G20 Central Banks Unite to Fight Economic Depression

Economics / Economic Depression Nov 18, 2008 - 05:41 PM GMTBy: Gary_Dorsch

Can Central Bankers Prevent the Great Depression?

Can Central Bankers Prevent the Great Depression?

Amid the worst financial crisis and market meltdowns since the 1930's, the world's top-20 central bankers and finance ministers are busy at work, inflating the world's money supply, slashing lending rates, and crafting stimulus packages, in order to prevent a normal recession from morphing into a Great Depression. The ECB has cut interest rates by 100-basis points to 3.25% since early October, and is telegraphing another 50 basis point cut at the next policy meeting in December.

Last week, the Bank of England slashed its base rate a whopping 150-basis points to 3%, its lowest in 53-years, and signaling more easing ahead. With new construction in China collapsing to its worst level in a decade, Beijing pledged to spend $600-billion over the next two-years, for new housing, road and rail infrastructure , agricultural subsidies, health care and social welfare. The stimulus package equals 16% of China 's total economic output .

But the dreaded “D” words – “Deflation and Depression,” are whispered quietly by the “Group of 20” central bankers, behind closed doors. Traditional monetary tools such as lowering interest rates are not working, because banks are hoarding cash and not passing along the lower costs. There is no light at the end of the tunnel until home prices finally stop falling, and banks can stop writing-off big losses.

“What this crisis reveals is a broken financial system like no other in my lifetime,” said former Fed chief Paul Volcker on Nov 17 th . “ Normal monetary policy is not able to get money flowing. The trouble is that, even with all this government protection, the market is not moving again. I don't think anybody thinks we're going to get through this recession in a hurry,” he warned.

The sub-prime crisis has morphed into a diabolical monster, spreading its tentacles across the globe. Bank credit remains tight in the United States and Europe , even for top-notch investment-grade companies, who are confronted with borrowing costs that are indicative of junk bonds. And the unregulated $55 trillion credit default swap market is a nuclear time-bomb, which can explode at a moment's notice.

In the lead-up to the G-20 central banker summit, the World Bank warned the global economy had suddenly stopped growing, and now predicts a meager growth rate of +1% for 2009, after expanding +5% or more from 2003-07. Global exports are seen tumbling -2.5% in the year ahead, a precipitous fall from growth rates of +5.8% in 2008, and +10% just two-years ago. In today's highly synchronized global economy, no nation has been left unscathed, not even Iceland .

The Baltic Dry Index (BDI), a composite of shipping prices for various dry bulk products such as iron ore, grain, coal, bauxite, and alumina, has plunged 11-fold from a record high of 11,800-points in May, to 840-points in mid-November, signaling a global depression. The largest cargo ships are unable to charge more than their daily operating costs, and must cut ship speeds in order to economize on fuel costs. China accounts for 40% of the movement in commodities being shipped around the world, on the 22,000 ships that sail the world's shipping routes.

China 's steel makers have cut production due to lower profit margins, and weaker demand at home and abroad. China produced 35.9-million tons of crude steel in October, down -23% from a record high of 47.1-tons in June. Some 90-million tons of iron ore are now stockpiled in Chinese ports, two months worth of imports, due to a sudden collapse in demand by steel mills. Chinese orders for copper, nickel and a range of other base metals have also plummeted.

India 's industrial production was only +1.3% higher in August, than a year earlier, a 10-year low. Indian exports fell -15% in October compared to a year earlier, the first such fall in five-years. Japan entered its first recession since 2001 and Germany contracted for the first time in five-years, after its industrial output plunged -3.6% in September, the largest monthly loss in 14-years. The jobless rate in the UK , has reached its highest since 1997 and its economy is expected to shrink -1.7% next year, its worst performance since the 1991 recession.

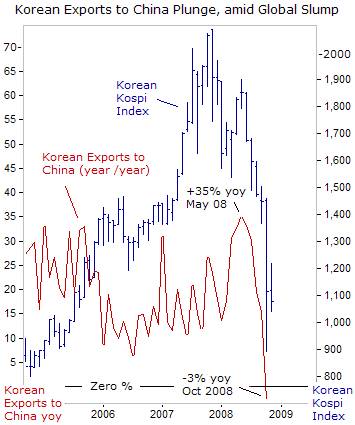

South Korea is a key bellwether of the global economy, with 52% of its GDP derived from exports. Korea 's shipments to China , its biggest customer, have plunged over the past six-months, and were -3% lower in October than a year earlier . Korean factory output fell for a third straight month, the longest run of declines in eight-years, adding to fear the Asian tiger is headed for its first recession in a decade.

