Climate Change Crisis and the Coming Global Reset

Politics / Climate Change Mar 18, 2022 - 04:27 PM GMTBy: Richard_Mills

It is 2050. Beyond the emissions reductions registered in 2015, no further efforts were made to control emissions. We are heading for a world that will be more than 3C warmer by 2100.

The first thing that hits you is the air. In many places around the world, the air is hot, heavy and, depending on the day, clogged with particulate pollution. Your eyes often water. Your cough never seems to disappear. You think about some countries in Asia, where, out of consideration, sick people used to wear white masks to protect others from airborne infection. Now you often wear a mask to protect yourself from air pollution. You can no longer simply walk out your front door and breathe fresh air: there might not be any. Instead, before opening doors or windows in the morning, you check your phone to see what the air quality will be.

Melting permafrost releases ancient microbes today’s humans have never been exposed to and have no resistance to. Fewer people work outdoors and even indoors the air can taste slightly acidic, sometimes making you feel nauseated. The last coal furnaces closed 10 years ago, but that hasn’t made much difference in air quality around the world because you are still breathing dangerous exhaust fumes from millions of cars and buses everywhere. Our world is getting hotter. Over the next two decades, projections tell us that temperatures in some areas of the globe will rise even higher, an irreversible development now utterly beyond our control. Oceans, forests, plants, trees and soil had for many years absorbed half the carbon dioxide we spewed out. Now there are few forests left, most of them either logged or consumed by wildfire, and the permafrost is belching greenhouse gases into an already overburdened atmosphere. The increasing heat of the Earth is suffocating us and in five to 10 years, vast swaths of the planet will be increasingly inhospitable to humans. We don’t know how hospitable the arid regions of Australia, South Africa and the western United States will be by 2100. No one knows what the future holds for their children and grandchildren: tipping point after tipping point is being reached, casting doubt on the form of future civilisation. Some say that humans will be cast to the winds again, gathering in small tribes, hunkered down and living on whatever patch of land might sustain them.

— ‘The Future We Choose: Surviving the Climate Crisis’ by Christiana Figueres and Tom Rivett-Carnac

The pandemic has fallen off the headlines, replaced by the regional war between Russia and Ukraine. As the media chases fast-moving global events, one of the most enduring problems of our time continues to churn in the background — climate change.

It was previously thought that the worst effects of climate change wouldn’t happen until 2100. Recent climate modeling has brought the point of no return forward. Last summer the much-ignored Intergovernmental Panel on Climate Change (IPCC) put out a report stating that the Earth’s average temperature will rise 1.5 degrees Celsius by 2030, a decade earlier than earlier projected.

Even if the 1.5C target is achieved, the report says it would still generate heat waves, rainfall, droughts and other extreme weather “unprecedented in the observational record.” To take just one example, at just slightly higher levels of global heating, what was once a once-in-a-century flooding event will happen every year by 2100.

A warming planet threatens to worsen substantially higher prices that are already making it hard for people to make ends meet, in both developed and developing countries.

Food inflation

The war in Ukraine is accelerating a global food crisis that is reverberating across the world, in countries that literally depend on the region for putting food on the table.

The conflict has choked off over 25% of the world’s supply of grain, putting the market on track for the “sharpest shock” since the 1970s. Higher prices are speeding up food inflation and raising concerns for countries reliant on foreign supply.

Gallup, the polling firm, provided data indicating which countries are most likely to suffer from a wheat supply disruption. Topping the list is Turkey, which received 75% of its wheat imports from Russia and Ukraine in 2019. Second is Egypt, which imported 70% of its grain from Russia and Ukraine in 2019. Note that Russia’s low wheat harvest in 2010 due to drought was a major factor in the Arab Spring that broke out in Egypt. Egyptians are worried that prices for the subsidized loaves of bread they depend on could rise for the first time in four decades.

Adding to current supply concerns for agricultural commodities, some countries are hoarding stockpiles, while others are restricting exports. Hungary is banning grain exports and Serbia announced it will halt exports of wheat, corn, flour and cooking oil. Indonesia tightened curbs on exports of palm oil, used in a range of food products including biscuits, margarine, laundry detergents and chocolate.

Over the weekend Argentina announced plans to increase control over local farm goods by suspending soybean meal and oil for export. The move caused soy meal futures to jump more than 2.2%.

Countries that could normally fill the void are themselves having production problems. A drought in Brazil, a major supplier of corn and soybeans, has ruined crops, while in Canada and the US, a prolonged period of hot and dry weather in 2021 also wilted fields.

