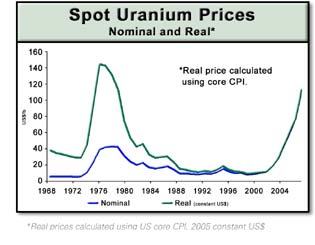

Uranium prices rise 19% to $113 in one week!

Commodities / Uranium Apr 11, 2007 - 10:47 AM GMTSean Brodrick writes :Boy, I sure hope you're holding some uranium investments … because at the latest auction for the white-hot metal, the spot price of uranium oxide (U3O8) soared $18 to $113 per pound!

That's a 19% rise in just one week. According to Nuclear Market Review , it's the largest single weekly price increase since uranium has been tracked!

And you know what?

You ain't seen nuthin' yet!

- While $113 per pound is pretty good, we're still below the price adjusted for inflation, around $140 per pound.

- We're an even longer way from my latest target that I told you about two weeks ago — $284 per pound. In fact, the price of the metal would have to increase another 151% to hit my new target.

- And if some of my friends in the industry are right, $400 per pound or even $1,000 per pound is not out of reach.

I'll give you my favorite ways to ride rising uranium prices in a moment. First, let's talk about something I just touched on last week, something that could be a huge force behind higher uranium prices …

Peak Oil and the Decline of The So-Called Supergiants

Peak oil is the theory that global oil production is near a top. Once that point is reached, oil companies can drill more and faster, but they won't be able to keep up their production.

Here's a big sign that this day is rapidly approaching — some of the biggest oil fields in the world are already peaking . I'm talking about the "supergiants," which produce 500,000 to one million barrels per day.

The big Texas oil fields peaked decades ago. Prudhoe Bay in Alaska is seeing production drop like a stone. The North Sea is past peak production. And Kuwait's super-giant Burgan oil field is also in trouble.

This is especially bad news because there aren't many supergiants in the world. Leading up to the 1970s, only eight had been discovered. Two more were discovered through the 1980s. Since then, only one (in Kazakhstan) has been found.

Now, another supergiant is falling apart right in our own backyard — Mexico's Cantarell oil field, which produces one out of every 50 barrels of oil on the world market.

I wrote about Cantarell's decline in early March . I explained how its production was declining even faster than the experts' worst-case scenarios. Well, guess what? It's even worse than we thought just a little while ago!

The verdict: From January 2006 through February 2007, Cantarell lost a staggering one-fifth of its production, with daily output falling from two million barrels per day to just 1.6 million.

In fact, the Wall Street Journal reports that Cantarell is fading so fast that Mexico may become an oil importer within eight years.

This could be catastrophic to Mexico's economy. But let's also think about the effect on the United States' oil and natural gas supplies:

- Mexico is our second biggest supplier of imported petroleum, below Canada and above Saudi Arabia.

- In January (the latest figures available), Mexico shipped the U.S. 1.57 million barrels of petroleum every day.

- Over the same period, the U.S. averaged 13.54 million barrels per day of total crude oil and petroleum products imports. So, Mexico accounts for more than 11% of our imports.

Imagine losing more than one in every 10 barrels of imported oil. What do you think that would do to oil and gasoline prices? Prices at the pump are already expected to get close to $4 per gallon this summer. If over one-tenth of our imported oil disappeared, $4 a gallon might look cheap!

And let me tell you, this could happen sooner than people think …

Reason: Even in a best-case scenario, Cantarell will probably continue to decline by roughly 10% a year, down to a daily average of 600,000 barrels per day in 2013. That's just six years away!

Ironically enough …

It Takes About Six Years To Construct a Nuclear Plant!

I'm not including the permitting process, or other regulatory hoops, but working flat-out, it takes about six years to build a new nuclear power plant. So I can only hope U.S. utilities use the next few years wisely.

After all, if we want to prepare for the coming head-on collision with peak oil, we are going to have to build a lot of new nuclear power plants. The U.S. has only 28 applications for new plant licenses between now and 2009 so we need to get on the stick and start building a lot of new nuclear plants soon.

