I Walked into the Mercedes Dealership…

Economics / Motoring Mar 16, 2023 - 09:35 PM GMTBy: Submissions

By Chris Wood :

I couldn’t believe what I saw at the Mercedes dealership… 5% is the magic number… The simplest way to profit from the EV boom…

By Chris Wood :

I couldn’t believe what I saw at the Mercedes dealership… 5% is the magic number… The simplest way to profit from the EV boom…

- I walked into a Mercedes shop in New Orleans the other day and was shocked…

All I saw were electric vehicles (EVs). Rows and rows of them.

I had to walk all the way to the back of the store to check out the “old school” gas-powered models.

My estimate is seven out of 10 cars in the shop were electric.

And the way the trend is going, it won’t be long before gas cars are considered “classic.”

- America has finally hit its EV “tipping point”…

It took a long, long time. Tesla (TSLA) sold its first EV way back in 2008.

As recently as 2019, EVs only accounted for a tiny 1.4% of new car sales in the US.

But last year, EV sales surpassed 5% of all new car sales in America.

That’s important because 5% is often the tipping point that takes a newer technology from obscurity to widespread adoption.

According to Bloomberg, after Norway hit 5% EV adoption in 2013, the floodgates opened. Today, eight out of 10 new cars sold in Norway are electric.

China surpassed 5% in 2020. Today, its EV sales account for 19% of new car sales.

The same kind of boom is happening in many other countries, like the UK, Switzerland, and Iceland.

It’s about to happen here in the US, too. Bloomberg estimates EVs will represent half of all new car sales in the US by 2030.

- What’s the best way to profit from this disruption?

When most people think EVs, they think Tesla.

A decade ago, Tesla was a $4 billion company. Now, it’s the world’s seventh-largest, valued at roughly $600 billion. It’s handed investors 15,000% gains since 2013.

Tesla pioneered high-performance EVs. And it remains the world’s largest EV producer to this day.

But is it the best stock to profit from the EV boom?

Probably not. Ford, Chevrolet, Toyota, Mercedes… Every legacy carmaker is offering EVs now. Not to mention competition from EV startups like Rivian (RIVN), Lucid (LCID), and Nio (NIO). Rumors have it even Apple (AAPL) is working on an EV.

It’s anyone’s guess which of these companies will come out on top 10 years from now.

So why take the risk?

Especially since there’s a simpler way to profit off the EV megatrend...

- You want to own the company fueling most of the EVs driving on American roads today…

When you pop the hood on an electric car, you won’t find an engine. You’ll find a motor powered by batteries.

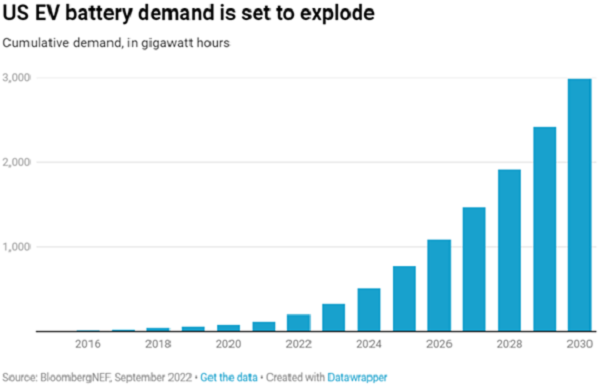

Every EV needs a high-quality battery... and Bloomberg estimates demand for EV batteries in the US will surge by 15X by 2030…

Source: Bloomberg

These batteries have to be made out of lithium.

Lithium batteries are the only ones efficient enough to power EVs. They’re lightweight, charge faster, and last longer than any other type.

With every automaker going electric, demand for lithium will continue to skyrocket. Tesla’s Model S, for example, has roughly 140 lbs. of lithium inside its battery.

And this is great for the world’s largest lithium producer, Albemarle (ALB).

- Albemarle controls over a quarter of the market and owns the purest lithium mines on the planet…

When carmakers like GM, Ford, and Tesla need boatloads of battery-grade lithium, they turn to Albemarle.

The miner sold over $5 billion worth of battery-grade lithium in 2022. It was its best year yet.

In fact, Albemarle’s lithium sales last year nearly quadrupled compared to 2021.

With EVs entering the “mass adoption” phase, now’s a great time to buy shares of ALB if you’re a long-term investor.

P.S. I don’t own an EV... yet. I’ve test-driven a few Tesla Model Ss, and they’re awesome. But I’m still waiting until the EV charging infrastructure gets a lot better.

Plus, I still love the roar of my bi-turbo V8 Mercedes.

- |

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption. |

By Chris Wood

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.