British Pound Falls Sharply Across the Board

Currencies / Forex Trading Jan 14, 2009 - 09:56 AM GMTBy: ForexPros

The USD continued to grind higher finding light stops in thin volume as the Majors retreated during New York trade. As equities sold off after the release of better-than-expected Balance of Trade data this morning USD/JPY rose to 89.89 high print before dropping back slightly to hold back above the 89.00 handle for most of the day. High prints were only challenged once as the rate was unable to hold the 89.00 handle into the close suggesting that short-covering has not provided enough impetus to hold the rate firm off the 2008 lows; traders now expect the rate to challenge the 87.00 handle near-term before making for a new 2009 low.

The USD continued to grind higher finding light stops in thin volume as the Majors retreated during New York trade. As equities sold off after the release of better-than-expected Balance of Trade data this morning USD/JPY rose to 89.89 high print before dropping back slightly to hold back above the 89.00 handle for most of the day. High prints were only challenged once as the rate was unable to hold the 89.00 handle into the close suggesting that short-covering has not provided enough impetus to hold the rate firm off the 2008 lows; traders now expect the rate to challenge the 87.00 handle near-term before making for a new 2009 low.

In my view, the rate will likely make lows for the year soon but I expect a short-covering rally to squeeze out the late shorts first. GBP continued to drop as cross-spreaders continued to buy the EURO/GBP rate; low prints in GBP at 1.4475 as stops under the 1.4520 area triggered. Traders note volumes remained low despite the interest from the sell side.

EURO continued to drop as well following GBP lower for a low print at 1.3140 with stops under the 1.3200 and 1.3180 area triggered; traders again expect lower prices with the next technical target near the 1.3000 area. Both EURO and GBP are under technical pressure now that important tech levels fell today; aggressive traders who are looking to get long should hold aside near-term and wait for the next tech level in both pairs.

USD/CHF is holding under tech resistance at the 1.1250 area with a high print at 1.1254 before dropping back under the 1.1200 handle; upside resistance appears firmer in this pair. USD/CAD failed at 1.2350 area with a high print at 1.2342 before dropping back under the 1.2300 handle and is a full big figure under at 1.2243 into the close. Traders note that the tech picture looks more toppy in the minor pairs suggesting that the USD may trade sideways for a day or two before a pullback is attempted.

For the most part, today’s USD action was on lower volume despite larger volume around the release of US data this morning. In my view, a low volume rally is usually followed by a pullback of some kind but with USD sentiment still firm into the start of the year more upside may be in store; the USD has some serious resistance ahead and it would be reasonable to expect a pullback from recent highs if we return to there. Look for the USD to follow through with more gains overnight and then a return to two-way action as cross-spreaders continue to sell GBP across the board.

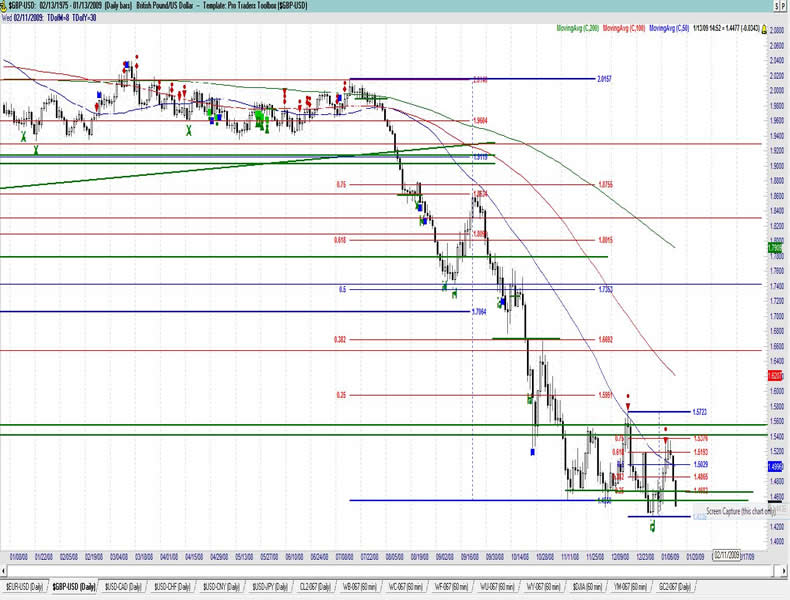

GBP USD Daily

Resistance 3: 1.5000 , Resistance 2: 1.4950/60 , Resistance 1: 1.4880

Latest New York: 1.4471 , Support 1: 1.4470/80 , Support 2: 1.4450 , Support 3: 1.4400

