China Panic Interest Rate Cut as Job Losses Soar

Economics / China Economy Nov 28, 2008 - 10:41 AM GMTBy: Mike_Shedlock

The Telegraph is reporting China slashes interest rates as panic spreads . Factory workers surround a damaged police car during a protest outside Kai Da toy factory in Dongguan, China. Photo: REUTERS

The Telegraph is reporting China slashes interest rates as panic spreads . Factory workers surround a damaged police car during a protest outside Kai Da toy factory in Dongguan, China. Photo: REUTERS

The People's Bank of China cut interest rates by more than 1pc point as the economy crumbles and millions of jobs are predicted to go ahead of Christmas.

The move came just one day after the World Bank predicted that China would grow by 7.5pc next year. The level of growth may appear robust by Western standards, but it would represent the slowest economic expansion in China for the last two decades. It is also perilously close to the 7pc minimum level of growth that Chinese economists believe is necessary in order to create enough jobs for the 6m university graduates who will enter the jobs market next year.

The PBOC reduced its main borrowing rate by 1.08pc points to 5.58pc, the biggest one-off cut since the Asian Financial Crisis in 1997.

Yin Weimin, China's Social Security minister, has revealed that employment is the Communist Party's number one concern in the downturn and said the "situation is critical". Unemployment is expected to rise from 4pc to 4.5pc by the end of the year and anecdotal reports have suggested that 3m people have already been fired in the industrial province of Zhejiang alone.

Two major provinces, Shandong and Hubei, have already responded by banning companies from firing staff without permission from the government.

Government Response

Note the typical counterproductive government response, to prohibit companies from firing workers.

Factories will either pay those workers to sit and do nothing or those workers will produce goods at a loss that no one wants to buy.

Concern Over Slowdown, Jobs

Bloomberg is reporting China Rate Cut Highlights Concern Over Slowdown, Jobs

The central bank yesterday lowered its one-year lending rate by the most since the 1997 Asian financial crisis, less than three weeks after Premier Wen Jiabao unveiled a 4 trillion yuan ($586 billion) stimulus plan.

About 1,000 police and security guards this week attempted to break up a demonstration of fired workers that overturned a police car, smashed motorbikes and broke company equipment in southern Guangdong province, the state-run Xinhua News Agency reported yesterday.

China vaulted past the U.K. in 2005 to become the world's fourth-largest economy, with growth averaging 9.9 percent for the past 30 years. The economy has expanded 68 times in size since free-market reforms began in 1978.

Gross domestic product may grow 5.5 percent next year, the slowest since a 3.8 percent expansion in 1990, CLSA Asia Pacific Markets forecasts. That compares with an 11.9 percent gain in 2007.

China, the world's most populous nation, is aiming for at least 8 percent growth to provide jobs for workers moving to the cities from the countryside. A decline to even that level would be tantamount to a recession, according to Tao Dong, chief Asia economist with Credit Suisse AG in Hong Kong.

Two-thirds of small toy exporters closed in the first nine months of this year, the customs bureau said this week.

“Employment is being impacted by factory closures and many migrant workers are returning to their home towns,” Zhang said.

China is trying to keep the official urban unemployment rate below 4.5 percent this year, which would be the highest in at least a decade. The Labor Ministry says the figures don't account for millions of migrants who work in urban areas but aren't registered there.

“The aggressive rate cut is a response to the central bank's concern about the short-term deflation risk,” said Xing Ziqiang, an economist at China International Capital Corp. in Beijing, who predicts another 108 basis points of rate reductions in the coming year.

The State Council has pledged “fast and heavy-handed investment” and a “moderately loose” monetary policy. The plan spans housing, rural development, railroads, power grids and rebuilding after May's earthquake in Sichuan province.

“In previous crises China could always get out of trouble by boosting its exports,” said Xie. “This time that's not an option.”

Reneging On Cotton Orders

In the midst of a slowing slowing exports China Textile Makers Said to Renege on Cotton Orders .

China's textile producers and cotton traders have reneged on purchase contracts for as much as 20,000 metric tons of overseas cotton after prices plummeted in the past three months, two global trading executives said.

As many as eight Chinese companies have failed to follow through on purchase agreements with merchants, and the trend may widen as the industry struggles with worsening demand and credit, said the executives, who declined to be identified as they are not authorized to speak to the media.

"Some Chinese cotton users initially tried to delay the contracts when prices began to fall," said Zhu Xuesong, general manager of China operations at merchant Ecom Trading (Shanghai) Corp. "When prices really plunged, they were caught with losses" they found difficult to accept.

China's cotton imports fell 8 percent in the first 10 months of this year to 1.9 million tons, customs data showed.

Cotton users are halting orders from the U.S., the world's biggest exporter, at the fastest pace in at least a decade as the economic slowdown erodes demand from China.

Cotton Futures At 2001 Prices

China Synopsis

- China has passed a $586 billion stimulus plan.

