2023: Preparing for tectonic shifts in the world economy

Economics / Global Economy Dec 18, 2022 - 10:05 PM GMTBy: Dan_Steinbock

Colossal structural shifts are taking place in the global economy, as evidenced by the huge challenges during the ongoing year. In 2023, China seeks recovery, but the West – the US, the Eurozone and the UK, and Japan - will cope with recession and the specter of a debt crisis.

In a recent Foreign Affairs commentary, Mohamed A. El-Erian warned that we are not facing just extraordinarily challenging business-cycle fluctuations, but structural and secular long-term pressures. As a result, “the global economy may never be the same.”

In reality, the “old normal” has been history since 2008 and the consequent debt crises. During the past decade, world economy has been driven by geopolitical agendas, not by economic priorities. And the results have been predictable: catastrophic.

Today, the risk of recession casts a dark shadow over the US economy. The Eurozone is facing a deep recession, Japan’s economy is shrinking, and the United Kingdom is struggling with the worst fall in living standards since records began.

West’s tough 2022 and darker 2023

In early 2022, the US, the Eurozone, the UK and Japan pledged geopolitical loyalty and ignored economic realities while promoting the worst military overstretch in decades. Thanks to the US/NATO-led proxy war against Russia in Ukraine, the costs of the misguided economic policies and geopolitics were predictable already in March.

Until recently, Western economies seemed fairly resilient. In 2022, US GDP growth on a year-to-year basis is likely to remain around 1.3% to 1.8%, though significantly below the 2021 projections. In the Eurozone, the comparable figure is likely to be higher; about 3.1% to 3.3%; and in the UK over 4.0%. Whereas in Japan, it is likely to be only 1.5%.

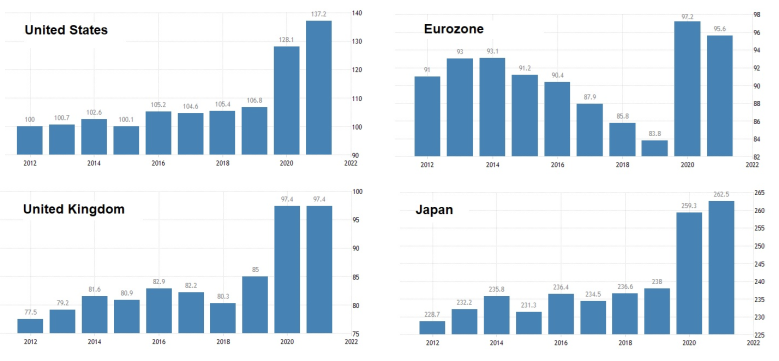

Nonetheless, the resiliency is elusive because it is based on soaring debt (Figure 1).

Figure 1 The West’s Debt Spiral

Gross Government Debt as % of GDP (2012-2022)

Source: Trading Economics; Difference Group

In the Eurozone, government debt to GDP remains close to 100%. Ironically, that’s 40 percentage points higher than the region’s own debt limit. In the UK, the figure has doubled since 2008 to almost 100%. In Japan, the figure is the worst among all high-income economies; close to 265%, thanks to over two decades of secular stagnation.

In the US, the debt ratio has doubled and is inching toward 140%. That’s over 20 percentage points higher than that of Italy amid Rome’s 2010 debt spiral. But unlike Italy (and its bygone lira), America is a global anchor economy and US dollar still dominates international transactions. So, when the US debt crisis ensues, adverse reverberations will be felt from the world economy to global foreign-exchange markets.

Yet, tragically, these are still the “good times.” The year 2023 will be more perilous.

In the US, growth will be at best stagnant around 0.1% to -0.2%. In the Eurozone, recession will be rough at -0.5%; in the UK, even worse at -1.0%. Thanks to recession in Germany and stagnation in France, Europe’s twin engines will both be spluttering. In Japan, stagnant growth is likely to stay around 1.0%.

In each case, the growth figure will require still more debt. Consequently, downside risks far outweigh upside risks. in adverse conditions, a cyclical downturn could unleash a secular nightmare.

China: From headwinds to recovery

In this dire international landscape, China is moving toward recovery in 2023, which could alleviate global economic prospects. Until the fall, Chinese economic data reflected mainly challenges. Yet, the story of 2023 is likely to be the impending recovery of the Chinese economy – if the current Covid ailments can be overcome.

A central determinant in unleashing the Chinese consumption potential, private sector investment and investor confidence hinges on the success of the more flexible Covid-policy and the consequent broad-based recovery. Though gradual, the new Covid impact could result in a surge of pent-up demand by the second quarter of 2023.

Such progress would strengthen economic data. In the property markets, the new support measures, particularly the government’s 16-point recovery plan, will contribute to stabilization.

Industrial production would pick up. Despite demand destruction in the West, the Belt and Road Initiative (BRIA) will promote steady progress on the back of recovery in Southeast Asia, which China is both driving and benefiting from. Less fixed asset investment by the public sector would reduce local governments’ debt pressures.

