Currency ETF Trends and a Flawed Monetary System

Currencies / Fiat Currency Jan 21, 2009 - 06:17 PM GMTBy: Tim_Iacono

Surely, at some point in time, some group of wise men somewhere will finally get together and realize that, during an era of excessive speculation, a monetary order where half the world's money floats freely and a good portion of the rest is rigidly fixed to the U.S. dollar is not an optimal system.

Surely, at some point in time, some group of wise men somewhere will finally get together and realize that, during an era of excessive speculation, a monetary order where half the world's money floats freely and a good portion of the rest is rigidly fixed to the U.S. dollar is not an optimal system.

News comes today that the British pound, a high flier not more than six months ago, has hit a seven-and-a-half year low against the greenback as the U.K. government ratchets up its government rescue plans for the nation's banking system.

Bank of England Governor Mervyn King noted yesterday that monetary policy alone will not cure the present economic ills (translation: borrow and/or print more money) and speculation is increasing that, with unemployment rising sharply and home prices falling at an even faster pace, data to be released later in the week will indicate that the economy is undergoing its sharpest contraction in 30 years - maybe longer.

Naturally, currency traders have seen fit to sell the British currency and buy something else, the Japanese yen and the U.S. dollar, where economic ills are nearly as bad, being the least offensive alternatives.

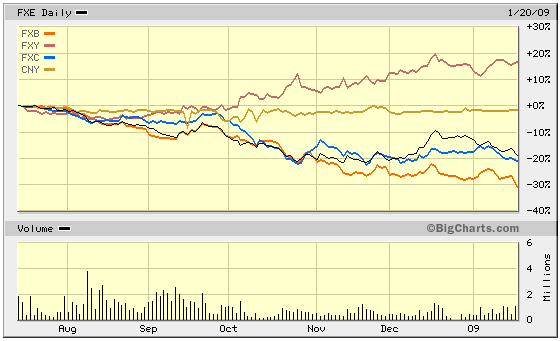

In chart form, the last six months look like this, the five currency ETFs shown below representing (from top to bottom in the legend to the left) the euro, the pound, the yen, the Canadian dollar, and the Chinese Renminbi versus the U.S. dollar (for a complete list of currency ETFs, see this item at Stock-Encyclopedia.com ).

The other massive problems of the global economy notwithstanding, how could those in the business of doing international business possibly develop a reasonable business plan when they're not sure if one currency or another is going to be up or down 20 or 30 percent over the next half-year.

It makes currency pegs, like the one seen above for the Chinese, seem a quite reasonable response to the condition where there are no "anchors" to the global monetary system other than the U.S. Dollar, which has its own share of problems, but, today, is apparently perceived as less flawed than most others.

Of course, that may change tomorrow.

At the moment, there are real and growing fears that the decline in the British currency has become too "disorderly", Ambrose Evans-Pritchard of the Telegraph noting yesterday that "the latest dive has a very malign feel."

The fear is that currency "traders", who apparently serve some sort of a useful purpose in the world by rewarding currencies of more deserving nations and punishing those where the economy and/or financial system are struggling, may be set to punish the pound a bit more.

Maybe a lot more.

Meanwhile, once high flying currencies in tiny countries such as Iceland and New Zealand remain basket cases and there are rumblings that Spain, Italy, Greece, along with Ireland may not last much longer within the harsh confines of the Euro where monetary policy is formulated by stern Germans and French.

The source of all the recent problems has to do with debt - too much of it.

And much of this debt was accumulated due to the very nature of the current world monetary order - financed by money from massive trade surpluses in Asia and the Middle East where currency pegs are the norm, some nations in the West developed even more massive credit and housing bubbles that have now burst.

With a better global monetary system, many of the world's current problems would not have been possible.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.