Global Stock Markets on a Knife Edge Warrant Extreme Caution

Stock-Markets / Stocks Bear Market Nov 12, 2008 - 08:14 AM GMT

The list of well-known names identifying value on the US stock market at current levels is growing by the day and includes the likes of Jeremy Grantham ( GMO – “ Careful buying is justified ”), Warren Buffett (“ Buy America. I am ”), John Hussman ( Hussman Funds – “ Why Warren Buffett is right ” and “ How low, how bad, how long ?”) and Barry Ritholtz ( The Big Picture – “ Another buy in ”). Even perma-bears such as James Montier and Albert Edwards ( Société Générale – “ Turning more bullish ”) are increasing their equity exposure, albeit only for the short term.

The list of well-known names identifying value on the US stock market at current levels is growing by the day and includes the likes of Jeremy Grantham ( GMO – “ Careful buying is justified ”), Warren Buffett (“ Buy America. I am ”), John Hussman ( Hussman Funds – “ Why Warren Buffett is right ” and “ How low, how bad, how long ?”) and Barry Ritholtz ( The Big Picture – “ Another buy in ”). Even perma-bears such as James Montier and Albert Edwards ( Société Générale – “ Turning more bullish ”) are increasing their equity exposure, albeit only for the short term.

Edwards sees the S&P 500 Index finally bottoming at 500, Grantham expects an “overrun on the downside” to between 585 and 780, and Hussman “hopes” for a bottom between 600 and 780. Bennet Sedacca (“ Living on a prayer ” and “ What would it take for me to become bullish ”) similarly has an index level of 500 to 600 in his sight.

In the meantime, the S&P 500 has been forming a so-called “descending triangle” since the middle of October. A triangle usually is a continuation pattern, i.e. when its occurs in a downtrend the break is usually on the downside. Based on technical analysis, such a breakout would imply a downside target of about 680.

On the other hand (as a good economist will say), if a downside breakout does not occur and we see a reversal to the upside, a strong countertrend rally could surprise investors.

Marc Faber, author of the Gloom, Boom & Doom Report , sees such an eventuality as follows: “… when based on some factors (technical and fundamental) a market is supposed to break out in one direction (up or down) and the breakout does not occur or fails, a very strong countermove usually gets under way. For what it's worth, I covered all my short positions before Tuesday's (November 4) almost 900 points rally [on the Dow Jones Industrial Index] and increased my equity exposure to 10% of my assets. I would consider a move above 900 for the S&P 500 to be a confirmation that a temporary low is in place.”

However, Faber cautions: “… the call for a temporary rebound (lasting three to six months and up by 20% or so) does not imply that we have seen the ultimate low – although I would not rule it out entirely in nominal terms. But it is unlikely that we are even close to a major low in real terms! In fact, in real terms the market would seem to have further considerable downside risk.”

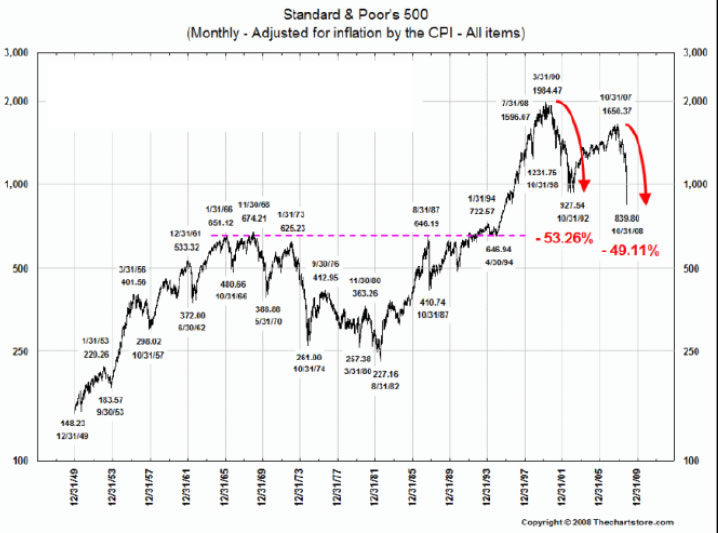

The long-term inflation-adjusted graph of the S&P 500 Index is provided below, courtesy of The Chart Store . This rather ominous-looking picture shows that the real S&P 500 has already breached its 2002 low.

Source: The Chart Store

Although the venerable Richard Russell ( Dow Theory Letters ) claims that “neither the duration nor the depth of a primary movement can be forecast in advance”, he does caution about the great false rally that followed the 1929 crash. “That deceptive rally took the Dow in April 1930, back to within 60 points of the 1929 peak. Following the April peak, the market crumbled as the Great Depression started. In view of that example, I will be very careful and suspicious of any large-scale advance from here. The quality of any rally from here should be examined minutely for any discrepancies,” said Russell.

In short, stock markets seem to be on a knife edge and the closing lows of October 27 (8,176 on the Dow Jones Industrial Index and 849 on the S&P 500 Index) are key levels on which to keep an eye. Suffice to say that extreme caution is still the recommended course of action.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.