- China needs to grow GDP at 8% but GDP is expected to drop to 5.5%

- Two-thirds of small toy exporters closed in the first nine months of this year.

- Textile manufacturers are reneging on cotton orders.

- The State Council has pledged “fast and heavy-handed investment” and a “moderately loose” monetary policy.

- China cannot get out of trouble by boosting its exports.

- Employment is being impacted by factory closures and many migrant workers are returning to their home towns

- The government response to rising unemployment is to prohibit companies from firing workers.

Decoupling Is Dead

Decoupling is clearly dead but one would not know it from headlines still preaching yesterday's news. Please consider Decoupling isn't dead: Emerging economies like China continue to cut into US lead .

Decoupling is the theory that emerging nations are increasingly weaning off US economic dependence and, thus, would weather an American economic slump better than in the past.

A retrenching US consumer "is totally irrelevant to China's investments in clean water, improved agriculture and better infrastructure," says Jim Rogers, the former hedge-fund manager turned global investor.

Peter Schiff, president of Euro Pacific Capital, offers a more severe assessment: "Everyone thinks the US is the engine, but it's the caboose just being pulled along. China and the others are healthy economies that foolishly loaned us their surplus capital that we squandered. But that doesn't reflect on the local economies. They're still intact. The factories are still there, the work ethic is still there, and they're not entirely dependent on the US for their own growth."

Question Of Timeframe

It's true that over time, China will become increasingly less dependent on the US. However the key is "less dependent" as it may take decades if ever for China to become independent.

And in the intermediate term, arguably lasting many years, Yuan bulls such as Jim Rogers need address the issue of sustainable Chinese GDP growth which is probably closer to 3.5% than the 8% needed to keep on the pace China wants.

Jim Rogers and Peter Schiff both conveniently overlook the enormous $586 billion in Chinese economic stimulus (printing) while harping on stimulus and printing in the US. In relative terms, the size of China stimulus is roughly 16% of its entire GDP, an enormous sum of money.

Calling the US the caboose at this stage in the game is downright silly. Perhaps that will be true 10 to 20 years from now or perhaps it will never be true, but investing for a long term thesis over the short to intermediate term is a recipe for disaster. Actual results prove as much.

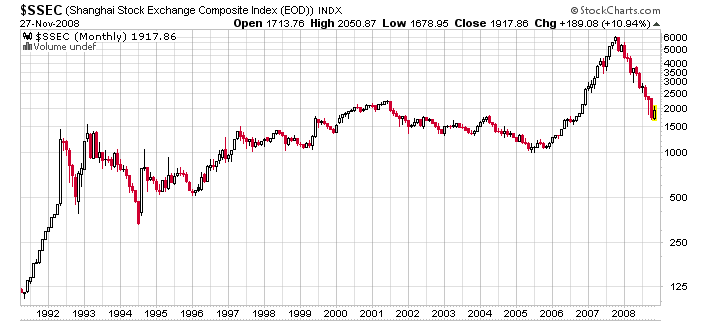

$SSEC Shanghai Composite Index

The Shanghai Composite Index after doing a moonshot in 2007 is now back below its 2000 yearly high. That's decoupling in reverse. And with sustainable Chinese GDP growth in question, don't expect another moonshot, although a significant bounce can happen at any time.

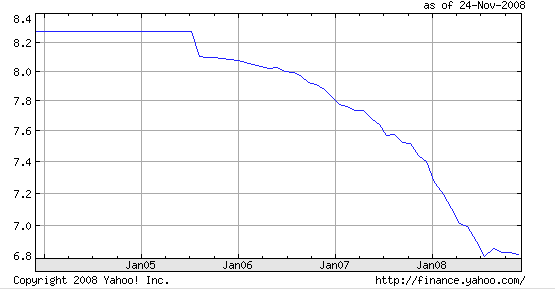

Renmimbi (Yuan) vs. U.S. Dollar Exchange Rate

The above chart courtesy of YahooFinance .

Since China removed the peg in since mid-2005 , allowing the RMB to fluctuate at a modest rate, the RMB has appreciated about 18% . If China allowed the RMB to float freely, it rather than the US dollar could conceivably crash.

For more on the China story please see:

- August 24: China's Olympic Sized Bust

- August 26: Is China's Growth Story Coming Unglued?

- September 2: China's Manufacturing Contracts for Second Month

- September 18: China, Russia Intervene In Equity Markets

- November 9: Peter Schiff Hugely Right, Enormously Wrong as Hard Landing Hits China

One simply cannot (rather I mean should not) harp on US economic weakness while ignoring the massive problems in China, the UK, the EU and in fact everywhere one looks.

I remind you of this statement: The State Council has pledged “fast and heavy-handed investment” and a “moderately loose” monetary policy .

I see no reason to be particularly bullish on China at this point. If China tries to expand at the same rate of growth it has for the last two decades, it is going to overheat. There are not enough jobs in China to support 8% growth without the US consumer. And in the near to intermediate term, the US is still the dog and China is still the tail no matter how much some people pretend otherwise.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.