Oil Price Rises Despite Larger US Crude Stocks. Russian Production Worries

Commodities / Crude Oil Feb 26, 2023 - 12:14 AM GMTBy: Submissions

The two global crude benchmarks are still enjoying momentum that began on Thursday – despite larger-than-expected US crude inventories – following reports from the financial press that Russia will cut oil exports from its western ports by 25% per month in March compared to February in response to Western sanctions.

The two global crude benchmarks are still enjoying momentum that began on Thursday – despite larger-than-expected US crude inventories – following reports from the financial press that Russia will cut oil exports from its western ports by 25% per month in March compared to February in response to Western sanctions.

These claims, however, have not yet been confirmed by the Russian Ministry of Energy.

The western ports of Primorsk, Ust-Luga, and Novorossiysk export around 2.5 million barrels of crude a day. Therefore, a 25% reduction would imply a reduction in exports of 625,000 barrels per day, or about 0.6% of the world oil supply.

This contraction would thus exceed that announced by the Russian Deputy Prime Minister in charge of Energy, Alexander Novak, earlier in February by 500,000 barrels per day.

In addition to the disruptions in supply from Russia, there is also growing demand from China and India, which might show signs of a market that could become even more tight.

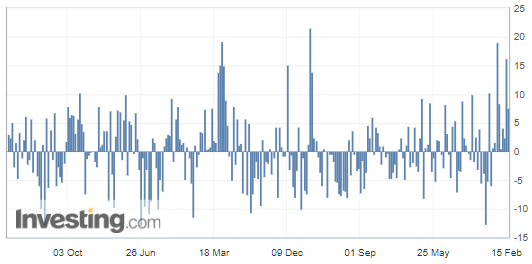

United States Crude Oil Inventories

Commercial crude oil reserves posted another strong weekly rise last week in the United States, according to figures from the US Energy Information Agency (EIA), marking their ninth consecutive increase.

These commercial stocks rose by 7.6 million barrels, well above the 2.8 million barrels forecast by analysts.

This new increase in crude oil reserves should have a downward effect on prices, but it reflects lower refinery activity due to the infrastructure maintenance season. On the other hand, it was accompanied by a decline in gasoline stocks:

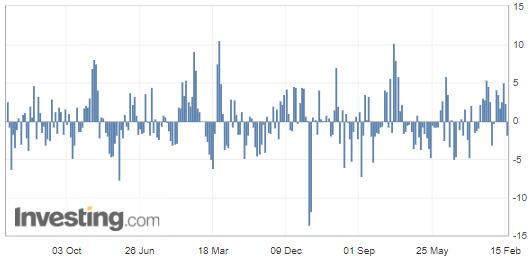

United States Gasoline Inventories

The pressure on the supply of distilled products can be explained by the relatively mild winter weather both in the United States and in Europe.

However, recession fears continue to dominate the market – thus capping crude's gains – as major central banks continue to send signals that further interest rate hikes are in sight amid high inflation.

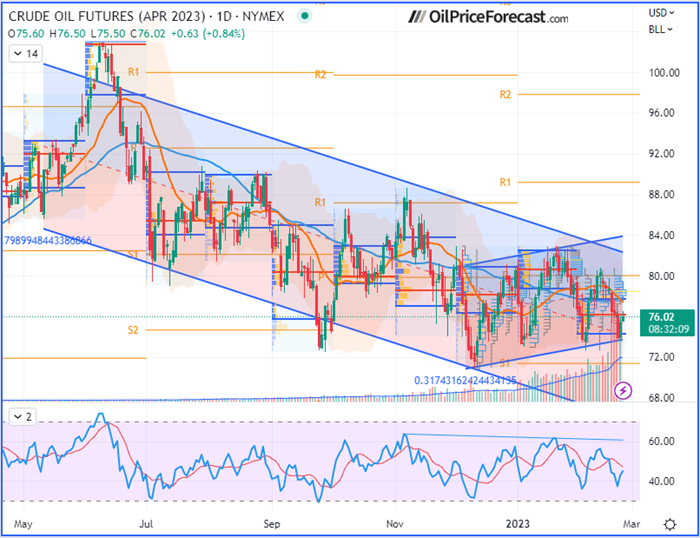

Charting and Analysis

On a macroeconomic level, the US dollar index (DXY/USDX) is returning to $105 territory, with the next quarterly pivot target of $107 if the index breaks above 105.631 (its previous swing high), as I mentioned in my previous article that such a breakout could be a sign of stronger bullish enthusiasm.

On the West Texas Intermediate (WTI) crude oil April 2023 futures contract, the bears gave up just on the lower side of the short-term regression channel, thus decreasing chances of a breakout below the short-term regression channel (the small one encompassed into the larger one). Now, as the market recovers, it is probably aiming towards the quarterly pivot located around the $80 psychological level as the next target.

Have a nice weekend!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.