Globally, wheat farmers are already running at full tilt and most northern hemisphere nations have limited ability to grow more because the crop has already been planted.

Hardship will fall on countries most dependent on Russia and Ukraine for food imports. The number of people facing starvation worldwide spiked from 80 million to 276 million before the invasion, due mostly to covid lockdowns. That figure is set to rise again.

Fertilizer is an often-underestimated aspect of the food supply chain that modern farming simply cannot do without; its higher cost must be borne by producers and so higher food prices are likely going to be “baked in the cake” for several years.

Before the war, the fertilizer market was pummeled by extreme weather, plant shutdowns and rising energy costs — in particular natural gas, the main feedstock for nitrogen fertilizer. Then came the invasion of Ukraine. On March 7 European natural gas hit an all-time high, briefly touching €345 per megawatt-hour, the equivalent $600 oil, on concerns over the availability of the fossil fuel, used for heating and electricity. Russia supplies about a third of European gas demand, and has threatened to cut flows via the existing Nord Stream 1 pipeline to Germany, as retaliation over Western sanctions.

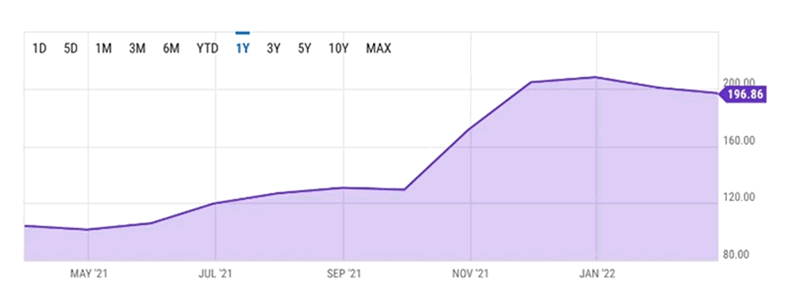

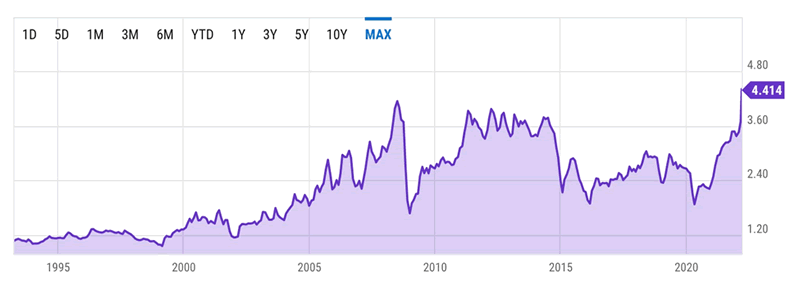

Fertilizers Price Index (February, 2022). Source: YCharts

Russia’s efforts to halt fertilizer exports are pushing the prices of crop nutrients to record levels. The country is the world’s largest exporter of urea and no. 2 for potash. The Green Markets North American Fertilizer Index jumped 16% Friday to a new high.

Farmers are having to reduce their plantings due to urea shortages. Any reduction in nitrogen, which must be applied annually, will immediately impact crop yields, severely impacting food staples like corn and wheat.

For most growers, they have no choice but to pass on the added costs to their customers.

Data from the United Nations shows world food prices reached an all-time high in February — a year on year increase of 20.7% — driven by an 8.5% increase in the FAO Vegetable Oils Price Index, which also hit a new pinnacle.

The dairy, cereal and meat price indices all punched higher.

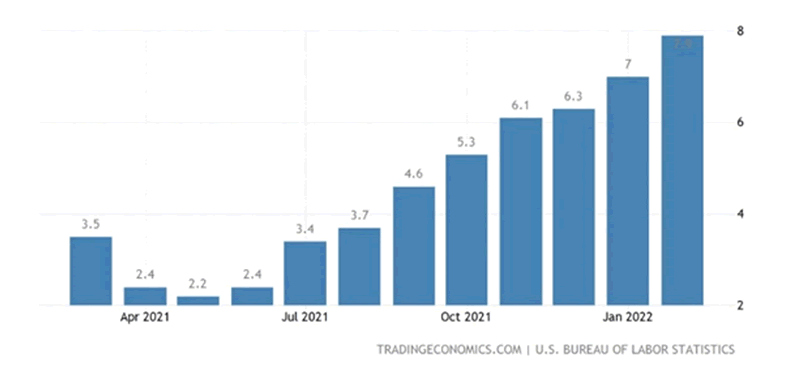

United States inflation rose 7.9% in February, with food and energy costs pushing prices to their highest in 40 years. Gasoline, groceries and shelter were the biggest contributors to the CPI gains.

