UK Inflation at 30-year high

Economics / Inflation Feb 24, 2022 - 03:26 PM GMTBy: Boris_Dzhingarov

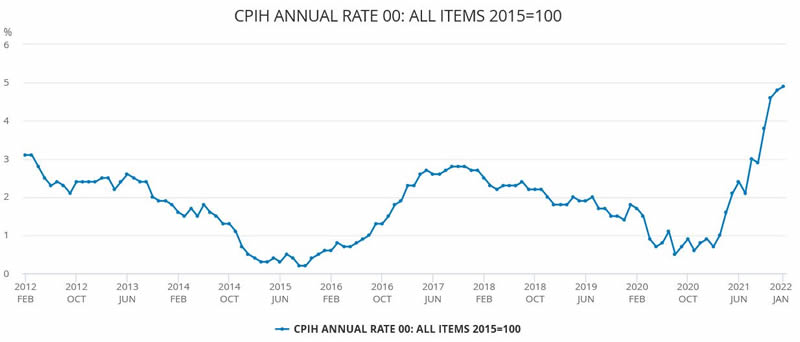

The rate of inflation in the UK is at its highest point for 30 years, according to recent government figures. The Office for National Statistics (ONS) said that the consumer price index (CPI) used to measure inflation had risen to 5.5% for January 2022. Not since March 1992 (7.1%) have levels been this high and economists predict it could even eclipse that benchmark by April.

All of which is concerning news for the average consumer, but what exactly is inflation, how is it measured and what is causing it? Can the living wage keep up? And what are the potential consequences of such an increase? Read on to find out more.

What is inflation?

Inflation refers to the rate at which costs are increasing. For example if a loaf of bread costs £1 but then rises by 10p, the inflation is 10%. This rate is continuously monitored by the ONS, which takes into account the price of hundreds of everyday goods such as food, clothing, toiletries and more.

Every month, the ONS releases its results and the inflation figure represents how much prices have increased since the same stage 12 months previously. So, things are 5.5% more expensive in January 2022 than they were at the start of 2021. By comparison, in 2021 the rate of inflation was only 0.7%.

What is causing this inflation?

The primary reason is the rising price of energy around the world, which has meant higher costs for businesses. In turn, these costs are passed on to consumers. For example, the average energy bills in UK households are set to rise by £693 from April 2022.

Greater shipping and transport costs are also hitting companies hard, which means investors’ habits are changing. Instead of operating in niches reliant on those industries, traders are turning to the forex markets, which are not dependent on the supply chain. Meanwhile, staff shortages in some sectors have meant a hike in wages, but this too can exacerbate inflation as businesses are having to offset that by increasing their prices.

What are the consequences?

Part of the problem is that the average living wage is not keeping up with the rate of inflation. All of which means the everyday consumer has less expendable income and is likely to feel a greater squeeze on their finances. That looks set to continue to be a problem unless the rate of inflation slows or salaries grow – or both.

By Boris Dzhingarov

© 2022 Copyright Boris Dzhingarov - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.