U.S. Dollar Stalling as Commodities Bull Market Returns

Currencies / US Dollar Jan 26, 2009 - 08:39 AM GMTBy: Donald_W_Dony

Many investors that I have spoken to have moved away from the powerful but volatile commodities market after the cliff-dive drop that occurred in the second half of 2008. Other investors are waiting on the sidelines for the global economic expansion to develop which will bring inventory levels down and prices up. Yet, the underpinnings for the next upward leg of natural resource prices is already in play and leading indicators are starting to break to the upside.

Many investors that I have spoken to have moved away from the powerful but volatile commodities market after the cliff-dive drop that occurred in the second half of 2008. Other investors are waiting on the sidelines for the global economic expansion to develop which will bring inventory levels down and prices up. Yet, the underpinnings for the next upward leg of natural resource prices is already in play and leading indicators are starting to break to the upside.

Though world demand for commodities has clearly contracted over the last 6-7 months and the forecast for the bottom of the global economic downturn from most leading economists is still 6-12 months away the key pieces for the rise have already been laid and the triggering mechanism pulled.

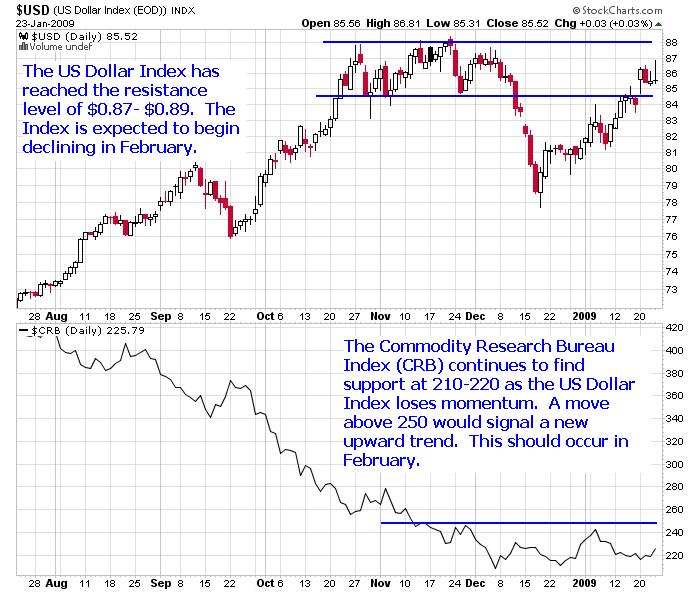

The U.S. dollar plays a very important role in the fledgling phase of the bull market. Long before growing fundamental demands drag inventory levels downward, the trading direction of the American currency triggers the near-term movements of the commodities market.

The U.S. dollar is largely driven, over the long-term, by its fundamentals. And the mounting deficit is clearing negative. During the last decade, the national debt for the U.S.A. has grown to represent about 60% of its GDP. This is in comparison with Brazil at 52% and Mexico at 24%. This immensely heavy burden has pulled the Greenback down from $1.20 in 2001 to almost $0.70 in 2008. Recent short-term flight-to-safety mentality has propped-up the dollar to the $0.89 level, however with near zero percent interest, $10.6 trillion in debt plus an additional $800 billion to $1.2 trillion coming from the bailout and the proposed economic stimulus package, selling pressure is starting again and the USD appears to be losing ground once more.

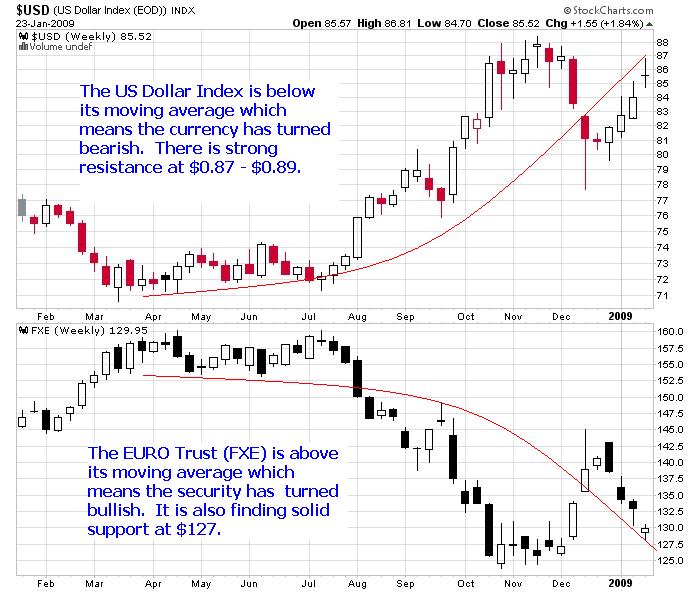

The first piece of evidence of the renewed weakness in the dollar comes from its mirrored currency; the EURO. In the comparative chart of the two currencies, the EURO (FXE) has found solid support at the $1.30 level and is beginning to stabilize and regain strength again after its plunge from $1.60 (Chart 1). The dollar, in contrast, has stalled in its flight-to-safety rise to $0.89. Models are indicating continued downward pressure should build for the currency in February and March and pull the greenback to or below the key $0.80 support line.

The second clue of the bull return to commodities lies with its leading indicator; gold. This natural resource (Chart 2) typically is the first raw material to advance in price before the other commodity groups because gold is the most sensitive to the movements of the USD and to future inflationary pressures. Gold normally leads the other commodity groups by 4-6 months (Chart 3). Models are indicating that gold should advance above $900 in February.

Other natural resources such as silver, zinc, nickel, agricultural grains and oil all appear to be gaining ground and finding solid support levels following gold's rise. As the US Dollar Index is expected to begin declining in February, these commodities should continue to firm in price and gradually advance.

Bottom line: The considerable US national debt plus near zero percent interest has once again made the US dollar less desirable. This building weakness fortifies commodity prices. As the dollar is expected to continue sliding in 2009, raw material prices, lead by gold, are anticipated to climb.

Investment approach: Gold and silver are leading the other commodities higher. Investors may wish to consider these metals now and slowly include the other natural resources as they begin to advance later this year.

More information about commodities can be found in the upcoming February newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.