US food inflation. Source: Trading Economics

Energy inflation

Economists pay close attention to energy prices because energy is the biggest contributor to the consumer price index.

Oil and inflation are linked because oil is such a major input of the global economy. Despite billions being spent on new solar and wind farms, the world still largely runs on fossil fuels.

If energy costs rise, so do the prices of end products. For example, plastic. A lot of manufacturers package and sell their products in plastic, but plastic is made from petroleum. When oil prices go up, plastic costs more, and this must be absorbed by companies that use it for packaging. To preserve their profit margins, they charge customers more for their products.

The same thing happens with transportation costs. Intermodal transportation is fueled by oil and gas, so when oil goes up, companies that ship their products pay more for freight, then pass these costs onto their customers.

As energy prices rise, each stage of the supply chain ends up costing more, causing an inflationary spiral.

Even before Russia invaded Ukraine, thus roiling energy markets over potential supply disruptions, oil and gas prices were rising due to demand outstripping supply.

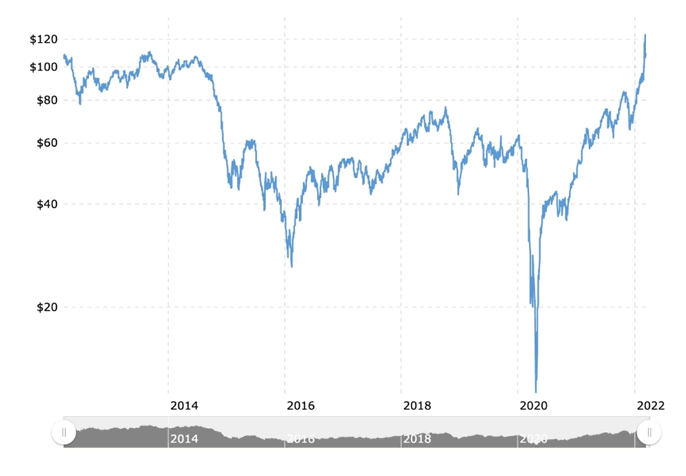

The coronavirus caught the oil market off guard. Unlike in 2014, when a wave of supply swamped prices, in early 2020 a sudden demand shock due to the onset of covid-19 pushed crude as low as -$40/bbl. Briefly, and unthinkably, oil became like a waste product, something you had to pay people to take away.

Historical West Texas Intermediate (WTI) price.

Source: Macrotrends

Since that historic plunge, crude oil prices have soared more than 700%! For the first time since 2014, oil went above $100/bbl. (though since last week WTI has pared back gains and now sits around $96)

Despite the push to green energy, demand for oil has stayed strong.

During the pandemic, consumer and business spending has focused more on manufactured items, which are oil-intensive to produce and transport, than in-person services, where infection risks are higher.

Whereas previously high oil consumption cycles were matched by increased production by some of the world’s top oil producers, including Saudi Arabia, Russia, the United States and Canada, this time is different.

The OPEC+ group of major oil exporters have refused to boost output faster, citing the risk to prices of another drop in oil consumption, should a new wave of infections materialize.

This has left the market chronically undersupplied, with prices ratcheting higher.

When tanks rolled into Ukraine, the oil market went bonkers. Crude prices climbed to 14-year highs and briefly topped $130 per barrel.

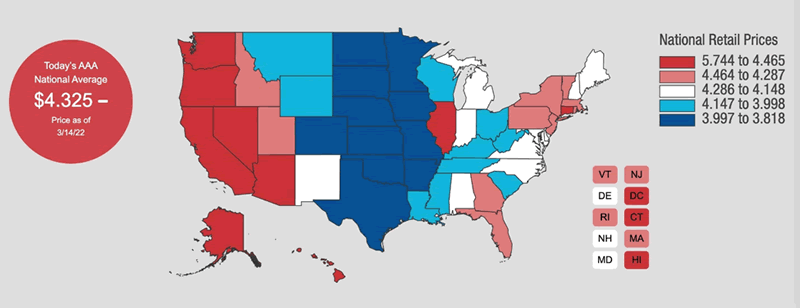

Gasoline pump prices have hit records too. The nationwide average for regular gas is now $4.32 a gallon, according to AAA. The average gas price in Canada as of March 7 was $1.90 per liter, says Globalpetrolprices.com. Vancouver motorists have the most expensive gas in North America, with prices marching up to $2.09 a liter on March 6, a record for the region.

