Stock Market Surefire Way to Go Broke

Stock-Markets / Investing 2024 Aug 23, 2024 - 07:32 PM GMTBy: Stephen_McBride

Summary:

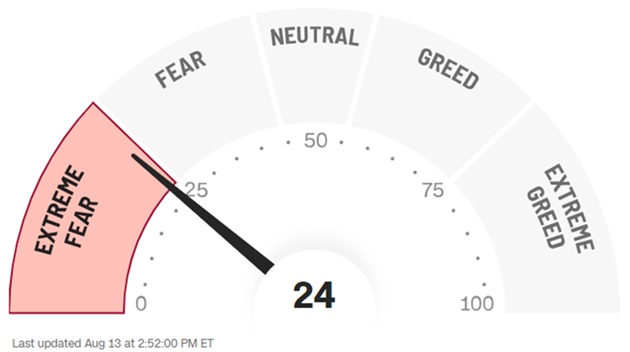

- After a strong start to the year, markets have cooled off and the Fear & Greed Index is signaling “extreme fear.” Despite this, stocks have rallied and remain up 14% for the year.

- Investors are hardwired to be pessimistic, but optimists are generally the ones who make more money.

- Despite many crashes, the odds of making money in US stocks is 88% over any five-year period in history. That’s why optimists have a higher chance of making money over the long term.

Investors are scared.

After a blazing-hot start to the year, in which US stocks soared 20%, markets have cooled off.

CNN’s popular Fear & Greed Index is flashing “extreme fear.”

Source: CNN

I recently explained how the implosion of the Japanese yen carry trade and fears of a possible US recession shook the market.

But stocks have rallied nicely since the selloff and are still up 14% on the year. That’s much higher than the typical 8%–10% average.

Why has everyone suddenly flipped the switch after a couple bad weeks in the market?

1. I’ll let you in on a dirty little secret of investing…

We’re hardwired to be pessimistic.

The skeptic who talks about what could go wrong sounds intelligent. He sounds smarter than the oblivious optimist. That’s why you see so many gloomy Wall Street analysts on CNBC.

My favorite mantra: “Pessimists sound smart. Optimists make money.” It’s so important, I printed it out and stuck it to my wall.

Overcoming our negative bias is one of the biggest challenges we face as investors. If you can conquer this bias, you’ll unlock huge opportunities in the stock market.

Let me show you why being rationally optimistic is a prerequisite to achieving investing success…

2. Confessions of a reformed perma-bear.

The first person I heard talk about the stock market was one of my college professors.

I owe that guy a lot. Maybe I wouldn’t have started investing without him. I used to think investing was an activity reserved for rich London stockbrokers.

Problem was… my mentor was a total pessimist. You know the type… always convinced the next stock market crash was right around the corner.

He owned a few stocks. But the majority of his money was in gold and silver. One day, he even brought in a 100 oz. silver bar in a plastic bag to show me. His arguments for buying hard assets sounded convincing.

Governments printed trillions of dollars after the financial crisis. This “funny money” pumped up stocks, which could collapse any day. To protect yourself, you had to own assets that couldn’t be created out of thin air.

I fell hook, line, and sinker for this argument and threw all my money into “smart” investments like gold and silver. It felt like I was in on some secret only intelligent investors knew about. Buy stocks? That was for suckers who were going to lose all their money.

But the joke was on me. US stocks went on to have one of their best decades ever... while precious metals were one of the worst-performing assets over the same timeframe.

3. I figured out early that betting on the end of the world is a surefire way to go broke.

I started investing the vast majority of my net worth in the stock market.

Reading Matt Ridley’s The Rational Optimist was a real eye-opener for me. It’s a book about the triumph of the optimists.

Take this line from Ridley:

If you say the world has been getting better, you may get away with being called naïve. If you say the world is going to go on getting better, you are considered embarrassingly mad. On the other hand, you say catastrophe is imminent, and you may expect the Nobel Peace Prize.

The Rational Optimist taught me to stop obsessing about what might go wrong and instead look at the facts. And the facts show markets reward optimistic investors.

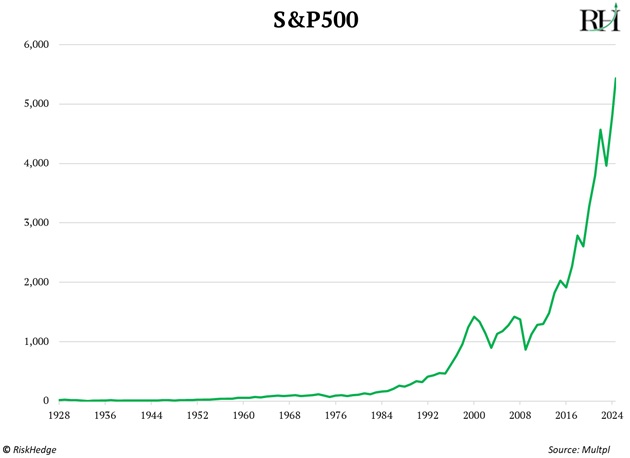

US stocks have risen roughly three out of every four years since 1945. Folks who invested $30,000 in the S&P 500 in 2010 have over $100,000 today. And despite many crashes, the odds of making money in US stocks is 88% over any five-year period in history.

I’ll take those odds all day long.

Unfortunately, many folks are still trapped in a pessimistic mindset today. It’s why most US investors expect stocks to crash even though the S&P 500 has notched 38 new highs this year.

4. Why are we hardwired to be pessimistic?

It dates back to hunter-gatherer times. In those days, focusing on what might go wrong was a matter of life and death. For example, if you didn’t store enough food, you starved to death. If you didn’t guard your camp, a bear might eat you.

Our brains still prioritize negative information. Tell someone the world is ending, and you’ll have their attention. Tell them everything is great, and you’ll be ignored.

You must train yourself to tame this instinct in order to achieve investing success.

Fidelity money manager Peter Lynch once said, “More money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Don’t get me wrong, I’m not saying optimists always make money. Or that they always get in early on the next big thing. But being willing to take chances on potentially world-changing businesses is a virtue.

As I’ve said, now is a great time to scale into top disruptor stocks using the dollar-cost averaging method.

Pessimists have no chance of catching the best-performing stocks. They’ll come up with 10 reasons why it won’t work. They’ll talk themselves out of buying.

But remember: The story of the US stock market over the past century isn’t one about pessimists. It’s about optimists and new record high after new record high.

I’ll have a lot more to say on why the optimists are winning in future issues of The Jolt. Click here to join today.

By Stephen McBride

© 2024 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.