Credit Crisis Eases as Interbank Rates Hit Multi-year Lows

Interest-Rates / Credit Crisis 2008 Nov 11, 2008 - 11:48 AM GMTBy: Ashraf_Laidi

Although signs of easing credit strains are manifested in multi-year lows in interbank rates, the market turmoil has exasperated the already shaky cash situation of US auto manufacturers, retailers and shippers, forcing fresh waves of nation-wide layoffs, which would only feed off the negative loop from rising employment, falling consumption, lower earnings and eroding bank credit. Consequently, JPY retains the last word over the USD, while both low yielding currencies dominate dealing flows against European and antipodean FX as Asian and European markets are mired in prolonged downside, failing to break Mondays sell-off in the US.

Although signs of easing credit strains are manifested in multi-year lows in interbank rates, the market turmoil has exasperated the already shaky cash situation of US auto manufacturers, retailers and shippers, forcing fresh waves of nation-wide layoffs, which would only feed off the negative loop from rising employment, falling consumption, lower earnings and eroding bank credit. Consequently, JPY retains the last word over the USD, while both low yielding currencies dominate dealing flows against European and antipodean FX as Asian and European markets are mired in prolonged downside, failing to break Mondays sell-off in the US.

The aforementioned negative channels of transmission will provide little positive backdrop to equities and overall risk appetite, and any gains such as last Fridays session remain an example of bear-market buying. Talk of the US unemployment rate reaching 10% by end of 2009 from its current 14-year high of 6.5% is to become a more common topic of discussion as companies struggle to survive in the midst of dried up credit and eroding domestic and global demand.

The US data calendar remains light as bond markets close in observance of Veterans Day, but the calendar will gradually resurrected, culminating with another major Friday release, namely the October retail sales report expected to show the fourth consecutive monthly decline (a pattern not seen over the last 15 years) and the second year-on-year decline in 6 years.

Euro Tests Triangle's Lows

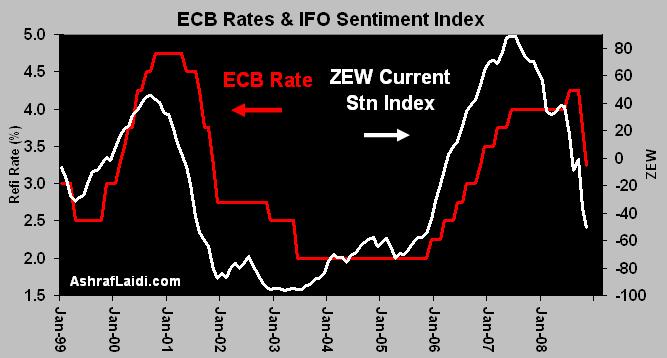

German

ZEW index on investors economic sentiment unexpectedly improved to -53.5 in November from -63 in October, after reaching an all time low of 63.9 in July. The historical average stands at +27.5.The improvement was attributed to the German governments approval in favor of rescuing select banks and insurance companies. Nonetheless, the current situation index fell to nearly a 3-year low at -50.4 from -35.9 in October. The improvement in the economic sentiment index does not necessarily suggest that next weeks release of the IFO survey on business sentiment will improve as the index targets businesses and executives.

EURUSD joined non USD-currencies on the downside, breaching below $1.28 and onto $1.27 as the failure for global risk appetite to recover erodes the hopes of euro bulls. The 4-hour EURUSD chart shows a clear formation of lower peaks and lower highs, forming a symmetrical triangle whose lows are being tested at $1.2700. Key foundation stands at $1.2650. Upside capped at $1.2830, followed by $1.2940 high, which is the 61.8% retracement of the decline from the $1.3116 high to last weeks $1.2650 low.

Dim GBP Prospects Ahead of Inflation Report

Sterlings prolonged selling across the board is especially heightened by i) renewed damage in global risk appetite and ii) expectations that tomorrows release of the Bank of England quarterly inflation report will further downgrade its inflation outlook, thereby, paving the way for further interest rate ahead. Yesterdays bigger than expected decline in October PPI supported the possibility for interest rates to reach 2.00% by end of H2 2009.

Having failed to regain the $1.5640 trend line resistance, cable was crushed towards the $1.5500s, making the way ahead for $1.5370. The lower highs from Oct 14, Oct 20, Oct 30 and Nov 05 underscore the sterlings failed recoveries, suggesting prolonged technical weakness prevailing ahead.

Yen Retains Risk-Driven Strength

Yen comes off the highs seen in the Asian session, but maintains the pattern of posting modest gains. With no data in the US economic calendar seen reversing sentiment to recall the 98.40-50s, yen bulls remain confident in finding bids below the 98.50s. Yen continues to shrug Japanese data, swinging to the pendulum of deteriorating risk appetite. Nonetheless, 97.00 yen remains firm support, which is above the 38% retracement of the 90.89 low to the 100.54 high.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.