Emerging Asian economies account for one-fifth of world growth, but are being dragged down as their biggest customers in the US , Japan and Europe are sliding into recession. Posco, PKX.n, Asia 's biggest maker of stainless steel, said it will slash output by about a third this quarter to cope with a slowdown in demand. The Bank of Korea slashed its overnight loan rate a record 100-basis points in October, after the Kospi stock index suffered its worst loss in two-decades.

Federal Reserve Shifts towards “Quantitative Easing”

The United States is the world's largest economy, and buys roughly 20% of the world's exports. But after a decade of living on easy credit, US consumers are now saturated with debt, (300% of GDP), and forced to de-leverage, leaving Asian exporter nations in a terrible bind. US retail sales plunged -2.8% in October, the fourth straight monthly decline, impacting across virtually all sectors of the retail economy. According to official figures, 10-million American workers are out of work and cannot find jobs, and over 85,000 US-homes were foreclosed in October.

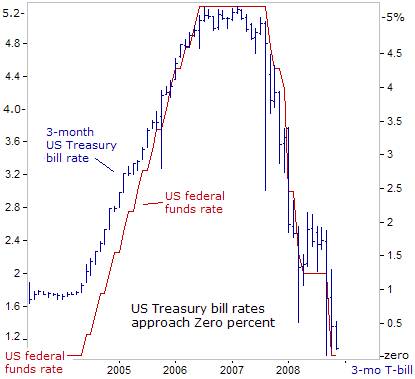

US consumer spending can collapse if the job-cutting continues and US households are deprived of credit, as home values fall and banks tighten access to mortgages, auto loans, and credit cards. Amid fears the US-economy is sliding towards a Great Depression, the 1-month US T-bill rate fell to 4-basis points, and the 3-month T-bill rate ended at 12-basis points. That leaves T-bill rates far-below their lowest levels in 2003-04, the last time the Fed pegged the fed funds rate at 1-percent.

With T-bill rates approaching zero-percent, the Fed has clandestinely adopted a radical monetary policy known as “Quantitative Easing,” (QE) pioneered by the Bank of Japan (BoJ) earlier this decade, in a desperate gambit to prevent a Great Depression. Wit h f alling retail sales, rising unemployment, collapsing commodity prices, and an international credit crunch in motion, the Fed is printing vast quantities of US-dollars, in order to buy government agency debt, commercial paper, and toxic mortgages, and other paper, from the financial industry.

“At the beginning of this year, the assets on the books of the Fed totaled $960 billion,” said Dallas Fed chief Richard Fischer on Nov 4 th . “Today, our assets exceed $1.9 trillion. I would not be surprised to see them reach $3-trillion, roughly 20% of GDP, by the time we ring in the New Year. The composition of our holdings has shifted considerably. Previously, almost 100% of our holdings were in the form of US Treasuries, today, it's less than a third. The remainder consists of claims deriving from our new facilities,” Fischer revealed.

During Japan 's quantitative easing campaign, the BoJ's balance sheet swelled to the equivalent of 30% of GDP. Today, the Fed has doubled its balance sheet in just five-weeks to 15% of US-GDP, by printing money and swapping for assets of the banking sector, some unmarketable. The Fed has also arranged $800-billion of foreign currency swaps with a dozen central banks, increasing dollar liquidity worldwide, and refuses to reveal the exact composition of its balance sheet.

With so much excess cash floating around, Treasury bill rates have gravitated towards zero-percent. But at the same time, the Fed is preventing the fed funds rate from tumbling towards zero-percent, by offering to pay 1.15% on overnight deposits, under new powers it was granted in the financial stabilization bill. For the week ending Nov 5 th , US-banks deposited $592-billion at the Fed, up from $11-billion at the beginning of October, instead of dumping the excess cash in the fed funds market. Meanwhile, the Fed continues to print money and build its balance sheet.

