CHANGE the Way You Think About Profit and Loss

InvestorEducation / Learning to Invest Dec 21, 2022 - 11:05 PM GMTBy: Nadeem_Walayat

From the comments section many patrons appear eager to trim holdings. However, this is a dangerous game and mindset to have one of selling on a few percent gain on fears that that smaller profit will evaporate into a loss.

Think about it?

If you follow this investing mindset what kind of portfolio will you end up with?

You will have a portfolio where you have sold all of your winners and are only left holding losers!

This is probably down to the way humans are hardwired to avoid pain, i.e. eat the food now rather than it be stolen or lost in the future.

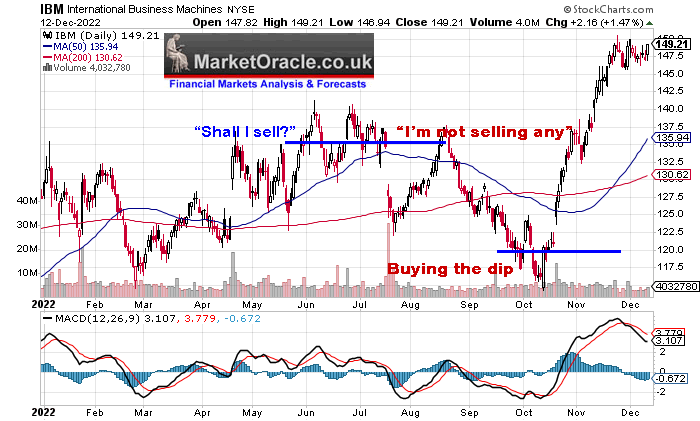

My solution is to aim to have a target holding to aim for i.e. to be 100% invested, thus the further below 100% the more uncomfortable I am in wanting to sell (take profits) because I don't hold enough exposure. This is one of the reasons why I have held onto my approx 50% exposure to IBM for the duration of the bear market as every time IBM outperforms I get comments asking shall I sell my IBM, where my response has been I'm not selling any IBM because I don't hold enough! And similar for others that are sub 100%. And don't even think of saying "but you could have sold at $135 and bought back at under $120", yes in HINDSIGHT! AFTER THE FACT!

Conversely the mechanism for SELLING is OVER EXPOSURE! i.e. when a stock is cheap such as TSM trading to below $70 I am far more inclined to ADD rather than to SELL! Which is what some patrons were asking at the time, i.e. Shall I sell TSM to buy AMD etc... Where my response is I don't sell ANYTHING at a LOSS! I would much rather the stock to go to ZERO than SELL and for ever by jumping from one stock trading near it's lows to another! What is that going to result in? SELLING EVERYTHING NEAR THE LOWS! Yes there is no sure fire bet, and all stock prices oscillate around earnings and fair value between extremes of over valued and under valued, but I would much rather lose it all then SELL a stock for a loss as I wrote several years ago when constructing the High Risk Portfolio, a case of HERO or ZERO, 0 or X10. no inbetweens!

Anyway my mechanism to deal with the human conditioning to sell for a small profit on fears of the profit turning into a loss is OVER EXPOSURE! To invest beyond 100% of target and thus I have leeway to either

1. Trim holdings on a rally so as to increase cash on account for further opps down the road.

2. To allow me to evaluate my maximum exposure at a later date, for instance I have decided to increase my target exposure to KLAC by about 15% which drops my over exposure from 135% down to 120%, all without having to wait for a dip to buy more exposure.

This is why I don't use stop losses when investing, as if I had they would have kicked me out of everything near the lows! Lam Research at sat $330. AMAT at say $80, TSM at $60 and so on.

Another solution to the trimming problem is that I trade futures and options, TRADE being the operative word, thus let investments ride whilst I spin my wheels on futures and options on the likes of the S&P.

This article is an excerpt form my recent analysis on the current state of the embryonic bull market Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month in th new year.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Most recent analysis includes -

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this increases to $5 per month in the new year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.