False Deflation Diagnosis and Gold Bullish Crossover Signal

Economics / Inflation Jan 02, 2009 - 05:25 AM GMTBy: Jim_Willie_CB

One of the most bothersome questions from 2005 to 2007 used to be whether the Untied States would ultimately submit to inflation or deflation. This is actually the wrong question. Many analysts in my view are incorrect in their conclusion that the US suffers from a powerful deflation episode, since they endorse the wrong definition, confuse effect with cause (as usual), do not properly monitor the money flow, and then draw improper conclusions from prices. They suffer from a type of Keynesian Tunnel Vision. They are confused, and fail to adapt certain key measures after the financial sector highjacked the entire national system in the last two decades.

One of the most bothersome questions from 2005 to 2007 used to be whether the Untied States would ultimately submit to inflation or deflation. This is actually the wrong question. Many analysts in my view are incorrect in their conclusion that the US suffers from a powerful deflation episode, since they endorse the wrong definition, confuse effect with cause (as usual), do not properly monitor the money flow, and then draw improper conclusions from prices. They suffer from a type of Keynesian Tunnel Vision. They are confused, and fail to adapt certain key measures after the financial sector highjacked the entire national system in the last two decades.

If the tail controls the dog, then the movement of the tail must be properly monitored in the data. They add to the murky waters emanating from US Fed marble-laden offices, and from USGovt agencies marred by clownish ineptitude. A divorce has occurred by the paper price of gold from the pure physical price. That is your loud unmistakable late signal of a system in a very important transition, where past indicators MUST be adjusted, so as to adapt to a new bizarre corrupt system. If deflation has won, the gold price would be closer to $500/oz than $800/oz, and surely would be to the 1995 price levels, like the housing sector. The iron rule of paper is in the process of yielding to a new power. It will be dictated by foreigners, and will involve a new monetary system linked to gold & silver just like before 1971 when the fatal schism occurred.

In my view, the entire topic of inflation is intentionally obfuscated by the economists at work across the entire financial sector spectrum. They prefer to maintain a high level of ignorance among the public, and of confusion even among the analysts, so that the USGovt officials and Wall Street bankers can continue to steal savings via confiscation by inflation, all without any formal tax levy and without any legislation in support. Worse, inflation is blessed as good, which actually enables those Elite in Power to continue vast counterfeit rings. Their vehicles are USTreasury Bonds, Fannie Mae bonds, Congressional appropriations, and sacred USMilitary budgets, each of which has had almost zero enforcement. It is my contention that each has been a principal part of syndicate activity, sanctioned and protected by USGovt agencies and US Financial titans, along with lapdog regulators. Generally, the dumber the nation remains, the more the Elite can continue to ply their privileged trade.

The era of paper pusher domination is gone, as Wall Street gradually will resemble a Ghost Town that mirrors suburban residential foreclosure blight. The nation has probably never been more ignorant on matters pertaining to inflation in its history, as it is now. The next stage will feature grand exposure of lies, fraud, deceit, and corrupt relationships including routine bribery, insider trading, and counterfeit rings.

The penalty suffered is a wrecked nation, and inevitable lost sovereignty. When foreigners own over half the national debt, and the US Economy is in tatters, and the US banking system is both dysfunctional and in failure mode, foreigners have the right to take control. They will do so. The arrogant will be swept aside as thoroughly as the billionaires will be ruined. If you think such words are wild and silly, just wait and watch! Receivership committees are being formed in foreign lands, but they must contend with military threats. Numerous bilateral trade agreements are being hammered out, designed to circumvent the corrupt paper price systems in US & UK control. Times are changing, and the door is open for some degree of colonization. Wealth will flow in the direction of those prepared. Owners of actual gold & silver, as well as crude oil & natural gas, will lead the next era.

INFLATION OR DEFLATION ?

Most one-word answers are replete with ignorance, usually revealing big blind spots. The simple answer is that the overall US Economy, complete with its cancerous Financial System, is enduring both inflation and deflation simultaneously. Inflation is defined as the growth of the monetary base (money supply) beyond the growth of the economy itself. Why smart people cannot grasp this is beyond me. Many smart analysts often forget it, or unlearned it. They insist on the official distraction definition of rising prices, which is NOT inflation. Instead, fast rising prices is a typical symptom of inflation, one of its effects, but not during a credit collapse like now. If focus is given to various classes, then the contrast of rising and falling prices is more clearly seen. Until late 2006 and early 2007, residential property was rising in price.

