UK Economy and British Pound GBP Trend Forecast

Currencies / British Pound Nov 07, 2022 - 10:02 PM GMTBy: Nadeem_Walayat

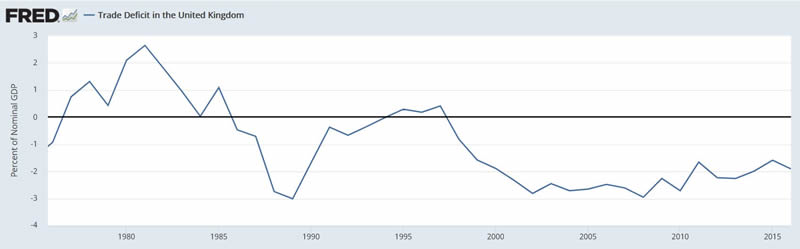

The big problem is this that as the Dollar rises investors SELL their domestic currency for dollar assets which is what all those outside of the US do when they invest in US stocks and other assets which drives down currencies such as sterling in a feedback loop, as a weaker currency tends to be accompanied by weaker economic fundamentals i.e. higher interest rates because there is less demand for domestic bonds and inflation rises because the cost of imports go up which feeds through to more selling of sterling for dollar assets in attempts to escape the falling currency which is where many outside of the US find themselves today, as my earlier example of the US stocks bear market in GBP illustrate. The consequences is that the US can bring inflation umder control whilst there's fat chance of the UK bringing inflation under control with a freefalling currency and given Britains perpetual trade deficit the odds of an significant sterling recovery is pretty slim.

There is only one thing that nations such as Britain can do which is to PRINT MORE MONEY! Which means the value of money FALLS! Brit's should be very wary of being enticed by higher interest rates to invest in UK bonds and saving products because real rates of return are WELL BELOW REAL INFLATION in a perpetual accelerating stealth theft of wealth as I have been voicing all year, get the hell out of sterling! Either into property that cannot be printed or US AI tech stocks as it is never wise to invest in a foreign property market because one does not understand the lay of the land unless one actually lives there and therefore will not make any money by doing so, get ripped off, end up buying garbage properties.

British Pound heading towards parity to the dollar but the plunge should prove short lived,

a. The government is gong on a debt fuelled spending spree, whilst bad today in terms of the market discounting huge amounts of additional borrowing to the tune of £200 billion when taking the energy bailout into account.

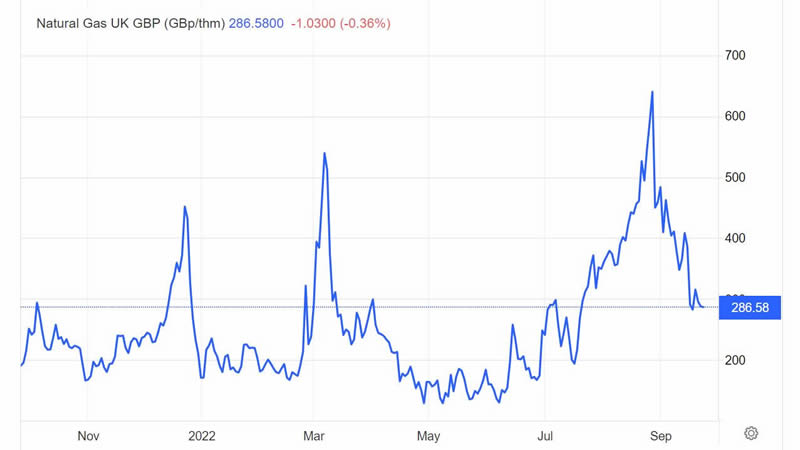

b. The energy crisis is not as extreme as the fear mongering MSM paints it out to be be, I mean this is the chart for UK natural gas prices, down from a peak of 650 to current $286. Yes the whole sale gas price could go up once more but what does one do when the gas price is low (not cheap but low) if one has any brain cells in their head? One stocks up! Replenishes the tanks! YES Winter is arriving but the wholesale price for Natural Gas is £286 and not £650, and remember this is in STERLING! The fall is even more spectacular in dollars.What does this mean well if prices persist at £286, then the panic over the £145 billion energy bailout may turn out to be a fuss about nothing, i.e. the final bill could be LESS than HALF that, more like £70 billion that the market is clearly not discounting given that sterling's drop is in response to the £45 billion give away budget and ensuing crisis of confidence is apparently not discounting economic growth or lower energy prices.

Of course the rip off energy firms are NOT passing on the fall in energy prices to consumers! What a con market! Hell bent on ripping off customers and now tax payers!

Thus whilst it's hard to say where the falling knife will settle especially given that the Dollar is going to be strong and UK rates are lower than US rates, I suspect that the UK drop to parity will prove short lived and a year from now sterling will be a lot higher than where it stands today ($1.11), probably north of 1.25, hence the GBP 1.315 column in my table which shows how the current dollar price of US stocks relates to where it would be at GBP 1.315 so as to better identify true bargains. For instance AMD $65.8 equates to GBP 1.315 of $76.6, therefore AMD is a good buy for US and UK investors, which is similar for most AI tech stocks. Whilst J&J and IBM are definitely not bargains right now, hence why I have added very little IBM or J&J during this bear market.

In terms of timing of sterling spike, we'll it's going to be a panic event. so any time between now and Mid November, and given that sterling already traded down to £/$1.02 it could well have already happened,though the window does not close until Mid November so only time will tell. Following which I expect sterling to enter into an uptrend that will likely take it to above £1.25 by the end of 2023 as my following trend forecast chart illustrates of how I suspect the trend to play out.

Though note the actual trend will be much rougher than this smooth line, i.e. oscillate around the trend forecast by 5 cents above and below the line, which means I would not be surprised if Sterling is above 1.30 by the end of 2023, with my central best guess being around $1.27 by late 2023. So I consider sterling today at $1.11 as being cheap in terms of the longer term outlook i.e. due a cyclical bull run within a secular bear market.

This article is an excerpt form my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes -

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

- Can the Stock Market Hold June Lows Despite Spiking Yields and Dollar Panic Buying?

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 10.1% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.