Inflationary Boom to Depression Bust

It was only five-months ago, when the “Commodity Super Cycle” was flexing its muscles, and lifting inflation rates to multi-decade highs around the world, fueled by an unrelenting global flight from the US-dollar. Mr. Bernanke, Vice chief Donald Kohn and governor Frederic Mishkin – the Fed's three intellectual amigos, were pursuing a reckless policy of pegging “negative” real interest rates, even with inflation raging at a 17-year high in the United States, to support the financial sector.

For months, the Fed appeared to be overestimating the risks of recession while underestimating the dangers of inflation. The Fed was too attentive to rigging the stock market, and not the inflationary squeeze on American's paychecks. Yet today, at remarkable speed, the inflationary boom has morphed into a deflationary bust, led by a stunning $90 per barrel plunge in the price of crude oil, with copper, corn, and soybean prices tumbling 50% or more.

In his infamous “helicopter” speech delivered in November 2002, Mr Bernanke raised the question, “S uppose that, despite all precautions, deflation were to take hold in the US-economy and moreover, that the Fed's policy instrument, the federal funds rate, were to fall to zero. What then? Well, the US government has a technology, called a printing press, or today, its electronic equivalent, that allows it to produce as many US-dollars as it wishes at essentially no cost,” Bernanke said.

“Under a paper-money system, a determined government can always generate higher spending and hence positive inflation. Normally, money is injected into the economy through asset purchases by the Fed. To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys.”

“One approach, similar to an action taken by the Bank of Japan, would be for the Fed to commit to holding the overnight rate at zero-percent for some specified period, which would induce a decline in longer-term rates. A more direct method, which I prefer, would be for the Fed to enforce interest-rate ceilings by committing to make unlimited purchases of securities up to two years from maturity at prices consistent with targeted yields. If this program were successful, not only would yields on medium-term Treasury securities fall, yields on longer-term public and private debt, such as mortgages, would likely fall as well,” Bernanke said.

Japan 's Experience with “Quantitative Easing”

In March 2001, the Bank of Japan (BoJ) began a radical monetary policy known as “Quantitative Easing,” pegging its overnight loan rate at zero-percent, and purchasing 1.2-trillion yen of Japanese government bonds (JGB's) each month, in an operation known as “Rinban.” At the time, Japanese banks were hobbled by 44.5-trillion yen of bad loans, and bank lending was -4.4% lower than a year earlier. The aim of the BoJ's operations was to flood the Japanese financial system with 35-trillion yen of excess liquidity, and inflate asset values.

The BoJ's long-term commitment to quantitative easing was an important element of the policy's success. The market was able to expect that the BoJ's zero interest rate policy would continue for years, and that Yen Libor rates and 2-year government yields would stay close to zero-percent. Throughout this decade, the BoJ has targeted the benchmark 10-year JGB yield in a narrow range between 1.20% and 2%, a remarkable feat of controlling the world's second largest debt market.

On the few occasions, when JGB 10-year yields threatened to move above the psychological 2% level, the Japanese MoF was quick to jawbone them lower. On June 12, 2003, when JGB yields hit a record low of 0.43%, former BoJ chief Toshihiko Fukui warned traders that yields had fallen too-low. “Now, we are implementing measures to boost the economy, aimed at creating situations which would drive up long term interest rates,” he warned. Three months later, JGB yields had quadrupled to 1.65% and have stayed above the BoJ's lower target of 1.20% ever since.

JGB yields hit historic lows in 2003, even though Japan had the largest government bond market in the world, with 562-trillion yen in marketable securities, ($4.7-trillion outstanding), compared with the US Treasury's $3.3 trillion. Tokyo floated 36.5-trillion yen of new bonds in 2003, and the Bank of Japan monetized roughly 40% of the debt, with its monthly purchases. Even today, with the JGB market equaling 180% of GDP, the BoJ continues its mastery over the market.

The Bernanke Fed might be inclined to follow the BoJ's blueprints, by monetizing most of the US Treasury's upcoming auctions that according to varied estimates, could mushroom to $1.8 trillion in fiscal 2009. The US Treasury is borrowing $550 billion in the fourth quarter, and $368 billion in Q'1/ 2009. That figure could climb higher, if Social Democrats vote to widen the scope of bailouts for state governments and city municipalities, and key industrial companies.