But since then, property prices have been falling. Energy prices experienced a blow off top in summer 2008, but now are in decline. Wages were rising gradually also, but now are somewhat flat. Stocks peaked in value in October 2007, and have crashed worse than any 12-16 month period since the Great Depression. Asset backed bonds were rising in value until 2006 also, as in mortgages, but have fallen in a manner better described as a tumultuous tragic crash. Prices are indeed falling for many groups, but from credit collapse and credit restriction. However, inflation continues, as in monetary inflation. But the two chambers of the real tangible economy and financial sector expose a split in inflation symptoms recently.

The most queer asset class nowadays involves the USTreasury Bonds. They are now experiencing their own blow off top, closely associated with what my analysis has called The Dollar Death Dance. As long as the US Economy continues in decline, as long as the corporate failures continue, the US Dollar will show strength. Given the colossal amount of funding necessary for the wide assortment of bailouts, rescues, stimulus packages, and nationalizations, with price tag over $8500 billion, the USGovt and US Fed have a powerful motive to doctor a USTreasury rally. This accomplishes two purposes. It encourages a flight into the frying pan, errrr flight to quality, which renders the supply as huge. It also lifts the bond principal prices, and reduces the yields paid to investors both domestic and foreign. The USTBond complex exposes an utterly huge money flow, which must be incorporated into money velocity data. It probably is not, by deflationist theory advocates.

Never overlook the corruptive influence at the COMEX for setting prices for important commodities like crude oil, natural gas, gasoline, gold, copper, and more. What used to be a formal price discovery mechanism and market system has turned into a thoroughly corrupt system of price control with leverage, fully ordained, fully approved, and fully protected by the titans who run USGovt financial policy. See Goldman Sachs and JPMorgan, two firms more responsible for the near collapse of the nation than any others. These two firms still remain highly revered, and remain fixed in control of bailout funds despite their responsibility in massive fraud. This juxtaposition in my view serves as loud confirmation of both investment community ignorance and controlled news reporting. These two firms are agents to control and interfere with market price systems, with full privilege both to benefit from insider trading and control most policies regarding rescues. They in all likelihood manage either the counterfeit operations or the money flow spun from them. This comes with the right to determine which firms are saved, which are killed, together with which hedge funds are denied credit and liquidated, when positions oppose the titans.

They made orders to halt shorting of bank stocks illegally. They objected to naked shorting, when they are prime perpetrators. Some call this a free market. Actually, the US financial system has never been more distorted, controlled, tampered, doctored, corrupted, and coordinated with official policy in the nation's entire history. The officials from the USGovt in charge of financial policy have given blessing to the titans at Goldman Sachs and JPMorgan to engage in financial genocide, directed against both the public investment accounts and hedge fund accounts. At times they employ the regulators for big assists. One should suspect that their detailed and protracted efforts are aligned closely with the consolidation of bank power. Refer to the nine select banks as part of the US Federal Reserve system. Rare is criticism on financial networks. The worst one might see is criticism over losses, not deeply engrained corruption.

My longer answer, more like filling in the background, is that inflation is the PRIME DIRECTIVE of the US Federal Reserve, whose chairman deserves the title of Secretary of Inflation. Inflation is still the order of the day. One can actually argue that the entire US Economy is a gigantic Ponzi Scheme, fueled by USTreasurys, now come unglued. In fact, with the Weimar-like explosion of monetary inflation has come more confusion, even within its proper definition. The private sector, often called Main Street, where people live and work, businesses operate, commerce directed, is being drained of money supply to some extent. Credit flow is being restricted, by order.

Despite all the hoopla of the US Fed flooding the system with money, the august central bank is draining the private sector in order to subsidize Wall Street in a final explosion of fraud, before the New Administration. Git while the gittin' is good! Expect very little in the way of change, and never confuse transition with change. With an insider Geithner at Treasury Secy, and with Bernanke to continue as US Fed Chairman, expect little change. Also, with Gates continuing as Defense Secy, an unprecedented decision, expect only cosmetic change to the war effort. At least the shady but revered Goldman Sachs is not in charge at Treasury anymore, an event whose importance has yet to be determined.

