US Recession 2023 Already Happened in 2022!

Economics / Recession 2023 Nov 27, 2022 - 08:57 PM GMTBy: Nadeem_Walayat

Yes it is a a big fat con because the US has already posted 2 quarters of negative GDP, what can you do? This is the world we inhabit of fake economic data, the Fed does not like CPI, lets run with the much lower PCE, 5% instead of 8% inflation! What a con!

The facts are the US had a recession in 2022 that everyone is ignoring!

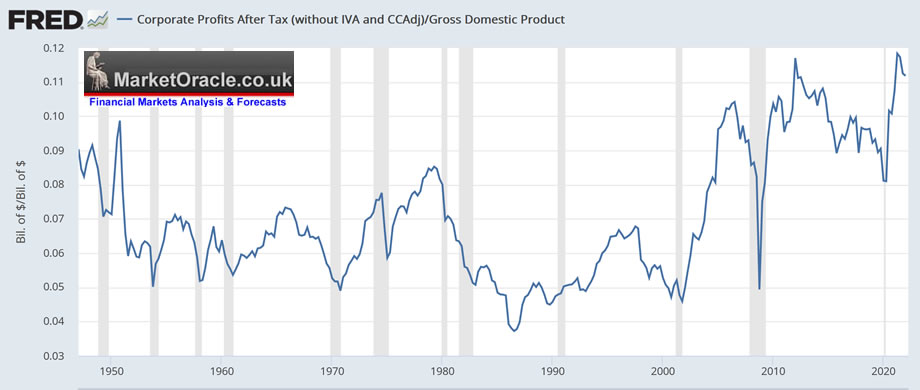

The US posted it's 2nd negative GDP of -0.6%, that's -2.4% year to date, what does that mean for stocks? Corporate profits Dividend by GDP graph clearly shows that we are still near the cycle peak, i.e .unlike Q4 2019 BEFORE the pandemic crash, earnings have not contracted anywhere near to signal an earnings bottom. So this metric suggests new highs in the indices are NOT likely anytime soon, especially given that GDP is FALLING. However against this we have the MAGIC of INFLATION that should support nominal stock prices as Inflation INFLATES GDP and corporate profits, case in point being the 1970's where corporate profits ROSE albeit form a 1970 trough, but the indices ended the decade little changed.

So I think corporate profits relative to GDP are going to fall, not drastically but the decline to date is not enough, we could see weak earnings for another 3 quarters which would take us into Q1 2023 as being THE earnings BOTTOM. Of course stock prices discount the future, and we have an Ace up our sleeve, EGF! Which gives a near 3 months advance warning of what to expect at the next earnings for each stock, as well as the probably less reliable 1 year out EGF12M.

The Stock Market CREATES Recessions and Recoveries! Think about that?

What drops first - STOCK PRICES!

What rallies first - STOCK PRICES!

Falling stocks create the recession

Rising stock prices create the recovery.

Of course it is not black and white but you get the picture of why at bear market bottoms the economic outlook is so bad, it's bad because Stocks have cratered! And why stocks rise on a wall of worry because it is the RISING stock prices that CREATE the RECOVERY!

The Stock Market Recession Pattern

The base pattern is that which we have experienced to date in that stock markets is to FALL BEFORE the recession materialises, the average bear market heading into and during a recession has been -29%, the median has been -24%, the current bear market to date has been -22.4% (Dow 28.7 / 37k = -22.4%). Which thus suggests the bear market could have further to go but not by a huge margin i.e. a couple of percent lower to say down to Dow 28k. What does this imply, that the current rally (should it materialise) will probably resolve in a lower low during the next recession.

So given that the next actual quarterly drop in US GDP may not materialise until Q3 of 2023, then that quarter can expected to be weak, i.e. wherever the stock market is by late Q2 it will start to trend lower going into Q3 and bottom towards the end of Q3 as it discounts an end to the recession following negative Q4. So we may get a double dip in the stock market during Q3 of 2023 that see's a lower low than that which we just made only a few days ago.

Against this is the possibility that the US recession is brought forward 1 quarter to Q2 and Q3,thus stocks peak during Q1, fall during Q2, bottom toward the end of Q2 and then head higher during Q3.

Which pattern is most probable?

At this point in time the former pattern looks more probable than that latter.

At the end of the day the guiding light is the deviation from the highs, for the greater the deviation the more of the recession is being discounted by the price. So, today's -22,4% does not carry much risk as the worst it implies is a double dip during 2023, which thus affords one the opportunity to collect dividends and trim positions ahead of the double dip.

This article is an excerpt from my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Recent analysis includes -

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.