Citigroup Blames Short Sellers For Share Price Crash

Companies / Banking Stocks Nov 21, 2008 - 01:04 AM GMTBy: Mike_Shedlock

Citigroup is in deep trouble and here is the proof: Citigroup Said to Urge SEC to Reinstitute Ban on Short-Selling .

Citigroup is in deep trouble and here is the proof: Citigroup Said to Urge SEC to Reinstitute Ban on Short-Selling .

Citigroup Inc., which fell as much as 25 percent in New York trading today, is urging the Securities and Exchange Commission to revive a prohibition on short-selling financial stocks, according to a person familiar with the matter.

The bank has also discussed with lawmakers its proposal to reinstitute the ban on bets that share prices will fall, said the person, who declined to be identified because the discussions weren't public. Citigroup, down for eight of the past nine trading days, declined $1.22 to $5.18 on the New York Stock Exchange at 2:37 p.m.

Buffeted by four straight quarterly losses, New York-based Citigroup has raised about $75 billion since December by selling assets and equity stakes, including a $25 billion injection from the U.S. Treasury.

SEC spokesman John Nester declined to comment. Citigroup spokesman Michael Hanretta didn't return a phone call seeking comment.

No One Wants To Comment

Since no one wants to comment, I will. It's a sure sign of desperation when companies blame short sellers for company woes. Make no mistake about it, Citigroup is desperate.

Let's look at a couple of charts.

Citigroup Weekly Waterfall

Citigroup 60 Minute Chart

Citigroup fell over 20% yesterday and at one point today was down over 30%, closing off $1.69 or 26%.

Citigroup's Ridiculous Short Selling Claim

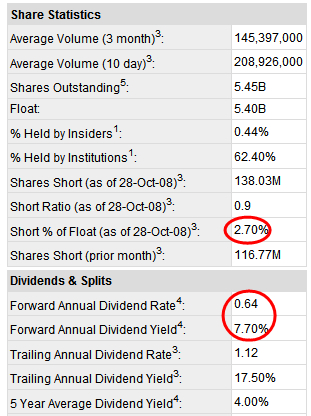

Inquiring minds are looking at Citigroup Statistics as of October 28, 2008.

Citigroup is blaming shorts when the short interest is under 3%. That's ridiculous. If Citigroup does not understand this, it is a sign of incompetence. If Citigroup does understand how ridiculous their claim looks (and is), that is additional support for the desperation thesis.

Note the dividend. Citigroup is paying a dividend when it is clearly in need of capital . Is that a sign of arrogance or incompetence? That Citigroup is in this mess in the first place is clearly sign of incompetence somewhere, at some point in time. Current management will attempt to place that blame on Chuck Price, but the culture of greed, arrogance, and excessive risk taking, permeated the entire financial industry.

Top Call

Flashback July 10, 2007 Quotes of the Day / Top Call

Chuck Prince Citigroup CEO: “ When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing ".

I leave it to you to decide whether or not this is the "last dance".

It's tough calling a top but I am going to try. I suggest the current trend is exhausted. My last " top call " was specially in regards to housing in the summer of 2005. Can lightning strike twice? Citigroup's $1.1 Trillion in Mysterious Shadow Assets

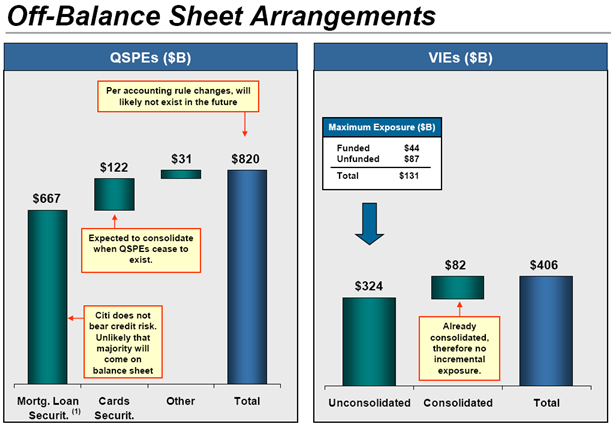

On July 14th 2008, I raised questions about Citigroup's $1.1 Trillion in Mysterious Shadow Assets .

The question of off balance sheet SIVs (shadow assets) came up again on November 17th 2008 in Citigroup's Town Hall Meeting .

Off Balance Sheet Holdings

Citigroup notes that the majority of $667 billion is unlikely to come on balance sheet yet presumes none of it will. I question the idea that Citi has no credit risk. Just how good are the counterparty guarantees for Citigroup to assume it has no risk on $667 billion? Also note that per an accounting rule change, Citigroup will be allowed to hide whatever risk there is, off the balance sheet and pretend that it does not exist at all. These risks need to be brought on the balance sheet and fully disclosed.

Citigroup would not be trading under $5 nor would it be down over 50% in two days if it was well capitalized as it claims. There is something wrong somewhere for the stock to be acting this way. Hiding behind accounting rule changes in this market is simply not going to work. Blaming short selling will not work either.

Looking ahead, foreclosures, credit card defaults, and bankruptcies are going to soar along with a soaring unemployment rate. Banks in general, and citigroup specifically, are woefully undercapitalized and unprepared for what is about to happen. One look at a chart of Citigroup should be proof enough.

The market seems to believe Citigroup is insolvent and so do I.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.