Financing the US Treasury's debt in the next 11-months could become more difficult, after China announced its huge $586-billion economic stimulus plan last week. Beijing is expected to steer most of its massive trade surplus ($250-billion in 2007) towards its own domestic economy, instead of recycling the surplus into US-bonds. Beijing already holds between $1-trillion and $1.5-trillion of US Treasury and agency bonds within its foreign currency stash of $1.8 trillion.

In the event of a sharp downturn in the global economy, China 's exports would be hard hit, but its imports would also fall sharply, perhaps narrowing its trade surplus to $175-billion next year. To finance its stimulus package internally, Beijing can also float government bonds in Shanghai , and instruct the central bank to monetize the debt, by printing yuan, following the same game plan as the BoJ and the Fed.

Can Beijing Prevent a “Hard Landing” of its Economy?

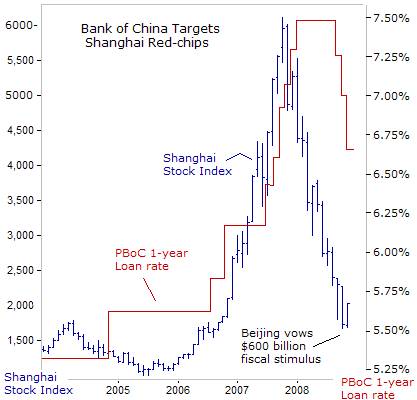

China 's consumer inflation has fallen steadily from a 12-year peak of +8.7% in February, to +4% in October, and the annualized rate could turn negative in early 2009, reflecting the recent collapse in commodity prices for food and energy. On Nov 9 th , China 's central bank chief Zhou Xiaochuan said, “Inflation has been easing remarkably, and the pace of easing is fairly fast. Chinese markets can expect more money supply and looser market liquidity,” he said.

After the bursting of the Shanghai equity bubble, and now the collapse in commodity markets, the PBoC could move quickly to avoid a “hard landing” for its economy. If inflation rates fall faster than Chinese interest rates, then real interest rates will rise and monetary policy will actually be tightening, even if market interest rates fall. Should this happen, the PBoC could inflate it money supply to achieve stable prices, while monetizing the national debt. One important lesson for the PBoC to learn from Japan 's experience in 1990's, is that falling prices, if left unchecked for prolonged periods of time, can be very dangerous.

In orchestrated moves with other major central banks, the People's Bank of China (PBoC) lowered its key one-year loan rate 81-basis points over the past seven-weeks to 6.66%, following the stunning collapse of the Dow Jones Commodity Index, (measured in yuan), to a six-year low. China 's economy is also growing at single-digit rate of expansion this year for the first time since 2003, as its annual economic growth slowed to +9% in the third quarter from a record +11.9% in 2007.

Zhou indicated that Beijing launched its massive stimulus package in order to stabilize the Chinese economy at a +8% growth rate in 2009. However, output by China 's vast manufacturing sector, which employs tens of millions of workers and has functioned as the world's cheap labor workshop, is slowing dramatically, as demand collapses in its major North American and European markets. About one-third of the 45,000 factories in the major export cities of Dongguan, Shenzhen, and Guangzhou are expected to close by the Chinese New Year in January .

There is plenty of room for the PBoC to slash interest rates and bank reserve requirements, in order to cope with the most severe recession in the United States since World War II, and deflation looming on the horizon. Some of the major mistakes of the Bank of Japan after the bursting of the Nikkei-225 bubble in the early 1990's, was its failure to inflate its money supply faster, maintaining high real rates of interest, and allowing deflationary psychology to develop.

After 1993, Tokyo also initiated a series of fiscal stimulus packages that by 1999, reached over $1 trillion. Yet Japan waffled between economic stagnation and deflation from 1991 thru 2001 after bubbles in its stock market and land market collapsed. Similarly, home sales in Beijing have plunged by -55% from a year ago, and are -38% lower in Shanghai and -15% nationally, driving down asset values.

