Don't forget your existing Cash ISAs

Personal_Finance / ISA's Apr 17, 2007 - 12:13 PM GMTBy: MoneyFacts

Rachel Thrussell , head of savings at moneyfacts.co.uk – the money search engine , comments: “As the new tax year begins, many of us will be shopping around for a home for our 2007/2008 ISA savings. But with up to eight years worth of ISA and the potential of up £9K TESSA contributions, your existing tax free cash savings pot could already be in excess of £33K, so it is equally if not more important to check you are getting the best possible deal on your existing savings too.

“Unfortunately its not as simple as looking for the best current deals, as almost all best buy rates won't accept transfers in (hence the ability to offer higher interest rates) and just under half of all ISAs currently available are open for current year's subscriptions only.

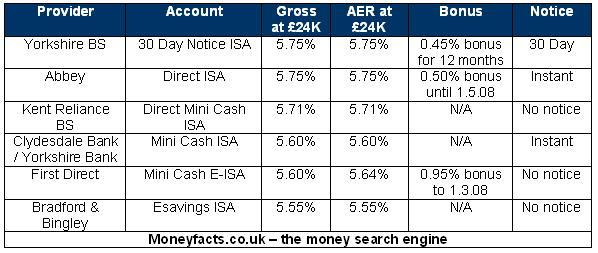

“However, there are still some great rates to be found. The chart below shows the best rates available for ISAs, which will accept transfers in for an investment of up to £24K.

“Investing your previous eight years' mini cash ISA allowance (£24K) at 5.75% will net you a yearly return of £1,380.

“To maximise your ISA returns, it is best to take advantage of the best current deal for your 2007 allowance, and move your existing contributions to the best possible provider, taking care to check your ISA rates at least once a year. Click here for current Best Buys http://www.moneyfacts.co.uk/savings/bestbuys/savings_mini_cash_isa.aspx

“Make sure you get the best rate on all your ISA accounts, both past and present. Transferring accounts is simple and your new provider will do all of the legwork for you – but don't make the mistake of taking the transfer process into your own hands as closing the account to transfer the funds over will invalidate your previous tax free allowance.”

By Rachel Thrussell

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.