By electrifying railroads and building electric cars (with tax breaks to make them affordable), along with conservation and pursuing alternative fuels, we could rev up our economy and eventually tell OPEC to go stick its oil where the sun don't shine.

An onslaught of new nuclear plants would strain already tight demand for uranium, of course. This year, demand should hit 183 million pounds, exceeding production by 56%, according to figures from industry leader Cameco.

And demand is only going to grow because the rest of the world is already building more nuke plants at a furious pace. There are 435 nuclear reactors operating around the world, with 28 more reactors under construction. Each 1-gigawatt nuclear power plant takes a first fill of uranium of about 600 metric tonnes, then consumes 200 tonnes a year thereafter.

One more thing to consider: It also takes six to eight years to get a new uranium mine permitted. So mines that are already moving along that path, and that have sharp management teams who know how to jump through government hoops, stand to make a killing! And so do investors who invest in the right uranium stocks and funds …

My Favorite Ways to Stake a Claim in Uranium

Last week, I said a pure way to play rising uranium prices is the Uranium Participation Corp ., a Canadian fund that tracks uranium. The symbol on the Toronto Stock Exchange is U . In the U.S., the symbol is URPTF on the Pink Sheets. (On Yahoo, that would be URPTF.PK.) And I still think this fund is a good choice.

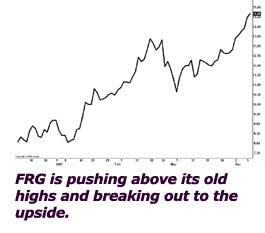

However, here's another: Fronteer Development Corp (FRG on the American and Toronto Stock Exchanges) is a uranium and gold explorer. It owns 47% of Canadian near-term uranium producer Aurora Energy. In February, Aurora announced that its 100%-owned Michelin and Jacques uranium deposits in Labrador contain a measured and indicated resource of 58 million pounds of uranium (U308), and an additional inferred resource of 38 million pounds of uranium.

In effect, Aurora's uranium resource base has increased 170% in slightly more than 12 months. I expect that Aurora will expand its resource with further drilling, but let's say that the inferred resource is the limit of the recoverable uranium. That's 98 million pounds, worth $11 BILLION at today's spot price!

Uranium in the ground isn't the same as uranium at a mill, so after mining costs, let's say that resource is worth $5 billion. Fronteer's 47% share of that would be $2.3 billion. Meanwhile, Fronteer has a market cap of just $933 million. Talk about a discount!

Readers of my first uranium report, The Golden Age of Uranium , are well acquainted with these names because Fronteer was one of my picks when I published the report on October 3. At the end of last week, Fronteer was up 146% from that day. Over the same period, Aurora posted a solid return of 66%.

Note: Fronteer is also a current pick in my Red-Hot Resources service, which recommends picks in U.S.-listed stocks. The stock is up 24% since I recommended it on March 7.

I believe both Fronteer and Aurora could go substantially higher as global warming heats up, oil peaks, and the uranium supply/demand squeeze sends the price of uranium oxide over $250 per pound.

This is why I prefer investing in individual stocks. You can get a lot more leverage by investing in miners. Just make sure you understand your appetite for risk before you go this route. The profit potential is great, but it won't always be a smooth ride.

Whatever way you decide to go, I think it's time to get on this profit train. Cantarell is just the latest warning sign that we're on a head-on collision with peak oil — and nuclear power is one of the few proven alternatives that we have. Uranium has already enjoyed a great move, but the best is yet to come.

Yours for trading profits,

By Sean Brodrick

P.S. If you're looking for my top uranium picks, check out my newest uranium report, The Small Uranium Wonders . It highlights six great mining stocks to jump on right away. I'll also send you four updates throughout the year. Just call us at 800-400-6916 and say you want "The Small Uranium Wonders" report or order online at my secure website.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.