Crude Oil Heading to Below $50

Commodities / Crude Oil Nov 12, 2008 - 11:38 PM GMTBy: Donald_W_Dony

As crude oil continuously declines, it reinforces what mid-term economic models have suggested for several months; that oil prices should remain in a downtrend until the end of the business cycle in 2010. Global economic activity, coupled with supply considerations and U.S. dollar movements are the overwhelming forces behind commodity price adjustments.

As crude oil continuously declines, it reinforces what mid-term economic models have suggested for several months; that oil prices should remain in a downtrend until the end of the business cycle in 2010. Global economic activity, coupled with supply considerations and U.S. dollar movements are the overwhelming forces behind commodity price adjustments.

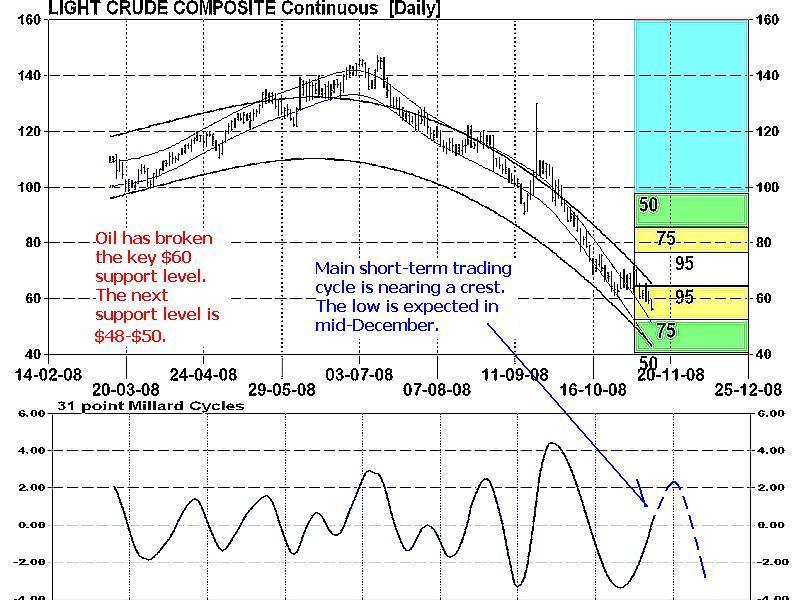

Though 12 month models point to crude oil below $80, short-term technical models (Chart 1) indicate oil prices should reach $48-$50 by mid-December. Monte Carlo simulation, a mathematical calculation, suggests there is a 95% probability of prices moving out of the $56-$71 range over the next 5 months and a 75% probability of prices trading above or below the $47-$80 zone. These numbers plus the growing economic weakness over the next 12 months strongly indicates that oil prices can be expected to remain down and trade at or below $50.

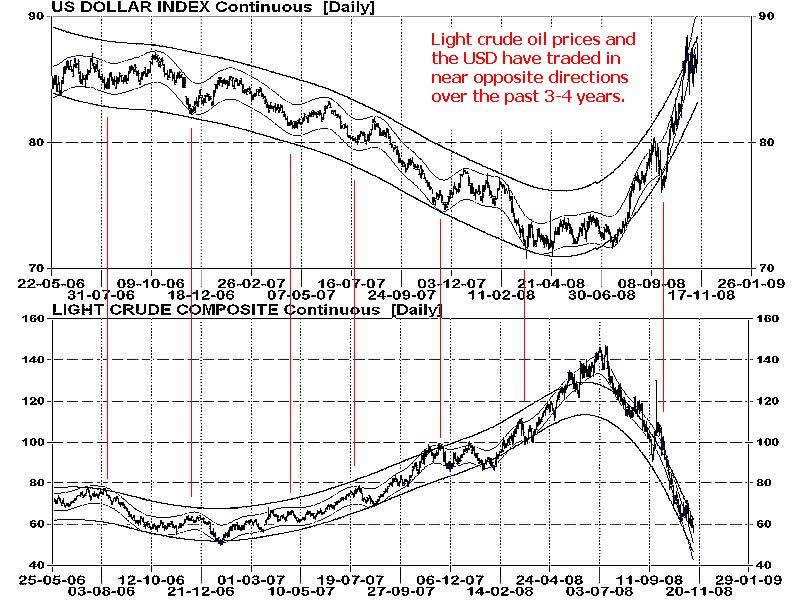

The U.S. currency also plays a larger role in determining the short and mid-term trading direction of oil then most analysts and investors realize. Chart 2 demonstrates just how closely these two securities mirror each other over the past few years.

Mid-term (4-6 months) technical models for the U.S. dollar suggest prices should remain above the major support level of $0.80 and likely hold closer to $0.87-$0.88 as the credit crises unfolds. Sustained higher values for the USD will apply negative pressure for oil prices.

Bottom line: The expected global contraction plus stable technical strength for the greenback indicates a continuation of the downtrend in oil prices into late 2009.

More research is available on commodities, currencies and equities in the November newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.