Comments

Rate continued lower into next support level before a “dead cat bounce”. No sign yet of the bottom firmly in after failing to hold the 1.4500 handle during the day. Cross-spreaders continue to sell GBP across the board. 2008 lows likely target but sellers are drying up in my view as volumes have been light on this break. Spillover from EURO likely but action still technical. Bears took a stand above the 1.5250 area last week; likely they will look to cover into significant lows—look for two-way action into this bottom. Sellers likely active suggesting a dip back to potential support around the 1.4500 area; but a short-covering rally is increasingly likely now. Two-way and firmer action due to cross-spreaders liquidating EURO-Sterling; repatriation also lending to the firm tone.

Data due Wednesday: All times EASTERN (-5 GMT)

NONE

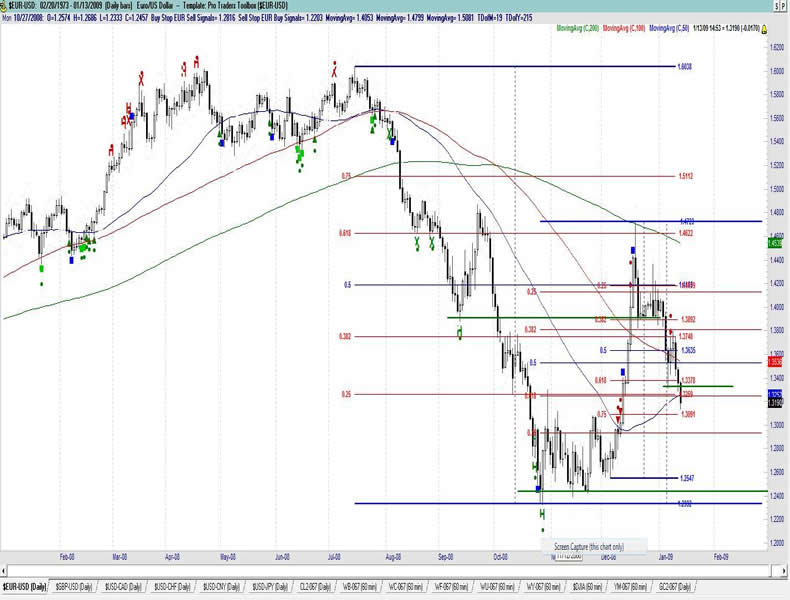

EUR USD Daily

Resistance 3: 1.3500/10 , Resistance 2: 1.3450 , Resistance 1: 1.3380

Latest New York: 1.3190 , Support 1: 1.3140 , Support 2: 1.3080 , Support 3: 1.3000/10

Comments

Rate two-way but falls through more stops to make a bottom under monthly support; 50 bar MA failed to offer solid support. Cross-liquidation continues. Rally likely bids absorb offers under the 1.3300 area. Sovereign offers seen into the highs last week traders say but those may be covering into the dip this week. Aggressive liquidation by EURO-Sterling cross spreaders providing the main selling. Technical levels around the 1.3300 area are firm; look for a solid bounce from here. Correction lower is likely near its end, likely at a buy point on this dip to start the week but some momentum still there for lower action.

Data due Wednesday: All times EASTERN (-5 GMT)

2:45am EUR French CPI m/m

4:00am EUR Italian Industrial Production m/m

5:00am EUR Industrial Production m/m

Join us for the Afternoon US Dollar Wrap-Up daily at 3:15 pm Central/Chicago time (GMT -6)

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.