The nation is slowly coming to grips with how broadly the dependence upon home equity was for several business sectors. My view all along has been that the US Economy had a lethal dependence upon the housing bubble, and when it burst, the entire US Economy would enter seizures, suffer from vicious cycles, and next enter a powerful disintegration phase. Retail centers, travel agencies, boating ventures, education, furniture stores, home supply centers, restaurants, bookstores, these are all facing near death experiences. The car industry plight has captured most of the current attention. A sad factor has come to light. If countless car supply firms are not bailed out, given massive assistance, and kept alive, then the Detroit car makers will die anyway from lost industrial supply chain starvation. Few are associated with the United Auto Worker union in the new Delphi was.

DRAINAGE & MORAL HAZARD

Over $700 billion in Cash Management Bills have been sold into the credit market, which is testimony to the drain of funds to cover some of the lending facilities, which have to date subsidized massive fraud and failure on Wall Street. The other phenomenon important in the process has been the informal order by the US Fed not to lend. Just this week, a subscriber to the Hat Trick Letter wrote to share information that his son in North Texas cannot obtain a development loan from his bank. The bank actually told him that land cannot be used as collateral in loans, BY ORDER FROM THE USFED ITSELF. Where is such information promulgated on the news networks? Banks are accumulating large amounts of funds, and not lending them to the people.

My conclusion is that the US Fed and the Federal Reserve Banks themselves are orchestrating a collapse of sorts for the US EconomyTheir purpose is unknown, but if the Great Depression Era is any teacher, this elite group of banksters harbours great lust for consolidated power. My conjecture is that they will purchase large slices of various asset groups at cheap distressed properties. The other purpose is to encourage the many private banks to engage in a basic form of carry trade. From their vast growing hoard, they borrow short-term money at the official near 0% rate, and invest in long-term USTreasurys at the higher rate. This carry trade has pushed the long rates down from 4% to 2% in amazing fashion. Like the 2002 episode urged by Greenspan, long-term rates are being directed lower, in order to aid the mortgage industry and housing market.

Moral hazard has permeated all chambers once again, a totally embraced policy, the inexorable step that Bernanke promised would never happen. Refer to the near 0% official rate. The US is so so so lost on a path into darkness. Why? Because the very cause of bubbles and their bust is once again official policy for remedy. What lunacy amidst desperation!!! Jack Daniels is served for free once again, to supply the hopeless alcoholic. Few seem to realize that the climax of a fiat system is the proliferation of crime syndicates engaged in counterfeit and fraud, whose assured systemic ruin assures myriad seeds planted. The new shoots lean toward the sunlight but coupled with violent change. Those who push for change will be labeled enemies of the state. We are witnessing the failure of the nation.

DEAD BANKS

THE END RESULT ON THE PRIVATE SECTOR SIDE IS THAT THE MONETARY BASE IS FLAT, FROM OFFICIAL NUMBERS. THE MECHANISMS THAT CONVERT BANK RESERVES INTO BORROWED MONEY, THEN LENT IN LOANS, PRODUCING ECONOMIC ACTIVITY, IS EITHER BROKEN OR SUSPENDED. Be sure to know that the new hoard of bank reserves is a pure US Fed donation, from swapping worthless garbage bonds for USTBond mere paper. This is only half the story though.

For a concise interview, see the iTulip article entitled “Major US Banks Worse Than Japan's Zombies” (CLICK HERE on Fred's piece). An anonymous industry insider Dr Banker is interviewed. The guest claims the massive blood infusions have failed to revive the defunct banking system . “The transfusions usually take two to six months, and typically six months or so after the crisis is over, are gradually withdrawn over a period of several months to return total money in the system to pre-crisis levels. My theory is, and I admit not everyone will agree with it, is this: the patient is dead

