Why AI Will Eat the World

Companies / AI Nov 04, 2023 - 06:26 PM GMTBy: Stephen_McBride

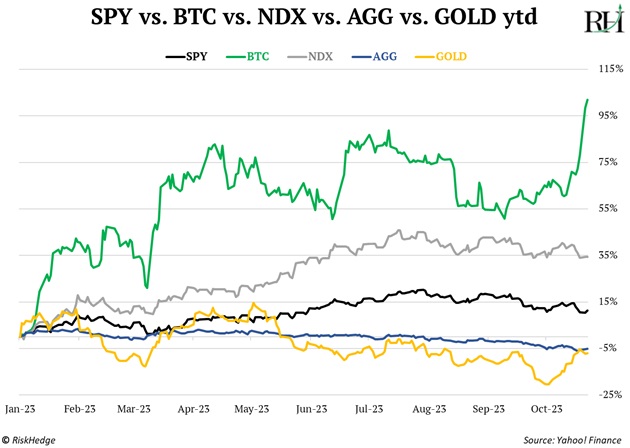

US stocks have been treading water lately… but the big news is in bitcoin (BTC).

It’s on fire, surging to $35,000—a price not seen in a year and a half.

Bitcoin has now doubled this year and is easily the best-performing major investment in the world:

If you don’t follow crypto closely, these price movements can seem to come out of nowhere. But really, it’s all part of bitcoin’s “halving” cycle.

In short, bitcoin’s next preprogrammed “halving” is approaching. And bitcoin is simply behaving exactly as it did prior to the last three halvings.

1. Nvidia: Buy, sell, hold?

I’ve gotten a ton of questions from RiskHedge readers (shout-out to Tim, Phillip, Joel, and others) about Nvidia (NVDA). That’s no surprise, considering I’ve been urging readers to buy it since 2018.

Everyone wants to know what the US government’s new restrictions on artificial intelligence (AI) chip sales to China mean for Nvidia. Nvidia’s stock fell more than 4% on the news, and some folks are worried.

In short: China needs Nvidia much more than Nvidia needs China. This is barely a hiccup.

Notice that Nvidia has hardly given back any of its gains during the recent market weakness. That’s impressive and tells me it wants to move higher.

Of course, Nvidia won’t go up in a straight line. But dips are a buying opportunity. The stock can finish the year above $500/share...

…and that’s only the beginning.

Picture this: It’s New Year’s Day 2030.

AI is helping doctors save millions of lives and giving special one-on-one tutoring to our kids. Meanwhile, AI-powered robo-taxis zip around US cities... and Amazon just delivered your parcel using AI-powered flying robots.

Nvidia’s GPUs are powering it all.

Our future is brighter than you can imagine.

2. AI will eat the world: Healthcare edition.

Economist and best-selling author Tyler Cowen wrote this recently: “While the hype and marketing may have died down… the AI revolution marches on.”

I agree. I continue to be blown away by AI advancements.

ChatGPT is synonymous with AI today. But as we know, there will be millions of “AIs” all solving different problems.

Google’s new AI healthcare tool is the prime example.

Google built a ChatGPT-like intern for doctors. When doctors need to know a patient’s medical history, they no longer need to rifle through filing cabinets and pull-out binders full of records.

Instead, they can simply ask their cool little AI sidekick questions like, “What medications has this patient taken in the last year?”… and get the correct answer in seconds.

This is a total game-changer.

I spent a lot of time visiting my late grandmother in the hospital last year.

I was shocked at how much time doctors and nurses spent filling out paperwork. Everything they do must be documented. (Think your job is stressful? Try being a nurse for one day!)

A recent study in the Annals of Internal Medicine found that for every hour doctors see patients, they spend nearly two hours on paperwork.

The number of healthcare administrators surged 35X faster than the number of doctors since 1970!

Maybe, just maybe, that’s why the average health insurance premium now costs $24,000/year. Yikes.

Source: Bloomberg

Google’s AI sidekick will give doctors hundreds of hours of their lives back by removing much of the paperwork that’s clogging up hospitals across the country.

AI is going to eat the world. Whoever thinks this is a fad simply isn’t paying attention.

Discovering new drugs and becoming a master cancer detector are two other healthcare problems AI is solving. There will be lots of winners, which is why it’s one of the megatrends we’re focused on at RiskHedge.

3. Earnings!

I intended to dive into Microsoft (MSFT) and Google’s (GOOG) earnings today, but there’s so much other exciting stuff going on, so I’ll just give my quick take.

The market is laser-focused on AI right now.

Microsoft is winning. It knocked earnings out of the park, driven by record demand for its AI products.

Google is losing. It reported weak demand for its AI cloud offering.

I’ve said this before, but I’ll say it again: I don’t like any of the big five tech stocks. There are better money-making opportunities elsewhere. Microsoft might be the one exception.

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.

By Stephen McBride

© 2023 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.