Source: AAA

US retail gasoline prices for the week of March 14. Source: YCharts

Commodities inflation

Accompanying food and energy inflation is a growing crisis of unaffordability. Consumers everywhere are getting squeezed on housing costs, fuel, inflation and a loss of purchasing power. Combined, it adds up to a perfect storm that, if nothing changes, will imo lead to a breaking point, when people have nothing left to lose and revolution is seen as the only means of forcing social and economic change.

Inflation is rampaging across much of the globe, including in the United States and Canada where it has hit multi-decade highs.

On Monday, March 7 Bloomberg wrote The rally from oil to wheat and natural gas to nickel is threatening a still-fragile economic recovery from the pandemic, exacerbating an inflationary surge for energy-consuming nations and worsening a cost-of-living crisis for millions.

The higher cost of living would be manageable if a worker’s wages were keeping up with inflation. Unfortunately, they are not.

We know from a previous article that the purchasing power of most Americans earning wages or collecting a salary, has stagnated.

This is all down to inflation and the inability of fiat currencies to protect against it.

Indeed US wages have failed to keep up with rapidly climbing prices. Wages (average hourly earnings) in February dropped on a year on year basis for the 11th straight month.

Regarding inflation, note that the data released last week for February does not include the crazy commodity price hikes we have seen lately, including wheat, oil, natural gas and nickel, the latter rallying 250% in two days. Nor does it reflect soaring house inflation. Next month’s CPI is therefore bound to be worse, likely much higher than 7.9%.

As inflation eats away disposable income, nearly two-thirds of Americans (64%) are living paycheck to paycheck.

Covid exposed the weaknesses in supply chains. The war has revealed how some of the countries most vulnerable to food price hikes, and social unrest, are dependent on the Russian-Ukrainian bread basket.

Of course it’s not only those countries. North Americans too are getting whacked by higher food, energy and housing costs.

Higher prices for agricultural commodities find their way into higher grocery bills. Farmers and ranchers are paying record-high input costs, including fuel, fertilizer and feed. To preserve his profit margin, the farmer must increase his prices, which are passed onto the grocery buyer. It’s the same principle for lumber, electronics and EVs, to take three examples.

Skyrocketing lumber prices last summer were passed onto developers and home builders. While EV battery prices have declined the past few years, higher material costs including nickel and lithium, exacerbated by Russia’s invasion of Ukraine, could reverse that trend, according to a recent Reuters report quoted by Green Car Reports. IHS Markit predicts that surging raw material prices will put further EV battery price declines on hold until 2024.

An October 2021 survey of electronics industry executives found that 7 of 10 manufacturers intend to raise prices in 2022, due to higher material and labor costs, including steel, nickel, copper and aluminum.

When I say we’re heading for a breaking point, a kind of global economic reckoning, it’s not only inflation due to covid-related supply chain issues (so-called “transitory” inflation) and commodity price increases that have been accelerated by the war in Ukraine.

We have to remember that the climate on planet Earth is changing, and a lot faster than many had anticipated. In North America, the manifestations of global warming can be seen in near-opposite weather and climate patterns on the west versus the east side of the continent.

As western and southern North America bake in a prolonged drought, the east coast is getting hit by an increasing number of freak storms, unusually harsh winter weather, and a shocking sea level rise that could see some of its major cities underwater within the next 35 years. That, I hasten to remind readers, is within most of our lifetimes.

Drought

In 2021, a prolonged stretch of hot weather in western Canada and the United States smashed temperature records and killed over a thousand people, mostly in British Columbia and Alberta.

June was exceptionally hot, with temperatures hitting 49.6 degrees Celsius in Lytton, BC, a national record. State-side, the city of Portland reached an all-time high of 46.6 C, breaking the previous record of 41.6, set in 1965.

Climate scientists at the UN warn that extreme heat waves, which previously struck once every 50 years, are now expected once per decade. US government scientists reported that 2021 was the sixth-warmest year on record.

An extended drought since 2000 in the Colorado River Basin — which includes bits of seven western states and a part of Mexico — has made it impossible for the country’s biggest reservoirs, Lake Mead in Nevada and Lake Powell straddling the border of Utah and Arizona — to recharge fully.