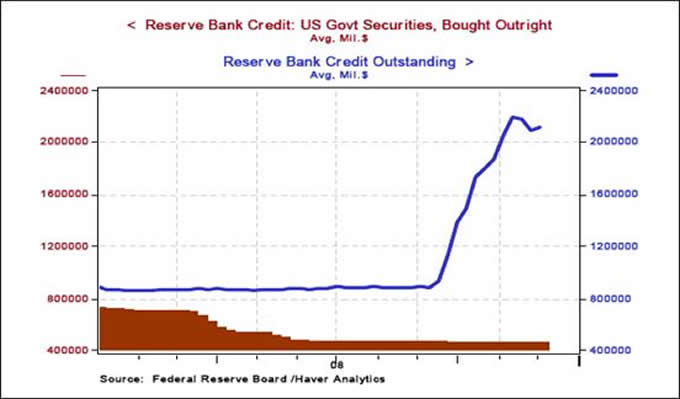

They can keep the intravenous tube hooked up to a pint bottle or a 100-gallon drum of blood, but it does not matter if the blood is not circulating through the patient , so he can take it in… Note that many smaller banks that do not operate as part of the Fed system are working just fine… The reason: Credit Default Swaps. It is now well understood that CDS are at the root of today's financial crisis. Your readers have known that risk since 1999… Some have suggested the simple expedient of canceling them all, declaring all of the CDS contracts null and void. CDSwaps certainly killed [the patient] but removing them is no cure.” Dr Banker went on to explain how in the last ten years, Credit Default Swaps have sustained the US banking system. Their liquidation would require the write down losses of between $5 and $10 trillion. See the transfusions in the chart below. Bank loans are not forthcoming. The system is defunct.

CDSwap trades are integral to the US Economy Do deflation theory advocates acknowledge this or factor them into their data? Certainly not. They are often Keynesian's who do not adapt to changing times. Imagine not counting a flow of funds in the money velocity data. Such practice is simply bad arithmetic. It is like not counting the midnight raids to the fridge for ice cream in the calorie intake calculus.

COMMENTS TO THE DEFLATIONISTS

Deflationists are totally pre-occupied by the standard sources of data. They are overly focused on the tangible economy, with a blind eye on the financial sector. Times have changed in a revolutionary manner, enough to require the entire deflation topic to widen its scope for detailed study. The ordinary economic manuals should be either updated, or sent to the dustbin. The entire economic and financial system has been turned upside down. This requires analytical methods to adapt or become useless, giving off entirely wrong indicators, resulting in downright wrong conclusions. Most analysts, even the best, have not adapted. They are thus wrong-footed, since the landscape has shifted from under their fixed feet.

Rick Ackerman is held in high regard, a fine analyst, a great technician. He is on my short list of required reading, who lifts my level of comprehension without exception. He has indeed been warning about severe price declines in broad asset classes for a full decade. However, that aint deflation . He has warned also about credit collapse, with full accuracy. However, that would qualify as deflation if not for over $8 trillion in expanded bond creations . Amidst a decade of huge monetary inflation and spectacular unbridled credit expansion, the fools at the US Federal Reserve, US Dept Treasury, and leading Wall Street firms have succeeded in producing a crash that has destroyed at least $6 trillion of value in financial assets, which offset the additional $6 trillion at least in property equity value. They also killed Wall Street itself.

The nature of their fool status is a unique combination of stupidity (no learning from the past), reckless risk management, corruption, bond fraud, and arrogance that is closely linked with running a monopoly of power and influence. One might better describe them as parasites inflicting a cancer upon the nation, having taken control of brain functions. Their risk models have served as phony brain synapses within the banking system. THESE CORRUPT INFLATION ENGINEERS HAVE KILLED ASSET VALUES WHILE CONTINUING TO PUMP PRIME VIA THE INFLATION MACHINERY. The system is near dead, if not dead. The banks are insolvent, and the households are insolvent. A failed state is emerging.

Ackerman states steadily in his work that the money supply is flat to down. Ackerman also points out that money velocity has slowed considerably. He relies upon these two pillars to make his argument for deflation as the prevailing phenomenon, pointing to prices fallen in a broad sense. Pardon my very succinct summary. It is not for me to cite his work in full. My motive is to cite a position that is gaining popularity, wrong-footed in my view. In his private work, he takes exception to being called a ‘Wrong-Footed Deflationist' in response to my recent article in late December. He claims our differences are semantics, to which another disagreement comes.

Three big phenomena on my radar must be identified in order to present the titanic struggle accurately. The second cited item exposes the primary flaw in the deflationist argument concerning the monetary aggregate. The third item exposes a paradoxical flaw since it centers upon gold itself. My role is not to take umbrage, but rather to engage the debate. Mike Shedlock also has too narrow a view of events, and regards deflation as having taken victory laps. He too makes improper interpretations, since too focused on the tangible real economy, without valid incorporation of unorthodox financial data. The analysis of monetary matters, such as inflation versus deflation, must take into account the ‘Double Booking Economics' very carefully. See the Shadow Banking System, and bring them into the analysis. CONCEPTS LIKE MONEY VELOCITY MUST ADAPT OR BECOME IRRELEVANT. Many monetary tectonic shifts have occurred, which must alter the analysis.

