What Should Forex Traders Know About the Ross Hook Pattern?

Currencies / Forex Trading May 09, 2023 - 10:15 PM GMTBy: Sumeet_Manhas

Trading experts note the great rivalry level in the global FX market nowadays. Specialists explain such a situation because of the intensive development of this investment sector. Reuters analysts state that the specified trading branch increased by 14% from 2019 to 2022. Intense rivalry forces investors to seek effective ways to make deals. And skilled traders consider the Ross Hook pattern one of today's most efficient trading strategies.

Specialists claim that the RH tactic only gives great results if you cooperate with trustworthy brokers (for instance, FBS), though. That's because unchecked brokerage sites often freeze and lag. That's especially true for peak hours. In this case, you can't make deals exactly at the right time. As a result, investors sell assets at lower prices or even have losses. And now, let's view the primary features of the RH strategy.

Ross Hook Pattern Explanation

The specified method was developed by an experienced investor and great analyst, Joe Ross. The latter had been working in financial markets his whole life since 1935. And he put all his experience into the described strategy.

Source

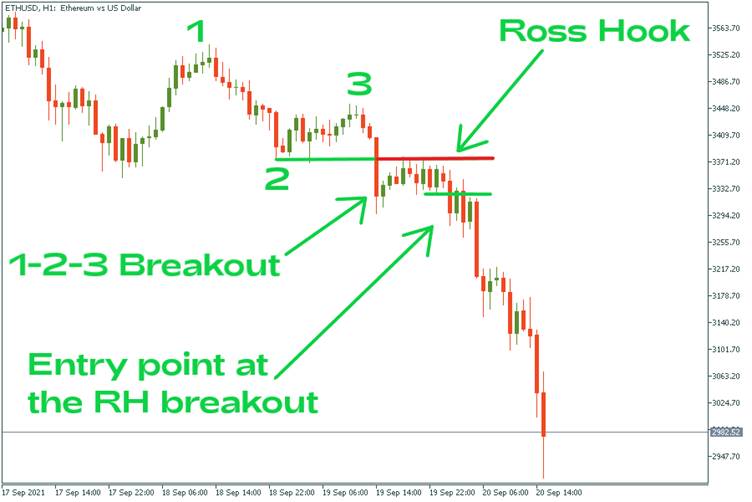

Joe developed the RH tactic based on the 1-2-3 chart analysis method. The specified strategy is a 100% price action pattern. The Hooks appear after 1-2-3 breakouts in a chart. So, the RH pattern is actually a smaller version of the 1-2-3 figure. Thus, finding "double hooks" is everything you need to use the mentioned tactic.

Comments of Joe Ross On How to Successfully Employ Hook Patterns

The great investor published a book with the necessary information to simplify the RH strategy usage. So, here are some pieces of advice from Joe on how to succeed when employing his tactic:

- Traders should accept the fact that they will have periodic money losses. If you strive to get a 100% profit from each deal, it can lead to an inadequate assessment of the ongoing market situation. As a result, a trader may become bankrupt shortly. You should keep in mind that all losses can be covered by the total profit with a reasonable approach to trading.

- Investors have to observe the hard steel discipline when trading. Otherwise, even the most effective strategy won't give proper results.

- Traders should evaluate their success by comparing regular and initial spending and total revenue.

The tips above passed the time test. So, investors will definitely succeed if they follow these simple suggestions.

When to Use the Ross Hook Pattern

The RH strategy is a perfect tool when dealing with assets where strong trends frequently appear. For example, the mentioned tactic may be successfully employed when trading currency pairs, including JPY (for example, EUR/JPY, USD/JPY, or GBP/JPY). At the same time, skilled traders don't recommend using Hooks when trading the EUR/USD currency pair.

RH Pattern Pros and Cons

The key advantage is that the mentioned tactic gives you clear trading signals. That's because the strategy is based on the behavior and technical features of the work of large FX market participants.

Among essential cons, it's worth noting the complexity of inexperienced investors' usage of the described pattern. So, experts recommend beginners consult proficient traders when employing the RH pattern.

Conclusion

The RH pattern may help investors get much more income if they trade assets that stand out for frequent strong market trend appearances. The method is quite simple to use if you have certain experience in trading. So, beginners are recommended to consult skilled investors when employing the RH strategy.

By Sumeet Manhas

© 2023 Copyright Sumeet Manhas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.