This is a huge problem, considering that the Colorado River provides water for more than 40 million people including major US cities Las Vegas and Los Angeles.

According to the CBC, the dramatic drying in 2021 deepened the American West’s 22-year “megadrought” so much that it is now the driest in 1,200 years (the previous megadrought was in the late 1500s). A study in ‘Nature Climate Change’ journal says the current drought shows no signs of easing.

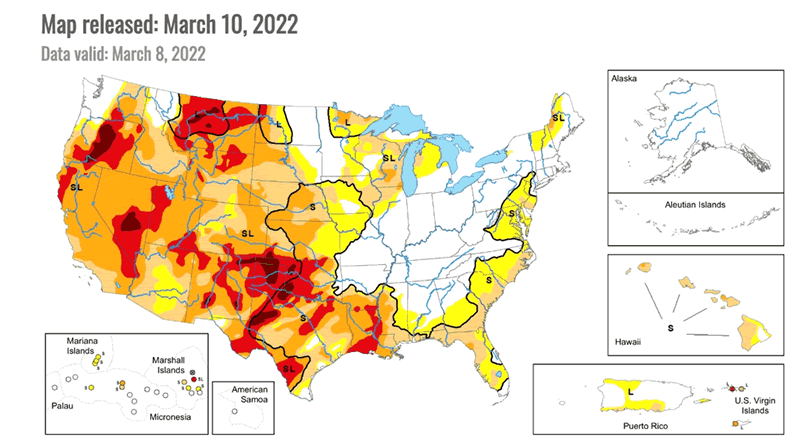

US Drought Monitor reveals 55% of the US West is currently dry, with 13% experiencing the two highest drought levels, shown on the map below as dark purple and red.

Source: US Drought Monitor

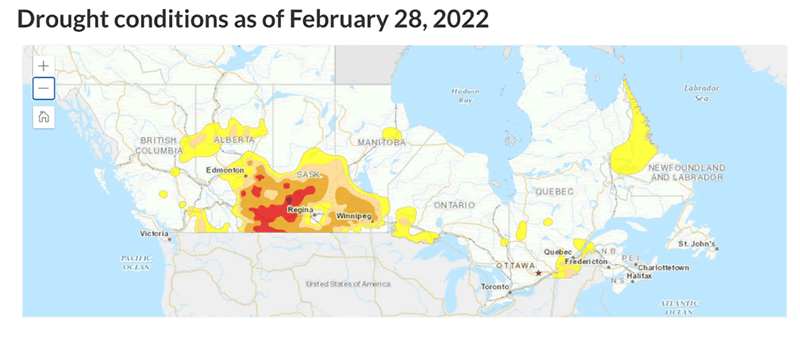

A second map shows much of the Canadian Prairies in drought, as of the end of January, with the driest areas (Severe drought in brown and Extreme drought in red) straddling most of southern Alberta, Saskatchewan and Manitoba. Abnormally dry areas depicted in yellow extend into British Columbia, northern Manitoba, Ontario, Quebec, and as far east as New Brunswick.

Source: Agriculture Canada

In fact drought conditions in western Canada and the United States extend all the way down the west coasts of North and South America as far as Chile and Paraguay.

Last summer in Chile, the continuation of a decade-long drought, with a lack of precipitation in the Andes, kept reservoir levels low and farm fields parched. There was only 78 mm of rainfall from last January to August, compared to the average 252 mm. The Mapocho and the Maipo rivers that provide Santiago with water, last August were lower than they were in 2019, the driest year in Chile’s history, Reuters said.

More recently, dry conditions in South America are leading to forest fires, plummeting water levels and ruined crops.

In Paraguay, a drought that started late last year has badly damaged crop yields and caused navigation problems in a key waterway, pushing up the costs of transporting grains. The landlocked country and major soybean exporter is facing its worst harvest in a decade.

Low water levels are also impacting Paraguay’s production of hydroelectricity; last year’s amount was the least in 25 years.

Government officials, climate scientists and businesses who depend on the waterways say the California-sized country hasn’t suffered through a drought this extreme since the 1940s.

Neighboring Argentina, the world’s top exporter of processed soy, is also facing the risk of drought hitting soy and corn harvests.

A lack of rainfall has resulted in eight separate forest fires that devastated almost 800,000 hectares. Al Jazeera reports that strong winds, low humidity and dryness fueled the fires which started in mid-January. They were especially intense, consuming about 30,000 ha a day and flattening up to 9% of a region dependent on agriculture, that normally sees abundant rain. Losses could top more than 26 billion Argentine pesos, equivalent to >US$240 million.

