U.S. Dollar Continues Firmer Trend

Currencies / Forex Trading Jan 13, 2009 - 11:37 AM GMTBy: ForexPros

After starting better this morning after a firmer overnight session the USD ends mixed as technical two-way action and thin conditions continue to dominate near-term. Traders note that some price action was “unexplainable” today, such as a fast 80 point rally shortly after the London fix in EURO which immediately fell back but the damage was done; the 1.3400 handle traded and that is important to the chart-watchers after the low prints at 1.3289 traded early in the day. Aggressive traders can buy EURO on any test of the lows under the 1.3300 area in my view.

After starting better this morning after a firmer overnight session the USD ends mixed as technical two-way action and thin conditions continue to dominate near-term. Traders note that some price action was “unexplainable” today, such as a fast 80 point rally shortly after the London fix in EURO which immediately fell back but the damage was done; the 1.3400 handle traded and that is important to the chart-watchers after the low prints at 1.3289 traded early in the day. Aggressive traders can buy EURO on any test of the lows under the 1.3300 area in my view.

GBP continued to soften as well but held lows around the 1.4800 area; low prints at 1.4811; overnight highs remained unchallenged in New York trade at 1.5179. Traders note some stops on a break of the European low around the 1.4900 area with cross-spreaders likely the main interest.

USD/JPY made new lows during the day at 88,87 and remained in the low 89.00 area afterwards; weak equities certainly contributed to the weakness as the DJIA had triple-digit losses but likely technical factors helped as the 89.00 area rumored to have option defense in that zone. Traders note that USD/JPY remains the firmest currency on the board and likely will press for an attempt at new lows near-term.

USD/CHF failed to follow the volatility seen in other pairs, although a new low in New York was traded. High prints at 1.1244 went unchallenged and lows at 1.1096 were not enough to break the pair out of last week’s ranges. Volumes were low as they were in other pairs but additional pressure was seen from the metals complex; gold off sharply on the day. The big mover to the upside today was

USD/CAD; high prints at 1.2177 found stops above the 1.2050 are and 1.2100 area of technical resistance; the rate settled firm on the day near the highs helping to sketch out a potential wedge pattern in the daily charts. Aggressive traders shorting the rate likely have been stopped out on the move and a test of the next level of resistance likely another sell. In my view, today’s action was exaggerated price moves due to thin conditions. Tomorrow will likely have thicker volume and with most pairs having cleared a lot of stops a reversal could be in the works.

Expect a USD follow-on rally in Asia as Japan gets back to work after the minor holiday yesterday. Volumes should drop off ahead of US data in the morning. Look for two-way action to continue.

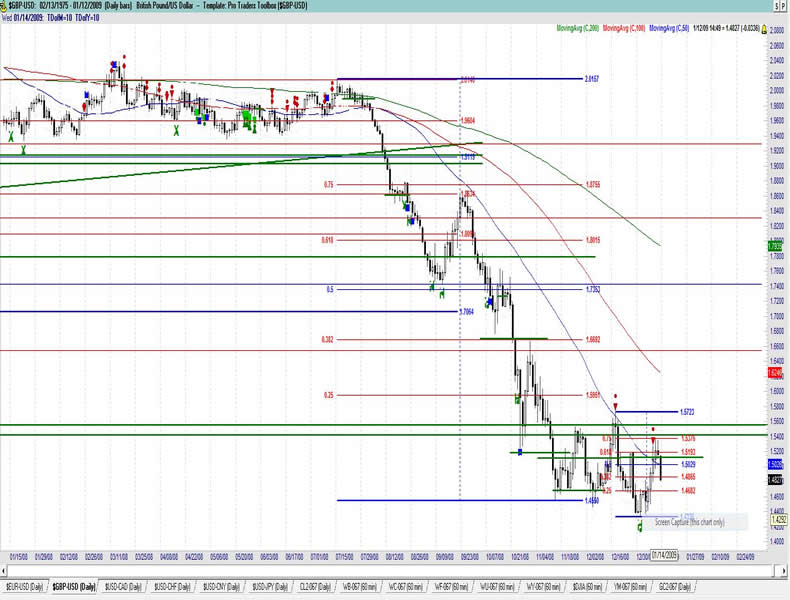

GBP/USD Daily

Resistance 3: 1.5480 , Resistance 2: 1.5420 , Resistance 1: 1.5350 , Latest New York: 1.4826

Support 1: 1.4800/10 , Support 2: 1.4760 , Support 3: 1.4720

Comments

Rate falls back to start on follow-on selling; cross spreaders still pressuring EURO/GBP spread. Spillover from EURO likely but action still technical. Stops noted under 1.5100 and 1.5050 area; more likely under the 1.4980 area. Rate recovers from lows in early New York to trade back above the 1.5000 area. Stops above the market likely now in the 1.5180 area or above as late traders place risk close-in. Bears took a stand above the 1.5250 area last week; likely they will be back again so look for two-way action near-term. Sellers likely active suggesting a dip back to potential support around the 1.4700 area although a close over 1.5100 today might negate that. Two-way and firmer action due to cross-spreaders liquidating EURO-Sterling; repatriation also lending to the firm tone.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Trade Balance

4:30am GBP DCLG HPI y/y

5:00am GBP CB Leading Index m/m

EUR/USD

Resistance 3: 1.3850 , Resistance 2: 1.3800 , Resistance 1: 1.3750/60 , Latest New York: 1.3379

Support 1: 1.3280/90 , Support 2: 1.3250 , Support 3: 1.3200/10

Comments

Rate two-way but falls through stops to make double-bottom at monthly support; rally back over the 1.3400 handle quickly suggests the bears are losing control from above the market and the dip may have been a technical correction. Super-fast correction after making lows was a “drive-by” traders say. Cross-liquidation continues. Rally back as official bids absorb offers under the 1.3350 area. Sovereign offers seen into the highs last week traders say but those may be covering into the dip this morning. Traders note sovereign offers seen above the 1.3640 area again and this time the sellers are winning. Aggressive liquidation by EURO-Sterling cross spreaders providing the main selling. Technical levels around the 1.3300 area are firm; look for a solid bounce from here. Correction lower is likely near its end, likely at a buy point on this dip to start the week.

Data due Tuesday: All times EASTERN (-5 GMT)

2:00am EUR German WPI m/m

2:45am EUR French Gov Budget Balance

4:00am EUR ECB President Trichet Speaks

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.