First is the reduction of money flow within the private sector, as a result of sharp reduction in credit creation in packaged loans. This applies to the sector outside Wall Street and the satellite markets upon which they exert their criminal fraudulent influence. No dispute here, since evidence abounds on reduced bank credit to both households and businesses. The loss of home equity, like $6 trillion in two years, has led to a truly mind boggling reduction of collateral to extract spendable money. The loss of stock valuation has also removed a key source from which to extract cash. The entire Cash Mgmt Bill activity has worked to neutralize the flood of US Fed Lending Facility activity for the benefit of New York firms. The public seems totally unaware of the huge drainage.

Second is the staggering explosive growth in the credit derivative market since the mid-1990 decade. In just the last few years, the growth of credit derivatives, traded over the counter, has been enormous. This is widely recognized. The annual growth levels lie in the 40% to 60% annual range. How can the deflationists ignore this? THIS IS MONEY IN FLOW, NOT COUNTED BY DEFLATIONISTS IN MONEY SUPPLY DATA. It is an important blind spot of theirs! Do they not call it money when gigantic swaths in the billions are traded, and enter the bank systems via the back door, recorded off balance sheet (read: double booking), but used in the flow of operations? Dr Banker claims the entire US banking system has depended vitally upon such flow of funds in order to conduct a decade of bank operations! Furthermore, the credit derivatives contracts represent a perverse cancer of money itself. Cancer must be accounted for. Does a sick man weigh less officially, after discounting the cancer tissue? No!

Third is the continuing powerful upward thrust in the open interest and trading activity of gold & silver futures contracts. During the summer and autumn of 2008, the gold & silver phony paper prices declined by 25% and 50% respectively. Price movements were dominated by heavy futures contract activity by the elite Wall Street firms. See JPMorgan, which registered a 50% rise in their short positions. THIS IS MONEY FLOW, NOT COUNTED BY DEFLATIONISTS IN MONEY SUPPLY DATA. It is an important blind spot of theirs! Do they not call gold money? What irony! They argue the merits of a gold-based system. They decry the corrupt monetary base in a debt foundation. Yet they fail to recognize gold trading hands in mammoth transactions, not acknowledged as money flow. In fact, the trading of gold is 10 times in turnover per ounce of gold (see LBMA data), generating fees, and forcing tax payments. Its commerce is undeniable. Movement of metal to and from vaults is evidence of money flow.

GOLD DENIES DEFLATION

The picture presented in the gold chart does not confirm the deflation thesis. If deflation were a powerful new force, then the resistance at 700 to 730 would not have held ground. In fact, the gold price has fluctuated around the mid-level profit taking zone between 790 and 830, set in late 2007. The deflationists observe a broad liquidation of hedge funds, of speculative positions, in an environment of tighter credit and profound bank system distress, and conclude a deflation event, in total confusion. They must explain why the gold price has not returned to the 2004 price, like crude oil has! We are seeing mammoth monetary inflation amidst mammoth assaults in commodity prices, enforced by mammoth assaults on private accounts (hedge funds), during a period of mammoth credit restriction. THAT AINT DEFLATION. Notice how the gold price has risen precisely when industry collapse has hit the newswires in the last few weeks. See the retail and car industries. If deflation were in the driver's seat, gold would be closer to 700 than 900, and technicals would be showing bearish signals, not bullish.

Meanwhile, the buck is stuck in the middle of nowhere. The US Economy stinks on ice, having entered a zone better described as disintegration, with numerous sectors hoping to avert actual collapse. The banking system stinks on ice, unsure of its solvency, hoping it can resort to sanctioned fraudulent accounting in order to continue zombie lending operations. The newest bubble on the endless highway of US bubbles is the US Treasury Bond itself. It is inconceivable that foreigners will be willing to pay top prices for bonds yielding nearly 0% anchored to a US Dollar grossly overvalued.

The US Dollar will offer very little to prevent the gold price from moving higher, step by step, as the switch is turned on by the Elite in Power. The clutch is soon to be released. Traction from the monetary inflation engine will result in long ugly black rubber tire patches. Gold will respond to the switch turned on. Then the deflationists will be silent, and their wrong-footed analysis will be forgotten.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” (ShawnU in Ontario)

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK.” (JanB in England)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” (RobertN in Texas)

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street.” (GeorgeC in Minnesota)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.