Chinese investors would return to equity markets, which would also be attractive to overseas investors seeking short-term bargains and long-term diversification. The MSCI China Index heralds the turnaround; it was 24% up in November, compared to only 2% for the S&P 500 Index.

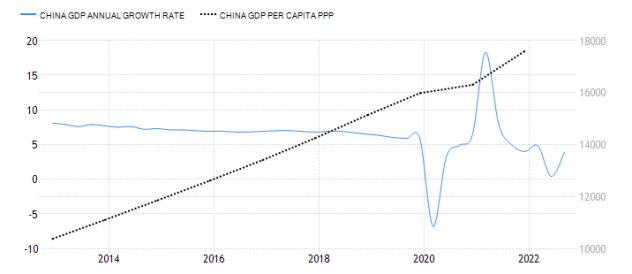

Certainly, domestic challenges will remain tough. Nonetheless, the aging-related reduction of the labor force will be smaller than expected, as the new UN projections attest. Furthermore, the share of investment to GDP likely peaked at 42 percent in the past half a decade, with a gradual decline set to ensue. And thanks to continued reforms and “common prosperity” policies, Chinese catch-up in productivity and per capita incomes has climbed to more than a third of the US level, even as secular growth is decelerating to 4% in the late 2020s. Like in postwar Europe, living standards rise, even though aggregate growth is slowing (Figure 2).

Figure 2 China’s Sustained Catch-Up

Annual GDP Growth and GDP Per Capita (PPP)

Source: Trading Economics; Difference Group

Thanks to the expected rebound, China’s growth could climb to around 4.0 to 4.5 percent in 2023.

US-Sino relations: Enduring thaw or calm before storm?

There is one common denominator that unites the economic outlook of the United States, the Eurozone and the UK, as well as Japan and China. And that’s the compelling need for the global landscape to remain manageable, as indicated by the easing of Sino-US tensions after the recent meeting between President Joe Biden and President Xi Jinping.

However, the question is, whether the current relative calm heralds a nascent bilateral thaw or whether it reflects an elusive calm before an impending storm.

The Biden White House can no longer control that future. While the US midterm elections were not as catastrophic to the administration as initially expected, Republicans did advance in all political fronts. The Senate is now bitterly divided and the House under Republican control.

In the medium-term future, naïve expectations should be shunned. The global economy is facing a perilous transition and the West’s recent track-record – especially the penchant for covert geopolitics at the expense of economic development – is perilous. In the past, Western governments, despite their ailing economies, have mainly “intensified their weaponization of trade, investment, and payment sanctions,” as El-Erian warned.

Globalization has come to a halt, even reversed. In the rejuvenation or degeneration of future globalization, U.S.-Sino relations will play a critical role – in good and bad.

Misguided economic policies, unwarranted economic crises

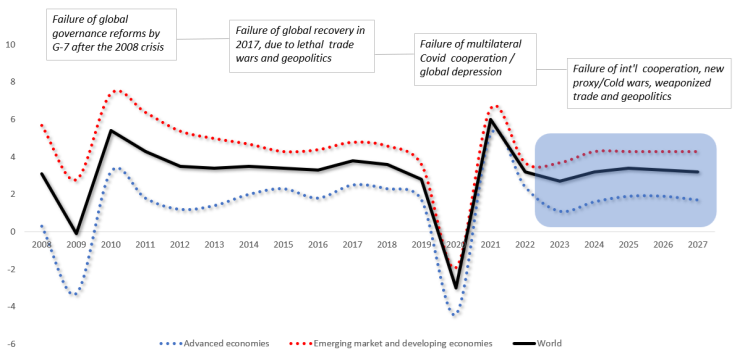

In effect, the West’s post-2008 track record has been a cumulative sequence of ever-worsening economic disasters. The list starts with the failure of post-crisis cooperation. It escalated with the missed global recovery of 2017 followed by vaccination apartheid; the failure of Covid multilateralism and the consequent global depression – up to the present proxy and Cold Wars that could unleash a global debt catastrophe (Figure 3).

Figure 3 The West’s Cumulative Economic Disasters

Real GDP growth (annual percent change)

Source: IMF; Difference Group

Notice that through the past years, these ill-advised policies have cost the deepest relative growth deceleration in the West; slowed rather than fostered global growth prospects; and hindered rather than supported the rise of emerging and developing economies.

Meanwhile the absence of international multilateral cooperation has systematically undermined initial growth projections (and the years 2023-27 are not likely to prove an exception).

Certainly, there is nothing inevitable in such calamitous global prospects. These cumulative disasters were unwarranted. With sensible multilateral cooperation, most of the collateral damage – trillions of dollars in economic costs, millions of lost human lives – could have been significantly reduced, even avoided.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2022 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.