Al Jazeera says Argentina has limited exports of beef this year because of the lack of rain.

Climate scientists say that deforestation in the Amazon rainforest is altering weather patterns, with less rain in the rainy season causing the dry season to become hotter and drier. Trees that produce much of the rainwater through evaporation are being replaced by farmland. Last October, the beginning of Brazil’s six-month rainy season, the Wall Street Journal said a sustained drought going on its third year is unlikely to ebb, according to climate scientists, government officials and agro-businessmen who track weather patterns.

Regarding the megadrought in North America, scientists point the finger at climate change.

Park Williams, lead author of the above-mentioned study, and a climate hydrologist at UCLA, studied moisture levels within a box-shaped area that included 12 states, using modern measurements and tree rings. Williams found that without climate change, the megadrought would’ve ended in the mid-2000s, because 2005 and 2006 would have been wet enough to break it.

The CBC quotes Jonathan Overpeck, dean of environment at the University of Michigan, saying the study “is an important wake-up call. Climate change is literally baking the water supply and forests of the southwest, and it could get a whole lot worse if we don’t halt climate change soon.”

According to the Center for Energy and Climate Solutions, higher temperatures can increase the rate of soil evaporation, further suppress rainfall in already dry areas, and alter narrow bands of moisture in the atmosphere, thereby disrupting precipitation patterns.

Inside Climate News reports that dry spells are getting longer between downpours and blizzards, and that the snowpack is melting during the winter. A warming atmosphere may also be suppressing critical summer rains.

As Western Canadian and Americans brace for another summer of droughts, fires, withered crops and higher food prices, that are already toppy due to 40-year-high inflation, conditions are entirely different on the other side of the continent.

Flooding

According to The Hill, in late January a major winter storm… pummeled the East Coast with near-hurricane strength winds, snow and coastal flooding, causing widespread power outages, travel challenges, economic impacts and unfortunately even some fatalities as snow piled up along the East Coast, from the Mid-Atlantic states to the Canadian border.

The winter wallop followed a particularly bad jag of storms last summer and fall, with more than 50 hurricanes, cyclones and tropical storms. They included Hurricane Elsa that hit Barbados; tropical storm Grace which brought damage and flooding to Haiti just days after an earthquake, then went on to kill eight people in Mexico; Hurricane Henri which made landfall in Rhode Island, USA; and Hurricane Ida, the second worst hurricane to hit Louisiana, behind Katrina in 2005. The remnants of the Category 4 hurricane caused flash flooding in the northeastern United States, inundated subways, and drowned 11 New Yorkers in their own homes.

Jonathan Overpeck, the same climate scientist quoted in the above-mentioned CBC story, says global warming is making these East Coast winter storms, often called “bomb cyclones” because they move so fast and their quick drops in atmospheric pressure, more likely and more destructive.

The storms are becoming more frequent and severe because the Arctic is warming faster than the rest of the globe. Polar warming has been associated with the loss of snow and ice.

This also makes the jet stream more “wavy”, allowing cold air to plunge southward. These “polar vortex” events often result in extreme winter weather especially in the northeastern US.

The Hill article notes two more ways that global warming is making East Coast winter storms more dangerous. First, because the atmosphere is warmer, it can hold and release moisture faster than previously. The second factor is rising sea levels. Dr. Overpeck writes:

Sea-level rise has been nonstop over the last century due to global warming, and this serves to amplify coastal flooding due to storm surges…

As the climate continues to warm, we can expect to see even more extreme winter storms. But with time, they won’t all be snowstorms. As temperatures rise, major winter storms will shift to producing mixed snow and rain, freezing rain or simply intense rain, creating a different range of hazards — particularly more extensive flooding.

This increasingly severe winter weather will have devastating economic impacts with property damage, business closures, lost wages, and of course, shipping and supply chain challenges.

Although it is virtually undetectable on an annual basis, US sea-level rise is getting worse.

According to the National Oceanic and Atmospheric Association (NOAA), via Reuters, the seas lapping US coasts are expected to rise at a faster pace than in the past 100 years; a one-foot rise by 2050 threatens coastal cities including New York, Boston and Miami.

The multi-agency report says the inundation will lead to more coastal flooding and make tidal and storm surges more severe, with nearly 8 million homes at a reconstruction cost of $1.9 trillion at risk. Among the other findings:

- Sea levels in Manhattan could rise by two feet as early as 2055;

- Rising waters are threatening coastal cities including New York, Boston and Miami, which already commonly experience flooding during high tides.

