Stock Market correction full steam ahead

Stock-Markets / Stock Market 2023 Sep 25, 2023 - 05:09 AM GMTBy: Nadeem_Walayat

Dear Reader

It's your lucky day as you get access to my latest stock market brief that was sent out to patrons Monday 25th September at 3am UK time.

Stock Market correction full steam ahead as the S&P ticks below the August low of 4340, closing Friday at 4320 thus continuing to target sub 4200 by Mid October with my pin point high probability target of 4150 now some 170 points away vs the S&P 2023 high of 4610 290 point above, thus about 60% of the correction is complete which has translated into huge price drops in target stocks from their 2023 highs such as AMD down 28%, ASML -24%, Qualcom & TSMC -23% and so on and even greater price drops in the higher risk stocks such as Roblox -46%, with even greater blood baths in the housing stocks.

So the S&P down 6% does not tell the true story of a market increasingly being forced to discount a recession of sorts during 2024, which is my base case for next year. Given that there isn't any economic data that points to a US recession right now it is hard to quantify the depths of, still it is what is most probable and hence my view that the highs are in for some time for most stocks i.e, for at least a year, so I would not expect a repeat of the likes of AMD spiking to $132 any time soon!

A further 4% drop in the S&P should translate into triple that in many target stocks, though I can already hear murmurs of feeling the PAIN as stock prices drop in the comments despite the fact that this is what folks have been waiting for several months!

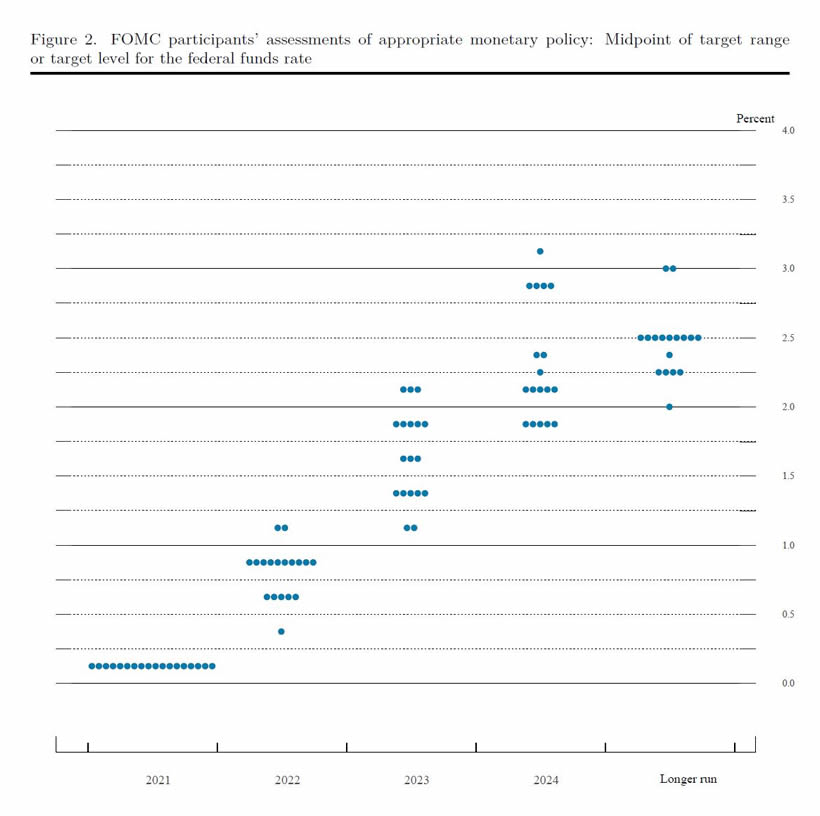

MSM have got their knickers in a twist over the Fed's latest dot plot which suggests rates will end 2024 at 5.1%. The Fed dot plot is meaningless drivel. For instance there Dot Plot of Dec 2021 forecast .0.75% for 2022 and 1.75% for 2023. So understand this the Fed funds rate will NOT be 5.1% at the end of 2024, likely a lot lower.

My portfolio currently stands at 78.4% invested, 21.6% cash with the drop in the value of stocks masking buying in AMD, TSMC, ASML, CRUS, PRX, INMD, ULH.RDFN, MGNI and RBLX. With my eye on capitalising other target stocks as they fall into their buy zones as the correction fulfills expectations for targeting S&P 4150. I also have an eye on the so far elusive Bitcoin price drop below 24.8k to target 20k to double my BTC holding to about 0.7% of portfolio.

https://docs.google.com/spreadsheets/d/13gDntQuyDP3db7WqEvOXftOxVVTJyYyB_s-O0XW2EIk/edit?usp=sharing

When alls said in done we are in the expected correction that is going to see the bull market mark time i.e. I don't see how we get to new all time highs anytime soon BUT being in a bull market means the risks are to the upside hence why I remain eager to accumulate as opportunities arise as my post correction expectation's remains for a year end rally that could see the S&P back over 4500.

Meanwhile in the UK folks should baton down their hatches for a Labour Government during 2024, Rishi is hopeless, even replacing him is not going to undue the damage done since the Tories ejected BJ, The Tories are going to try and pull a rabbit out of the hat to game the election in their favour, they are going to try and bribe the electorate but the gap between Labour and the Tories right now is a huge 24%, that's not going to get filled. not with an idiot such as Sunak in charge! Labour will win! As for when the election will be held? If I was Rishi looking at the polls I'd try and stay in No 10 for as long as possible on the chance of getting lucky and the polls turning, but he is an idiot so the election could come anytime between March and December 2024..

I continue to target the completion of 'How to Get Rich' Part 2 before the end of this month.

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series/

Change the Way You THINK! How to Really Get RICH Guide 2023

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top, followed by correction into Mid October.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Quad Witching Cracks Stock Market Nuts

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO to buy the Dip analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.