue the current rise in Gold and Bonds may be an early indicator that we have begun the transition. Traders should be watching Gold and Bonds very closely for any continued rise in prices, which would indicate a potential end of the Kondratieff Summer Season. The Autumn Season is associated with “Disinflation.” Disinflation is more of a stalling of market trends while inflation is still trending higher. This type of activity pushes traders to become more protective of investment capital and risks.

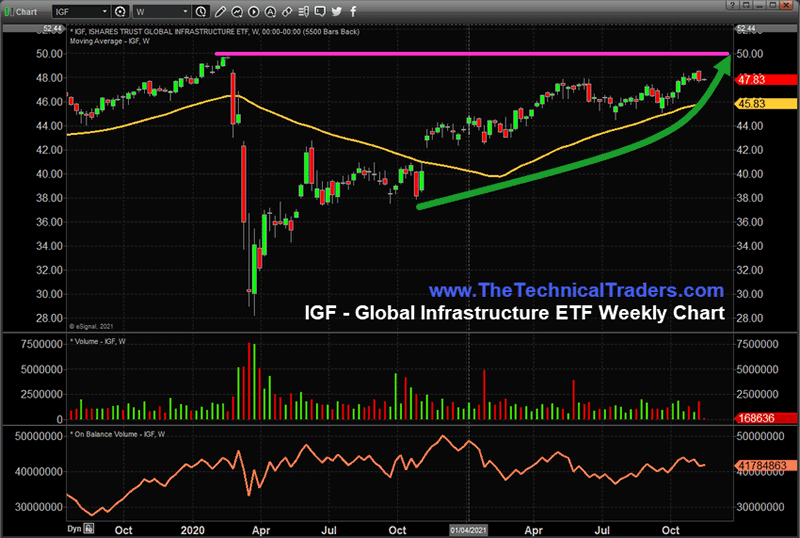

IGF Weekly Chart

The IGF Weekly chart below shows how the Global Infrastructure sector is trending higher and about to break above all-time highs near $50. With the signing of the US Infrastructure Bill, this sector may continue to trend higher and attempt to move above $60 to $65 by April/May 2022. Should the Kondratieff cycles push markets higher as well, IGF may explode above $50 in the near future. Potentially, this could start a big rally higher.

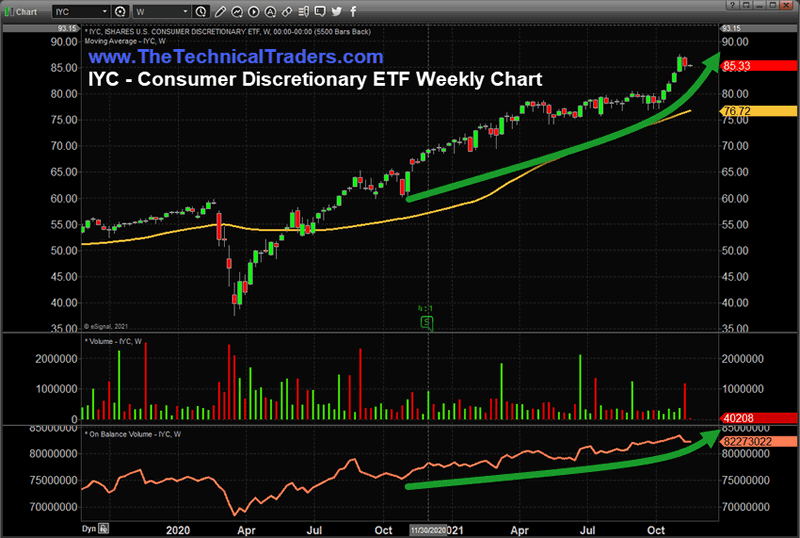

IYC – Consumer Discretionary ETf

Consumer Discretionary ETF IYC has already rallied more than 100% from the COVID lows and begun to rally even stronger over the past 6+ weeks. Consumers continue to drive retail sales and core economic activity in the US, and this trend will continue through the Christmas holiday season. IYC will likely continue to trend higher, possibly breaking above $110 within the next 60+ days. Should the US Federal Reserve not do anything to break this trend, it may continue higher well into the end of Q1:2022.