- High-tide flooding has more than doubled in New York since 2000 and now occurs 10 to 15 times a year.

The science behind it

As for why Western North America is trapped in a decade-plus-long drought, while the East Coast is prone to hurricanes, bomb cyclones, flooding and sea-level rise, the answer just might be found in an Environmental Defense Fund blog post written in 2014.

Unsurprisingly, it has to do with rising temperatures.

According to the piece by EDF climate scientist Ilissa Ocko, in the northeastern US, the combination of more moisture in the atmosphere due to warming, and changes in circulation patterns, are bringing more rain. In the southwest of the country, rainfall is suppressed by a northward expansion of high pressure in the sub-tropics:

The crippling drought now plaguing California is due to a persistent high pressure system off of the coast that is deflecting storms away from the region.

Rains are also more intense in a warmer atmosphere where there is more evaporation going on.

The third factor has to do with soil moisture. The higher the moisture content, the more runoff there will be from rainfall. Because soil moisture is increasing in the northeast, flooding events are on the rise. This is made worse by rising sea levels, which have moved higher by about a foot since the 1900s.

However in the US southwest, Ocko writes, the drop in overall precipitation brings drier conditions that spawn or magnify drought. As the soil there dries out, the incoming sunlight will heat the ground instead of evaporating water from the soil. This creates a vicious cycle of more heat and less rain.

Droughts, floods and food

Droughts are impacting food production in Canada and the United States, lowering crop yields, and causing ranchers to cull part of their herds. Stubbornly high natural gas prices are being reflected in record-high fertilizer prices. Other farm inputs like feed and barley are going through the roof.

A 2017 research paper found that each degree Celsius increase would on average reduce global yields of wheat by 6%, rice by 3.2%, maize by 7.4% and soybeans by 3.1%. These foods provide two-thirds of human caloric intake.

A new study showed more than a fifth of global food output growth has been lost to climate change since the 1960s, putting an estimated 34 million people on the brink of famine.

According to BNN Bloomberg, heat-related drops in crop yields affecting the supply of food could be with us for decades.

Atmospheric-river floods in southern BC last November killed thousands of cows, pigs, chickens and bees, not to mention fouling supply lines already stretched thin because of covid-19. They showed that without smooth road and rail access to key markets, delays and goods shortages are inevitable.

Availability of fresh water is also becoming a growing concern.

Fresh water aquifers are one of the most important natural resources in the world, but in recent decades the rate at which we’re pumping them dry has more than doubled.

Of the world’s major aquifers, 21 out of 37 are receding.

In North America the major concern is over water levels in the Ogallala aquifer under the US Great Plains. The Ogallala is the world’s largest known aquifer. With an approximate area of 450,600 square kilometers, it stretches from southern South Dakota through parts of Nebraska, Wyoming, Colorado, Kansas, Oklahoma, New Mexico and northern Texas. The Ogallala aquifer was formed roughly 10 million years ago when water flowed onto the plains from retreating glaciers and streams of the Rocky Mountains.

The Ogallala is no longer being recharged by the Rockies and precipitation in the region is only 30-60 cm per year. In three leading grain-producing states – Texas, Oklahoma and Kansas — the underground water table has dropped by more than 30 meters.

Much of the reason for declining groundwater is due to over-use. For example the Ogallala aquifer is being sucked dry at an annual volume equivalent to 18 Colorado Rivers.

Streams, rivers and lakes are almost always closely connected with an aquifer. The depletion of aquifers doesn’t allow these surface waters to be recharged. Lower water levels in aquifers are reflected in reduced amounts of water flowing at the surface. This is happening along the Atlantic Coastal Plain. Groundwater depletion is also responsible for the Yellow River in China not reaching the ocean for months at a time, the failure of the Colorado River in the US and the Indus River in Pakistan failing to reach the ocean every day.

Last summer the federal government declared a water shortage on the Colorado for the first time, triggering mandatory water consumption cuts. Lake Mead, the largest reservoir in the US, last August hit its lowest level since it was filled in the 1930s. Lake Powell, also fed by the Colorado River, also hit a record low and last summer was just 32% full.

If too much groundwater is pumped out from coastal aquifers, saltwater may flow into them, causing contamination of the aquifer. Many coastal aquifers – the Biscayne Aquifer near Miami and the New Jersey Coastal Plain aquifer for example – have problems with saltwater intrusion.

