U.S. Dollar Topping Action Intensifies, Sell Dollars into Strength

Currencies / Forex Trading Dec 15, 2008 - 11:37 AM GMTBy: ForexPros

The USD opens the week on a softer note and remains under light pressure at the start of New York trade. Overnight action was subdued with most of the action contained in Yen cross spreads after the release of Japan’s Tankan report; traders note that the report was very soft and below forecasts prompting some analysts to expect the BOJ to cut interest rates at some point soon. With rates at .3% from the BOJ it is difficult to expect that a rate cut would help much as the bank has held effectively a zero-rate policy since the 1990’s; USD/JPY is lower at 90.74 with highs at 91.37 and lows at 90.47 making for an inside range day with lower two-way action. Traders report bid interest on the dip to 90.50 area likely from option defense and profit-taking from shorts. Additionally, EURO/JPY was firmer after the Tankan report which helped to support USD/JPY.

The USD opens the week on a softer note and remains under light pressure at the start of New York trade. Overnight action was subdued with most of the action contained in Yen cross spreads after the release of Japan’s Tankan report; traders note that the report was very soft and below forecasts prompting some analysts to expect the BOJ to cut interest rates at some point soon. With rates at .3% from the BOJ it is difficult to expect that a rate cut would help much as the bank has held effectively a zero-rate policy since the 1990’s; USD/JPY is lower at 90.74 with highs at 91.37 and lows at 90.47 making for an inside range day with lower two-way action. Traders report bid interest on the dip to 90.50 area likely from option defense and profit-taking from shorts. Additionally, EURO/JPY was firmer after the Tankan report which helped to support USD/JPY.

Both EURO and GBP are steady to mixed with both pairs in technical two-way action. Traders note that both pairs have reached or held technical resistance or projections making the potential for a pullback a bit higher today. With light economic news for this morning traders will likely focus on firmer equities and how they respond to TICS and housing data today.

EURO rallied to a high print at 1.3500 before dropping back to test technical support at 1.3350/60 area; low prints at 1.3366. Traders note an Australian bank on the offer into the highs; the rate is firm after the offers opening New York around the 1.3450 area.

GBP held Friday’s gains initially for a high print at 1.5068 before dropping back with EURO; low prints at 1.4919 holding the 1.4900 handle on the dip. Traders note that the BOE is unlikely to support the falling GBP and cite room for further rate cuts after the first of the year are likely. If the 1.5000 fails to hold on a closing basis this week the GBP is likely to correct lower some analysts suggest.

USD/CHF continues lower, high prints at 1.1767 with lows at 1.1687 making a full retracement off the highs into technical support. Traders note that Gold prices may be finding it harder to move higher by year end keeping a bit of downward pressure on CHF; Oil is higher and they may be lending some pressure.

USD/CAD remains under pressure after Fridays’ dead-cat-bounce; high prints at 1.2467 with lows at 1.2280 making the pair technically weak in my view. After today’s news all eyes will be on the FOMC statement due Tuesday with most analysts expecting a rate cut but differ on the size of the cut. Consensus is for a 50BP cut this week. In my view, the USD is continuing to top but the bulls will likely make a try for gains near-term; any strength in the USD is a great sell in my view.

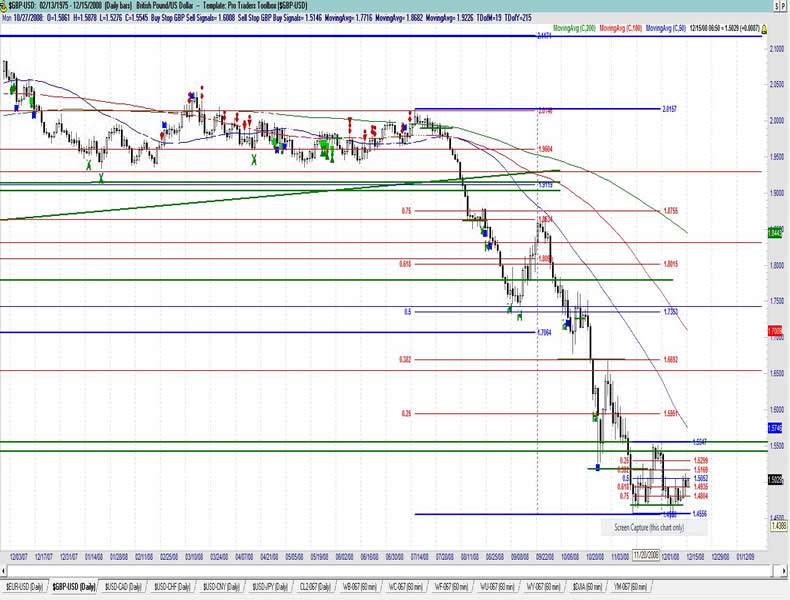

GBP/USD Daily

Resistance 3: 1.5150 , Resistance 2: 1.5100/10 ,Resistance 1: 1.5080 ,Latest New York: 1.5025

Support 1: 1.4850 , Support 2: 1.4740 ,Support 3: 1.4680

Comments

Two-way technical trade holds pair close to Friday’s action; lows holding at 1.4900/10 area. Bounce off early weakness suggests buyers are willing on dips; aggressive traders can buy the next dip in my view, look for prices around the 1.4780 area. Rally in EURO holds under pressure from cross spreaders; stops not enough to hold above 1.5050 area. Cross-spreaders likely keeping pressure on as GBP/EURO cross holds near lifetime high. Although close is above the 1.4850 area the failure at highs is a caution. Some spillover from EURO likely. Traders note solid two-way action. Sellers hold control above 1.5100 area so far; profit-taking likely to result in a squeeze on the further strength. Technical trade overnight again. Traders note liquidity is only moderate and still on the lower side.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP CPI y/y

4:30am GBP Core CPI y/y

4:30am GBP RPI y/y

Tentative GBP BOE Inflation Letter

EURO/USD Daily

Resistance 3: 1.3580 , Resistance 2: 1.3520/30 ,Resistance 1: 1.3500 .Latest New York: 1.3503

Support 1: 1.3360 ,Support 2: 1.3280 , Support 3: 1.3200

Comments

Rate scores new high overnight into early New York but sellers take a stand; likely stops building in size over the 1.3520/30 area. Firm NY open likely to attract offers if US data is USD-supportive. Close at 1.3380 area last week makes a seven week high close and argues for more upside coming but a correction is likely. Likely bulls will lighten up. OK to buy a dip on a test of 1.3080 area near-term; dips likely to be bought hard now that sellers couldn’t make a stand over 1.3000 with confidence on the three tries last week. Support also from cross-spreaders as they unwind Yen. Rate is an absolute screaming buy in my view—I can’t see further weakness being ignored by the buyers.

Data due Tuesday: All times EASTERN (-5 GMT)

2:45am EUR French CPI m/m

2:45am EUR French Final Non-Farm Payrolls q/q

3:30am EUR German Flash Manufacturing PMI

3:30am EUR German Flash Services PMI

4:00am EUR Flash Manufacturing PMI

4:00am EUR Flash Services PMI

5:00am EUR Employment Change q/q

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2008 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.