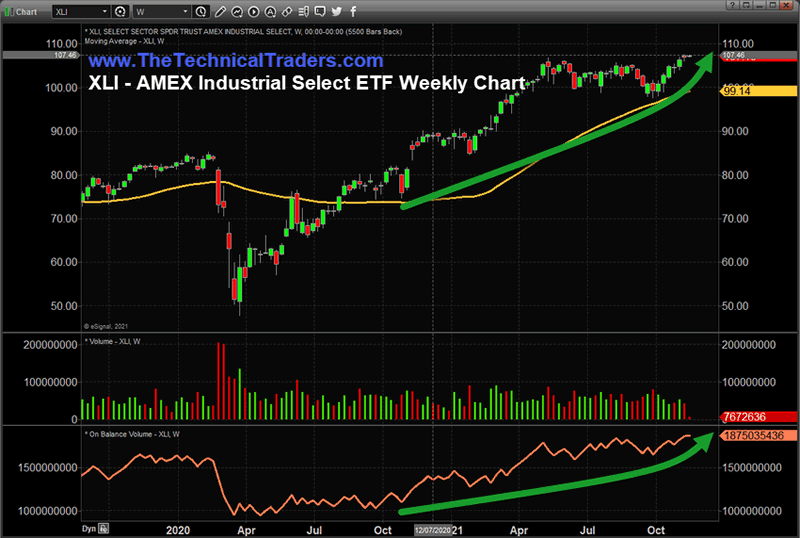

XLI – AMEX Industrial Select ETF

The AMEX Industrial Select ETF, XLI, is just above a 100% move from the COVID-19 lows. I believe XLI may see a breakout rally above $110 over the next few weeks as the continued Kondratieff Summer/Autumn season pushes sector trends higher through early 2022. I believe the Industrial sector will rally due to the recently signed Infrastructure Bill and will rally following the S&P 50 and NASDAQ higher. In fact, given the current range between the GAP near November 2020, my Fibonacci Price Expansion technique suggests a target level near $124.

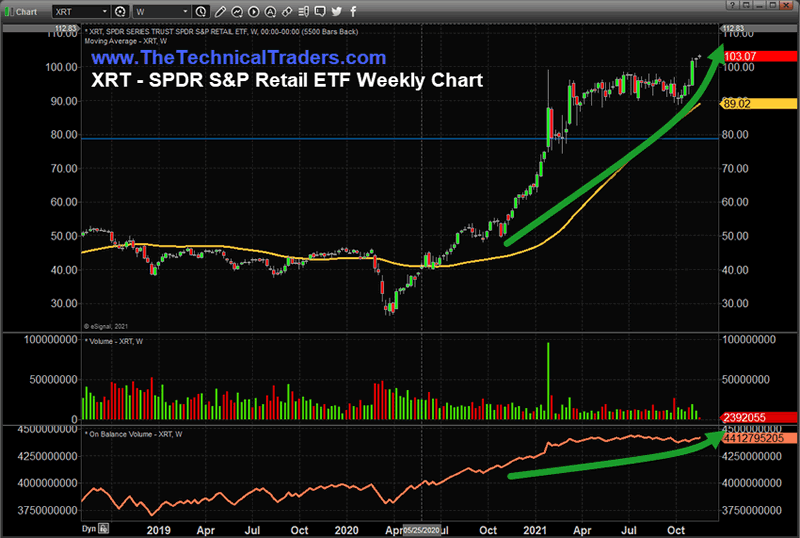

XRT – S&P Retail ETF

XRT, the S&P Retail ETF sector, is almost certainly poised for another broad move higher after US sales data came in stronger than expected, and we head into the 2021 Christmas holiday season. I would expect Q4:2021 retail numbers to be moderately strong this year – even though we hear about supply chain issues.

XRT has rallied almost 400% from the COVID-19 lows and may rally another 15% to 20% higher before the end of January/February 2022. Any pullback below $100 may present an excellent entry opportunity for new long trades.

As we explore the Kondratieff Seasonal cycles and attempt to apply this knowledge to the current market dynamics, I believe the end-of-year rally may be much more robust than many people think is possible. US consumers are still very active in the economy, homes are still selling, and the post-COVID recovery strengthens. Unless something happens to disrupt this trend, US stock sectors are still likely to continue higher well into Q1:2022.

Now is the time to consider where and how to participate in this rally phase while we watch Gold, Bonds, and these sector trends for any shift into a late Autumn Kondratieff season.

WANT TO LEARN MORE ABOUT MARKET TRENDS?

Follow my research and learn how I use specific tools to help me understand price cycles, setups, and price target levels. Over the next 12 to 24+ months, I expect large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase. Next, a revaluation phase may begin as global traders attempt to identify emerging trends. Precious Metals will likely start to act as a proper hedge as caution and concern drive traders/investors into Metals.

Please take a minute to visit www.TheTechnicalTraders.com to learn about our Total ETF Portfolio (TEP) technology and it can help you identify and trade better sector setups. We’ve built this technology to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the TEP system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.