Saltwater intrusion is also caused by rising sea levels caused by melting ice. The warming of the Earth’s surface has caused a widespread retreat of the glaciers at both poles. According to NASA, Greenland and Antarctic ice sheets have decreased in mass, with Greenland losing an average 269 billion tons per year between 1993 and 2019, and Antarctica losing about 148 billion tons a year.

In Florida the ocean is already starting to seep into swamp land, which weakens the plants from their peat bedding. “When we start to lose the structure of the plants, essentially this peat, which is otherwise held together by roots, becomes a soupy pond,” explains a University of Florida researcher in an NPR article. Millions of people in South Florida get their fresh water from the Biscayne aquifer in the Everglades.

The problem is also occurring in China, the Philippines and Australia. Salt water from the Bay of Bangladesh has penetrated over 100 kilometers inland, due to sea levels rising higher than elsewhere, thereby increasing the risk of water contamination and hypertension caused by drinking high-salinity water. High river and soil salinity in Bangladesh is also predicted to reduce rice crop yields, affect the productivity of fisheries, crack road surfaces, and increase poverty.

Conclusion

The impacts of droughts and floods, climate change and covid-19, are all being passed up the food supply chain to the consumer, who is seeing double-digit inflation in some products such as meat.

The invasion of Ukraine by Russia, a major oil and gas producer, and the world’s largest exporter of wheat, is adding to higher grocery bills. As extreme weather continues to hit us from both sides of the continent, we best get used to it.

Climate change has a major impact on agricultural commodities that are affected by droughts and flooding. Paraguay was hit by a drought late last year that has badly damaged crop yields and caused navigation problems in the Paraguay-Panama waterway, pushing up the costs of transporting grains for export. Neighboring Argentina, the world’s top exporter of processed soy, is also facing the risk of drought diminishing soy and corn harvests. Dry conditions often cause forest fires that can ruin crops and kill livestock.

Flooding and saltwater intrusion are also threats to farming, especially in coastal areas vulnerable to rising sea levels. The latest projections by the National Oceanic and Atmospheric Administration (NOAA) have levels increasing by a foot by 2050, threatening to inundate cities including Miami and New York.

Last fall’s “atmospheric rivers” in southern British Columbia caused nearly half a billion dollars in flood damage to one of the province’s most important regions for fruits, vegetables, eggs and dairy products. The B.C. Agriculture Council says the freak weather events will cost farmers “hundreds of millions of dollars”. The B.C. Dairy Association estimates 500 cattle died from Fraser Valley flooding.

Higher food, energy and housing prices tie into a growing crisis of affordability. Wages haven’t kept up with historically high inflation. Two in three Americans currently live paycheck to paycheck, unable to save or invest their earnings. The US Federal Reserve is widely expected to raise interest rates by a quarter percentage point this week. The last time the Fed tried to raise rates it only got to 2.5% before it crashed the stock market and rates began falling again. Higher US Treasury yields are already throttling the US economy and growth is set to slow sharply this year. Zero Hedge reports rising rates are causing lending standards to tighten and banks are becoming less willing to extend consumer loans. Consumption will face growing headwinds as credit is squeezed.

Remember, the American consumer makes up nearly 70% of US GDP. If consumer spending slows it will definitely put a damper on economic growth.

The war in Ukraine and Western sanctions against Russia are driving up the costs of energy and agricultural/ metal commodities. The conflict threatens to raise the costs of transporting and manufacturing a range of goods, while further disrupting global shipping networks.

All of this has complicated the Fed’s efforts to tame inflation through a series of rate hikes this year and next. The Wall Street Journal says the inflation threat for the Fed is two-fold:

The first risk is that the surge in prices could become intense enough or last long enough to change consumers’ and businesses’ inflation psychology, making those expectations self-fulling. If workers anticipate a robust inflation rate in a year’s time, they will be more likely to push for higher wages now.

The second risk is that a tight labor market, with demand for workers far outstripping the supply, generates wage growth that keeps inflation above the Fed’s 2% target.

Those two forces threaten to ignite an inflationary spiral, where workers face higher prices and demand more pay, leading businesses to continue raising prices.

I see the war in Ukraine, covid, supply chain interruptions, inflation and climate change coalescing into a perfect storm of unaffordability that could eventually erupt into mass social unrest.

When people can’t afford the basic necessities of life and prices keep rising, to quote Karl Marx, “proletarians have nothing to lose but their chains. They have a world to win.”

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.