China 's leaders must navigate carefully to prevent a hard landing, defined as a +6% growth rate. If China 's stimulus package is poorly directed towards unproductive public works projects or businesses that are no longer economically viable, it could greatly lose its effectiveness. It might be better to reduce tax rates and allowed households to deploy the increase in disposable incomes as they see fit.

Greenspan's Nightmare

The wild speculation fueling the Nasdaq high-tech bubble in the late 1990's, followed in the footsteps of earlier infrastructure-related booms and busts. Many new high-tech companies had no earnings, and were worth no more than a dream. For them to be sold, Wall Street bankers developed new valuation methods, at multiples of far-distant revenues. Eventually, the façade collapsed, and losses from the stock market meltdown reached the equivalent of US gross domestic product.

The Fed knew a Nasdaq bubble was brewing in 1996, when Fed chief Greenspan spoke of “irrational exuberance.” Further, the Fed knew that raising share margin rates could have stopped the bubble before it became too frothy. But a combination of factors, including the fear of not getting re-nominated as Fed chief for reining in a bull-market, and a succession of international crises, - the Asian, Russian, LTCM, and Y2K, were all rationalizations for Greenspan's inaction. Furthermore, the Fed chief became a covert of the “productivity miracle” in the New Economy.

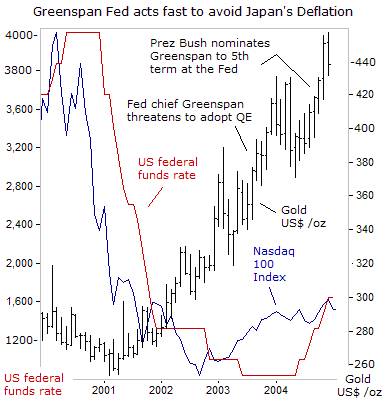

However, mindful of Japan's serious policy errors of the 1990's, and America's in the 1930's, in the aftermath of historic stock market meltdowns, the Greenspan Fed moved forcefully to contain the damage from the bursting of the Nasdaq bubble in 2000-01. The Fed slashed its overnight loan rate 550-basis points to a 45-year low of 1%, and pegged it there for an entire year, until it was confident that deflation wasn't going to take hold in the broader economy. The US economy has not seen sustained deflation since the Great Depression of the 1930's.

On December 20, 2002, St. Louis Fed chief William Poole said the central bank would not make the same mistakes as the BoJ in its failed bid to ward off falling prices in the 1990's. “Japanese authorities failed to lower interest rates quickly enough to ensure the money supply kept growing after bubbles in its real estate and stock markets burst. We're not going to make that mistake in the United States . The Fed is well aware that we must maintain money growth,” he said.

Greenspan's original sin was fueling the Nasdaq bubble with excess liquidity, when legions of speculators were taking collective leave of their senses and succumbing to delusions of ever-expanding wealth. If left unchecked, “Bubble-mania” engenders a massive, largely uncorrected rise in valuations that discounts not just the present and the near future, but a distance far over the horizon as well. Greenspan says bubbles can't be accurately detected by central bankers nor popped without severe collateral damage to the economy. Instead, he suggests that central banks should only attempt to mitigate the fallout by slashing interest rates.

Greenspan's second error was pegging interest rates too-low and too-long at 1%, and moving too slowly to lift the fed funds rate to a more neutral level, that could have taken the wind out of the housing bubble. Instead, Greenspan was a “serial bubble blower,” inflating commodity and housing prices at the same time, while casting a blind-eye to reckless sub-prime lending in the mortgage market.

After stock market “bubbles” collapse, coinciding with economic recessions, it can take several years until the forces of inflation gain the upper-hand over deflation. The textbook way to combat deflation is for central banks to rapidly expand the money supply or bank credit, and slash interest rates. That's what the BoJ and Fed did in 2001, in a double barreled assault against deflation.

While the BoJ adopted QE to ward off deflation, the Greenspan Fed dropped the fed funds rate to a 45-year low, and warned Treasury bond traders, that it could follow the BoJ's blueprints. “Even though short-term rates are something slightly over 1%, longer-term rates are significantly above that. We do have the capability should that be necessary, of moving out on the yield curve, essentially moving long-term rates down. The Fed would do that by buying Treasury securities with longer maturities and setting a cap on their yields,” Greenspan said on May 21, 2003.

The Fed hasn't relied on long-term Treasury securities as a tool of monetary policy since the 1940's. However, the threat of the Fed resorting to QE gave a big psychological boost to the gold market. The Fed laid the groundwork for a sustained rally in precious metals, which carried gold above $400 /oz in New York , and 42,000-yen /oz in Tokyo , six-months later. “Should it turn out that pressures drive the federal-funds rate down close to zero, that does not mean that the Federal Reserve is out of business on the issue of further easing,” Greenspan added.

On May 18, 2004, President Bush nominated “Easy” Al Greenspan to a fifth-term as Fed chief, “Sound fiscal and monetary policies have helped unleash the potential of American workers and entrepreneurs. Alan Greenspan has done a superb job,” Bush said. Greenspan was set free to begin a “baby-step” rate hiking campaign, “the current highly accommodative stance of monetary policy must be returned to a more neutral setting at some point in order to foster price stability and maximum sustainable growth,” Greenspan said on June 2, 2004.

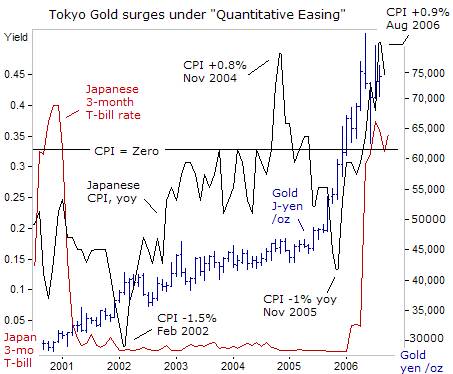

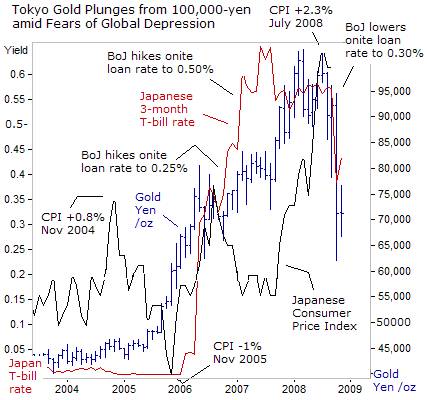

Utilizing gold as an indicator of inflation expectations, the Greenspan Fed waited until gold prices climbed above $400 /oz, before lifting the fed funds rate a quarter-point to 1.25% on June 30, 2004. The Bank of Japan waited until March 2006, to begin dismantling its QE framework. By then, Tokyo gold was trading near 75,000-yen /oz, up 150% in value from five-years earlier, or an annualized gain of 30-percent. Tokyo gold prices vaulted sharply in late-2005, even though Japan 's government reported no inflationary pressures at all in the local economy.

Tokyo gold traders understand the government is fudging the numbers, and understating the true rate of inflation. The manipulation of inflation statistics helps the Bank of Japan to manhandle the giant JGB market within a narrow range, and at artificially low yields. Instead, Tokyo gold traders watch for other visible signals in the marketplace, to gauge the real direction of inflation.

The Bank of Japan's ultra-low interest rate policy helped to triple the price of Tokyo gold to a record high of 100,000-yen /oz, while also inflating bubbles in numerous other markets around the world. Tokyo gold peaked in July, when government reports showed consumer prices galloping ahead at a +2.3% clip, the fastest in 10-years. In recent months however, there has been a sharp -30% setback in Tokyo gold towards 70,000-yen /oz, alongside tumbling commodity markets.

For the first time in seven years, the BoJ lowered its overnight loan rate, by 20-basis points to 0.3%, as part of a coordinated effort with other G-20 central bankers. The Bernanke Fed has shifted towards “Quantitative Easing” with a slightly different twist than the BoJ's experiment. How will gold perform when central banks are inflating their money supplies, to prevent a Great Depression? The upcoming Nov 21 st edition of the Global Money Trends newsletter takes a special look at gold's future, and whether the global economy is about to experience a “decade of lost growth.”

This article is just the Tip of the Iceberg of what's available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2008 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.